Gold prices have been soaring to new heights, reaching a historic $2,400 per ounce this week. Renowned economist David Rosenberg, President of Rosenberg Research, believes that the momentum could carry the precious metal to $3,000 before the next business cycle shift, marking another 25% increase from current levels.

Rosenberg attributes this surge to strong demand, particularly from central banks resembracing gold as a reserve asset. Central banks have been steadily increasing their gold holdings, with a notable turnaround from -77 tonnes in 2022’s third quarter to 361 tonnes in the same period of 2023. This trend is driven by a desire for security amidst geopolitical risks and a fear of overreliance on the US dollar, especially as the Chinese yuan loses its grip as the world’s second reserve currency.

Gold’s allure is also bolstered by rising industrial usage, particularly in the electronics sector, which is experiencing a boom due to the demand for AI-related models. Furthermore, the precious metal’s safe-haven status is reinforced by global geopolitical risks and unpredictable macroeconomic outlook, with the US debt-to-GDP ratio at 120% and the looming possibility of a fiscal crisis.

Rosenberg isn’t alone in his beliefs. Jonathan Rose, CEO of Genesis Gold Group, also sees $3,000 gold on the horizon.

“We look at precious metals as long-term hedges against tumultuous markets, but major gains obviously make them even more attractive,” Rose said. “It is extremely encouraging to see gold moving up now because it bodes well for our clients who get into physical precious metals soon.”

Genesis Gold Group specializes in rolling over or transferring retirement accounts into Genesis Gold IRAs backed by physical precious metals.

In both a “soft landing” and a typical bear market scenario, Rosenberg sees a 15% upside for gold, with a potential 30% increase in play as central banks begin to cut rates. He cites the historically negative correlation between gold prices and real interest rates, predicting that a decline in real interest rates would lead to a 10-15% increase in gold prices.

“If Bitcoin, an invisible man-made token, can reach $70,000 then what’s stopping gold, a limited precious resource with a proven track record, from surpassing $5000?” Rose asked.

Rosenberg appears to agree. In light of these factors, Rosenberg advises investors to include gold in their portfolios and overweight it, as the downside risks are well contained but the upside is significant.

Click here to receive a free, quick reference gold investment guide from Genesis Gold Group.

I call it your personal “cheat sheet”!

Here is what conservative star Dean Cain says about working with Genesis Gold Group:

==>Click here to contact Genesis Gold Group today and receive a free Definitive Gold Guide and learn more about protecting your life’s savings from the various threats we’re facing today.

(Note: Thank you for supporting American businesses like the one presenting a sponsored message in this article and working with them through the links in this article which benefit WLTReport. We appreciate your support and the opportunity to tell you about Genesis Gold! The information provided by WLTReport or any related communications is for informational purposes only and should not be considered as financial advice. We do not provide personalized investment, financial, or legal advice.)

RELATED:

Costco Gold Selling Out Within Hours…

Last week I told you that Costco would begin selling gold.

They have, and they can’t keep it in stock.

Selling out within hours!

As you know, I’m a big fan of gold and I’ve been telling you about it here for a while…

I was on this before Costco, which is why so many people love and trust our reporting…because we beat the MSM and now we’re beating the big retailers like Costco!

By the way, keep reading and I can get you connected with someone who has MUCH BETTER prices than Costco for gold and silver…

But first, the news:

Costco, $COST, is selling one-ounce gold bars and they are selling out within a few hours, per CNBC.

— unusual_whales (@unusual_whales) September 27, 2023

Costco is apparently selling gold bars that consumers are snapping up at a record pace. https://t.co/BVMASNZ4An

— Breitbart News (@BreitbartNews) September 29, 2023

From Breitbart:

Costco is apparently selling gold bars that consumers are snapping up at a record pace.

On Wednesday, CNBC described the gold bars as one-ounce gold PAMP Suisse Lady Fortuna Veriscan bars. They were reportedly being sold for approximately $1,900, the outlet said.

Costco’s chief financial officer, Richard Galanti, said Tuesday during the company’s quarterly earnings call that the bars were selling fast.

“I’ve gotten a couple of calls that people have seen online that we’ve been selling 1 ounce gold bars. Yes, but when we load them on the site, they’re typically gone within a few hours, and we limit two per member,” he commented.

