An American banking giant has come under fire after it was revealed that they de-banked a Trump ally and prominent conservative figure.

John Eastman, a former attorney for President Trump, unexpectedly and abruptly had his accounts terminated at both Bank of America and USAA. Daily Caller confirmed:

Bank of America alerted Eastman in September of 2023 that it would be closing his accounts, a letter obtained by the Daily Caller shows.

Shortly thereafter, USAA notified Eastman in November that his two bank accounts with the company would be closed, a separate letter shows.

The de-banking of conservatives is nothing new and peaked during the height of the Covid years.

However, the disgusting practice has not yet seen its last days, and financial institutions continue to persecute Americans for their political beliefs.

MAGA patriots took to social media to speak out against Bank of America and called for widespread boycotts of the bank:

Boycott Bank of America & USAA. https://t.co/5Jpyxum0JE

— Kat1776 ✝️🇺🇸 (@Kat17763) April 17, 2024

Boycott Bank of America.

— Insurrection Barbie (@DefiyantlyFree) April 18, 2024

LAWFARE: The Biden regime is pressuring (directly and indirectly) US companies to stop doing business with lawyers who represent(ed) President Trump. Lawyers who dare to represent Trump are forced to resign from their firms. It is a war on the 6th Amendment. pic.twitter.com/ppC8QidF7u

— @amuse (@amuse) April 17, 2024

No one should be using Bank of America for their personal accounts as they are not personal loan friendly and have not been for years. They want the larger corporate customers.

It is time to boycott Bank of America so they are forced to be bought out. We do not need DEI in the… https://t.co/BupM2dh4ck

— LJ Lindsey (@lind52218) April 17, 2024

Newsweek added:

Elsewhere, 15 Republican attorneys general signed a letter warning Bank of America CEO Brian T. Moynihan against its alleged “discriminatory behavior” targeting people for their political or religious views.

“Your bank needs to be transparent with and assure us, its shareholders, and others that it will not continue to de-bank customers for their speech or religious exercise,” they wrote.

RELATED:

Bank of America “Near Insolvent”? Bank Run Possible?

Recently, I covered a story about the $650 BILLION of “unrealized losses” about to hit the Big Banks in the United States.

Wild story!

I will post that full report below in case you missed it.

But what I really want to focus your attention on is a couple quotes from a Yahoo News article that I featured in that story.

Because it’s not getting nearly enough attention….

It’s a quote from Larry McDonald saying that Bank of America is INSOLVENT at a 6% Fed Funds rate.

Read that again.

BOA — INSOLVENT — in the same sentence!

So, you might be asking, “what is the current Fed Funds Rate”?

It’s 5.5%.

Uncomfortably close to INSOLVENT.

Wow.

He was quoted in the article I’ll show you below, but he also posted it to Twitter so you can see it right here.

I believe Bank of America is insolvent with a 6% Fed funds rate, leverage explodes. If your core capital is impaired, any losses on tertiary assets (credit cards, commercial real estate, asset backed securities) are exponential painful. https://t.co/Xd76VATiOr

— Lawrence McDonald (@Convertbond) October 10, 2023

More here:

Hollyyyy Fuckkkk is anyone talking about this. Bank Of America May be insolvent. #MOASS #boa #BankofAmerica #insolvent pic.twitter.com/0jC0Q0mM9b

— Nazeem Elkommos (@NazeemElkommos) October 3, 2021

And then of course you have The Simpsons predicting it in advance:

The Simpsons predicted Bank of America running out of money.

All banks are insolvent, which is why you are unable to withdraw all of your money in one day. pic.twitter.com/5xMPs7YT6M

— Shannon Crawford (@shae33172) January 21, 2023

Bank Runs incoming?

🚨 BREAKING: There's going to be a #BankRun Many #Banks are gonna start falling rapidly and become insolvent. #CitizensBank in Iowa is insolvent and the dominoes are falling. Even Bank of America #BOA & Wells Fargo #WFC are warning depositors of withdrawal issues plus… pic.twitter.com/jn6pdLEvny

— Richard Barry (@irishchink) November 4, 2023

My original report is below, with much more information.

I recommend you read in full and take action IMMEDIATELY if you have significant funds in a bank.

