America is broke….

BANKRUPT!

Broker than Jaden:

Funniest thing I've seen in a long time! 🤣🤣🤣🤣🤣🤣🤣 pic.twitter.com/M7PDzQhXKA

— Noah Christopher (@DailyNoahNews) August 3, 2023

That cracks me up every time….

Love that kid and his infectious laugh!

But this is actually serious.

The U.S. is literally insolvent.

By the book definition, we are wildly upside down with no hopes of getting better.

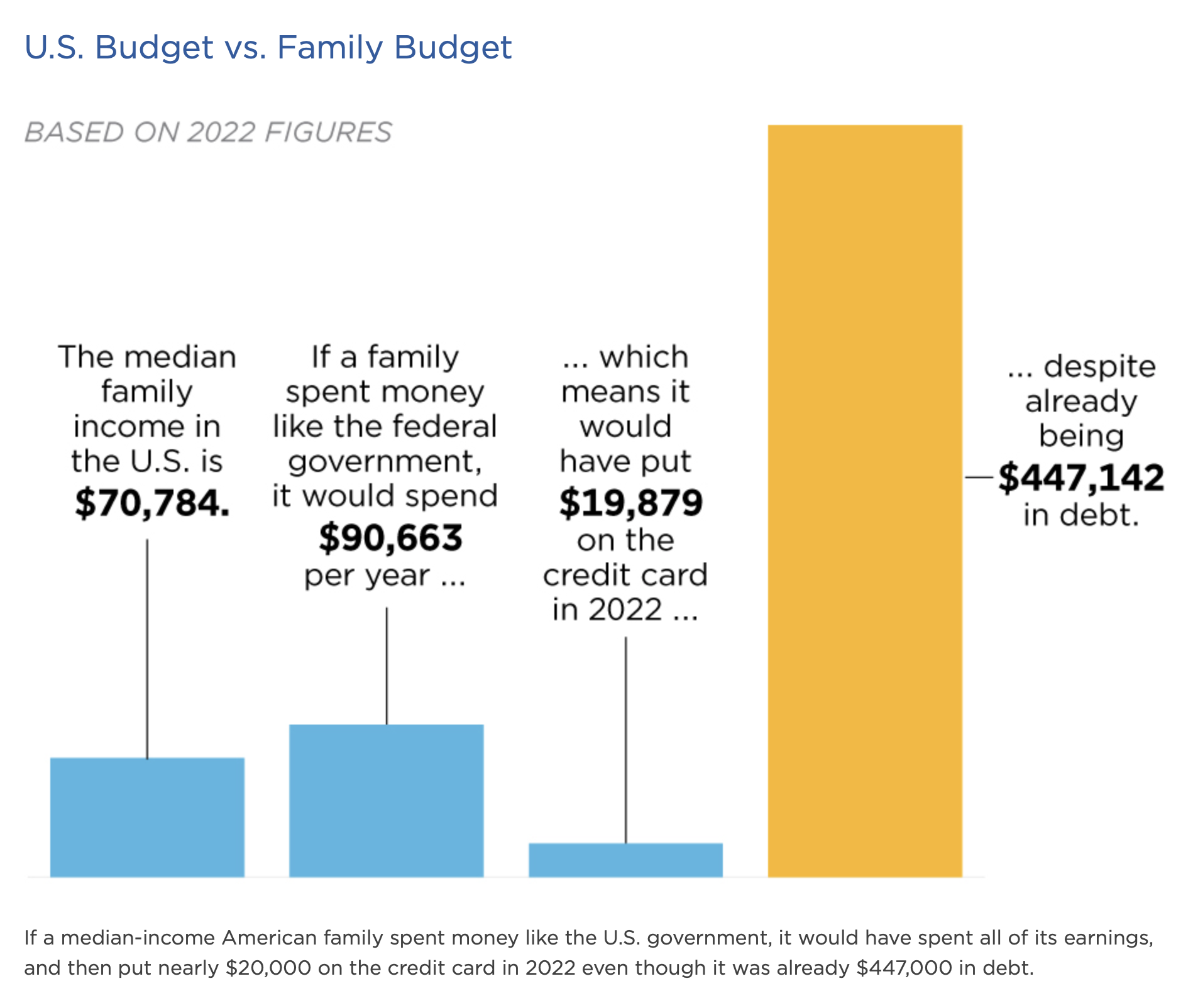

I love this example….

