Quick disclosure: I have $0 in student loan debt—I have no dog in the fight.

That being said, student loan debt is a tough issue. On one hand, the conservative-libertarian in me says to pay back the loans you take out. On the other hand, I realize that this country has failed its youth.

For decades, the reigning orthodoxy from 99% of American adults was that children essentially existed on a school-to-university pipeline.

Every single parent, teacher, coach, guidance counselor, and media influencer shoved college and university down the throats of their children—I know, I was there, and I saw it happen.

I’ll never forget the day that I told my high school guidance counselor that I didn’t plan on attending college, he told me that this was a road to poverty and homelessness.

Eventually, I did attend and graduate from college, but on my terms: no debt. Today, without even contacting that man, I know that I have less debt and am in better financial condition than he will ever be.

It cannot be ignored that the ‘adults’ in this society, the people who should know better, cajoled young, impressionable people, who do not know better into taking out mountains of debt and pursuing useless college degrees.

After all, kids rely on their parents, teachers, coaches, etc for guidance—a child does not know better, nor are they expected to—it is the job of adults to properly guide children and young adults.

If this condition cannot be fulfilled, then what the hell is the purpose of the adults? Why not just grant a fetus complete autonomy?

It bears mentioning that the only reason I did not share the same debt-laden fate as many in my cohort was that my parents are deeply religious people and raised their children to believe that debt financing (usury) is a sin.

They raised us to believe that debt is evil and is expressly prohibited except as a medium of exchange to be paid off immediately before any interest accrues—basically credit arbitrage.

Most American parents do not raise their children this way, and hell will freeze over before a public school ‘teacher’ ever says it.

America is in between a rock and a hard place. As I stated earlier, personal responsibility is paramount. We should do everything we can to teach children self-reliance and personal responsibility.

If this had been any other type of loan, I would not be sympathetic to the people defaulting; however, student loan debt does not represent a normal type of loan—nothing about these loans is normal.

I cannot in good conscience advocate for hard-working Americans paying the loans of others.

I also cannot ignore the obvious dereliction of duty on behalf of most American adults. …So what’s the solution?

Call me crazy, but I believe that it is the universities, who price gouge, and the originators of such predatory loans who should be forced to foot the bill.

Public-facing universities should be denied public funding at all unless they get their acts together collectively—this means no $20,000 tuition a semester, no rules forcing students to live on campus, and no $500 college textbooks.

J.K. Rowling, who created the Harry Potter franchise from scratch, made a fortune off of selling books for $15-$25. …I hear the publisher made a pretty penny too.

If someone can do the work of creating an entire universe, and a 7-part book series for $25 a book, then the pastiche compilers of college textbooks that utilize public domain knowledge can do the same—no book is worth $500 unless it is an antique.

Once they are punished severely by being forced to pay the cost of the loans they essentially forced students to take out, we will see if they price gouge by 4,000% ever again.

Of course, something tells me this will never happen because universities are left-wing breeding grounds controlled by the same communists that comprise the mainstream media and the Democrat Party.