I have a solution for you farther down below.

BOND MARKET CRASH? “Big Banks Have $650 Billion of Unrealized Losses”

Earlier today I brought you the report that Moody’s has DOWNGRADED the USA to a “Negative” outlook.

The United States of America.

Unbelievable.

But we’ve been warning you as loudly as we can that this was coming!

More on that below in case you missed it.

But that’s not all the bad news out today….

No folks, it’s starting to look VERY ugly almost everywhere you look.

We just had this happen, FEDWIRE going down, major issues, reports of hacking:

*FED REPORTS 'SERVICE ISSUE' WITH FEDWIRE SECURITIES SERVICE

everyone getting hacked

— zerohedge (@zerohedge) November 10, 2023

It almost feels like they’re about ready to shut this current system off and roll us into a new one, doesn’t it?

One that uses Gold, Silver and Cryptocurrency?

Hey, what do I know, I could be totally wrong, but sure feels like it to me!

After all, this happened last Friday:

BREAKING: Reports Of Missing Deposits As “Direct Deposit System” Crashes (All Major Banks Affected)

Remember that?

Sure does seem like they love testing these things (or breaking these things) on Fridays, doesn't it?

Things that make you go "hmmmmmm".

But the even bigger story, perhaps, is the impending Bond Market Collapse.

Even if you don't know much about bonds or how they operate, trust me that this is historic, unprecedented, and very, very bad.

Unlike the last time, there are no "bond vigilantes" coming to bail us out.

🚨🚨BOND MARKET COLLAPSE 🚨🚨

🚨🚨CENTRAL BANK COLLAPSE 🚨🚨

🚨🚨 WHAT TO KNOW🚨🚨

What people (investors) need to understand now is, it doesn't matter how much currency a central bank prints (in the form of a bond), the currency, in this case, the U.S. Dollar has no…

— MikeCristo8 (@MikeCristo8) November 10, 2023

For the visual learners:

🔴⚠️ #US bond market crash, visualized

US bank stocks hitting historic lows against the S&P 500 index due to a bond market collapse.

Moody's estimates that US banks now have $650 b. in unrealized losses on such securities with Bank of America alone dealing with $130 b. pic.twitter.com/x5fVTq6hXf

— @PalasAtenea🍊 (@AthenaMia2nd) November 10, 2023

Massive report on Yahoo earlier:

Even Yahoo can't deny it.

Our banking system is broken, and on the verge of collapse. Banks own over half a TRILLION in bonds that have collapsed in value, but YOU (taxpayer) have been put on the hook to ensure bank execs' stock values don't drop. https://t.co/hIIs9rF3tj

— Steve Eitreim (@SteveEitreim) November 7, 2023

From Yahoo News, here's more on the $650 BILLION in pending losses -- gee, you think that's going to cause a problem or anything?

Crashing bond prices sank Silicon Valley Bank in March — and there's reason to believe that what triggered the California lender's collapse may be haunting Wall Street again.

The brutal Treasury-market meltdown has hit some of the largest financial institutions hard, dragging down the share prices of big names such as Bank of America and fueling fears that the turmoil triggered by SVB's bankruptcy may not be over just yet.

Here's everything you need to know about unrealized losses, including why they're dragging on bank stocks and whether they could trigger another financial crisis.

Unrealized losses

Treasury bonds — debt instruments the government issues to fund its spending — have been on a nightmarish run since the onset of the pandemic, with investors fretting about rising interest rates and the long-term viability of the US's massive deficit.

BlackRock's iShares 20+ Year Treasury fund, which tracks longer-duration debt prices, has plunged 48% since April 2020. Meanwhile, 10-year Treasury yields, which move in the opposite direction to prices, recently spiked above 5% for the first time in 16 years.

As a result of that sell-off, some of the US's biggest banks are now sitting on unrealized, or "paper," losses worth hundreds of billions of dollars. That means the value of their bond holdings has plunged, but they've chosen to hold on rather than offload their investments.

Moody's estimated last month that US financial institutions had racked up $650 billion worth of paper losses on their portfolios by September 30 — up 15% from June 30. The ratings agency's data still doesn't account for a hellish October where the longer-term collapse in bond prices spiraled into one of the worst routs in market history.

