Patriots, you have power. You have power where your money goes and which way the wind blows. …

Bud Light, Disney, and Target have all found out that the power of the dollar can be wielded by masses of conservative Americans coordinated against their woke agendas.

The lesson here? Mind where you spend your dollar—a dollar is a vote—vote responsibly.

In an unexpected turn of events, financial giant BlackRock seems to have taken a cue from Bud Light, Disney, and Target. …

According to the hedge fund’s 2023 Investment Stewardship report, most of the firm’s proposed ESG measures were dropped or shot down. …This is the first time this has happened.

BlackRock reportedly backtracked on its ESG agenda due to massive public pushback, and it’s no wonder why: just look at some of the voices speaking out against the ESG movement. …

Presidential hopeful Vivek Ramaswamy had this to say about large financial institutions and the ESG agenda:

“BlackRock, State Street, & Vanguard represent arguably the most powerful cartel in human history: they’re the largest shareholders of nearly every major public company (even of each other) & they use *your* own money to foist ESG agendas onto corporate boards – voting for “racial equity audits” & “Scope 3 emissions caps” that don’t advance your best financial interests.

This raises serious fiduciary, antitrust, and conflict-of-interest concerns.

As President, I will cut off the real hand that guides the ESG movement – not the invisible hand of the free market, but the invisible fist of government itself.”

BlackRock, State Street, & Vanguard represent arguably the most powerful cartel in human history: they’re the largest shareholders of nearly every major public company (even of each other) & they use *your* own money to foist ESG agendas onto corporate boards – voting for “racial… pic.twitter.com/FhCfmEsDdp

— Vivek Ramaswamy (@VivekGRamaswamy) August 20, 2023

Patrick Bet-David of Valuetainment Media recently appeared on the Joe Rogan podcast and claimed: “88% of companies on the S&P 500 are managed by BlackRock, State Street, or Vanguard”…

88% of companies on the S&P 500 are managed by BlackRock, State Street, or Vanguard…

ESG and BlackRock’s monopoly deconstructed by @patrickbetdavid on the Joe Rogan Experience podcast: pic.twitter.com/8wkdHRmVx1

— Valuetainment Media (@ValuetainmentTV) August 15, 2023

Blackrock ditches ESG?

WE are making progress! https://t.co/ZpZDH4sE0h

— Patrick Bet-David (@patrickbetdavid) August 23, 2023

According to The Epoch Times:

Support for ESG proposals fell 9 percent this year from 2022, when the asset manager supported 24 percent of such shareholder proposals, and from 2021, when backing was a high as 43 percent.

Meanwhile, BlackRock’s investment stewardship team only backed 7 percent of resolutions on climate and the environment and social considerations.

The trillion-dollar asset manager turned down 91 percent, or 742, out of the 813 proposals it voted on and 373, or 93 percent of the social and climate proposals it faced.

Director of Consumers First Will Hild presented this lecture and implored his audience: “If you’ve ever wondered what ESG is, why BlackRock is pushing it and how it impacts your daily life — you need to watch this.”

If you've ever wondered what ESG is, why @BlackRock is pushing it and how it impacts your daily life — you need to watch this:

I sat down with @EWErickson at The Gathering and we went cover-to-cover, breaking down the ESG scam in its entirety. pic.twitter.com/djZB3rDGAp

— Will Hild (@WillHild) August 19, 2023

Valuetainment reports:

In the last year, public backlash against the effects of ESG investing has intensified as Republican lawmakers zero in on the agenda.

This has led to significant cracks developing in the ESG push, including the purging of the acronym from corporate websites and banking strategies, as well as the S&P dropping the ESG scale from its debt rating system.

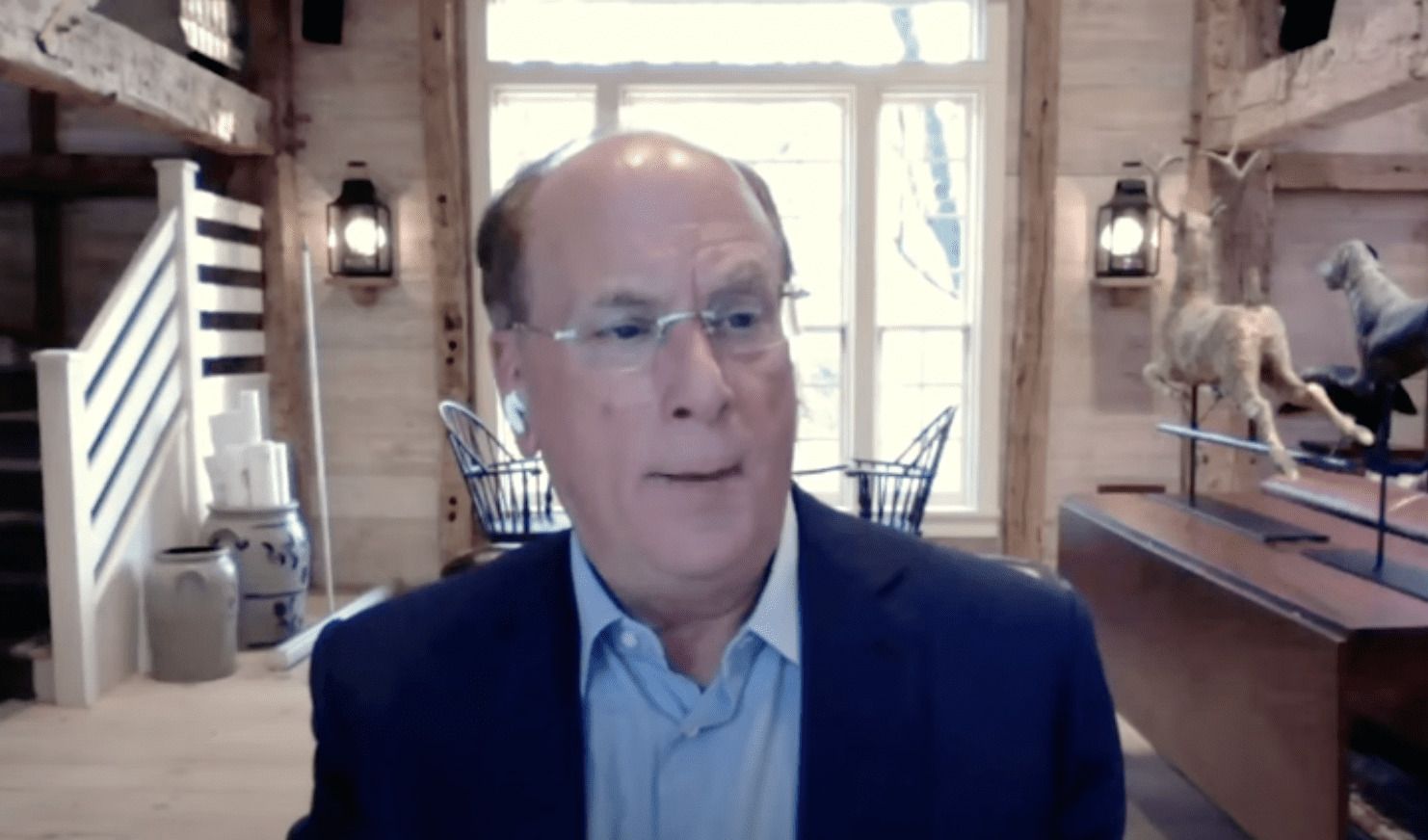

In another notable instance, BlackRock CEO Larry Fink, known by many as “the most powerful man on Wall Street,” omitted reference to ESG from an annual company letter sent out in March.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!