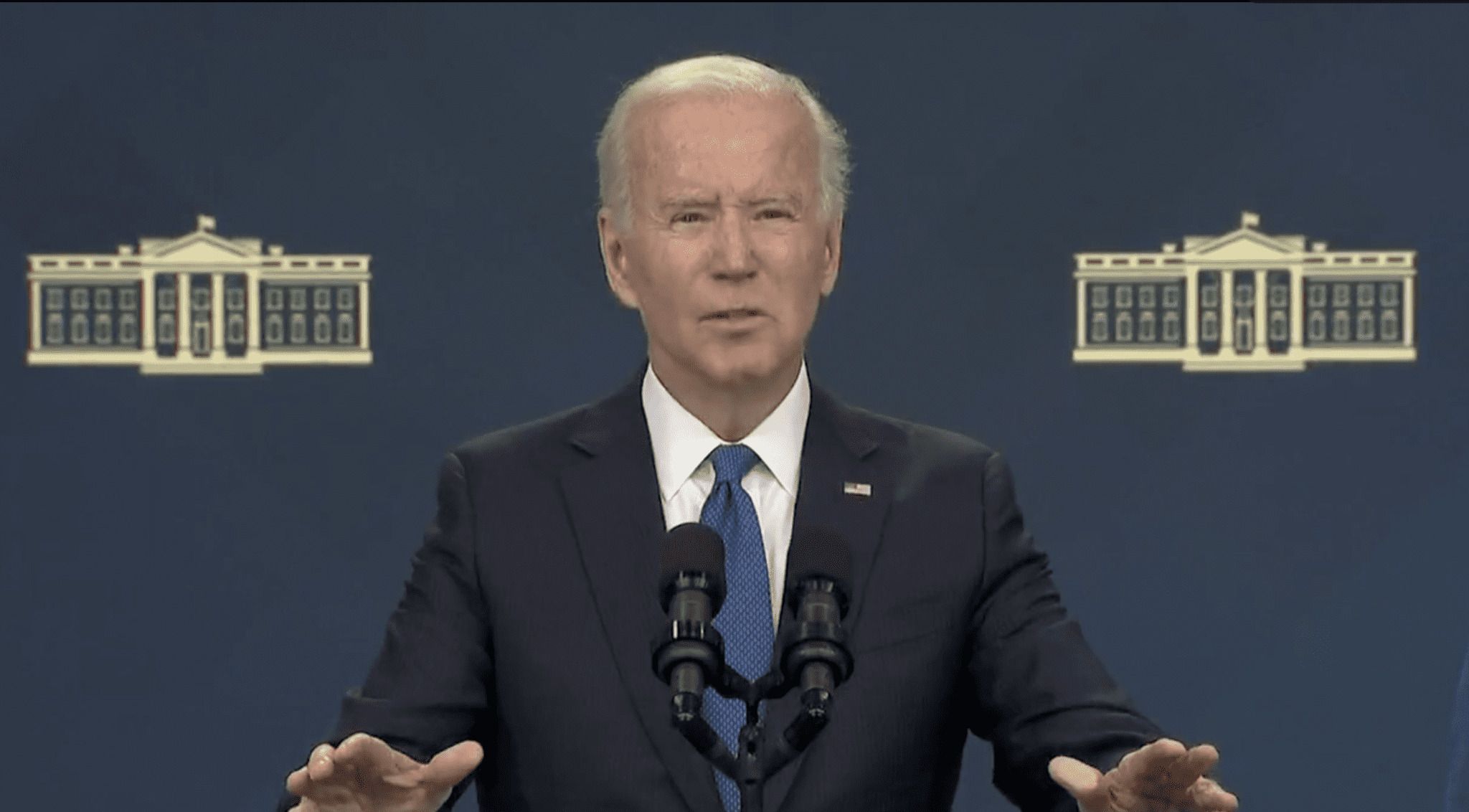

WLTReport previously reported that Joe Biden’s student loan relief efforts were struck down by SCOTUS, yet Biden continues to circumvent the court and press on.

Mere days ago, Biden announced: “For years, student loan borrowers haven’t received forgiveness under their Income-Driven Repayment plans despite making payments for over 20 years. I’m determined to fix it. Today, thanks to my Administration’s actions, 804,000 borrowers will start to see their debt canceled.”

For years, student loan borrowers haven't received forgiveness under their Income-Driven Repayment plans despite making payments for over 20 years.

I'm determined to fix it.

Today, thanks to my Administration's actions, 804,000 borrowers will start to see their debt cancelled.

— President Biden (@POTUS) August 14, 2023

The Biden regime’s Secretary of Education, Miguel Cardona, made a similar announcement, with a corresponding social media post from the Department of Education:

“Today, the Biden-Harris Administration is beginning to discharge loans for 804,000 borrowers who never received the forgiveness they rightfully earned through decades of payments. We are fighting for borrowers and fixing a broken student loan system.”

Today, the Biden-Harris Administration is beginning to discharge loans for 804,000 borrowers who never received the forgiveness they rightfully earned through decades of payments.

We are fighting for borrowers and fixing a broken student loan system.https://t.co/a3aDtc7L9V

— Secretary Miguel Cardona (@SecCardona) August 14, 2023

Beginning this week, 804,000 student loan borrowers started receiving $39 billion in automatic student loan discharges thanks to fixes to income-driven repayment (IDR) plans implemented by the Biden-Harris Administration. https://t.co/yA1sYHbOLR

⬇️ Learn more ⬇️ pic.twitter.com/Kw6VNUj3sS

— U.S. Department of Education (@usedgov) August 15, 2023

According to The Epoch Times:

“The forthcoming discharges are a result of fixes implemented by the Biden-Harris Administration to ensure all borrowers have an accurate count of the number of monthly payments that qualify toward forgiveness under income-driven repayment (IDR) plans,” said the administration in an Aug. 14 press release—a month after the forgiveness plan was announced.

The department said that the forgiveness program was part of fixes to address “historical failures” in which “qualifying payments made under IDR plans that should have moved borrowers closer to forgiveness were not accounted for.”

Congressman Ben Cline urged action to stop Biden’s student debt relief:

“The Biden admin is moving forward with its student loan giveaway, canceling $39 billion for 804,000 borrowers. This goes against the previous SCOTUS ruling that this scheme is unconstitutional, which is why the Senate must pass the House GOP’s resolution to stop it.”

The Biden admin is moving forward with its student loan giveaway, canceling $39 billion for 804,000 borrowers.

This goes against the previous SCOTUS ruling that this scheme is unconstitutional, which is why the Senate must pass the House GOP’s resolution to stop it.

— Congressman Ben Cline (@RepBenCline) August 15, 2023

Axios reports that challenges to Biden’s new student loan relief effort have fallen flat:

A federal judge dismissed a lawsuit Monday from conservative groups looking to block student loan forgiveness for some 804,000 borrowers.

The decision marks a win for student loan borrowers and for President Biden, who promised to continue pursuing debt relief after the Supreme Court’s decision last month to strike down his administration’s loan forgiveness plan.

ADVERTISEMENT

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!