I keep warning you: the Banking Crisis is NOT over.

We saw six banks go under last year in 2023 and many people thought that was the end.

My opinion is it was only the prelude…the warm up act.

We’ve reported on New York Community Bank a few weeks ago, but things just went from bad to worse.

The stock just plunged another 30%, their CEO is gone, and losses were revised UP from $252 million to $2.7 billion.

Remember how I told you just yesterday that they always “revise” the data after the fact? They just did it again.

Here’s the latest:

BREAKING‼️New York Community Bank, $NYCB, falls ~20% after disclosing "material weakness of internal controls"

This is the bank that acquired the collapsed Signature Bank.

Bank Crisis II on the way… 👀 pic.twitter.com/BbFTGqQoqv

— Radar🚨 (@RadarHits) March 1, 2024

🫡NYCB crashes again. Just like NYCB, think of all the banks with toxic assets. It's all coming down. Welcome to march.

"The turmoil surrounding New York Community Bancorp (NYCB) is intensifying again after it disclosed the exit of CEO Thomas Cangemi, weaknesses in its internal… pic.twitter.com/xddiYqJEga

— Israel (@_AlphaAnon) March 1, 2024

Will it go to $0 or get bought out?

That is one UGLY chart:

JUST IN: New York Community Bank $NYCB crashes 20% in after hours trading citing "material weakness in internal controls."

Another one bites the dust pic.twitter.com/dSw1UPbiru

— Bitcoin Magazine (@BitcoinMagazine) February 29, 2024

The NY Post reports the crash is closer to 30% than 20%:

New York Community Bancorp sent its shares plummeting as much as 28% in premarket trading Friday after the regional lender said has discovered “material weaknesses” in the ways it tracks loan risks and that its CEO is leaving.

The New York-based firm announced late Thursday that CEO Thomas Cangemi would be leaving NYCB — capping off a 27-year tenure at NYCB — and that Alessandro DiNello would take his place, effective immediately.

DiNello, NYCB’s executive chairman, had been acting as the bank’s true boss since earlier this month, according to Yahoo Finance. In the weeks leading up to his departure, Cangemi had been reporting to DiNello, even changing its bylaws to make it happen.

New York Community Bancorp amended its fourth-quarter losses to $2.7 billion on Thursday when it separately announced a CEO change. The moves sent shares falling as much as 28% in premarket trading Friday.

One NYCB director, Hanif “Wally” Dahya, said in a Feb. 25 letter that he “did not support the proposed appointment” of DiNello as CEO without saying why, according to Yahoo.

Dahya, who had been presiding director, also resigned from the board on Thursday.

U.S. stocks smashed a new record high last week, but the rally may not last for long thanks to heightened risks that the economy returns to a 1970s-style stagflation scenario.

US heading to 1970s-style stagflation, JPMorgan Chase strategists warn Jamie Dimon, Jane Fraser and Wall Street sign Bank CEOs celebrate pay raises while junior bankers face another year of stingy bonusesHe was replaced by Marshall Lux, who initially joined NYCB’s board in early 2022, works as a senior partner at Boston Consulting Group, and previously served as global chief risk officer for Chase Consumer Bank at JP Morgan from 2007 to 2009, according to a press release on the leadership changes.

Separately on Thursday, the bank — among the top 30 in the US — amended its fourth-quarter losses from $252 million to $2.7 billion and divulged “internal control issues.”

“As part of management’s assessment of the Company’s internal controls, management identified material weaknesses in the Company’s internal controls related to internal loan review, resulting from ineffective oversight, risk assessment, and monitoring activities,” the company said in a filing with the Securities and Exchange Commission.

Now watch this as Bloomberg tells you exactly what I’ve been saying all along. This is NOT an isolated issue and it’s about to get much worse.

Here is Guggenheim Securities Co-Chairman Jim Millstein says that the bank failures we’ve see are from idiosyncratic issues:

With shares of NYCB falling, Guggenheim Securities Co-Chairman Jim Millstein says that the bank failures we’ve see are from idiosyncratic issues https://t.co/larVpxp7na pic.twitter.com/DdsR0rfMaX

— Bloomberg TV (@BloombergTV) March 1, 2024

Now I want to address something I hear people say sometimes on this topic…

Oh, it’s just a small regional bank, no big deal!

Not true!