These "losses" are not the same as debt, however, which describes actual borrowings that need to be repaid.

Bank of America is the big lender worst affected by the crash in bond prices, having disclosed a potential $130 billion hole in its balance sheet last month.

The other "Big Four" banks — Citigroup, JPMorgan Chase, and Wells Fargo — have also racked up unrealized losses in the tens of billions, according to their second- and third-quarter earnings reports.

Another SVB-style crisis?

Silicon Valley Bank failed in March after disclosing a $1.8 billion loss on its own bond portfolio, triggering a run on deposits. Similarly, big banks' huge unrealized losses are also sparking concern among Wall Street doom-mongers.

"'Higher for longer' is absurd baloney," the market vet Larry McDonald said in a post on X Sunday, referring to the Fed signaling it would hold interest rates at about their current level well into 2024 in a bid to kill off inflation. "A 6% + Fed funds and Bank of America is near insolvency."

It's important to remember that BofA's $130 billion losses are still unrealized. Unlike SVB, it isn't officially in the red yet because it has not sold its bond holdings.

The bank's chief financial officer, Alastair Borthwick, shrugged off the market's worries on last month's earnings call, pointing out that most of the bank's fixed-income portfolio was low-risk government bonds it planned to hold until the debt expires.

"All of these are unrealized losses are on government-guaranteed securities," he told reporters. "Because we're holding them to maturity, we will anticipate that we'll have zero losses over time."

There's still a possibility that spooked BofA customers will pull their money en masse, as they did with SVB — but that hasn't happened. In fact, deposits are up after registering about 200,000 new accounts in the third quarter.

Read that last part that I put in bold....

Folks, this is YAHOO NEWS speculating that we may soon see a BANK RUN on Bank of America!

That would be the Black Swan event, no doubt.

Can you imagine what would happen after that?

Very scary.

This all comes on the heels of this report from earlier today:

BREAKING: Moody's Cuts USA Outlook To "Negative"

It seems like every day there is a new breaking story I have to bring you about our economy falling off a cliff....

Of course that should come as no big surprise after the intentional destruction caused by the Biden Regime, but the news that just broke is being described as "dropping a nuke" -- financially speaking.

Top rating agency Moody's just cut the USA outlook.

You might be thinking we went from AAA+ to AAA or something, but no....it's been cut to "NEGATIVE OUTLOOK".

The United States of America!

I told you, they LOVE to drop bombs late in the day on a Friday:

BREAKING: Moody's changes outlook on United States' ratings to Negative

Moody's: Debt affordability in the U.S. to be significantly weakened.

Of-course they waited until after close on Friday, before OpEx week and a government shutdown on Friday to do this 😉

— Financelot (@FinanceLancelot) November 10, 2023

Ohhhh buddy, Black Monday incoming?

JUST IN: 🇺🇸 Moody's downgrades US credit outlook from stable to negative.

— Watcher.Guru (@WatcherGuru) November 10, 2023

Boom 💣

Moody’s drops a nuke AH.

No one should be surprised.

Cheers to Moody’s for having the guts to do this. pic.twitter.com/xPIYwqmdEp

— QE Infinity (@StealthQE4) November 10, 2023

Here's more from CNBC on this breaking story:

Moody’s Investors Service on Friday lowered its ratings outlook on the United States’ government to negative from stable, pointing to rising risks to the nation’s fiscal strength.

The ratings agency has affirmed the long-term issuer and senior unsecured ratings of the U.S. at Aaa.

“In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues,” the agency said. “Moody’s expects that the US’ fiscal deficits will remain very large, significantly weakening debt affordability.”

Brinkmanship in Washington has also been a contributing factor, Moody’s said.

“Continued political polarization within US Congress raises the risk that successive governments will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability,” the ratings agency said.

As far as keeping the nation’s ratings at Aaa, Moody’s said that it expects the U.S. to “retain its exceptional economic strength.” “Further positive growth surprises over the medium term could at least slow the deterioration in debt affordability,” the agency said.

“While the statement by Moody’s maintains the United States’ Aaa rating, we disagree with the shift to a negative outlook,” said Deputy Secretary of the Treasury Wally Adeyemo in a statement. “The American economy remains strong, and Treasury securities are the world’s preeminent safe and liquid asset.”

