Are we headed toward a war with China? Recent developments seem to suggest that things are heading in that direction.

Congressional lawmakers are now pressing the Federal Reserve to ‘stress tests’ banks for the ensuing fallout from a potential war with the Chinese Communist Party.

Aside from the fact that this indicates Washington D.C. is anticipating conflict, it also calls into question the current health of our banking sector overall.

It’s no secret that banks have been failing left and right, while both consumer and national debt have skyrocketed to unsustainable levels.

Consumer spending is down in several key areas, while the Federal Reserve has indicated that it plans to slash interest rates at least three times next year, both are signs that a looming recession is imminent.

These current reports are all concerning, to say the least, and while they are not definite proof of something big happening soon and a broader collapse ensuing, they do paint a grim outlook for 2024 and beyond.

The Select Committee on the Chinese Communist Party announced on Tuesday: “Fed should stress test US banks for China war risk ‘The U.S. now has a choice: accept Beijing’s vision of America as its economic vassal or stand up for our security, values, and prosperity,’ the Select Committee’s bipartisan report concluded.”

NEW: Fed should stress test US banks for China war risk

“The U.S. now has a choice: accept Beijing’s vision of America as its economic vassal or stand up for our security, values and prosperity,” the Select Committee’s bipartisan report concluded. https://t.co/M3IYfYrWWd

— Select Committee on the Chinese Communist Party (@committeeonccp) December 12, 2023

The Washington Post had more details on the House Select Committee report:

The report, released Tuesday by the House Select Committee on the Chinese Communist Party, contains a broad legislative blueprint that — if followed — could ratchet up duties on Chinese goods, significantly curtail certain U.S. investments in China and further restrict or ban U.S. market access for companies including TikTok, as well as drone makers, chip manufacturers and telecommunications groups.

It also lays out a strategy for cushioning the blow to U.S. companies and banks from the potential shock waves of a partial decoupling and — in more serious scenarios — protect banks and enact sweeping economic penalties against Beijing in the event of conflict.

Numerous individuals shared both this headline and related headlines indicating that lawmakers are bracing for a war with China.

LAWMAKERS CALL FOR RAISING TARIFFS AND SEVERING ECONOMIC TIES WITH CHINA – NYT

FED SHOULD STRESS TEST US BANKS FOR CHINA WAR RISK, HOUSE PANEL SAYS – FT

— Neil Wilson (@marketsneil) December 12, 2023

recommended Washington develop strategies with allies to enact “severe diplomatic and economic costs” on Beijing, while calling on U.S. banks to undergo “stress tests” led by the FedReserve to assess their ability to withstand a sudden loss of access to China in the event of war. https://t.co/PtJRtqmjwz

— CdSmithy (@cd_smithy) December 13, 2023

House Asks Fed to Test US Banks for China War Fallout https://t.co/t254t4NgWr via @epochtimes

— Vince Quill (@VinceQuill) December 15, 2023

Cryptopolitan, a digital assets and economic outlet, writes:

Experts like Emily Kilcrease from the CNAS think-tank have pointed out the global repercussions of sanctions against China, given its deep economic ties.

The interconnected nature of China’s economy means that any sanctions could send shockwaves through global markets, including the U.S.

This complexity is further echoed by concerns from business leaders, who fret over the logistics of relocating supply chains in the event of a conflict.

RELATED:

Top U.S. Banks Shut 64 Branches In A Single Week—Are You Affected?

Think the banking troubles were a thing of the past?

Back in April/May, when we had 4 bank failures in one week, that was bad.

Then things died down for the summer and many people thought all was good again….all was fixed!

We told you it wasn’t.

In fact, ever since then we’ve been shouting at the rooftops that now is not the time to get lulled into complacency. Now is the time to get prepared and get ready for the bigger crash that’s coming!

And the crashes always seem to occur and get worse in the fall and winter.

In other words, we’re in prime territory.

Which is why I wasn’t surprised a few weeks ago when Citizens Bank failed:

Fact-Check: FAILED Citizens Bank Was Rated BBB+ Right Before Going Under?

That was only two branches.

The news out today is top banks have filed to close down 64 branches in one week!

Folks, I don't care how you slice it, that is NOT a good sign!

💥27th Nov, 2023 64 US Bank Branches File To Shut Down In A Single Week

PNC Bank filed for 19 branch closures.

JPMorgan Chase followed closely with 18 filings

Citizens Bank came in third with eight branch closure filings

Minneapolis-based U.S. Bank filed for seven closures… pic.twitter.com/DplxQrMp47

— Dr. Shah (@ankitatIIMA) November 27, 2023

PNC Bank leads with 19 branch closures, but JPMorgan Chase and Bank of America are high up on the list too!