When Breitbart News searched the Costco website Thursday morning, the company had listed the gold bars as a “Member Only Item,” and buyers must sign into their accounts to view the price:

And from ZeroHedge:

Just think about this for a moment: people are buying gold from Costco. This tells us that the average American has grown so weary of our government’s reckless spending and the Fed’s irresponsible monetary policy that they literally want to fill their shopping cart — online or in person — with something they know is real money. From People:

The retail giant has recently been selling 1 oz. bars of authentic 24-karat gold from South African mining company Rand Refinery and Swiss precious metal supplier PAMP Suisse on their website for $1,949.99 and $1,979.99, respectively, according to Insider.

According to the product details on Costco’s page, Rand Refinery’s gold bars are individually stamped with a unique serial number and arrive in a sealed black assay card, while PAMP Suisse’s gold bars are individually “controlled, registered, and secured” within CertiPAMP™ packaging with an official Assay Certificate and a digital certificate accessed with a QR Code.

Both items are non-refundable, provide air shipping via UPS and currently have a 4.9 out of 5 average rating on the company’s website, with one member writing on Rand Refinery’s gold bar customer rating that it was a “beautiful piece of gold” and “brand new.”

It’s an incredible commentary on the average American citizen. Americans are literally choosing to transact U.S. dollars for gold.

Now keep reading for our original report and for a place to get gold and silver with better pricing that Costco:

Costco To Begin Selling Gold

I love it when we beat the big players to the table.

We take great pride in our reporting and I love to see when that reporting is confirmed like what just happened here.

For the past few months we’ve been telling you that it might be time to look into Gold and Silver.

You know, “God’s Money”.

Since the beginning of time, that has been the only enduring sound money.

So it made sense, especially as they print the U.S. Dollar into oblivion.

When you can just print trillions of new Dollars whenever you want, it doesn’t take an economist to realize that soon the Dollars in your pocket have less value.

They’re literally “worth less” and in the future may even be entirely “worthless”.

But Gold and Silver have always endured.

We’ve been telling you over and over and what just happened this week?

Now Costco is telling you.

In addition to selling you 18 bottles of ketchup and a 32-pack of Mac-and-Cheese, Costco will now be selling GOLD.

Simple question, and again it doesn’t take an economist to figure this out: What do you think all that increased Demand is going to do to the price of Gold?

Yup.

Looks like Costco is joining the gold trade. In time we may see a run for gold bars where lineups out the door at Costco not for groceries but for gold. #gold #costco pic.twitter.com/JGstjxdilL

— Mario Stifano (@Mario_Stifano) September 6, 2023

This is a bit technical, but it shows just how well Gold has done recently:

While $GOLD prices may be falling, it's important to remember that gold has held up extremely well considering the rise in real yields on treasuries.

Once real yields inevitably fall, gold prices can be expected to soar. pic.twitter.com/3q7TKPIZTi

— GOLY ETF Fan | Stocks & Gold (@GOLY_ETF) August 27, 2023

Many are saying the Costco pricing is “not great” on Gold:

Costco getting a piece of the action! #Gold

Can't complain about Costco's service however the premium on their 1 OZ Gold Offer is STEEP!

Check the link in the comments to get the best hookup on your Precious Metals! 👇 pic.twitter.com/p9bM8hrmzF

— Zach Rector (@ZachRector7) September 10, 2023

From The Daily Mail:

Bulk-buy retailer Costco starts selling GOLD worth up to £24,500 in its supermarkets – but shoppers are warned to be wary because of violent price fluctuations

Bulk-buy specialist Costco is now offering bars of gold for up to £24,500 a time

Experts warned people could be getting a poor deal after swings in gold market

The price of gold has risen 28 per cent in past 12 months, but it’s a volatile market

It’s not an item likely to be on the weekly shopping lists of many households – but one supermarket giant has started selling gold bullion alongside its everyday groceries.

Bulk-buy specialist Costco, more normally known for its ‘pile-’em-high, sell-’em-cheap’ philosophy, is now offering bars of the precious metal for up to £24,500 a time.

But experts last night warned shoppers they could be getting a poor deal, particularly after violent swings in the gold market this year.

While the company’s mark-up on gold is up to seven per cent on the market rate, it is also selling silver bars at a whopping 28 per cent premium.

Many investors have been turning to what they see as the security of gold this year, amid huge uncertainties in the world economy caused by Covid-19, international tensions and political discord in America.

But while the price of gold has risen by 28 per cent in the past 12 months to almost $1,900 (£1,469) an ounce, it is a volatile market, declining by more than six per cent in the past two months alone.

