The price of Gold is surging…

And that’s a good thing if you hold Gold like I have suggested over the past several months.

It’s NOT a good thing otherwise because Gold often serves as the Canary in the Coal Mine.

What’s the mean?

It means the Canary often alerts you to trouble before you might have otherwise noticed it….and then the tidal wave hits soon after.

Here’s the latest:

⚠️ BREAKING:

*GOLD PRICES HIT NEW ALL-TIME HIGH OF $2,323.70/OZ$GC_F $GLD pic.twitter.com/WNwqgyIa9f

— Investing.com (@Investingcom) April 4, 2024

And a great summary from Grok over the bullish burst up in Gold over the past week:

In the past week, gold prices have been making headlines as they hit new all-time highs, showcasing a significant surge in the precious metal’s value. This remarkable performance has not only captivated the attention of investors but has also placed gold in a unique historical context.

On April 4, 2024, gold prices reached an unprecedented $2,293.07 per ounce, marking a noteworthy increase from the previous year’s average closing price of $2,086.33 per ounce. This surge reflects a 11.16% rise in just one year. The current price stands as a testament to gold’s resilience and its capacity to maintain value amidst global economic uncertainties.

The past week has been particularly significant for gold. The precious metal has been on a bullish trend, with several key milestones achieved:

All-Time High: Gold hit a new all-time high of $2,297.41 per ounce on March 28, 2024. This is the highest gold has ever been in the history of the precious metal.

Weekly Highs: Over the past month, gold closed at an all-time high on more than half of all trading days. This consistent upward trend indicates strong bullish sentiment among investors.

Historical Context: Looking back at the past decade, gold prices have shown a steady upward trend. From 2023 to 2024, the average price of gold increased by 11.16%, reflecting the metal’s enduring appeal as a safe-haven asset.

Market Sentiment: The surge in gold prices is partly attributed to escalating Treasury yields and expectations of a cutting cycle by the Federal Reserve. Market analysts suggest that gold could reach new highs in the coming months, driven by these macroeconomic factors.

Investment Demand: Managed money in net long positions for gold was only at around 6/10 at the end of 2023, suggesting room for further growth in investor interest. Total ETF holdings in gold have fallen steadily since mid-2022, indicating a potential re-lengthening of investor positioning that could further support the rally in gold prices.This surge in gold prices is not just about the numbers. It reflects broader economic trends and investor sentiments. The precious metal is often seen as a hedge against inflation and a safe store of value in times of economic uncertainty. As we navigate through the current economic climate, the performance of gold will continue to be closely watched by investors and market analysts alike.

This is spot on:

Inflation is not going away …

Gold prices surged Monday to a record high of $2,265.73 an ounce.

Central banks are buying gold at a record pace. pic.twitter.com/pcyN3WHUoK

— Wall Street Silver (@WallStreetSilv) April 2, 2024

Pay particular attention to that last part: Central Banks are buying gold at a RECORD pace!

Folks, what do I always tell you?

Don’t listen to what they “say”, watch what they “do”!

Has CNBC been telling you to buy gold?

Not that I’ve seen.

Have I been telling you to buy Gold?

YES! Shouting from the rooftops to all who would listen.

Now look, I’m not a financial advisor….let’s be clear about that. I’m simply a reporter and I’m reporting what I see. And I see Central Banks buying Gold by the fistfull.

You can draw your own conclusion from that.

Central Banks On A Gold Buying Spree — What Do They Know That You Don’t?

What do the Central Bankers know that you don’t?

A lot.

Oh, I don’t mean they’re any smarter than you, but what’s the best way to predict the future? To plan it out and control it!

And make no mistake, these are the shadowy people pulling the strings of world affairs behind the scenes….and they rarely lose.

So I always say don’t listen to what they say (because they always “talk their book” and lie to your face) but watch what they do!

The beautiful thing is we live in a time where it’s hard to hide real data, especially when you have people like us researching it and posting it for all to see.

And what is it that they’re doing?

Simply put — they’re on a GOLD buying spree!