BREAKING THE BANK‼️

PNC Bank shutters 19 branches in a single WEEK as US Bank, JPMorgan Chase and Bank of America also close locations - is your local affected?

Seven banks filed to close 42 branches last week, leaving a growing number of Americans with limited access to basic… pic.twitter.com/1vnub5RfmI

— SANTINO (@MichaelSCollura) November 27, 2023

But hey, Biden says the economy is doing great!

DERP!

US Banks File to Shut 64 Branches in a Single Week—Are You Affected?

JPMorgan Chase and PNC Bank filed for closing over a dozen branches each, along with other major banks across the country.https://t.co/BZXAGa7YEf

— The Epoch Times (@EpochTimes) November 27, 2023

Here is the complete list of PNC closures slated for closure on February 16th:

- 202 N. Walnut St., Bath, Pennsylvania

- 301 W. Trenton Ave., Morrisville, Pennsylvania

- 14 N. Main St., Plains, Pennsylvania

- Two N. Mill St., New Castle, Pennsylvania

- 1969 E. 3rd St., Williamsport, Pennsylvania

- 321 Bel Air Blvd., Mobile, Alabama

- 2811 Eastern Blvd., Montgomery, Alabama

- 5650 S. Brainard Ave., Countryside, Illinois

- 2217 W. Market St., Bloomington, Illinois

- 1949 E. Sangamon Ave., Springfield, Illinois

- 505 W. Liberty St., Wauconda, Illinois

- 8733 U.S. Highway 315, Indianapolis, Indiana

- 528 Station Ave., Hadden Heights, New Jersey

- 410 Main St., Orange, New Jersey

- 115 E. Van Buren Ave., Harlingen, Texas

- 407 S. Commerce St., Harlingen, Texas

- 801 W. Kearney St., Mesquite, Texas

- 1040 Mt. Vernon Ave., Columbus, Ohio

- 1140 N. Main St., Gainesville, Florida

The Gateway Pundit reports the following is a list of bank branches that have either recently ceased operations or are on the schedule for imminent closure:

- Wells Fargo. 1155 Union Circle, 2ND FL RM 222, Denton.

- Wells Fargo. 700 Jackson, Richmond

- Wells Fargo. 14999 Preston Rd, Building F, Dallas

- Verabank. 1100 Williams Dr, Georgetown

- Amerant Bank. 12145 FM 1960 West, Houston

- Wells Fargo. 3580 Frankford Rd, Dallas

- Wells Fargo. 1200 Flower Mound Rd, Flower Mound

- JP Morgan. 213 W Greens Rd, Houston

- Wells Fargo. 2824 Hillcroft St, Houston

- Bank of America. 9660 Hillcroft St, Houston

- Wells Fargo. 1420 West Mockingbird Lane, Dallas

- JP Morgan Chase. 16802 El Camino Real, Houston

- Capital One. 2301 E. Riverside Dr, Austin

- Capital One. 2910 S. Lakeline Blvd, Cedar Park

- Wells Fargo. 11152 S. Gessner Dr, Houston

- Woodforest NB. 80 Uvalde, Houston

- JP Morgan. 14114 Dallas Parkway, Dallas

- Wells Fargo. 1420 West Mockingbird Lane, Dallas

- JP Morgan Chase. 16802 El Camino Real, Houston

- JP Morgan. 1200 Clear Lake City Blvd, Houston

- JP Morgan. 3103 FM 528 Friendswood

- Home Bank. 12941 Gulf Freeway, Houston

- Home Bank. 251 West Medical Center, Webster

- Bank of America. 7900 Shoal Creek Blvd, Austin

- First NB. 5671 Treaschwig Rd, Spring

- First NB. 5671 Treaschwig Rd, Spring

- Bank of America. 7900 Shoal Creek Blvd, Austin

PNC Bank shuts 19 branches in a single week - is your local affected? https://t.co/3Mln7SVmkd via @MailOnline

— Bo Snerdley (@BoSnerdley) November 25, 2023

ZeroHedge had more details:

Between Nov. 12 and 18, several banks filed to close branch locations, with PNC Bank with the most filings, according to data from the U.S. Office of the Comptroller of the Currency. Pittsburgh-based PNC Bank filed for 19 branch closures—five in Pennsylvania, four in Illinois, three in Texas, two each in Alabama and New Jersey, and one each in Indiana, Ohio, and Florida.

JPMorgan Chase followed closely with 18 filings—three in Ohio, two each in Connecticut and South Carolina, and one each in 11 states, including New York, Illinois, Florida, and Massachusetts.