On September 24, Costco’s 100g bar was on sale for £4,939.99, when the market price for that much gold was £4,619.70 – equal to a seven per cent mark-up in store.

Now, take this and remember what Andy Schectman just told us….

Have you seen this?

Gold and Silver: “No one wants to sell at these make believe prices”

I’ve been telling you for a long time now that Gold and Silver are vastly undervalued.

I’m not a financial advisor and I can’t tell you what to do, but I can look at historical data and I can easily see that the current price of Gold and Silver makes no sense unless….it’s being manipulated.

Now who would want to do that?

And the more important question: will it go on forever, or do the manipulators eventually release the stretched rubber band and ride an explosion up?

I’ve you’ve been paying attention in life, you know the answer.

You know these crooks on Wall Street manipulate things down, ⭐️ then they load their boats, then they manipulate them up into a bubble.

Where are we in that process right now for commodities like Gold and Silver?

Right exactly where I placed that star up above.

⭐️ = You Are Here

The Big Boys are loading their boats.

But that’s not just my opinion.

I’m a nobody.

Listen to Andy Schectman who is an expert on these things and he lays it out PERFECTLY in two minutes.

Here’s my rough paraphrase:

“A concerted effort by the very powerful to use the suppression of commodities (gold, silver, but also a long list of all other commodities)…these countries are not complaining about suppressed low prices yet because they’re accumulating! But once it becomes obvious that the availability of these commodities is very scarce and no one wants to sell at these “make believe prices” then the public says “OMG, what have we been missing?” And maybe that all happens in concert with a breakdown of the banking system, then the public says “give it to me now” and that’s when you’ll see the circuit breakers be put into affect. But at that point it’s too late.”

Oh my!

It’s so much better to listen to him explain it in his own words.

It’s just 2 minutes long.

Watch here (as presented by my friend the Digital Asset Investor):

Comex 589 pic.twitter.com/uPzrOGXhZ5

— Digital Asset Investor (@digitalassetbuy) September 11, 2023

But it’s not just Andy either.

It’s this latest interview over at SGT Report.

Sean does such a great job over there of interviewing people on topics the MSM doesn’t want you to see, and his latest is called “$1,000 Silver — Seriously, Stop Laughing”.

There’s actually a lot of history that goes into that quote and this was a great discussion by four very smart individuals.

Watch here:

I’ve been sounding the alarm for a while now…

Have you taken action?

As always, there’s one thing I always say and it’s never been proven wrong: Watch what they DO, not what they SAY.

Who is “they”?

The same people Andy Schectman was talking about.

Big Governments.

Central Banks all over the world.

Big Business.

What are they doing?

They are LOADING THEIR BOATS with as much Gold and Silver as they can find and they’re laughing all the way to the bank because they’re buying at what Andy says are “make believe prices”.

Are you?

After the Great Financial Crash of 2008, I made a decision.

From that point forward, I would simply do what the Big Boys were doing.

I would simply watch what they’re doing and copy it.

Oh, and if they had Jim Cramer telling people the OPPOSITE (i.e. Cramer says Gold is a loser, but the Central Banks are buying with both fists) that was usually the perfect confirmation I needed.

So that’s been my strategy since 2008 and it’s worked very well for me.

Here’s more….

Here’s Why Banks Are Buying Up All of the Gold

I’ve got Jordan Peterson and Peter Schiff in a fascinating conversation about the Value of Gold.

And it’s not just some academic debate.

This could very soon be one of the most important things in your world when the U.S. Dollar crashes and gets its value cut in half….or worse.

These guys know what they’re talking about and this short 8 minute clip is definitely worth your time to watch.

I always say this: don’t listen to what the “Elites” tell you….watch what they are DOING.

And what are they doing?

Stacking gold and silver.

As much as they can get their hands on.

Look, I hope I’m wrong but I think we’re in for a massive event that is going to destroy bank accounts and destroy the U.S. Dollar.

So what happens to YOU when that happens?

Watch this and then scroll down for how I can help you stay safe right now….