This really explains it — if the U.S. Budget were shown at the scale of a regular family budget, this is how out of control and upside down it would be:

Folks, that chart is the visual depiction of “insolvency”.

The ONLY reason we can still pay our debts is because we print new money out of thin air and the U.S. Dollar is the “best of the worst” currencies out there.

At least it has been.

I keep warning you that the U.S. Dollar is about to collapse (READ MORE HERE) and once that happens the ponzi scheme is over.

O-V-E-R.

And then things get really ugly.

Ok, so why did I tell you all of that?

Because in light of that background, we are insanely still sending BILLIONS upon BILLIONS to Ukraine!

It’s flat out treason, and I think you need to know the names of the 28 Republican Senators who just voted to send more to Ukraine:

🔥 REPORT: 28 United States Republican Senators have voted in favor of additional funding for Ukraine even though we don’t have the money. Here are their names: 1. John Barrasso (WY) 2. John Boozman (AR) 3. Shelly Moore Capito (WV) 4. Bill Cassidy (LA) 5. Susan Collins (ME)… pic.twitter.com/JwvRqhkj8x

— Wayne DuPree (@TheDupreeReport) September 27, 2023

🔥 REPORT: 28 United States Republican Senators have voted in favor of additional funding for Ukraine even though we don’t have the money. Here are their names: 1. John Barrasso (WY) 2. John Boozman (AR) 3. Shelly Moore Capito (WV) 4. Bill Cassidy (LA) 5. Susan Collins (ME) 6. John Cornyn (TX) 7. Tom Cotton (AR) 8. Kevin Cramer (ND) 9. Mike Crapo (ID) 10. Joni Ernst (IA) 11. Lindsey Graham (SC) 12. Chuck Grassley (IA) 13. John Hoeven (ND) 14. Cindy Hyde-Smith (R) 15. John Kennedy (LA) 16. James Lankford (OK) 17. Mitch McConnell (KY) 18. Jerry Moran (KS) 19. Markwayne Mullin (OK) 20. Lisa Murkowski (AK) 21. Mitt Romney (UT) 22. Mike Rounds (SD) 23. Marco Rubio (FL) 24. Dan Sullivan (AK) 25. John Thune (SD) 26. Thom Tillis (NC) 27. Roger Wicker (MS) 28. Todd Young (IN)

Not only did we vote to send Ukraine more BILLIONS, but get this….

If our Government shuts down, as it looks like it will in 3 days, all payments to American citizens stop.

You know what doesn’t stop?

Even in light of a Government Shutdown, the Ukraine payments still go on!

I am not kidding you!

“If there's a shutdown, US government workers will NOT be paid, but Ukrainian workers will be paid by the US taxpayer"

"There's nothing in the constitution that allows for spending like this on another country"

"It violates every precept of the Constitution" pic.twitter.com/spBGEh3qZG

— illuminatibot (@iluminatibot) September 27, 2023

Folks, we have treason inside our gates and we either stop it now or kiss this country goodbye.

Do you know how the scam works?

I know at this point you probably sense there’s a big scam going on here, but do you know exactly how it works?

I do.

FTX Money Laundering Scheme To Ukraine CONFIRMED?

Buckle up folks!

I have a MAJOR update on a story we first brought you back in the Fall of 2022.

“Fall” is appropriate because that’s when crypto firm FTX had its massive fall from grace.

And now just this week it looks like we may have confirmation that our reporting back in 2022 was 100% accurate.

Imagine that.