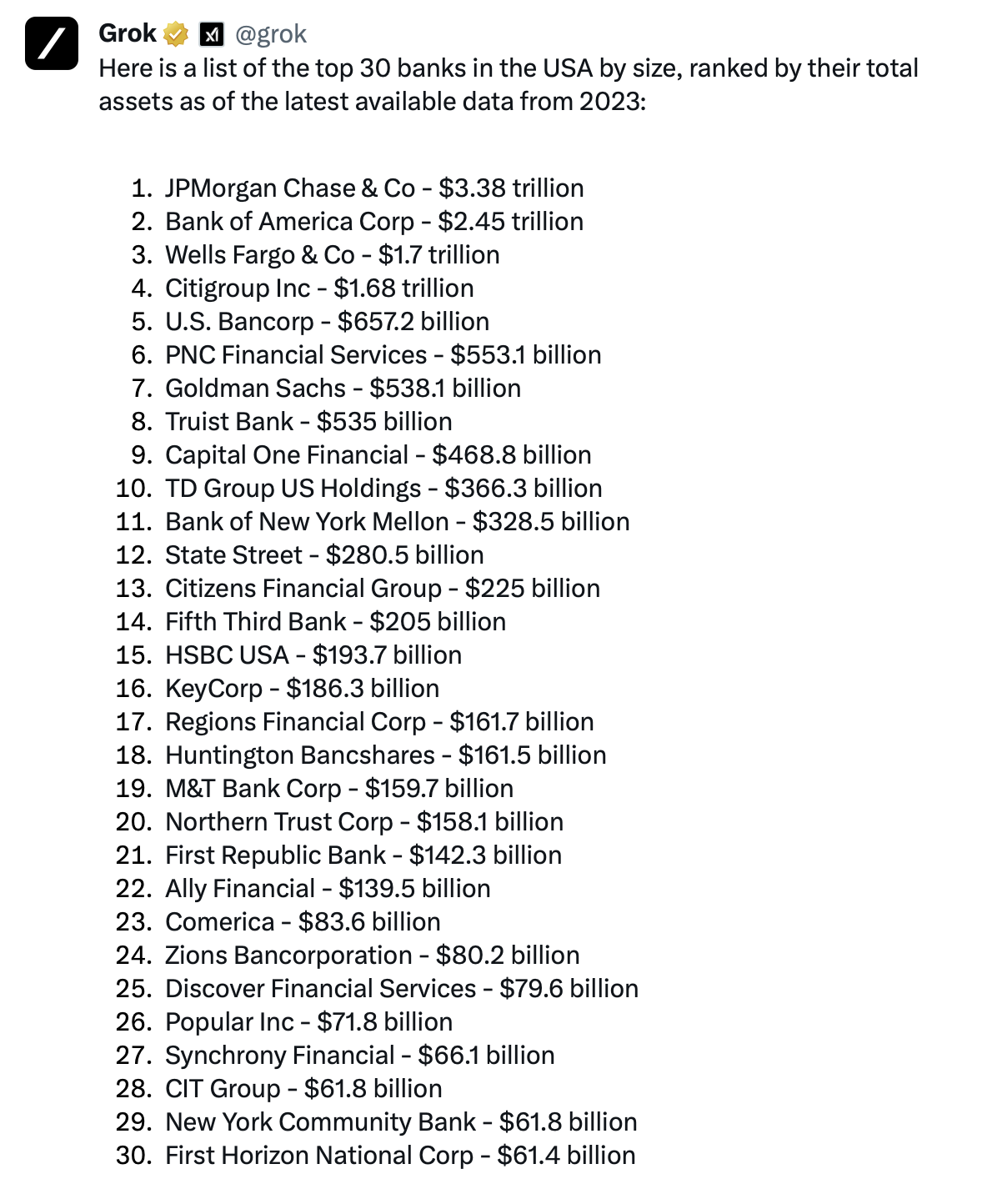

In fact, this is a TOP 30 U.S. Bank.

Take a look at this:

FACT-CHECK: New York Community Bank (NYCB) Is a Top 30 U.S. Bank!

We’ve been actively reporting on the crash of New York Community Bank, which has plunged roughly 60% over the past week and it looks on track to either be merged, taken over, or outright fail.

Earlier today Moody’s downgraded them to “Junk Status” and you don’t need to be a financial expert to understand that’s not good!

But I wanted to comment on something to put this into what I feel is the right perspective.

I’ve seen some people try to write this off as just one small bank failing and not a big deal. Even as 5 U.S. banks failed last year and now we already have one teetering on the edge in 2024, it’s easy to say it’s no big deal because it’s just some small, regional bank that no one has heard of.

Except….that’s not really true.