Watch:

For those who can’t listen, here’s the transcript (and then scroll down for what YOU can do right now! That’s the most important thing!):

One of the reasons that people are so

arrogant particularly in America that

the dollar status is not in jeopardy and

so that we can keep on running these

huge deficits we can create keep on

creating inflation and the world’s got

no choice right but to stick with the

dollar because are they going to go to

the euro are they going to go to the Yen

you know the poundI mean they’re

winning B I agree all of those

currencies also have problems

and so do you really want to switch from

one flawed fiat currency to another even

if those other Fiat currencies may be

less flawed than the dollar rightdo you really want to make that shift I

don’t think that that’s what’s going to

happen what everybody is missing is that

there is an alternative

to the dollar that doesn’t involve

another fiat currency and that’s goldthat is real money everybody forgets

that for thousands of years gold was

money it was money because it worked now

over the course of time uh we had paper

currencies that would rise and fall I

mean hundreds of years ago they were

paper currencies that are now worthless

and you don’t even know their namesyou

know they come and go but gold has has

stayed you know gold works as money and

so I think what these central banks are

going to do is as they get out of

dollars they will just increase their

Holdings of gold gold will be the

monetary anchor gold will be the reserve

monetary asset just the way it was

before the dollar it wasn’t the British

poundI mean the British pound was a

dominant currency but gold was what

everybody owned the British back to

pounds do you see any do you see any

evidence that some of these alternate

currencies are starting to back their

currency claims with gold oh yeah you

can what’s happening on the central

banks are now buying more gold than

they’ve bought in in in decadesespecially a lot of the uh you know the

Emerging Market countries not even maybe

so much the United States isn’t buying

any gold and maybe you know some of the

more mature uh countries but a lot of

other countries that had predominantly

held dollars and then to a lower degree

Euros or Yen or pounds these countries

are increasingly buying gold that’s why

gold is at a record highI mean Gold’s

around two thousand dollars an ounce but

in terms of just about every other

currency on the planet gold has been

hitting all-time record highs uh and

again that’s not really gold going up

that’s all these Fiat currencies going

down but what are the reasons that

countries would want gold as opposed to

the dollar is the US government doesn’t

have any control over ityou know gold

is an asset that’s not also somebody

else’s liability and nobody could create

it you have to mine it no one country

you know has the advantage so you know

why would you want to take away

uh that that privilege that the United

States has and just bestow it on

somebody else who is going to abuse it

the same wayI mean the United States

abused that privilege that we had and we

we we exported all this inflation to the

world we took advantage of the this the

position that we were in uh so why would

you want to put another nation in in a

position to similarly take advantage of

the world it’s much better to go back to

to honest money and againeven when we

were on Bretton Woods before you know

1971 and we were on the dollar standard

it was because the dollar was backed by

gold again if you held dollars you held

gold that’s where the saying came from

the dollar is as good as gold in fact

the legal definition of a dollar is a is

a weight of gold that’s what a dollar is

dollars are gold the the the paper

currency that circulated Federal Reserve

notes are not dollars they are notes of

the Federal Reserveinitially the those

Federal Reserve notes were payable in

dollars the dollars were the gold that

the Federal Reserve notes paid because

if you think about what a note is a note

is a promise to pay something a Federal

Reserve Note is supposed to pay

something well what did it pay it paid

gold it paid dollars today Federal

Reserve notes pay nothing their ious

nothing the Federal Reserve is not

obligated to give you anything I mean if

you have a ten dollar bill okay so

people people might object and they and

they havethat well gold is just another arbitrary

standard of value it has some intrinsic

worth it’s useful for jewelry it’s

useful for certain industrial

applications but it’s just another

psychologically valuable currency

without any intrinsic value and so it

shouldn’t be a repository of value in

principle that’s any more stable than

let’s say a well-managed or even a badly

managed fiat currency and so what do you

what do you why is it that gold has

proved itself let’s say over centuries

or Millennia as a storehouse of value

what is it about gold

intrinsically let’s say that seems to

have given it that edge the idea that

