No, this is not a reprint of an old article.

This is brand new breaking news that Jeff Bezos has just sold MORE Amazon stock.

A lot more….

$863.5 million more!

Take a look:

JEFF BEZOS JUST SOLD $863 MILLION DOLLARS WORTH OF AMAZON SHARES TODAY

JEFF BEZOS HAS NOW SOLD OVER $8.3 BILLION DOLLARS WORTH OF AMAZON SHARES SO FAR THIS YEAR$AMZN @JeffBezos pic.twitter.com/X834pFnLZ9

— GURGAVIN (@gurgavin) July 9, 2024

This is on the sales from last week that we recently reported on, making it $1.2 BILLION in the last WEEK alone:

BREAKING:

Jeff Bezos sells another $863.5M in $AMZN stock.

He has sold nearly 1.2 BILLION in the last week alone. 💰 pic.twitter.com/oagsJ1oZKO

— TrendSpider (@TrendSpider) July 9, 2024

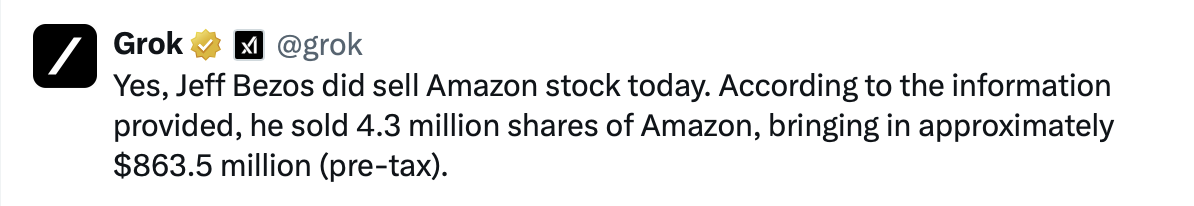

Grok confirms:

Here’s the report I brought you just last week:

REPORT: Jeff Bezos Selling ANOTHER $5 Billion In Amazon Stock!

I always say: watch what they DO, not what they SAY….

And what “they” (the Wall Street insiders) are doing is Selling.

BIG LEAGUE.

It was just last year when we told you Jeff Bezos was selling $8.5 billion of Amazon stock:

Insider’s Selling (Part 1): Jeff Bezos Sells $8.5 BILLION of Amazon Stock

I'll republish that entire report down below in case you missed it.

But apparently times are tough and he needs some more "walking around money" because new reports say he is selling ANOTHER $5 billion!

JEFF BEZOS HAS JUST FILED TO SELL ANOTHER $5 BILLION DOLLARS OF AMAZON SHARES

JEFF BEZOS HAS ALREADY SOLD OVER $7.5 BILLION DOLLARS WORTH OF AMAZON SHARES THIS YEAR$AMZN pic.twitter.com/FdfLHo2Cqw

— GURGAVIN (@gurgavin) July 3, 2024

Jeff Bezos to sell $5 billion in Amazon shares.

Jeff Bezos intends to sell 25 million extra shares of Amazon, worth $5 billion, as the stock reaches a new high.

This follows $8.5 billion in sales earlier this year, bringing his total to $13.5 billion by 2024.

Bezos will still… pic.twitter.com/lP0QY2sISA

— DailyNoah.com (@DailyNoahNews) July 3, 2024

Of course, maybe times aren't tough at all for Bezos....

The man has more money than he could spend in a lifetime.

But perhaps he just knows what is coming?

Perhaps he knows a 1929-level stock market crash is imminent?

What do you think?

Here was our original report from late last year (2023):

Insider's Selling (Part 1): Jeff Bezos Sells $8.5 BILLION of Amazon Stock

As always, never just listen to what they say....watch what they DO!

And just like Nancy Pelosi trading stocks, these insiders rarely lose.

I mean, why would they?

They set the rules, so when it's their game of course they're going to win.

And right now they're all flashing SELL in bright red letters.

Is that because they know it's a market top or close to it?

It makes you wonder.

This is going to be a 3-part series and we're starting with Amazon's Jeff Bezos.

Jeff Bezos isn't really hard up for cash, but he just sold $8.5 BILLION worth of stock -- yes, that's Billion with a B:

Bezos sells $8.5 Billion of stock Jamie Dimon (JP Morgan) sells $150 million of stock https://t.co/YdsUeK7nBj

— Jacqueline (@Jacquel2873634) February 26, 2024

Talk about raising some serious cash!

From the BBC:

Multi-billionaire Jeff Bezos has sold another 14 million Amazon shares, worth around $2.4bn (£1.9bn).

The latest sale brings the total number of shares he has sold in the firm over the last nine trading days to about 50 million, with a value of around $8.5bn.

The tech giant had previously said Mr Bezos would sell up to 50 million shares by the end of January 2025.

His sales of Amazon stock comes after they have risen by more than 76% in the past year.

Mr Bezos, who is the firm's founder and executive chair, had previously last sold Amazon shares in 2021.