Citizens Bank came in third with eight branch closure filings—six in New York, and one each in Massachusetts and Delaware. Minneapolis-based U.S. Bank filed for seven closures—three in Tennessee and one each in Missouri, Wisconsin, Ohio, and Illinois.

Bank of America made five filings—two in New York and one each in Texas, Massachusetts, and California.

Citibank filed for two branch closures, and Sterling, Bremer, First National Bank of Hughes Springs, Windsor FS&LA, and Aroostook County FS&LA made one filing each.

Altogether, banks filed to shut down 64 branches.

The recent closures are part of a long-term branch shutdown trend that has been ongoing over the past several years. A report from the National Community Reinvestment Coalition shows that between 2017 and 2021, 9 percent of all bank branches shut down. The closure rate doubled during the COVID-19 pandemic.

According to data from S&P, there were 3,012 branch closures last year and 958 branch openings, leading to a net closure of 2,054 branches. This was the third consecutive year that net closings exceeded 2,000.

One major factor that led to a surge in branch closures is the rise of digital banking, a trend that accelerated during the pandemic when people were stuck at their homes.

A survey by the American Banking Association (ABA) conducted in September showed that 8 in 10 Americans used a mobile device to manage their bank accounts at least once in the previous month.

“Digital banking tools have made it more convenient and more secure than ever for consumers to manage their finances,” Brooke Ybarra, ABA’s senior vice president of innovation strategy, said, according to a Nov. 3 statement.

Cost Saving, Negative Effects

Going digital rather than expanding physical branch locations is also part of a cost-saving strategy for banking institutions. Opening a new site costs millions of dollars and several hundreds of thousands in annual recurring costs.Most of the operations done via a physical bank can now be done online. Digital transactions are cheaper than the costs incurred in transacting via bank tellers.

On the flip side, the shutdown of bank branches can negatively affect customers, especially in small towns. Due to such closures, many towns have become “bank deserts,” where the nearest bank is more than 10 miles away.

“When bank branches close, there are several adverse effects on the surrounding community. Small business lending and activity in the area declines. More people use alternative financial services that open them to unregulated and predatory financial practices. An important commercial tenant and employer are lost,” the National Community Reinvestment Coalition report said.

“While consumers have embraced mobile and internet banking to one degree or another, they clarify that branches matter to them as well, and without branches nearby, they are more likely to be un- or under-banked.”

A recent survey by Daily Mail found that 51 percent of Americans were either “very concerned” or “somewhat concerned” about the closure of bank branches.

PNC Bank Closure

PNC Bank registered the largest number of closure filings amid its heightened focus on cost-saving measures. During its second-quarter earnings call, CEO William S. Demchak said the bank is “going to have to take a hard look" at where it can "generate savings ... without cutting the potential for growth.”At the time, Chief Financial Officer Robert Q. Reilly revealed that the institution was boosting the target of an expense reduction program by $50 million to $450 million. For next year, PNC Bank is targeting $725 million in expense cuts.

This all comes on the heels of an exclusive report I brought you not less than two weeks ago:

Bank of America "Near Insolvent"? Bank Run Possible?

I covered a story last night about the $650 BILLION of "unrealized losses" about to hit the Big Banks in the United States.

Wild story!

I will post that full report below in case you missed it.

But what I really want to focus your attention on is a couple quotes from a Yahoo News article that I featured in that story.

Because it's not getting nearly enough attention....

It's a quote from Larry McDonald saying that Bank of America is INSOLVENT at a 6% Fed Funds rate.

Read that again.

BOA -- INSOLVENT -- in the same sentence!

So, you might be asking, "what is the current Fed Funds Rate"?

It's 5.5%.

Uncomfortably close to INSOLVENT.

Wow.

He was quoted in the article I'll show you below, but he also posted it to Twitter so you can see it right here.

I believe Bank of America is insolvent with a 6% Fed funds rate, leverage explodes. If your core capital is impaired, any losses on tertiary assets (credit cards, commercial real estate, asset backed securities) are exponential painful. https://t.co/Xd76VATiOr

— Lawrence McDonald (@Convertbond) October 10, 2023

More here:

Hollyyyy Fuckkkk is anyone talking about this. Bank Of America May be insolvent. #MOASS #boa #BankofAmerica #insolvent pic.twitter.com/0jC0Q0mM9b

— Nazeem Elkommos (@NazeemElkommos) October 3, 2021

And then of course you have The Simpsons predicting it in advance:

The Simpsons predicted Bank of America running out of money.

All banks are insolvent, which is why you are unable to withdraw all of your money in one day. pic.twitter.com/5xMPs7YT6M

— Shannon Crawford (@shae33172) January 21, 2023

Bank Runs incoming?