gold doesn’t have any intrinsic value is

just pure nonsenseit’s obviously

politicians have a vested interest in in

trying to diminish gold as a monetary

alternative to the Fiat system and even

now you have a lot out of cryptocurrency

enthusiasts who say the same thing well

you know gold has no value because they

want to justify something like Bitcoin

which also has no value and say well

gold worked as money and it has no valueso so Bitcoin could work well it’s not

true that gold has no value gold is the

most valuable the most useful metal on

the periodic table gold became money

because it was such a valuable commodity

but gold has a lot of properties that

make it uniquely qualified to be money

more so than than other Commodities

that’s why gold was so successful over

the centuries as money because people

preferred to use it as money it wasn’t

governments that decided gold is going

to be money

the people decided that gold was going

to be money and once the people decided

that gold was going to be money if you

were a king you know well you would tax

people in Gold because if you wanted to

pay your soldiers to protect you your

soldiers wanted gold right so it was the

money created in the free market and it

beat out all other forms of money

because gold you know a gold coin uh all

they’re all all the sameyou could melt

gold down and you can make it into coins

uh it’s fungible it’s portable it’s

divisible but the other aspect of goal

that is the key you can save gold

because if I have an ounce of gold in

100 years in a thousand years it’s

exactly the same it doesn’t lose any of

its properties and in fact even if I

take my gold and I make you know I make

a ring out of it or I I use it to make a

watch rightyou can melt this ring down and you get

your gold back and it’s exactly the way

it was you could do something else with

it there’s really no other metal you can

keep using it over and over and over

again I mean they fill teeth with gold

if you find somebody buried in the

ground you know you could take their

fillings and you know the Gold’s still

there you know there treasure ships from

the 1400s 1500s they sink if they

recover the wreckage the only thing

that’s still there is the goal it’s an

it looks exactly the way it looked when

the sink when the ship sank 500 years

ago so from a point of savings because

money has to satisfy three primary

conditions two of them are a unit of

account an immediate exchange but the

third one is the store value

and that’s importantbecause it’s also makes it possible to

do loans that I can borrow money you can

lend money and you can be repaid and you

know that the money that you’re going to

get repaid is going to retain its value

and so that’s something that gold that

gold does better than than other metals

butthe value of gold even if I’m not

using my gold today as a metal let’s say

I have gold stored in a safe and you say

well you know you’re not using it for

anything that’s true but I’m preserving

the future use of that gold

somebody in the future is going to need

that gold and so I’m storing it right

nowbecause you know there are more uses for

gold that are discovered all the time

because of its very unique properties

I’m sure in a hundred years or a

thousand years

there will be more uses for gold than

there are now

So, what can YOU do to protect yourself?

To protect your family?

To stay safe?

Simple: you need to get some #Gold or #Silver in your own possession.

It’s called “physical” gold and silver.

Not paper traded garbage on the stock exchanges that isn’t backed by anything.

Don’t touch that stuff.

I have two special hook-ups for you.

Both involve PHYSICAL gold and silver.

Because if you do NOTHING else, make sure you own “physical” gold and silver, not paper contracts.

The paper contracts (like stock ticker SLV and GLD) could very well go POOF one day and disappear or go to zero, because they’re not actually backed by the gold and silver they claim to represent.

It’s a massive game of musical chairs out there and when the music stops (and I think it will stop soon…) people who only own paper might find themselves owning something not worth the paper it’s literally written on.

And I know you’ll never forget it if I give you this GIF so….Let’s Get Physical:

Now…WHERE do you get physical gold and silver and how do you know it’s real and safe?

And that you’re getting the best price?

Oh, and how about personal one-on-one real customer service?

You know, like you were some Big Wig millionaire at Goldman Sachs who could just call their personal banker and get help?

That’s what I’m about to tell you.

I have two killer connections for you…

The first is for purchasing gold and silver bullion.

That means bulk bars.

That’s the cheapest and most economical way to do it, to stretch your dollar into as much gold and silver as possible.

The website is called WLT Precious Metals and when you see my logo in the top left-hand corner, you’ll know you’re in the right place.