Moody's was actually the SECOND big ratings agency to cut the USA....

Fitch was first:

U.S. Dollar DOWNGRADED Due To "Governance Deterioration"

Something big happened yesterday and you might have missed it amidst all the Trump Arraignment coverage.

In fact, it was something we've been warning you about for a long time.

Specifically, Bo Polny has been telling you for almost two years now that the Dollar is about to CRASH.

When he first said it people thought he was crazy.

Now?

Now it doesn't look so crazy, not at all.

Especially not in light of what just happened yesterday.

Credit Rating Agency Fitch just DOWNGRADED the U.S. Dollar.

Dollar shaky after US credit rating downgrade https://t.co/du4oaIoooG pic.twitter.com/8Ep3csMcyn

— Reuters (@Reuters) August 2, 2023

And in case your eyes just glazed over a bit because you don't know what all of this means, let me make it very simple for you...

Have you ever bought a car or a house?

What does the bank look at before they give you a loan?

Your Credit Score.

Well, just like you have a Credit Score the United States also has a credit score.

And that Credit Score just went down.

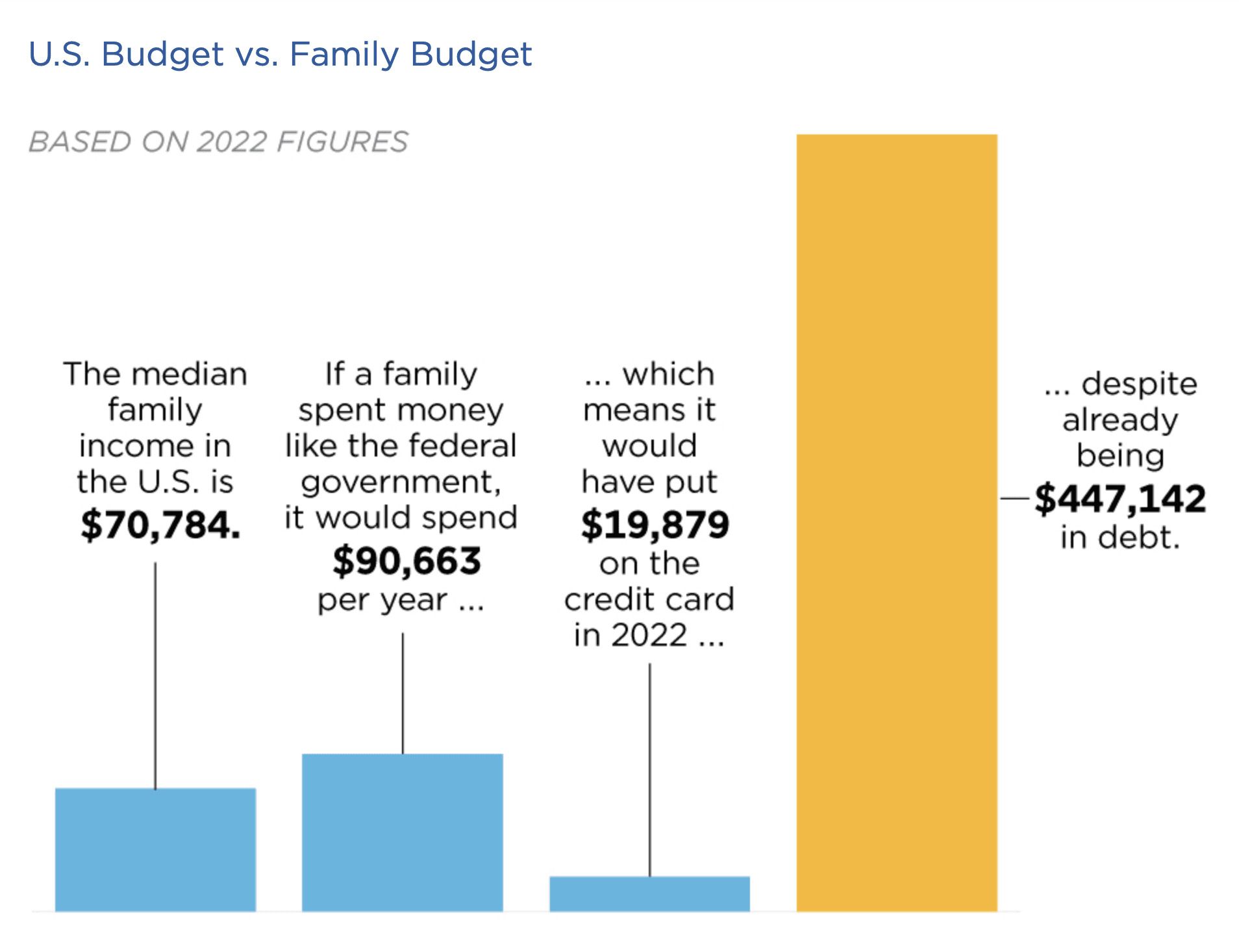

That really shouldn't be any big surprise because this chart (based on 2022 numbers) shows you how the U.S. Government is managing its budget -- as compared to a Family Budget.

So it takes the ratios of the U.S. Government spending and budget and it puts those into how it would look for a family earning the Median Income in the U.S.

The results are stunning:

Would a bank give a loan to someone with these numbers?

No way.

Not in a million years.

So...why do other countries still trust the U.S. Dollar?

Simple, only one reason: "the full faith and credit of the U.S. Government".

In other words, investors and other countries trust that the U.S. Government will always pay its bills -- somehow.

And so far that's true, the U.S. Government has never defaulted.

But the minute that confidence and trust in the U.S. Government goes away?

BOOM -- you'll have an instant and sharp crash of the U.S. Dollar.

And that's why this downgrade is so important.

Because they cite "governance deterioration" as one of the main reasons:

Fitch has downgraded #US #credit rating over fiscal and governance deterioration, dealing a serious blow to US’ global reputation and standing. The downgrade may also be a part of the gradual decline of the US #dollar system, analysts said. https://t.co/hddzja0wF2 pic.twitter.com/aMcGxHswOV