🚨 BREAKING: There's going to be a #BankRun

Many #Banks are gonna start falling rapidly and become insolvent. #CitizensBank in Iowa is insolvent and the dominoes are falling.

Even Bank of America #BOA & Wells Fargo #WFC are warning depositors of withdrawal issues plus… pic.twitter.com/jn6pdLEvny— Richard Barry (@irishchink) November 4, 2023

My original report is below, with much more information.

I recommend you read in full and take action IMMEDIATELY if you have significant funds in a bank.

I have a solution for you farther down below.

BOND MARKET CRASH? "Big Banks Have $650 Billion of Unrealized Losses"

Earlier today I brought you the report that Moody's has DOWNGRADED the USA to a "Negative" outlook.

The United States of America.

Unbelievable.

But we've been warning you as loudly as we can that this was coming!

More on that below in case you missed it.

But that's not all the bad news out today....

No folks, it's starting to look VERY ugly almost everywhere you look.

We just had this happen, FEDWIRE going down, major issues, reports of hacking:

*FED REPORTS 'SERVICE ISSUE' WITH FEDWIRE SECURITIES SERVICE

everyone getting hacked

— zerohedge (@zerohedge) November 10, 2023

It almost feels like they're about ready to shut this current system off and roll us into a new one, doesn't it?

One that uses Gold, Silver and Cryptocurrency?

Hey, what do I know, I could be totally wrong, but sure feels like it to me!

After all, this happened last Friday:

BREAKING: Reports Of Missing Deposits As “Direct Deposit System” Crashes (All Major Banks Affected)

Remember that?

Sure does seem like they love testing these things (or breaking these things) on Fridays, doesn't it?

Things that make you go "hmmmmmm".

But the even bigger story, perhaps, is the impending Bond Market Collapse.

Even if you don't know much about bonds or how they operate, trust me that this is historic, unprecedented, and very, very bad.

Unlike the last time, there are no "bond vigilantes" coming to bail us out.

🚨🚨BOND MARKET COLLAPSE 🚨🚨

🚨🚨CENTRAL BANK COLLAPSE 🚨🚨

🚨🚨 WHAT TO KNOW🚨🚨

What people (investors) need to understand now is, it doesn't matter how much currency a central bank prints (in the form of a bond), the currency, in this case, the U.S. Dollar has no…

— MikeCristo8 (@MikeCristo8) November 10, 2023

For the visual learners:

🔴⚠️ #US bond market crash, visualized

US bank stocks hitting historic lows against the S&P 500 index due to a bond market collapse.

Moody's estimates that US banks now have $650 b. in unrealized losses on such securities with Bank of America alone dealing with $130 b. pic.twitter.com/x5fVTq6hXf

— @PalasAtenea(2)🍊 (@AthenaMia2nd) November 10, 2023

Massive report on Yahoo earlier:

Even Yahoo can't deny it.

Our banking system is broken, and on the verge of collapse. Banks own over half a TRILLION in bonds that have collapsed in value, but YOU (taxpayer) have been put on the hook to ensure bank execs' stock values don't drop. https://t.co/hIIs9rF3tj

— Steve Eitreim (@SteveEitreim) November 7, 2023

From Yahoo News, here's more on the $650 BILLION in pending losses -- gee, you think that's going to cause a problem or anything?

Crashing bond prices sank Silicon Valley Bank in March — and there's reason to believe that what triggered the California lender's collapse may be haunting Wall Street again.

The brutal Treasury-market meltdown has hit some of the largest financial institutions hard, dragging down the share prices of big names such as Bank of America and fueling fears that the turmoil triggered by SVB's bankruptcy may not be over just yet.

Here's everything you need to know about unrealized losses, including why they're dragging on bank stocks and whether they could trigger another financial crisis.

Unrealized losses

Treasury bonds — debt instruments the government issues to fund its spending — have been on a nightmarish run since the onset of the pandemic, with investors fretting about rising interest rates and the long-term viability of the US's massive deficit.

BlackRock's iShares 20+ Year Treasury fund, which tracks longer-duration debt prices, has plunged 48% since April 2020. Meanwhile, 10-year Treasury yields, which move in the opposite direction to prices, recently spiked above 5% for the first time in 16 years.

As a result of that sell-off, some of the US's biggest banks are now sitting on unrealized, or "paper," losses worth hundreds of billions of dollars. That means the value of their bond holdings has plunged, but they've chosen to hold on rather than offload their investments.

Moody's estimated last month that US financial institutions had racked up $650 billion worth of paper losses on their portfolios by September 30 — up 15% from June 30. The ratings agency's data still doesn't account for a hellish October where the longer-term collapse in bond prices spiraled into one of the worst routs in market history.