Take a look at this:

Central banks are on a $GOLD buying spree…

This says a lot about fiat and debt 🤔 pic.twitter.com/6kSxEMvCZv

— FinFluential • Simplifying the Market (@FinFluentialx) December 6, 2023

42 tons in October alone, that is staggering!

Central banks added a net 42 tonnes to global official gold reserves in October.

Central banks continue to stockpile #gold. pic.twitter.com/BnlNtqATlG

— Gold Telegraph ⚡ (@GoldTelegraph_) December 5, 2023

For the second year in a row, these are the HIGHEST purchases by Central Banks since 2010:

Central Banks are on pace to buy more than 1,000 tons of gold for the 2nd straight year and possibly reach the highest level purchased since 2010 pic.twitter.com/UXkLPx8DY8

— Barchart (@Barchart) December 7, 2023

Here’s more from Peter Schiff:

Central banks gobbled up gold over the summer and the buying spree has continued into the fall.

Globally, central banks added another net 42 tons of gold to their reserves in October.

China continues to be the biggest gold purchaser. The People’s Bank of China added another 23 tons of gold to its hoard in October as it expanded its official reserves for the 12th straight month.

Since the beginning of the year, the People’s Bank of China increased its reserves by 204 tons, and it has added 255 tons since it resumed official purchases in November 2022. As of the end of October, China officially held 2,215 tons of gold, making up 4% of its total reserves.

Most people believe the Chinese hold even more gold than that off the books.

There has always been speculation that China holds far more gold than it officially reveals. As Jim Rickards pointed out on Mises Daily back in 2015, many people speculate that China keeps several thousand tons of gold “off the books” in a separate entity called the State Administration for Foreign Exchange (SAFE).

Last year, there were large unreported increases in central bank gold holdings. Central banks that often fail to report purchases include China and Russia. Many analysts believe China is the mystery buyer stockpiling gold to minimize exposure to the dollar.

The Central Bank of Turkey also made another big gold buy in October, expanding its holdings by 19 tons. Even with big purchases over the last several months, Turkey is still a net seller on the year.

The Turkish central bank sold 160 tons of gold last spring but returned to buying in the third quarter. According to the World Gold Council, the big gold sale earlier this year was a specific response to local market dynamics and didn’t likely reflect a change in the Turkish central bank’s long-term gold strategy. It sold gold into the local market to satisfy demand after the government imposed import quotas in an attempt to improve its current account balance. The country is running a significant trade deficit.

Although the Turkish government reinstated gold import quotas in early August, so far we haven’t seen a repeat of sales into the local market to meet elevated demand.

The National Bank of Poland also continued its recent gold-buying spree, expanding its reserves by another 6 tons. Its gold holdings have now risen by over 100 tons this year.

In 2021, Bank of Poland President Adam Glapiński announced a plan to expand the country’s gold reserves by 100 tons. Now that it’s reached that gold, Glapiński indicated it will continue to add gold to its holdings.

This makes Poland a more credible country, we have a better standing in all ratings, we are a very serious partner and we will continue to buy gold. The dream is to reach 20 percent.”

When he announced the plan to expand its gold reserves, Glapiński said holding gold was a matter of financial security and stability.

Gold will retain its value even when someone cuts off the power to the global financial system, destroying traditional assets based on electronic accounting records. Of course, we do not assume that this will happen. But as the saying goes – forewarned is always insured. And the central bank is required to be prepared for even the most unfavorable circumstances. That is why we see a special place for gold in our foreign exchange management process.”

So….what can YOU do about it?

It’s simple: GOT GOLD?

Here are two easy ways, and one can get you a LOT of gold into your account with NO MONEY OUT OF POCKET!

Yes, for real.

Read on:

The ONLY Two Gold Companies I Am Proud To Partner With

We mostly cover politics here, but politics affects the economy and the economy affects…YOU and ME! And our pocketbooks.

Big league.

So in the midst of covering politics, we also cover money from time to time…and while I’m not a financial advisor, I share what I’m learning in the hopes that it can help you and keep you and your family safe.