Let me back up for just a minute in case we have people who are new to this story or who need a refresher.

I’ll publish our full reporting from 2022 down below but here’s the quick recap…

This image explains it perfectly:

— Kim Dotcom (@KimDotcom) November 13, 2022

You pay taxes…

Taxes out the ears!

Then the US Government takes your tax dollars and sends billions upon billions over to Ukraine…

Ukraine then invested a big chunk of that money in FTX (that’s called money laundering)…

FTX donates huge amounts back to the Democrat party…

The Democrats then use that money to buy, influence and steal elections.

What a great system!

And if you think that’s just crazy Noah coming up with a crazy conspiracy theory, it’s not.

Here is Elon Musk exposing it too:

— Elon Musk (@elonmusk) November 13, 2022

NOW does it make sense why billions of your tax dollars are going to Ukraine every month?

You didn’t honestly think we were just giving it all away, did you?

Of course not!

It’s a complex money laundering operation!

Ok, now here’s the update.

Prepare to have your mind blown.

This is truly “hidden in plain sight”.

So we start here with the understanding that after FTX collapsed it owed customers about $8.7 BILLION:

JUST IN: New report shows FTX owed its customers $8.7 BILLION after commingling and misusing their deposits.

Take your #Bitcoin off exchanges!!

— Bitcoin Magazine (@BitcoinMagazine) June 26, 2023

Ok, you with me so far?

FTX is in the hole $8.7 BILLY.

But remember, FTX was a key player in the money laundering operation, so they have to be made whole.

Then this happens:

Pentagon has said that an accounting error has provided an extra $6.2 billion dollars for Ukraine. pic.twitter.com/wpVBTWsEOR

— unusual_whales (@unusual_whales) June 24, 2023

Remember that from last week?

The Pentagon “accidentally” sent Ukraine $6.2 billion dollars!

So, uh, when you accidentally send $6.2 billy, do you call and get a refund or something?

Of course that’s an EXTRA $6.2 billion on top of the billions we are sending weekly:

Last week the Pentagon said that they accidentally sent Ukraine an extra 6.2 Billion dollars. Today the White House said they are sending more money this week! 🤡 pic.twitter.com/tTviaDdPCl

— Jeff (@ISO_XRP) June 26, 2023

How did Ukraine get an extra $6.2 billion from the Pentagon? pic.twitter.com/bNrCIyWsZK

— ACT For America (@ACTforAmerica) June 22, 2023

Really gotta hate those “accounting errors” don’t you?

The Biden admin "accidentally" sent $6.2 billion extra to Ukraine.

Gotta hate those "account errors." pic.twitter.com/21gnmiOlOu

— Tim Young (@TimRunsHisMouth) June 22, 2023

Is anyone REALLY that bad at their job that they “accidentally” send $6.2 billion where they aren’t supposed to?

Not even people in Government are that inept.

Folks, it’s CORRUPTION, not “mistakes”.

Ok, now stay with me because here’s the final piece…

To recap:

FTX needs $8.7 Billion…

$6.2 Billion “accidentally” gets sent to the wrong place…

Now here it is:

FTX suddenly “recovers” $7 billion!

Wow, it’s a miracle!

JUST IN: Bankrupt FTX says they have recovered $7 billion in liquid assets.

— Watcher.Guru (@WatcherGuru) June 26, 2023

For once, some good news to come from the FTX bankruptcy team. pic.twitter.com/Mc12FjbHMZ

— Coin Bureau (@coinbureau) June 27, 2023

Just how DUMB do they think we are?

You kidding me with this?

We see right through it, and so do others:

It was a deep-state money laundering operation. https://t.co/Vbh9ra46fM

— Jeffrey A Tucker (@jeffreyatucker) June 26, 2023

IT’S MONEY LAUNDERING FOLKS!

Can’t get much more clear than this!

Are you awake?

Are you paying attention?

They are laughing at you and stealing BILLIONS of your dollars as they do it!