He has also given away shares in Amazon as part of his philanthropy, most recently in 2022.

As Mr Bezos moved to Miami in Florida from Seattle in Washington last year, he will save almost $600m in tax on the $8.5bn worth of stock he has sold.

Gains above $250,000 from the sale of shares or other long term investments, are taxed at 7% in Washington state. Florida does not have state taxes on incomes or capital gains.

However, he will still be liable to federal taxes as a result of selling the shares.

When Mr Bezos announced his move to Florida it prompted speculation over whether it was because of a potential tax bill he would have faced in Washington after the state approved a new tax on large stock sales.

Mr Bezos said in November that his parents had recently moved back to Miami where he spent some of his childhood and that he wanted to be close to them and to his Blue Origin space project, which was "increasingly shifting to Cape Canaveral".

"Lauren and I love Miami," he wrote on Instagram, referring to his fiancée Lauren Sánchez.

He did it in smaller chunks of $2 billion a piece.

I guess I should put "smaller" in quotes, because 2 Billion of anything isn't really small, is it?

Fox Business had more details on his latest round of selling:

The Amazon founder conducted the latest transactions involving nearly 12 million shares on Friday and Monday. They were disclosed in a Tuesday filing with the Securities and Exchange Commission (SEC).

The stocks amounted to about $2.08 billion.

Amazon informed investors earlier in February that Bezos had taken up a trading plan in November that would involve the sale of a maximum of 50 million shares by Jan. 25 of next year. The latest sales — and another set last week — were tied to that.

Prior to the stock sales disclosed Tuesday, Bezos had parted ways with roughly $2.04 billion worth of Amazon stock, another SEC filing showed.

Bezos, who relocated to Florida from Washington with his fiancée Lauren Sanchez, could see massive tax savings on stock sales in the Sunshine State compared to Washington, where he created the e-commerce giant. While neither state has an income tax, Washington recently implemented a 7% capital gains tax.

As usual, Patrick Bet-David has some of the best analysis out there.

Here's what PBD had to say:

By the way, I don't fault ANYONE for making money....as long as it's done legally and ethically.

And there's nothing to suggest Bezos hasn't done it above board.

So congrats to him! Fantastic!

My only point is....is this the Market top? Do people like Bezos tend to sell at the top or the bottom?

Look, I'm not a financial advisor, but if you'd like to get out of stocks and into something SAFER for your retirement, may I suggest that Gold has ALWAYS been God's money?

Gold has never failed, it was money in the Bible and it's still money today.

And a store of value.

If you're looking for safe, grab this free Guide from my friends over at Genesis -- I love what these guys do!

How One 12-Page Pamphlet Tells the Story of God, Gold and Glory

When you first start learning about gold as an investment, it’s easy to get overwhelmed.

Should you choose Gold ETFs, pooled accounts, individual accounts...

Or, maybe you should just buy gold outright. There are websites that'll sell gold with a huge markup, and even pawn shops that sell gold around the corner from your favorite taco stand.

If you're new to buying gold, you first need a trusted resource to lay out the plain facts. You need to know a brief history, why gold works, and the options available to you.

Thankfully, there’s a new, easy-to-read guidebook that’s opening minds and growing investment accounts.

Genesis Gold is offering a free guide that has everything you need to learn about investing in gold and other precious metals.

In just a short, 12-page read, you’ll learn what clues the Bible gives about man-made money (paper currency). You’ll even learn the three simple steps to investing in metals like gold.

And, you’ll also get a quick tutorial on:

-

Which precious metals are approved by the IRS

-

The different forms of gold, silver and other precious metals - coins, ingots, bars

-

Why the symbology (i.e. olive branches) matters on gold coins

-

Why there are different sized measurements of gold coins and bars

-

And a stunning innovation made by the Swiss

Genesis Gold is giving you the tools to make your own decisions. Instead of trusting in fly-by-night investment opportunities, or Wall Street lies, you can learn the long-term strategy that has worked since Moses.

As it says in Ezekiel 28:4 - By your wisdom and understanding you have gained wealth for yourself and amassed gold and silver in your treasuries.

Click here to get this free pamphlet from Genesis Gold and begin your journey to investing with the wisdom of Solomon.

Here is what conservative star Dean Cain says about working with Genesis Gold Group:

==>Click here to contact Genesis Gold Group today and receive a free Definitive Gold Guide and learn more about protecting your life's savings from the various threats we're facing today.

(Note: Thank you for supporting American businesses like the one presenting a sponsored message in this article and working with them through the links in this article which benefit WLTReport. We appreciate your support and the opportunity to tell you about Genesis Gold! The information provided by WLTReport or any related communications is for informational purposes only and should not be considered as financial advice. We do not provide personalized investment, financial, or legal advice.)

RELATED:

Gold and Silver: "No one wants to sell at these make believe prices"

I've been telling you for a long time now that Gold and Silver are vastly undervalued.

I'm not a financial advisor and I can't tell you what to do, but I can look at historical data and I can easily see that the current price of Gold and Silver makes no sense unless....it's being manipulated.