These "losses" are not the same as debt, however, which describes actual borrowings that need to be repaid.

Bank of America is the big lender worst affected by the crash in bond prices, having disclosed a potential $130 billion hole in its balance sheet last month.

The other "Big Four" banks — Citigroup, JPMorgan Chase, and Wells Fargo — have also racked up unrealized losses in the tens of billions, according to their second- and third-quarter earnings reports.

Another SVB-style crisis?

Silicon Valley Bank failed in March after disclosing a $1.8 billion loss on its own bond portfolio, triggering a run on deposits. Similarly, big banks' huge unrealized losses are also sparking concern among Wall Street doom-mongers.

"'Higher for longer' is absurd baloney," the market vet Larry McDonald said in a post on X Sunday, referring to the Fed signaling it would hold interest rates at about their current level well into 2024 in a bid to kill off inflation. "A 6% + Fed funds and Bank of America is near insolvency."

It's important to remember that BofA's $130 billion losses are still unrealized. Unlike SVB, it isn't officially in the red yet because it has not sold its bond holdings.

The bank's chief financial officer, Alastair Borthwick, shrugged off the market's worries on last month's earnings call, pointing out that most of the bank's fixed-income portfolio was low-risk government bonds it planned to hold until the debt expires.

"All of these are unrealized losses are on government-guaranteed securities," he told reporters. "Because we're holding them to maturity, we will anticipate that we'll have zero losses over time."

There's still a possibility that spooked BofA customers will pull their money en masse, as they did with SVB — but that hasn't happened. In fact, deposits are up after registering about 200,000 new accounts in the third quarter.

Read that last part that I put in bold....

Folks, this is YAHOO NEWS speculating that we may soon see a BANK RUN on Bank of America!

That would be the Black Swan event, no doubt.

Can you imagine what would happen after that?

Very scary.

This all comes on the heels of this report from earlier today:

BREAKING: Moody's Cuts USA Outlook To "Negative"

It seems like every day there is a new breaking story I have to bring you about our economy falling off a cliff....

Of course that should come as no big surprise after the intentional destruction caused by the Biden Regime, but the news that just broke is being described as "dropping a nuke" -- financially speaking.

Top rating agency Moody's just cut the USA outlook.

You might be thinking we went from AAA+ to AAA or something, but no....it's been cut to "NEGATIVE OUTLOOK".

The United States of America!

I told you, they LOVE to drop bombs late in the day on a Friday:

BREAKING: Moody's changes outlook on United States' ratings to Negative

Moody's: Debt affordability in the U.S. to be significantly weakened.

Of-course they waited until after close on Friday, before OpEx week and a government shutdown on Friday to do this 😉

— Financelot (@FinanceLancelot) November 10, 2023

Ohhhh buddy, Black Monday incoming?

JUST IN: 🇺🇸 Moody's downgrades US credit outlook from stable to negative.

— Watcher.Guru (@WatcherGuru) November 10, 2023

Boom 💣

Moody’s drops a nuke AH.

No one should be surprised.

Cheers to Moody’s for having the guts to do this. pic.twitter.com/xPIYwqmdEp

— QE Infinity (@StealthQE4) November 10, 2023

Here's more from CNBC on this breaking story:

Moody’s Investors Service on Friday lowered its ratings outlook on the United States’ government to negative from stable, pointing to rising risks to the nation’s fiscal strength.

The ratings agency has affirmed the long-term issuer and senior unsecured ratings of the U.S. at Aaa.

“In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues,” the agency said. “Moody’s expects that the US’ fiscal deficits will remain very large, significantly weakening debt affordability.”

Brinkmanship in Washington has also been a contributing factor, Moody’s said.

“Continued political polarization within US Congress raises the risk that successive governments will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability,” the ratings agency said.

As far as keeping the nation’s ratings at Aaa, Moody’s said that it expects the U.S. to “retain its exceptional economic strength.” “Further positive growth surprises over the medium term could at least slow the deterioration in debt affordability,” the agency said.

“While the statement by Moody’s maintains the United States’ Aaa rating, we disagree with the shift to a negative outlook,” said Deputy Secretary of the Treasury Wally Adeyemo in a statement. “The American economy remains strong, and Treasury securities are the world’s preeminent safe and liquid asset.”

Moody's was actually the SECOND big ratings agency to cut the USA....

Fitch was first:

U.S. Dollar DOWNGRADED Due To "Governance Deterioration"

Something big happened yesterday and you might have missed it amidst all the Trump Arraignment coverage.

In fact, it was something we've been warning you about for a long time.

Specifically, Bo Polny has been telling you for almost two years now that the Dollar is about to CRASH.

When he first said it people thought he was crazy.

Now?