Oh, and a TON of politicians are caught in the middle too.

You didn’t think this story went away did you?

I believe when all of this is exposed it will be a major factor in clearing out Washington.

Take a look:

MAJOR Republican RINOs Caught In FTX Donation Scandal…

We’re going to name names…

If you’ve been following this Sam Bankman-Fried / FTX scandal, you know this is big.

In fact, it’s looking like Biden, Ukraine, Crypto and Pedos….are all possibly connected.

More on that at the end of this article — jump down there first if you don’t know anything about this story and need to get caught up to speed first.

We already knew Biden and many top Dems were ensnarled in this thing, and the crooked MSM is doing everything they can to give them cover.

But here’s what’s also been ignored: it’s not just the Democrats.

I’ve been telling you for 7 years now, it’s NEVER been about Republican vs. Democrat.

That’s a fake dichotomy designed to keep you distracted.

R’s and D’s are mostly on the same team.

In fact, I estimate there are maybe 10-20 honest people left in the entire D.C. system.

One is Trump.

Another is Kari Lake.

And there are probably no more than 20 others — if that many.

Everyone else, whether they’ve got an (R) or a (D) in front of their name is all crooked and sold out.

So sad to see what they’ve done to our country.

Let’s get into the details…

According to Bloomberg, McConnell took $1 million:

From Bloomberg, here’s more:

FTX US, a part of Sam Bankman-Fried’s crypto empire that catered to American customers, contributed to a super-PAC fighting for control of the Senate in the midterm election just days before the company’s collapse.

The Senate Leadership Fund, which is aligned with Senate Republican Leader Mitch McConnell and was the top spender in the 2022 midterms, received the $1 million donation on Oct. 27, according to its most recent filing with the Federal Election Commission. Only a couple of weeks later, more than a 100 FTX-related companies, including the US arm, filed for bankruptcy, and Bankman-Fried resigned as head of the corporate group.

The contributor listed on the FEC donation report is West Realm Shires Services Inc. and FTX US is its commercial name.

The Senate Leadership Fund did not immediately respond to a request for comment. The super-PAC spent $239 million in the midterms on behalf of Republican candidates, according to OpenSecrets, which tracks money in politics.

While several members of Congress, including Illinois Senator Richard Durbin, a Democrat, and Republican Representative Kevin Hern of Oklahoma have said they would return donations from FTX executives or give the money to charities, there isn’t a requirement in election law for committees to return donations to companies that go bankrupt.

FTX US also gave $750,000 to the Congressional Leadership Fund and $150,000 to the American Patriots PAC, both of which supported House Republican candidates. It gave $100,000 to the Alabama Conservatives Fund, which backed Republican Katie Britt’s successful run for the state’s open Senate seat.

Individual executives at the broader FTX company have given far more money. Bankman-Fried emerged as major donor to Democratic candidates leading up to the Nov. 8 midterm elections, donating most of the $39.4 million that he gave to them, FEC records show. One of his top lieutenants, Ryan Salame, gave $23.6 million — mostly to Republicans.

We always knew Mitch was a snake, didn’t we?

A rich snake.

According to a popular report circulating Twitter, here is the FULL LIST:

List of GOP committees and candidates who took money from FTX Executives. McConnell and McCarthy both took over $2mil. #DrainTheSwamp pic.twitter.com/SAYOVaJ4Me

— Bruce Porter Jr. (@NetworksManager) November 26, 2022

We have not been able to independently verify every name on this list, and to be fair we also note that candidates are rarely aware of every person or entity that makes a donation to their campaign — but that said, you might want to write down these names and remember them.

Kari Lake says the corruption is SO DEEP and SO WICKED it will blow your mind:

The depth of the corruption will blow your mind. It is time to expose it and bring it down. https://t.co/KLngjf5fK0

— Kari Lake (@KariLake) November 26, 2022

Here is just a portion of the article Kari Lake posted…from Revolver read the full story here:

Just days ago, Bloomberg estimated 30-year-old Sam Bankman-Fried’s (SBF) personal wealth at an astonishing $16 billion. Now, the disgraced FTX founder is essentially bankrupt, and if there is a shred of justice in the world, soon headed for prison.