Now who would want to do that?

And the more important question: will it go on forever, or do the manipulators eventually release the stretched rubber band and ride an explosion up?

I've you've been paying attention in life, you know the answer.

You know these crooks on Wall Street manipulate things down, ⭐️ then they load their boats, then they manipulate them up into a bubble.

Where are we in that process right now for commodities like Gold and Silver?

Right exactly where I placed that star up above.

⭐️ = You Are Here

The Big Boys are loading their boats.

But that's not just my opinion.

I'm a nobody.

Listen to Andy Schectman who is an expert on these things and he lays it out PERFECTLY in two minutes.

Here's my rough paraphrase:

"A concerted effort by the very powerful to use the suppression of commodities (gold, silver, but also a long list of all other commodities)...these countries are not complaining about suppressed low prices yet because they're accumulating! But once it becomes obvious that the availability of these commodities is very scarce and no one wants to sell at these "make believe prices" then the public says "OMG, what have we been missing?" And maybe that all happens in concert with a breakdown of the banking system, then the public says "give it to me now" and that's when you'll see the circuit breakers be put into affect. But at that point it's too late."

Oh my!

It's so much better to listen to him explain it in his own words.

It's just 2 minutes long.

Watch here (as presented by my friend the Digital Asset Investor):

Comex 589 pic.twitter.com/uPzrOGXhZ5

— Digital Asset Investor (@digitalassetbuy) September 11, 2023

But it's not just Andy either.

It's this latest interview over at SGT Report.

Sean does such a great job over there of interviewing people on topics the MSM doesn't want you to see, and his latest is called "$1,000 Silver -- Seriously, Stop Laughing".

There's actually a lot of history that goes into that quote and this was a great discussion by four very smart individuals.

Watch here:

I've been sounding the alarm for a while now...

Have you taken action?

As always, there's one thing I always say and it's never been proven wrong: Watch what they DO, not what they SAY.

Who is "they"?

The same people Andy Schectman was talking about.

Big Governments.

Central Banks all over the world.

Big Business.

What are they doing?

They are LOADING THEIR BOATS with as much Gold and Silver as they can find and they're laughing all the way to the bank because they're buying at what Andy says are "make believe prices".

Are you?

After the Great Financial Crash of 2008, I made a decision.

From that point forward, I would simply do what the Big Boys were doing.

I would simply watch what they're doing and copy it.

Oh, and if they had Jim Cramer telling people the OPPOSITE (i.e. Cramer says Gold is a loser, but the Central Banks are buying with both fists) that was usually the perfect confirmation I needed.

So that's been my strategy since 2008 and it's worked very well for me.

Here's more....

Here's Why Banks Are Buying Up All of the Gold

I've got Jordan Peterson and Peter Schiff in a fascinating conversation about the Value of Gold.

And it's not just some academic debate.

This could very soon be one of the most important things in your world when the U.S. Dollar crashes and gets its value cut in half....or worse.

These guys know what they're talking about and this short 8 minute clip is definitely worth your time to watch.

I always say this: don't listen to what the "Elites" tell you....watch what they are DOING.

And what are they doing?

Stacking gold and silver.

As much as they can get their hands on.

Look, I hope I'm wrong but I think we're in for a massive event that is going to destroy bank accounts and destroy the U.S. Dollar.

So what happens to YOU when that happens?

Watch this and then scroll down for how I can help you stay safe right now....

Watch:

For those who can't listen, here's the transcript (and then scroll down for what YOU can do right now! That's the most important thing!):

One of the reasons that people are so arrogant particularly in America that the dollar status is not in jeopardy and so that we can keep on running these huge deficits we can create keep on creating inflation and the world's got no choice right but to stick with the dollar because are they going to go to the euro are they going to go to the Yen you know the pound

I mean they're winning B I agree all of those currencies also have problems and so do you really want to switch from one flawed fiat currency to another even if those other Fiat currencies may be less flawed than the dollar right

do you really want to make that shift I don't think that that's what's going to happen what everybody is missing is that there is an alternative to the dollar that doesn't involve another fiat currency and that's gold

that is real money everybody forgets that for thousands of years gold was money it was money because it worked now over the course of time uh we had paper currencies that would rise and fall I mean hundreds of years ago they were paper currencies that are now worthless and you don't even know their names

you know they come and go but gold has has stayed you know gold works as money and so I think what these central banks are going to do is as they get out of dollars they will just increase their Holdings of gold gold will be the monetary anchor gold will be the reserve monetary asset just the way it was before the dollar it wasn't the British pound

I mean the British pound was a dominant currency but gold was what everybody owned the British back to pounds do you see any do you see any evidence that some of these alternate currencies are starting to back their currency claims with gold oh yeah you can what's happening on the central banks are now buying more gold than they've bought in in in decades

especially a lot of the uh you know the Emerging Market countries not even maybe so much the United States isn't buying any gold and maybe you know some of the more mature uh countries but a lot of other countries that had predominantly

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!