— Global Times (@globaltimesnews) August 2, 2023

Simply put: we now have LESS faith and confidence that the U.S. Government will actually pay its bills in the future because the country is being run so terribly!

Hello Joe Biden!

Kevin O'Leary confirms it's bad -- "There's no way to sugarcoat this."

Interestingly, the U.S. Credit Rating has only been cut one other time in history.

Care to guess when that was?

2011.

When Joe Biden was Vice President and Barack Hussein Obama was busy destroying this country in much the same way that Joe is doing right now.

Reuters has more details:

The dollar rose on Wednesday as investors shrugged off Fitch's U.S. credit rating downgrade while data showing a larger-than-expected increase in private payrolls in July bolstered the greenback as it points to labor market resilience.

Private payrolls rose by 324,000 jobs last month, the ADP National Employment report showed, more than an increase of 189,000 that economists polled by Reuters had forecast.

The U.S. labor market is gradually slowing after the Federal Reserve's hiking of interest rates by 525 basis points since March 2022. But the economy remains strong, as indicated by the Atlanta Fed's GDPNow running estimate of real GDP growth for the third quarter at 3.9%.

"The dollar is likely rising more in response to the economic data that continues to be stronger and therefore the market thinks that the Fed will continue to raise rates," said Michael Arone, chief investment strategist for State Street Global Advisors in Boston.

"Those interest rate differentials compared to other countries will continue to expand or be strong," he said. "The dollar is getting a rally, in conjunction with a little bit of flight to safety."

The dollar index , a measure of the U.S. currency against six peers, rose 0.57% to a fresh three-week high. The dollar index has gained 3.0% from a 15-month low on July 18.

Fitch on Tuesday downgraded the United States to AA+ from AAA in a move that drew an angry response from the White House and surprised investors, coming despite the resolution two months ago of a debt ceiling crisis.

So...what happens next?

Bank crashes and "BAIL INS".

That's what I expect to happen.

Ever heard of a "Bail In"?

Let me explain...

SPECIAL ALERT: Here Come Bank "Bail-Ins"!

You've heard of bank bailouts.

We all learned about those back in 2008/09.

And last weekend.

But there's something new they're going to roll out this time around....Bank Bail-INS.