The collapse of FTX and its founder is one of the most spectacular implosions in history. There is no shortage of narratives to mine for interesting article fodder. Celebrities like Tom Brady and his now ex-wife Gisele lost millions to the scam. There’s the Silicon Valley “smart money” that was hopelessly entranced by a wunderkind founder. SBF also used his ill-begotten lucre to become one of the largest donors in left-wing politics of the past four years. There’s also the FTX pet philosophy of “effective altruism,” the cult-like fad ideology of contemporary Silicon Valley that SBF exploited to conduct his fraud and justify taking enormous risks. And who can forget the 28-year-old girlboss CEO of Alameda Research Caroline Ellison, who bragged that her vast financial empire only requires “elementary school math” to turn profits, and whose public list of turn-ons includes “controlling major world governments.”

Last but not least, there’s the group sex (don’t worry, everyone involved in this “polycule” situation is hideous).

All of these storylines are being regurgitated ad nauseum by countless other media outlets. The story that Revolver is about to tell you is even bigger and more spectacular than all the other fascinating storylines listed above. In fact, dear reader, FTX may not even be the biggest scam in crypto. Another, even more spectacular scam may still be live, ready to collapse at any moment… if anyone decides to take a real look at it.

The story you’re about to hear concerns the third-largest crypto-currency on the planet, which you’ve probably never heard of. It is a story of how a former Disney child-actor — a Jeffrey Epstein associate who was embroiled in an under-age sex scandal — bizarrely emerged as one of the world’s strangest crypto-currency moguls. It is the story that raises serious questions as to whether an entire cryptocurrency is a scam — effectively a private money-printer. And to top it all off, there is reason to believe that if this cryptocurrency is the scam that it appears to be, it will nonetheless be allowed to continue because of this particular cryptocurrency’s usefulness to intelligence agencies in funneling money to foreign rebel groups and jihadis with plausible deniability.

Sound crazy? Sound interesting? Strap in, it’s about to get wild.

USDT, or Tether, is what is known as a “stablecoin.” A stablecoin is a cryptocurrency that, instead of fluctuating in value, is intended to hold to a consistent price. Tether is a USD stablecoin — each Tether is supposed to be equal in value to one U.S. dollar. While most cryptocurrencies are wildly speculative and backed by essentially nothing, each Tether is supposed to be backed directly by a U.S. dollar, or an extremely liquid, reliable investment like a U.S. treasury bond.

These USD stablecoins are used on cryptocurrency exchanges to conduct on-the-blockchain trades in lieu of using actual U.S. dollars. Without stablecoins like Tether, the current crypto ecosystem simply would not exist. There are multiple USD stablecoins, but Tether is by far the most popular. According to coinmarketcap.com, Tether has the third highest market cap of any crypto currency at $66 billion, trailing only Bitcoin and Ethereum. Today, fully half of all bitcoin trades globally are executed using Tether.

A year ago, crypto news site Protos summarized Tether this way:

If cryptocurrency was an engine, Tether (USDT) is one of its pistons.

Over the past seven years, the maverick stablecoin has evolved into a primary crutch for the ecosystem. It’s a tool for onboarding new money, managing and growing liquidity, pricing digital assets, and generally oiling crypto markets to keep them smooth.

Tether boasted a $1 billion market capitalization when Bitcoin hit $20,000 at the end of 2017. This year, it’s a $70 billion-plus powerhouse.

Practically every crypto exchange supports USDT trade in some form. The makeup of Tether’s reserves and its inner workings are yet to be disclosed in clear detail.

Still, the question of who exactly buys Tether directly from its parent company Bitfinex has remained unanswered since its inception way back in 2014.

