If you’ve been following us for a while, you know I talk a lot about Gold here.

There’s a good reason for that…

Gold is the ONLY asset other than cash to be classified as a “Tier 1 Risk Free Asset” by the banking industry.

That’s a huge deal, more on that here if you want more details.

I’m not a financial expert and I can’t give you personalized financial advice, but many financial experts refer to gold not as an “investment” but as a preservation of wealth.

That doesn’t mean you have to be Warren Buffett level wealthy to buy it, it just means if you don’t want your net worth to go down over time due to the destructive power of inflation, many people recommend holding precious metals to “preserve” that wealth.

Smart.

And as much as I love Gold (that isn’t changing one bit), I have neglected Silver a little bit and it’s time I correct that.

There’s a reason why they’re called Precious Metals (plural) because it’s Gold AND Silver.

Both have incredible value and both have a place in preserving and growing wealth, at least in my opinion.

In fact, the current gold-to-silver ratio is approximately 80:1. This means that it takes about 80 ounces of silver to buy one ounce of gold.

Now allow me to put that into context for you…

As of the most recent estimates, there is a significant difference in the amount of gold and silver above ground.

- Gold:

- The total amount of gold mined throughout history is approximately 212,582 metric tons. This gold is mostly still in circulation because gold is virtually indestructible and has a long-lasting value. The distribution includes 96,487 tons in jewelry, 47,454 tons in bars and coins, and 36,699 tons held by central banks (World Gold Council) (SD Bullion).

- Silver:

- The total amount of silver mined historically is around 1.6 million metric tons. However, much of this silver has been used in industrial applications and is not recoverable. The most optimistic estimate for above-ground silver stocks is about 357,000 metric tons. This includes silver in bullion form, industrial silver, and a fraction from jewelry (SD Bullion) (SilverSeek).

This gives a rough ratio of gold to silver above ground of approximately 1:7, meaning there is seven times more silver than gold above ground. However, the industrial use of silver means that much of it is not recoverable, making the effective amount of silver available for investment purposes considerably less.

Let me just explain that in plain English….in terms of raw supply and demand, there is only 7x more Silver than Gold above ground, and yet it’s priced as though there is 80x more!

This is what we call a major mismatch and eventually most experts believe it will come back in line.

In fact, historically the ratio has been closer to 12:1 or 15:1 and only recently with all the massive printing of the US Dollar has it moved to 80:1.

- Long-Term Historical Average:

- Historically, the gold-to-silver ratio was often set by governments for monetary stability. For instance, during the Roman Empire, the ratio was set at 12:1. In the United States, the Coinage Act of 1792 set the ratio at 15:1 (LongTermTrends).

- Over the long term, the historical average is around 15:1 to 16:1, reflecting the natural abundance of the metals and their economic uses in earlier times.

- Modern Historical Average:

- In the modern era, particularly after the abandonment of the gold standard in the 20th century, the ratio has been much higher. From the 1970s onwards, the ratio has fluctuated widely, often ranging between 50:1 and 80:1.

- For example, from 1971 to 2020, the average ratio has been approximately 57:1 (Monex).

- Recent Trends:

- In recent years, the ratio has experienced significant volatility. It peaked at an all-time high of around 122:1 in March 2020 during the economic uncertainty caused by the COVID-19 pandemic (SD Bullion).

- As of 2023, the ratio has generally ranged between 70:1 and 80:1 (Gold Price) (Gold Price).

BOTTOM-LINE?

Ok, can I bottom line it for you?

Let’s make it real simple….Gold is the grand-daddy of them all, it’s the King of “God’s Money” for a reason and in my opinion since it has never lost its value since the foundation of civilizations, I don’t expect it will lose it’s value any time soon. Hence why even the banks now call it the only other “Tier One Risk Free Asset”.

But Silver has a unique opportunity to not only “preserve wealth” but also increase in value perhaps quicker than Gold.

It doesn’t take a math or economics wizard to understand what would likely happen to the price of Silver if it suddenly went from 80:1 back to 15:1 or even 7:1 against Gold.

Can you say 🚀?

It’s why Bo Polny tells me he sees Silver going from it’s current price of $30-32/ounce up to $60 and then up over $100 in a “very short window of time”.

And Bo is far from the only person to expect that will happen.

Can I guarantee it?

Of course not.

I can only report on things I am seeing and things that personally make sense to me, but it sure seems like holding some Silver in addition to Gold could make a lot of sense right now!

Which brings me to the brand new Silver “invention” that has never been done before!

I had to give you all of that background to explain why this is so exciting.

Because many believe that Silver could become a means of barter in the future, purchasing goods and services if the US Dollar perhaps crashes?

But you don’t want to be trying to chip off pieces from Silver bars or even cut up Silver coins into smaller chunks….

That’s the problem we’ve had until now.

Imagine you own a bunch of 1 ounce Silver coins and Silver does go to $125/ounce. Great, right? But how do you take that to the store and buy something for $50 or $25? You can’t.

Introducing the Silver (and Gold) Prepper Bars!

These things are absolutely beautiful and the solve the problem of actually using Silver (and Gold) to buy and sell things:

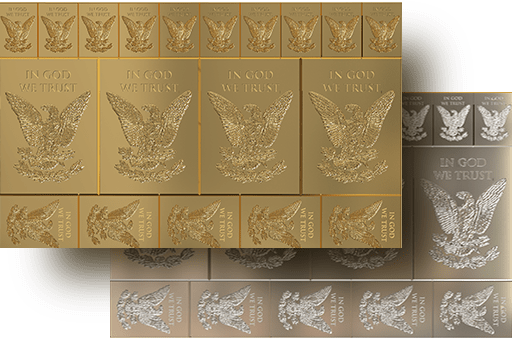

They come in flat sheets like this, beautifully made with “In God We Trust” printed on the front.

Small and flat enough to fit nicely within a wallet:

My trusted partner, Genesis Gold, has created these and I am so proud to continue partnering with them to bring these to you!

The Gold Prepper bar is already SOLD OUT.

You can get on the Wait List here:

The Silver is still in stock, at least as of the time I’m writing this.

It’s .999 pure silver, and proudly made in the USA.

As you can see in the pictures above, you get (10) 1.555 gram bars pieces, (4) 7.776 gram bars pieces and (5) 3.110 gram bars pieces.

They just snap apart and you can snap one off when you need to actually use one!

They are also IRA eligible.

Gold, Silver and Crypto are three things that I personally believe are very important.

Make sure with all of them you get PHYSICAL Gold, Silver and Crypto (not the “paper contracts” imitation stuff that will be the first to disappear in a crisis)…

From there, a good mix of bars, coins and Prepper Bars seems smart to me.

Spread your eggs out in multiple baskets, at least that’s what I’m doing.

I can’t promise these will be in stock when you check, but if they are sold out just bookmark it and check back later.

(Note: Thank you for supporting American businesses like the one about my partner Genesis Gold and their proprietary Prepper Bar in this article. The information provided by WLTReport or any related communications is for generalized generalized informational purposes only and should not be considered as personal financial advice. We do not provide personalized investment, financial, or legal advice.)

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!