And that often leads me to covering Gold and Silver.

You know, what they have always called “God’s Money”.

He made it, they aren’t making any more of it, and it has always been highly valued as money from the beginning of time until now.

So I’m a big fan and I think it has the potential to do big things if, say, the U.S. Dollar were to suddenly collapse.

So that’s why I talk about it and why I want to make sure everyone protects themselves and your families.

So to answer the question of “what can I do?” it’s really quite simple: you need to get some #Gold or #Silver in your own possession.

It’s called “physical” gold and silver.

Not paper traded garbage on the stock exchanges that isn’t backed by anything.

Don’t touch that stuff.

And because I get asked so much how to buy it and what the best places are, I thought I would publish this and just get it out there for all to have….

I have two special hook-ups for you and these are the ONLY two companies I am proud to partner up with on Gold and Silver.

Both involve PHYSICAL gold and silver.

Because if you do NOTHING else, make sure you own “physical” gold and silver, not paper contracts.

The paper contracts (like stock ticker SLV and GLD) could very well go POOF one day and disappear or go to zero, because they’re not actually backed by the gold and silver they claim to represent.

It’s a massive game of musical chairs out there and when the music stops (and I think it will stop soon…) people who only own paper might find themselves owning something not worth the paper it’s literally written on.

And I know you’ll never forget it if I give you this GIF so….Let’s Get Physical:

Now…WHERE do you get physical gold and silver and how do you know it’s real and safe?

And that you’re getting the best price?

Oh, and how about personal one-on-one real customer service?

You know, like you were some Big Wig millionaire at Goldman Sachs who could just call their personal banker and get help?

That’s what I’m about to tell you.

I have two killer connections for you…

The first is for purchasing gold and silver bullion.

That means bulk bars.

That’s the cheapest and most economical way to do it, to stretch your dollar into as much gold and silver as possible.

The website is called WLT Precious Metals and when you see my logo in the top left-hand corner, you’ll know you’re in the right place.