Earlier this year, Protos shed light on that mystery by reporting that just two companies, Alameda Research and Cumberland Global, were responsible for seeping roughly two-thirds of all Tether into the crypto ecosystem.

Did that last sentence set off any alarm bells? It should have. Alameda Research is the quantitative trading firm founded by Sam Bankman-Fried. Bankman-Fried and his partner in crime, Alameda CEO Caroline Ellison, allegedly propped up their trading firm by plundering FTX customer accounts.

The inner workings of Tether remain remarkably opaque.

New Tethers are supposed to only be minted, and added to the crypto ecosystem, when somebody gives Tether Limited dollars to create them. And if that’s how it all worked, Tether would be fine.

But there is no evidence Tether actually works this way. We repeat: There is no proof that Tether stablecoins are backed by the store of tangible assets that is supposed to justify their value.

Despite first being released eight years ago, Tether has never been audited in any way. It first promised an audit in 2017…to, you know, happen eventually. How is that coming along? As reported by the WSJ, “Tether Says Audit Is Still Months Away as Crypto Market Falters”: … Tether is designed to grease the rails of the roughly $1 trillion cryptocurrency market by promising each token can be redeemed for $1. Market observers have long questioned whether the firm’s reserves are sufficient and have been demanding audited information.

The company has been promising an audit since at least 2017. An audit is “likely months” away, said Paolo Ardoino, chief technology officer of Tether Holdings Ltd., which issues the tether coin that recently carried a market value of $68 billion.

“Things are going slower than…we would like,” Mr. Ardoino said.

Instead of a full audit, Tether, like other leading stablecoins, publishes an “attestation” showing a snapshot of its reserves and liabilities, signed off by its accounting firm.

Audits are typically more thorough than other types of attestation. The attestations for some crypto companies sign off on the numbers provided by the company’s management for a specific date and time without testing the transactions before or after that date. That process can make the reports more vulnerable to being used to paint an unduly rosy picture.

A 2017 attestation of Tether was skewed by its sister company, Bitfinex, transferring $382 million to its bank account, hours before the accountants checked the numbers, the Commodity Futures Trading Commission said last year.

Take a moment to register that: In 2017, when Tether’s total market cap was still under $1 billion, it needed a last-minute transfer of $382 million just to sly its way through a non-audit attestation of its assets. This is ominously reminiscent of the accounting trick used by borrowers to obtain so-called “liar loans” in the run-up to the 2008 subprime mortgage crash.

That 2017 attestation, incidentally, led the Commodity Futures Trading Commission to fine Tether $41 million last year, without the company admitting any wrongdoing. Tether also paid an $18.5 million fine to New York state to settle claims that it misrepresented its reserves. The settlement forced Tether and its associated Bitfinex exchange to cease operations in New York. Crucially, though, none of these fines have fully exposed how Tether works, forced it to change its methods, or even compelled it to admit wrongdoing. Tether essentially made a political payoff, it seems, and moved on.

You know things are fishy when even legendary scammer Jordan Belfort calls you out:

It’s important to state what is happening if Tether is not actually backed by the dollars that it claims. If Tether Limited is pumping out new Tethers without actually taking in an equal amount of USD, then it is essentially a privately-run money printer.

Just manufacture new Tethers, pump them into a crypto exchange, use them to buy bitcoin, then sell the bitcoin for real U.S. dollars.

That would be, in the words of Dire Straits, “Money For Nothing”:

To avoid a Dire Straits situation, in other words, the whole system must place its faith in the unaudited pinky promise of Tether’s management team. So, what remarkable financier is behind this arrangement? What person of impeccable morals is helming Tether such that it commands so much importance in the global crypto ecosystem despite doing so little to merit confidence?

Say, anybody remember the Mighty Ducks movies?

Or how about the Sinbad movie First Kid? Anybody ever catch that on The Disney Channel back in the day?

Meet Brock Pierce.