Now it doesn't look so crazy, not at all.

Especially not in light of what just happened yesterday.

Credit Rating Agency Fitch just DOWNGRADED the U.S. Dollar.

Dollar shaky after US credit rating downgrade https://t.co/du4oaIoooG pic.twitter.com/8Ep3csMcyn

— Reuters (@Reuters) August 2, 2023

And in case your eyes just glazed over a bit because you don't know what all of this means, let me make it very simple for you...

Have you ever bought a car or a house?

What does the bank look at before they give you a loan?

Your Credit Score.

Well, just like you have a Credit Score the United States also has a credit score.

And that Credit Score just went down.

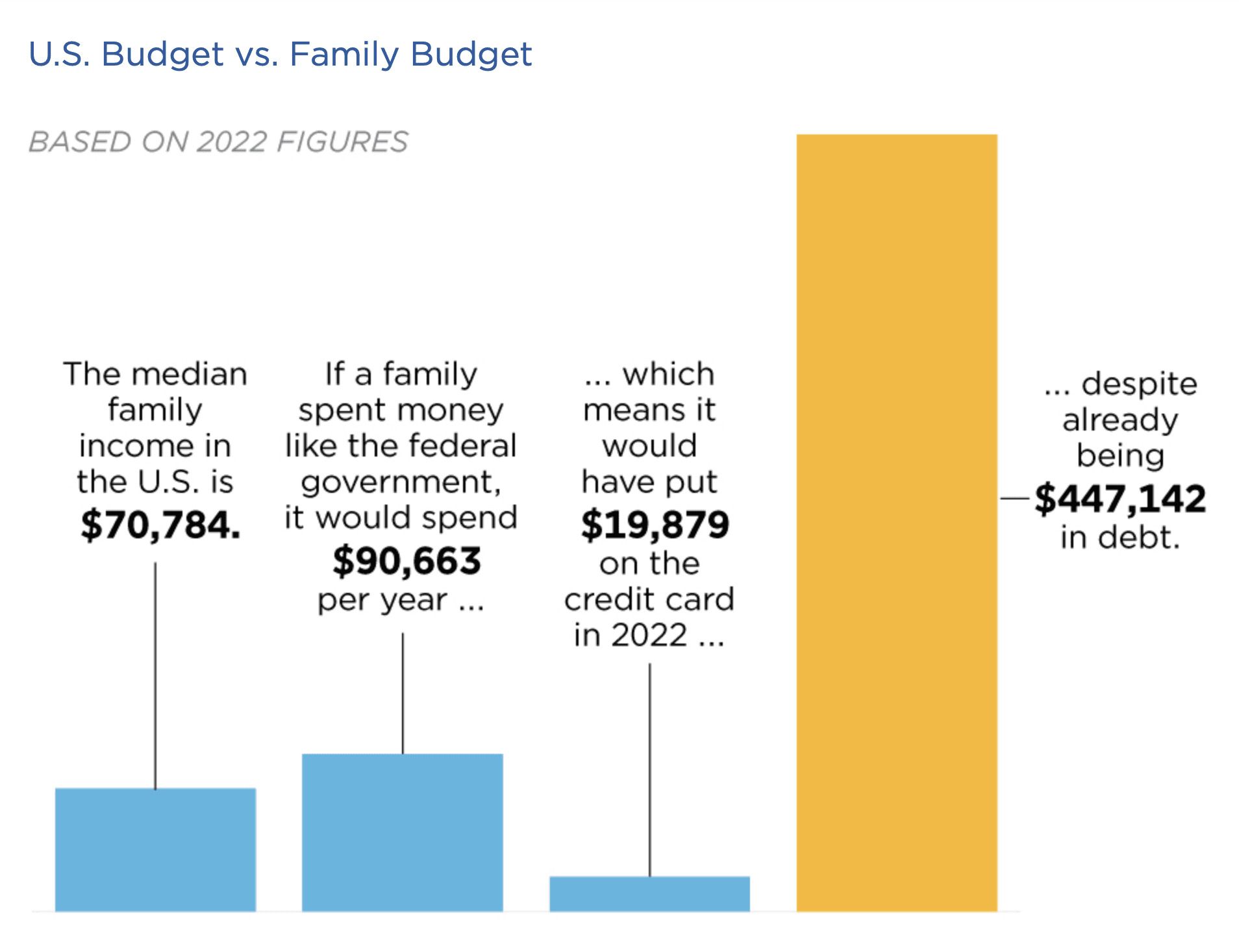

That really shouldn't be any big surprise because this chart (based on 2022 numbers) shows you how the U.S. Government is managing its budget -- as compared to a Family Budget.

