It has become abundantly clear that the United States dollar will lose its global reserve status—the only question now is when?

For years the globalist, administrative state waged pointless and costly wars across the globe; Vietnam, Iraq, Afghanistan, Syria, and all the smaller ‘operations’ occurring worldwide. …

Now, it has become the Democrats’ turn to destroy the United States and further hollow out the middle class through an unjust and illegal proxy war in Ukraine. …

This time it’s different though. …

After years of abuse, Ukraine is the proverbial straw that broke the camel’s back. …

Sovereign nations watched in shock as the government of the United States shut off Russia’s access to SWIFT—the global financial messaging system and standard.

Without access to SWIFT, U.S. dollars held by a country’s central bank cannot move internationally—they locked Russia out of its U.S. dollar reserves.

This, combined with the rampant money printing to prop up the failed state of Ukraine, has sent the global community over the edge, in a coordinated effort to turn away from reliance on the U.S. dollar, and I can’t blame them. …

I am putting all my money into Bitcoin and other capped, neutral assets for this same reason—I don’t trust the U.S. dollar, and I sure as hell won’t let the U.S. government turn off my money and life through a CBDC.

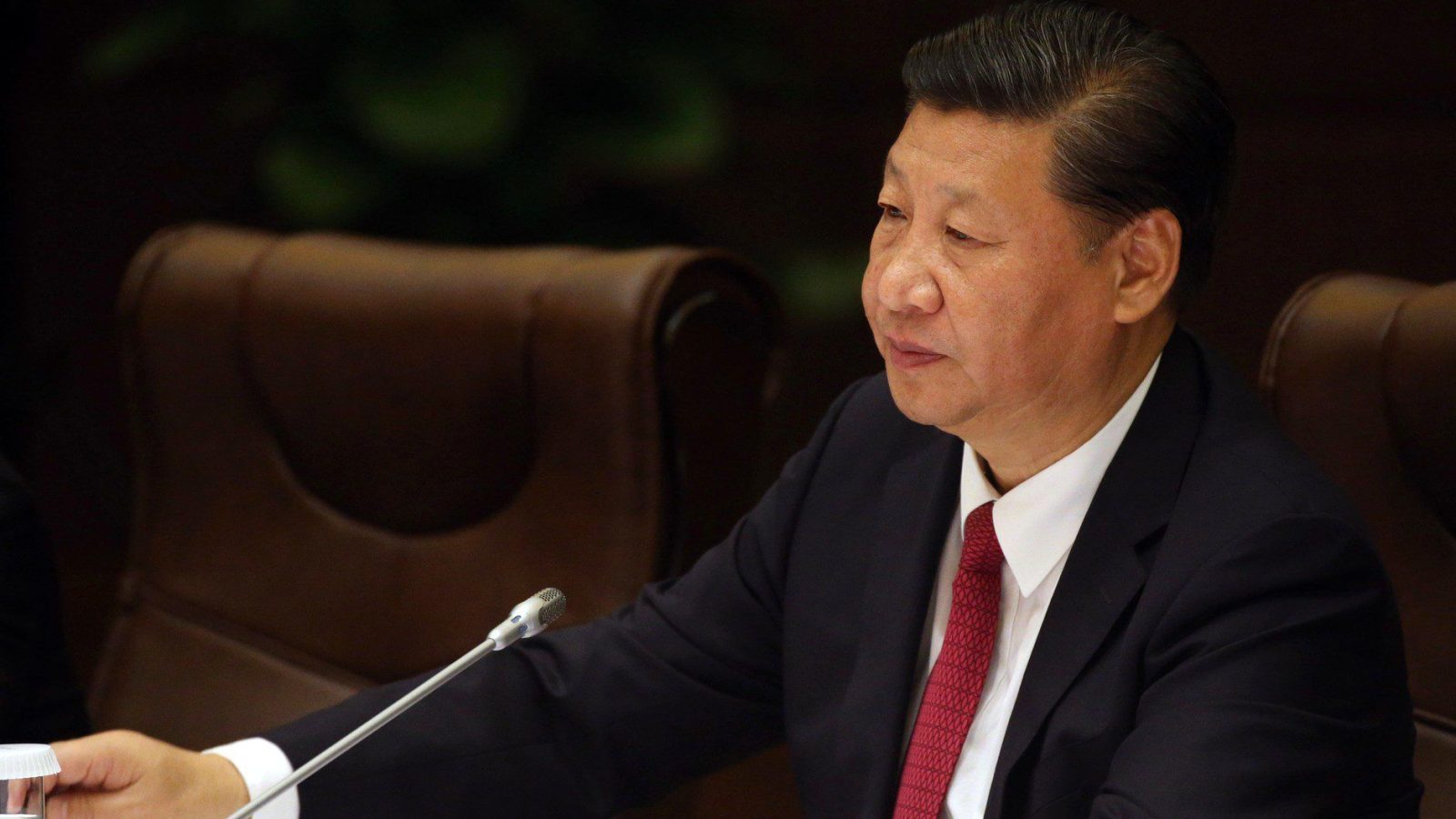

Applications to enter the BRICS alliance, led by China, are surging —at least 19 member nations have now applied to join.

This brings me to the main point of this article. …

According to Watcher Guru and other financial outlets, the Chinese Yuan, for the first time in history, has unseated the dollar in Chinese cross-border transactions. …

This trend is only expected to accelerate in the coming weeks, months and decades:

JUST IN: 🇨🇳 Chinese Yuan overtakes US dollar as most-used currency in China's cross-border transactions for the first time in history.

— Watcher.Guru (@WatcherGuru) April 26, 2023

Chinese Yuan overtakes US dollar as most-used currency in China's cross-border transactions for the first time in history.

Yuan-share rose to a record high of 48%, UP from nearly zero in 2010.

U.S-share declined to 47%, DOWN from 83% over the same period.

Wow. pic.twitter.com/Lm3Rygpm45

— Genevieve Roch-Decter, CFA (@GRDecter) April 26, 2023

Watcher Guru provided a more nuanced take:

While the above development is certainly a step against bringing down the dollar, it is quite dainty. Chris Leung, an economist at DBS Bank notes,

“Yuan internationalization is speeding up as other countries seek an alternative payment currency to diversify risks and as the credibility of the Federal Reserve is not as good as before.

But at the same time, we are still talking about a long way from dollar dominance, and the yuan’s share in global payment might be forever small.”

According to SWIFT, the Chinese Yuan’s share of international payments was essentially unchanged in March at 2.3%.

NEW: For the first time ever, the Chinese Yuan has overtaken the US dollar as China’s most used currency for cross-border transactions.

It’s really shocking how much destruction Joe Biden has caused in just 2 years. He weaponized the U.S. dollar and now it is coming back to…

— Collin Rugg (@CollinRugg) April 26, 2023

The Russian ruble and the Chinese yuan are already replacing the U.S. dollar in mutual settlements between Russia and China, said the Russian finance minister. #dedollarization https://t.co/OlteBHIuzu

— Bitcoin.com News (@BTCTN) April 25, 2023

The Chinese yuan and Russian ruble have replaced the US dollar in over 70% of China-Russia bilateral trade. The rate was about 30% 1-2 years ago, Russian Finance Minister Anton Siluanov said on Mon, adding that the situation is "mutually beneficial," media reported.… Show more pic.twitter.com/X4iu8zvS81

— Zhang Meifang (@CGMeifangZhang) April 25, 2023

Markets Insider had more:

The yuan’s use in cross-border payments and receipts rose to 48.4% at the end of March while the dollar’s share slid to 46.7%, according to a Reuters calculation of data from China’s State Administration of Foreign Exchange.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!