In the early 90s, Pierce enjoyed a brief career as a child actor. But before even reaching legal adulthood, Pierce pivoted into a new career, which soon ended bizarrely: In the trailer for First Kid, the forgettable 1996 comedy about a Secret Service agent assigned to protect the president’s son, the title character, played by a teenage Brock Pierce, describes himself as “definitely the most powerful kid in the universe.” Now, the former child star is running to be the most powerful man in the world, as an Independent candidate for President of the United States. Before First Kid, the Minnesota-born actor secured roles in a series of PG-rated comedies, playing a young Emilio Estevez in The Mighty Ducks, before graduating to smaller parts in movies like Problem Child 3: Junior in Love. When his screen time shrunk, Pierce retired from acting for a real executive role: co-founding the video production start-up Digital Entertainment Network (DEN) alongside businessman Marc Collins-Rector. At age 17, Pierce served as its vice president, taking in a base salary of $250,000.

DEN became “the poster child for dot-com excesses,” raising more than $60 million in seed investments and plotting a $75 million IPO. But it turned into a shorthand for something else when, in October of 1999, the three co-founders suddenly resigned. That month, a New Jersey man filed a lawsuit alleging Collins-Rector had molested him for three years beginning when he was 13 years old. The following summer, three former DEN employees filed a sexual-abuse lawsuit against Pierce, Collins-Rector, and their third co-founder, Chad Shackley. The plaintiffs later dropped their case against Pierce (he made a payment of $21,600 to one of their lawyers) and Shackley. But after a federal grand jury indicted Collins-Rector on criminal charges in 2000, the DEN founders left the country. When Interpol arrested them in 2002, they said they had confiscated “guns, machetes, and child pornography” from the trio’s beach villa in Spain.

Pierce managed to get out of his Interpol jam that without being charged, and his strange path through life continued.

“Wait, is there somehow an Epstein connection here?” you might be wondering. Oh, you bet there is an Epstein connection here.

In early 2011, about a decade after the Digital Entertainment Network imploded, [Brock] Pierce visited the Virgin Islands to attend “Mindshift,” a conference of top scientists hosted by Epstein. A representative for Pierce says he didn’t even know who Epstein was when he flew (commercial) to the event, which the financier had arranged as part of his elaborate effort to launder his lurid reputation. It was not even 18 months after Epstein had completed his slap-on-the-wrist solicitation sentence in Florida and registered as a sex offender. … Nothing suggests that anything of a sexual nature or anything untoward at all occurred at Mindshift. Pierce is only one of dozens of figures in Epstein’s dizzyingly vast network, and the link between the two may be nothing but a curiosity. But it is a strange tale: how a former child actor who never went to college ended up as an Epstein guest — a seemingly unlikely addition to a group that included a NASA computer engineer, an MIT professor of electrical engineering and a Nobel laureate in theoretical physics. “I don’t know what he had to do with science [or] why he was there,” says one person who attended.

So, we have the world’s third largest crypto currency, a stablecoin that has never been audited, founded by a washed up former child actor involved in a sex scandal with underaged minors that quietly dissipated without charges, who has prospered in crypto despite zero technical background, and who maintained a hard-to-explain connection to Jeffrey Epstein. But hey, Pierce says he hasn’t actually been involved with Tether since 2015. And maybe Pierce was just the “celebrity” face of the venture, and the other leaders have more legitimate background.

Tether’s CEO is Jean-Louis van der Velde:

The chief executive of Tether ran a company that faced a string of lawsuits in China over unpaid bills and fines for late tax payments before he helped launch the contentious stablecoin now at the heart of the crypto industry. As crypto has moved from finance’s fringes to its mainstream, investors have increasingly relied on stablecoins, digital tokens backed by real-world assets, as a means to buy and sell volatile currencies such as bitcoin. But as Tether’s role in the crypto universe has mushroomed since it was founded in 2014, with $78bn of its stablecoins now in circulation, so has scrutiny from regulators. The company’s rapid rise has also turned the spotlight on publicity-shy chief executive Jean-Louis van der Velde.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!