So it takes the ratios of the U.S. Government spending and budget and it puts those into how it would look for a family earning the Median Income in the U.S.

The results are stunning:

Would a bank give a loan to someone with these numbers?

No way.

Not in a million years.

So...why do other countries still trust the U.S. Dollar?

Simple, only one reason: "the full faith and credit of the U.S. Government".

In other words, investors and other countries trust that the U.S. Government will always pay its bills -- somehow.

And so far that's true, the U.S. Government has never defaulted.

But the minute that confidence and trust in the U.S. Government goes away?

BOOM -- you'll have an instant and sharp crash of the U.S. Dollar.

And that's why this downgrade is so important.

Because they cite "governance deterioration" as one of the main reasons:

Fitch has downgraded #US #credit rating over fiscal and governance deterioration, dealing a serious blow to US’ global reputation and standing. The downgrade may also be a part of the gradual decline of the US #dollar system, analysts said. https://t.co/hddzja0wF2 pic.twitter.com/aMcGxHswOV

— Global Times (@globaltimesnews) August 2, 2023

Simply put: we now have LESS faith and confidence that the U.S. Government will actually pay its bills in the future because the country is being run so terribly!

Hello Joe Biden!

Kevin O'Leary confirms it's bad -- "There's no way to sugarcoat this."

Interestingly, the U.S. Credit Rating has only been cut one other time in history.

Care to guess when that was?

2011.

When Joe Biden was Vice President and Barack Hussein Obama was busy destroying this country in much the same way that Joe is doing right now.

Reuters has more details:

The dollar rose on Wednesday as investors shrugged off Fitch's U.S. credit rating downgrade while data showing a larger-than-expected increase in private payrolls in July bolstered the greenback as it points to labor market resilience.

Private payrolls rose by 324,000 jobs last month, the ADP National Employment report showed, more than an increase of 189,000 that economists polled by Reuters had forecast.

The U.S. labor market is gradually slowing after the Federal Reserve's hiking of interest rates by 525 basis points since March 2022. But the economy remains strong, as indicated by the Atlanta Fed's GDPNow running estimate of real GDP growth for the third quarter at 3.9%.

"The dollar is likely rising more in response to the economic data that continues to be stronger and therefore the market thinks that the Fed will continue to raise rates," said Michael Arone, chief investment strategist for State Street Global Advisors in Boston.

"Those interest rate differentials compared to other countries will continue to expand or be strong," he said. "The dollar is getting a rally, in conjunction with a little bit of flight to safety."

The dollar index , a measure of the U.S. currency against six peers, rose 0.57% to a fresh three-week high. The dollar index has gained 3.0% from a 15-month low on July 18.

Fitch on Tuesday downgraded the United States to AA+ from AAA in a move that drew an angry response from the White House and surprised investors, coming despite the resolution two months ago of a debt ceiling crisis.

So...what happens next?

Bank crashes and "BAIL INS".

That's what I expect to happen.

Ever heard of a "Bail In"?

Let me explain...

SPECIAL ALERT: Here Come Bank "Bail-Ins"!

You've heard of bank bailouts.

We all learned about those back in 2008/09.

And last weekend.

But there's something new they're going to roll out this time around....Bank Bail-INS.

Why bail out a bank with money from Congress if you can just take the money right out of your existing bank account!

Gee, what a novel concept!

In other words, this:

The 2010 Obama-era Dodd-Frank Act, claims to ‘PROTECT’ your money by allowing banks to STEAL it through a process called ‘bank bail-ins'.

Unfortunately, it looks like we might all become EXPERTS on this in the weeks to come. pic.twitter.com/LoiTDRZ9Yy

— Epstein's Sheet. 🧻 (@meantweeting1) March 11, 2023

That's a funny clip, but this is no laughing matter.

This is very real.

And once again I'm warning you that it's coming before it happens....so maybe you can protect yourself!

It's not just me and my crazy ideas....here is one of the top financial YouTubers, Meet Kevin, talking about it:

https://www.youtube.com/watch?v=5OoO3hf_s8I&t=1108s

And my man, Patrick Bet David too from just a few days ago:

Now check this out....

Video has leaked from closed door Fed meetings where they talk about how they can't possibly warn the public (i.e. we can't tell the public the truth!) because it will lead to mass hysteria.

Stunning.

They won't tell you the truth, but we will.

Watch this:

HOLY CRAP!

🇺🇸FDIC Bankers Discuss ‘Bail-Ins’, Bank Runs & Market Collapse

They're talking about financial crisis and their lack of faith in our banking system and how to keep the public from freaking out.