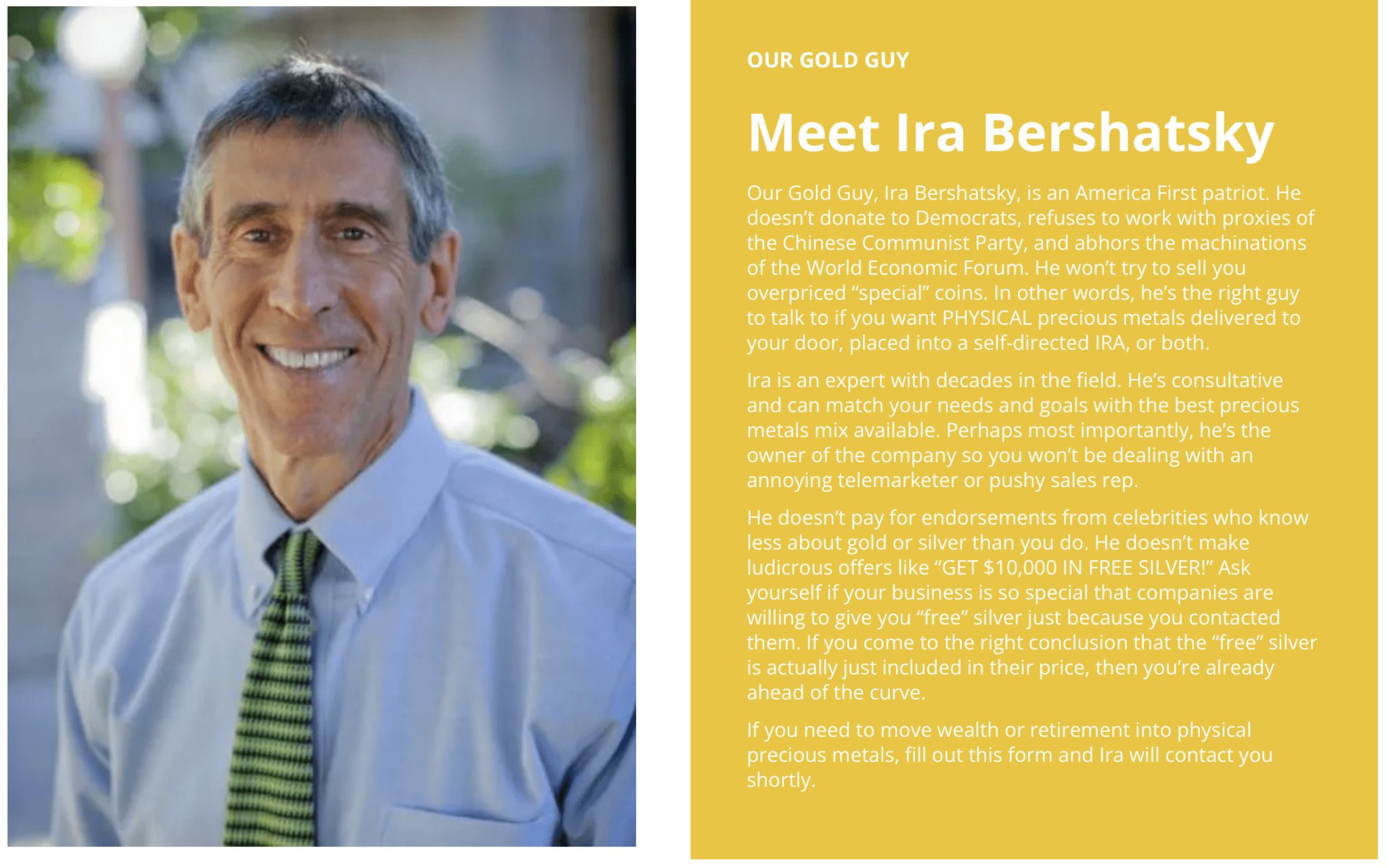

You’ll get a personal phone call with Ira Bershatsky (or someone on his team) and they will work with you free of charge for as long as needed to answer any questions you have and get you taken care of.

How about that!

You don’t see that much anymore, but Ira and his team pride themselves on good old-fashioned real customers service:

No sales pitch, just real, actual help.

And the best prices you will find.

Here’s the only disclaimer I will give you: because they do pride themselves on dedicated service, it might take a few days before you get a phone call back. Just be patient.

Good things come to those who wait!

You can contact Ira and WLT Precious Metals here.

Ok, that was #1.

Now I want to tell you about option #2.

An equally great company, I am so happy to be working with these guys…and this one can get you gold with NO MONEY OUT OF POCKET.

This next company is called Genesis Gold and this is for people who want to purchase real physical gold or silver in their IRAs (Investment Retirement Accounts).

You know what the beauty of that is?

Two huge benefits actually…

First is TAX FREE baby!

I’m not a tax advisor, but that’s a general oversimplification.

Never pay more taxes than you are legally required to pay.

And that’s why I love getting gold and silver in my IRA (and why I hold a large chunk in an IRA myself!).

Second is if you simply shift money out of stocks (like Peter Schiff recommends) and into Gold, it won’t cost you anything! No money out of pocket!

BOOM!

There’s so much to love about Genesis Gold, starting with the fact they are proudly and un-ashamedly Christina!

They call it “Faith-Driven Stewardship” and they put it right on the homepage of their website along with a quote from Ezekiel:

Here’s more on why gold and silver in your IRA are so powerful:

You can contact Genesis Gold here.

They are also very backed up with record demand, so you may have to wait a bit, but someone WILL get in touch with you for personal customer service and assistance!

Tell ’em Noah sent ya!

Oh, and did you know Genesis is recommended by SUPERMAN himself?

It’s true.

Superman himself, Clark Kent — Dean Cain — came on my show a few weeks ago and we broke it all down:

Watch here:

Stay safe!

Make sure you can weather the storm when it hits!

Because the storm always hits eventually, doesn’t it?

As for me and my house, we will be ready. 💪

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!