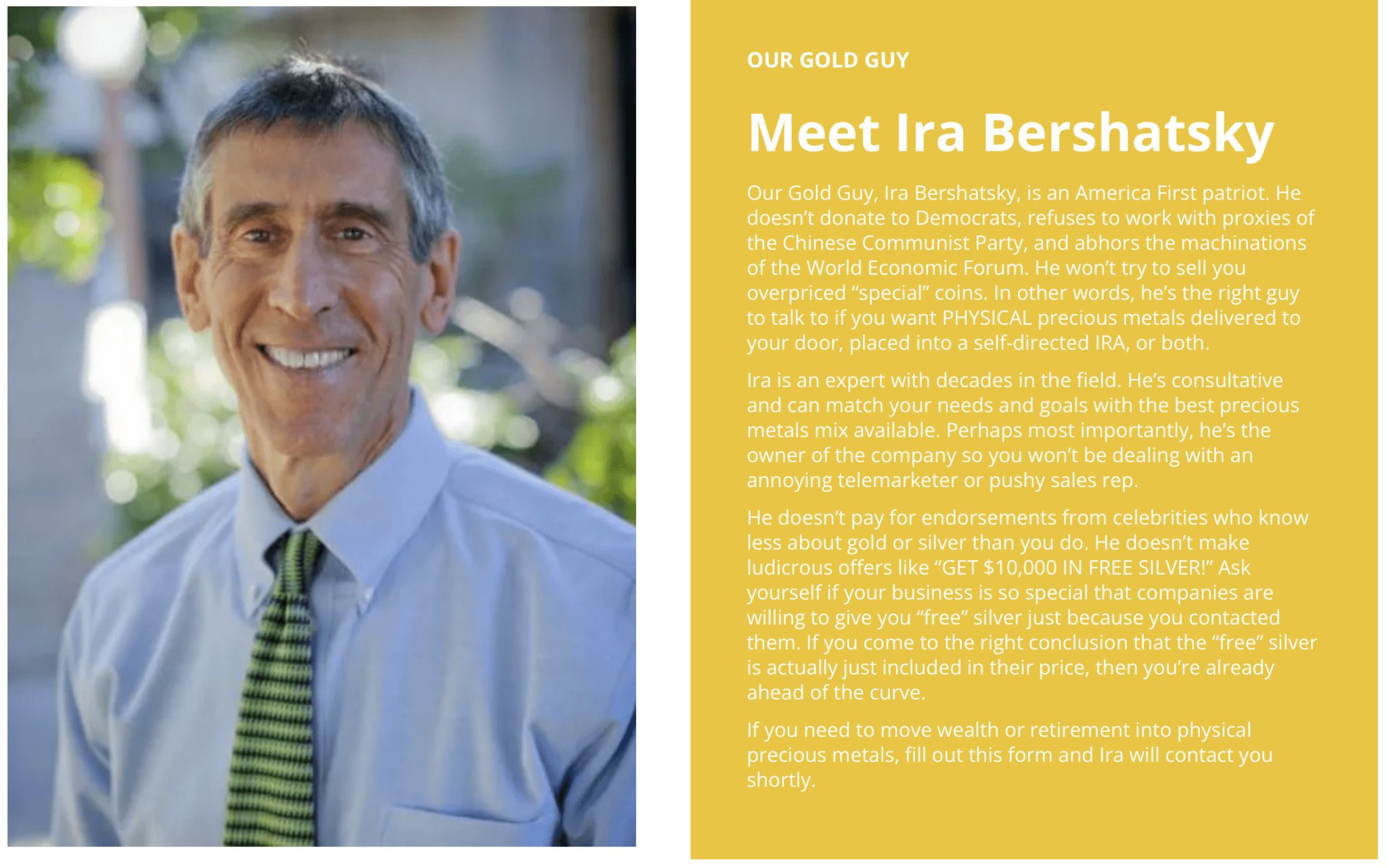

You’ll get a personal phone call with Ira Bershatsky (or someone on his team) and they will work with you free of charge for as long as needed to answer any questions you have and get you taken care of.

How about that!

You don’t see that much anymore, but Ira and his team pride themselves on good old-fashioned real customers service:

No sales pitch, just real, actual help.

And the best prices you will find.

Here’s the only disclaimer I will give you: because they do pride themselves on dedicated service, it might take a few days before you get a phone call back. Just be patient.

Good things come to those who wait!

You can contact Ira and WLT Precious Metals here.

Ok, that was #1.

Now I want to tell you about option #2.

An equally great company, I am so happy to be working with these guys.

This next company is called Genesis Gold and this is for people who want to purchase real physical gold or silver in their IRAs (Investment Retirement Accounts).

You know what the beauty of that is?

TAX FREE baby!

I’m not a tax advisor, but that’s a general oversimplification.

Never pay more taxes than you are legally required to pay.

And that’s why I love getting gold and silver in my IRA (and why I hold a large chunk in an IRA myself!).

There’s so much to love about Genesis Gold, starting with the fact they are proudly and un-ashamedly Christina!

They call it “Faith-Driven Stewardship” and they put it right on the homepage of their website along with a quote from Ezekiel:

Here’s more on why gold and silver in your IRA are so powerful:

You can contact Genesis Gold here.

They are also very backed up with record demand, so you may have to wait a bit, but someone WILL get in touch with you for personal customer service and assistance!

Tell ’em Noah sent ya!

Oh, and did you know Genesis is recommended by SUPERMAN himself?

It’s true.

Superman himself, Clark Kent — Dean Cain — came on my show a few weeks ago and we broke it all down:

Watch here:

Stay safe!

Make sure you can weather the storm when it hits!

Because the storm always hits eventually, doesn’t it?

As for me and my house, we will be ready. 💪

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!