Why bail out a bank with money from Congress if you can just take the money right out of your existing bank account!

Gee, what a novel concept!

In other words, this:

The 2010 Obama-era Dodd-Frank Act, claims to ‘PROTECT’ your money by allowing banks to STEAL it through a process called ‘bank bail-ins'.

Unfortunately, it looks like we might all become EXPERTS on this in the weeks to come. pic.twitter.com/LoiTDRZ9Yy

— Epstein's Sheet. 🧻 (@meantweeting1) March 11, 2023

That's a funny clip, but this is no laughing matter.

This is very real.

And once again I'm warning you that it's coming before it happens....so maybe you can protect yourself!

It's not just me and my crazy ideas....here is one of the top financial YouTubers, Meet Kevin, talking about it:

And my man, Patrick Bet David too from just a few days ago:

Now check this out....

Video has leaked from closed door Fed meetings where they talk about how they can't possibly warn the public (i.e. we can't tell the public the truth!) because it will lead to mass hysteria.

Stunning.

They won't tell you the truth, but we will.

Watch this:

HOLY CRAP!

🇺🇸FDIC Bankers Discuss ‘Bail-Ins’, Bank Runs & Market Collapse

They're talking about financial crisis and their lack of faith in our banking system and how to keep the public from freaking out.

"I completely agree...you can't tell the public about this, they would… pic.twitter.com/0dSFYQYWVT

— DailyNoah.com (@DailyNoahNews) March 19, 2023

More here:

🇺🇸FDIC Bankers Discuss ‘Bail-Ins’, Bank Runs & Market Collapse

They're talking about financial crisis and their lack of faith in our banking system and how to keep the public from freaking out.

"You don't want a huge run on the institutions, and, and they're going to be… (🧵) pic.twitter.com/K8yaM8jzta

— Angelus caelis 🇮🇱 (@caelisangelus) March 11, 2023

Why Bank Bail-Ins will be the new bailouts:

https://twitter.com/VersanAljarrah/status/1616842617026658305

It's coming:

Body Language: FDIC Bank BAIL-INs pic.twitter.com/6IFodaGy5D

— ʙᴏᴍʙᴀʀᴅꜱ ✝️🐟 (@BombardsBL) December 30, 2022

ChatGPT knows EXACTLY what they are:

Bank bail-ins are a method of resolving a failing bank's financial difficulties by requiring the bank's shareholders and creditors to contribute to the bank's recapitalization, rather than relying solely on taxpayer funds. In a bail-in, the bank's creditors, including bondholders and depositors with balances over a certain threshold, may have a portion of their holdings converted into equity in the bank or written off completely.

This approach is intended to protect taxpayers from having to bail out a failing bank, and instead puts the burden on the bank's investors and creditors to bear the losses. Bail-ins are generally seen as a way to increase the accountability of banks and their investors, and to create incentives for banks to operate more prudently and manage risks more effectively.

Bail-ins have been implemented in various countries as part of financial regulatory reform efforts following the global financial crisis of 2008-2009. The European Union, for example, introduced a bail-in framework in 2014 that requires failing banks to first use their own funds and resources to address their financial difficulties before seeking public support.

Translation of that bold part: say you had $100,000 in a bank account.

One day they just decide a "bail in" is necessary and now you have $50,000. Or $25,000.

But they will thank you for doing your patriotic duty!

Wow, not me folks!

No way.

I'm going Crypto and Gold & Silver.

That's just me, but I like my money where the thieves can't just take it!

Here's more:

Everything you need to know about bank bail-ins. Convenient timing considering what's happening at #Silvergate $SI pic.twitter.com/qrmvfREIDN

— Nobody Special (@JG_Nuke) March 2, 2023

Of course the Government is telling you NOT to withdraw your funds....they're safe!

"Don't withdraw your money from the bank" The countdown to bank bail-ins just began. https://t.co/M4P1co2y9N

— Erik Voorhees (@ErikVoorhees) March 24, 2020

Look, I can't tell you what to do, I'm not a financial advisor.

But me personally?

I have a big chunk of my assets in crypto and another big chunk in precious metals.

I keep as little as possible in the banks.

That's just what helps me sleep best at night.

Here's more on gold:

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!