NYCB is actually the 29th largest bank in the USA:

When I first heard that it really shocked me.

Here’s more….

Of the five banks that failed it 2023, three were LARGER than New York Community Bank:

-

Silicon Valley Bank (SVB): SVB was the 16th largest bank in the USA at the time of its failure, with $209 billion in assets. This placed it just outside of the top 15 banks in the country.

-

Signature Bank: Signature Bank was the 29th largest bank in the USA at the time of its failure, with $110 billion in assets. It was one of the larger banks to fail in 2023, and its failure had a significant impact on the banking sector.

-

First Republic Bank: First Republic Bank was the 14th largest bank in the USA at the time of its failure, with $229 billion in assets. This placed it in the upper half of the top 30 banks in the country, making its failure particularly noteworthy.

-

Heartland Tri-State Bank: Heartland Tri-State Bank was not among the top 30 banks in the USA at the time of its failure. However, its failure still contributed to the overall increase in bank failures in 2023.

-

Bank of the West: Bank of the West was not among the top 30 banks in the USA at the time of its failure. Like Heartland Tri-State Bank, its failure added to the growing number of bank failures in 2023.

So if you think this is just some isolated incident of some small bank that was ran poorly or mismanaged, I would push back on that and say this looks much larger, and much more systemic than that.

And that’s scary.

So….what can YOU do about it?

I’ve been telling you for a while now, and perhaps this is the “sign” you need to finally take action!

First, you need to watch what the big boys are doing and understand it’s smart to ride their coattails.

And what are the big boys doing?

Stockpiling as much Gold as they can get their grubby hands on:

Now, here’s my preferred solution for owning gold….

Why preferred?

A couple reasons….

I’m not a CPA or tax advisor or even an investment advisor of any kind, but the folks I’m about to tell you about are experts at this.

They’re patriots…

They’ll give you personalized, one-on-one attention by phone….

And they’ll show you how you can do this with NO MONEY OUT OF POCKET — all in a retirement account and usually tax free!

How’s that for a win-win-win?

So what can you do?

THIS! 👇

Here’s Why Central Banks Are Buying All the Gold They Can — And What YOU Can Do!

For the last two years, central banks across the globe have been buying up as much gold (and often silver) as they can acquire without raising alarm bells. Now, we see why.

The recent bank runs and ongoing collapse of the U.S. banking system was anticipated by the “elites” and the central bankers who run things behind the scenes. They saw it coming and knew the best way to protect their assets was through physical precious metals.

If you’ve been waiting for me to bring you a solution about what YOU can do to protect yourself and you’re family, I’m happy to introduce you to something I absolutely love!

Precious metals.

I just talked about precious metals this week with Bo Polny and now I’m bringing you a solution that you can utilize right away if you’re so inclined…

A faith-driven, conservative precious metals company is currently helping Americans tap into the rising precious metals market through self-directed IRAs backed by physical precious metals. And while this service is not unique to Genesis, their adherence to Biblical stewardship of money makes them singularly qualified to receive a sponsored recommendation from this site.

Unlike most companies offering similar services, Genesis deals only with physical precious metals. They do not offer “virtual” or “paper” gold or silver.

With Genesis and their depositories, customers can see and touch the precious metals that back their retirement accounts. When it comes time to take distributions, Genesis customers can cash in some or all of their precious metals or have them delivered to their door.

Central bankers aren’t slowing down. In fact, nations like China and even U.S. states like Tennessee are quickly but quietly buying up gold to back their own treasuries. When the writing on the wall is this clear, it’s understandable why these governments are moving quickly to get ahead of any potential economic catastrophes in store.

Working with Genesis is the best way our readers can explore the physical precious metals market through self-directed IRAs. It benefits us as well when our readers work with this America-First company.

Visit genesiswlt.com or call 866-292-0443 today.

Don’t wait too long, we might have more bank failures right around the corner.

You know what has NEVER “failed”?

Gold. Precious metals. Indestructible.

There’s a reason they call it “God’s money”.

Watch this for more:

Or….I guess you could buy Gold at Costco?

If you can find any?

Oh, and you’ll pay a huge markup and you’ll be limited to two bars.

A “Gold Rush” Hits Costco With Demand For Gold Bars – Here’s One Way To Own Gold if Your Money Is In a Retirement Account

The demand for physical precious metals has been rising since before the pandemic. Central banks have been buying ton after ton for two years. Even some U.S. states — like Tennessee — are filling their coffers with physical precious metals.