"I completely agree...you can't tell the public about this, they would… pic.twitter.com/0dSFYQYWVT

— DailyNoah.com (@DailyNoahNews) March 19, 2023

More here:

🇺🇸FDIC Bankers Discuss ‘Bail-Ins’, Bank Runs & Market Collapse

They're talking about financial crisis and their lack of faith in our banking system and how to keep the public from freaking out.

"You don't want a huge run on the institutions, and, and they're going to be… (🧵) pic.twitter.com/K8yaM8jzta

— Angelus caelis 🇮🇱 (@caelisangelus) March 11, 2023

Why Bank Bail-Ins will be the new bailouts:

https://twitter.com/VersanAljarrah/status/1616842617026658305

It's coming:

Body Language: FDIC Bank BAIL-INs pic.twitter.com/6IFodaGy5D

— ʙᴏᴍʙᴀʀᴅꜱ ✝️🐟 (@BombardsBL) December 30, 2022

ChatGPT knows EXACTLY what they are:

Bank bail-ins are a method of resolving a failing bank's financial difficulties by requiring the bank's shareholders and creditors to contribute to the bank's recapitalization, rather than relying solely on taxpayer funds. In a bail-in, the bank's creditors, including bondholders and depositors with balances over a certain threshold, may have a portion of their holdings converted into equity in the bank or written off completely.

This approach is intended to protect taxpayers from having to bail out a failing bank, and instead puts the burden on the bank's investors and creditors to bear the losses. Bail-ins are generally seen as a way to increase the accountability of banks and their investors, and to create incentives for banks to operate more prudently and manage risks more effectively.

Bail-ins have been implemented in various countries as part of financial regulatory reform efforts following the global financial crisis of 2008-2009. The European Union, for example, introduced a bail-in framework in 2014 that requires failing banks to first use their own funds and resources to address their financial difficulties before seeking public support.

Translation of that bold part: say you had $100,000 in a bank account.

One day they just decide a "bail in" is necessary and now you have $50,000. Or $25,000.

But they will thank you for doing your patriotic duty!

Wow, not me folks!

No way.

I'm going Crypto and Gold & Silver.

That's just me, but I like my money where the thieves can't just take it!

Here's more:

Everything you need to know about bank bail-ins. Convenient timing considering what's happening at #Silvergate $SI pic.twitter.com/qrmvfREIDN

— Nobody Special (@JG_Nuke) March 2, 2023

Of course the Government is telling you NOT to withdraw your funds....they're safe!

"Don't withdraw your money from the bank" The countdown to bank bail-ins just began. https://t.co/M4P1co2y9N

— Erik Voorhees (@ErikVoorhees) March 24, 2020

Look, I can't tell you what to do, I'm not a financial advisor.

But me personally?

I have a big chunk of my assets in crypto and another big chunk in precious metals.

I keep as little as possible in the banks.

That's just what helps me sleep best at night.

Here's more on gold:

Here's Why Central Banks Are Buying All the Gold They Can -- And What YOU Can Do!

For the last year, central banks across the globe have been buying up as much gold (and often silver) as they can acquire without raising alarm bells. Now, we see why.

The recent bank runs and ongoing collapse of the U.S. banking system was anticipated by the "elites" and the central bankers who run things behind the scenes. They saw it coming and knew the best way to protect their assets was through physical precious metals.

If you've been waiting for me to bring you a solution about what YOU can do to protect yourself and you're family, I'm happy to introduce you to something I absolutely love!

Precious metals.

I just talked about precious metals this week with Bo Polny and now I'm bringing you a solution that you can utilize right away if you're so inclined...

A faith-driven, conservative precious metals company is currently helping Americans tap into the rising precious metals market through self-directed IRAs backed by physical precious metals. And while this service is not unique to Genesis, their adherence to Biblical stewardship of money makes them singularly qualified to receive a sponsored recommendation from this site.

Unlike most companies offering similar services, Genesis deals only with physical precious metals. They do not offer "virtual" or "paper" gold or silver.

With Genesis and their depositories, customers can see and touch the precious metals that back their retirement accounts. When it comes time to take distributions, Genesis customers can cash in some or all of their precious metals or have them delivered to their door.

Central bankers aren't slowing down. In fact, nations like China and even U.S. states like Tennessee are quickly but quietly buying up gold to back their own treasuries. When the writing on the wall is this clear, it's understandable why these governments are moving quickly to get ahead of any potential economic catastrophes in store.

Working with Genesis is the best way our readers can explore the physical precious metals market through self-directed IRAs. It benefits us as well when our readers work with this America-First company.

Visit genesiswlt.com or call 866-292-0443 today.

Don't wait too long, we might have more bank failures right around the corner.

You know what has NEVER "failed"?

Gold. Precious metals. Indestructible.

There's a reason they call it "God's money".

Watch this for more:

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!