Now, Costco is offering gold bars to their members — and some observers are saying there is a “gold rush” on Costco’s gold:

Mike Cernovich reported: “People buying them but bars sold out fast. One disappointed customer had paid but the membership pick-up said it was out.”

Others had no idea Costco sold gold:

Buying gold at Costco is great for those who have extra cash on hand — but what about those of us with money tied up in retirement accounts?

Can we rollover or transfer retirement accounts into physical precious metals and keep it tax-deferred?

Genesis Gold Group says “Yes!”

Genesis Gold Group specializes in self-directed IRAs backed by gold and silver. As a Christian company, they believe this is an appropriate form of financial stewardship that puts Americans’ money on the fiscal high ground.

This isn’t “paper” or “virtual” gold or silver; Genesis Gold Group customers can physically see their precious metals at their convenience. And when it comes time to take a disbursement, they can convert to cash or have their precious metals shipped directly to their homes.

Click here to reach out today through genesiswlt.com.

Genesis Gold Group was given 5 stars by reviewers on the Better Business Bureau website. Here is what some of them say:

“Genesis Gold Group has been very helpful to me as a first time customer. They were very patient with me and answered every question I had. The process of moving my funds from my former account to Genesis Gold Group was straightforward and easy. I highly recommend their services.” — Brian B.

“Recently, I had two experiences with Genesis Gold Group and both were very easy transactions. My agent was very knowledgeable and informative about the products that I was interested in. I suggest that for anyone looking to move their retirement into tangible materials, Genesis Gold Group is the company to choose.” — Joyce R.

“Genesis Gold Group is a wonderful company to do business with. The staff are knowledgeable, courteous, and patient. They know I’ve had many questions before, during, and even after opening my Self-Directed IRA and everyone has been very kind and open. Start your Gold IRA with Genesis Gold Group without reservation!” — Gerald C.

To work with Genesis Gold Group to own precious metals via your retirement accounts, click here to reach out today.

Oh, and did you know SUPERMAN loves them too?

Yup!

Here is what conservative star Dean Cain (Superman) says about working with Genesis Gold Group:

When Genesis Gold Group was first built, co-founder Jonathan Rose knew two things were necessary in order to thrive in the extremely competitive precious metals industry. First, he knew they wouldn’t repeat the same deceptive marketing tactics “Big Gold” companies use to entice customers. Second, he knew they needed spiritual guidance if they were going to succeed in reaching Americans who want their life’s savings protected from the tumultuous markets.

“If we are going to live up to our namesake, we have to be truly driven by Biblical principles… not only as individuals but as a company,” Rose said.

Millions of Americans have grown increasingly concerned about the trajectory of our nation. It made sense for Genesis Gold Group to launch by combining over 50-years of experience in gold and silver with proper guidance from faith leaders. This is why Director of Philanthropy David Holland, was one of the first people they hired.

“As a minister of the Gospel of Jesus Christ, I firmly believe good stewardship of a believer’s resources is important and a foundation for a close walk with Him,” Holland said. “It is not difficult to see, based on the lack of biblical values in both our government and financial system, that we are swiftly heading into unstable times.”

The challenges aren’t just coming from the economy or government. The precious metals industry itself is rife with “Big Gold” companies who are willing to use sketchy marketing tactics and over-the-top sales pressure to get Americans into overpriced products.

Self-directed IRAs backed by physical precious metals are becoming more popular for mature Americans who are concerned about inflation, unsustainable debt, the ongoing banking crisis, and “woke” ESG funds filling their retirement portfolios.

Click here to reach out to Genesis Gold Group today.

The challenge, as Rose noted, is that the vast majority of self-directed IRA products being pushed by “Big Gold” are not built with the customers’ best interests in mind.

“The process appears to be the same from one gold company to another but there’s a huge gap between how secular gold companies do business versus how we do it,” Rose said. “We guide our clients to back their retirement accounts with metals that are priced right and have the greatest opportunity for growth. Most gold companies look only at their own margins when filling their customers’ depositories.”

==>Click here to contact Genesis Gold Group today and receive a free Definitive Gold Guide and learn more about protecting your life’s savings from the various threats we’re facing today.

(Note: Thank you for supporting American businesses like the one presenting a sponsored message in this article and working with them through the links in this article which benefit WLTReport. We appreciate your support and the opportunity to tell you about Genesis Gold! The information provided by WLTReport or any related communications is for informational purposes only and should not be considered as financial advice. We do not provide personalized investment, financial, or legal advice.)

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!