I try my hardest to rarely cover China, but this story caught my eye because the implications may potentially be far-reaching. …

It seems that the CCP has been lying to us the whole time, at least that’s what top analysts believe about the rising global power. …

According to sources, “China’s 40-year boom is over”, and the CCP has likely been lying to us the entire time about the size of China’s economy. …

Some experts believe that the actual Chinese economy is likely 20% smaller than what has always been reported. 20% is a huge figure—1/5th is no joke.

So what am I getting at here? China is a world away, right?

Wrong, absolutely not. Although Americans are not allowed to own property and businesses in China, this has not stopped our hedge funds, publicly listed companies, financial firms, and venture capitalists from investing in the preeminent Asian power.

This relationship goes both ways and is even more permissive and liberal for the Chinese doing business in America—no restrictions on property and outright business ownership exist for Chinese nationals doing business in the United States.

Our economies are intertwined and misrepresenting figures by 20% could spell disaster for both our economy and theirs. 20% drop-offs in the economy are typically associated with depressions or severe recessions.

Wall Street Silver explained:

“Much of the economic data from China has been massaged into being meaningless, much like the USA. Remember when China had annual GDP growth of 7% like clockwork?

There is a lot of evidence that China has overreported their economic growth over the past two decades. Always adding an extra few % points to make the numbers look amazing for political purposes.

There is no way to truly know how big the Chinese economy actually is. We have a few proxies such as measuring their commodity imports.”

“China’s 40 year boom is over” 🔊

Much of the economic data from China has been massaged into being meaningless, much like the USA. Remember when China had annual GDP growth of 7% like clockwork?

There is a lot of evidence that China has overreported their economic growth over… https://t.co/tgNUjZkvxs

— Wall Street Mav (@WallStreetMav) August 30, 2023

Barchart shared this troubling data regarding Chinese debt-to-income levels: “Another potential problem for the Chinese economy – For the last 4 years, consumer loans have averaged more than 100% of disposable income.”

Another potential problem for the Chinese economy – For the last 4 years, consumer loans have averaged more than 100% of disposable income 👀 pic.twitter.com/gjfWYM6f2J

— Barchart (@Barchart) August 27, 2023

According to The Mises Institute:

In 1978, China’s gross domestic product (GDP) per capita was $156 per year. In the same year, GDP per capita in the United States was $10,564.

Between the economic opening and 2010, China experienced double-digit GDP growth in most years.

From 2010 to the present, however, its growth has been trending steadily downward. In 2022, growth was only 3 percent.

Although China is the world’s second-largest economy, Chinese people are still relatively poor.

The average income in China in 2022 was $12,823, roughly the same as in the US in 1980.

China has worked toward reducing wealth disparity and has a Gini coefficient of only 3.8 percent as of 2019, but roughly half the population still survives on an income of less than ten dollars per day.

Journalist and writer S.L. Kanthan presented these figures and claimed that it was not all doom and gloom for the Chinese economy:

China’s trade surplus over the last year* is mind-boggling $1 trillion.

$1 TRILLION!

One’s brain has to be severely damaged by China Derangement Syndrome to keep writing negative things about Chinese economy. 🙄

(*June 2022 – June 2023)

Source for chart: Brad Setser pic.twitter.com/EZdqtJcolL

— S.L. Kanthan (@Kanthan2030) August 29, 2023

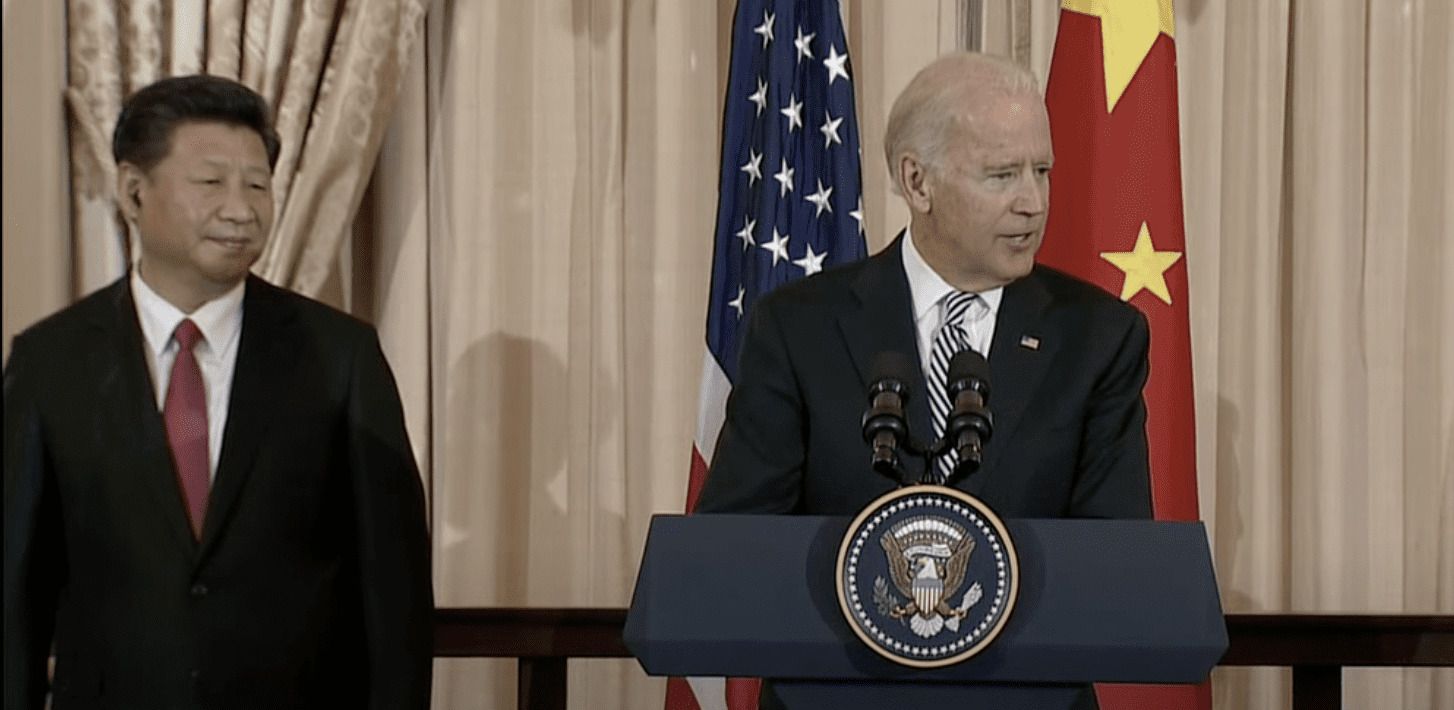

President Xi Jinping had this to say about China’s current economic troubles:

“The Chinese economy is not a pond, but an ocean. The ocean may have its calm days, but big winds and storms are only to be expected. Without them, the ocean wouldn’t be what it is.

Big winds and storms may upset a pond, but never an ocean. Having experienced numerous winds and storms, the ocean will still be there!

It is the same for China. After going through 5,000 years of trials and tribulations, China is still here! Looking ahead, China will always be here to stay!”

Antonio Graceffo of The Epoch Times provided more troubling facts about the Chinese economy:

The Chinese economy is riddled with debt and sinking to a low not seen in decades.

On Aug. 16, the yuan hit a 16-year low of 7.2981 to the U.S. dollar.

This prompted the central bank to sell off large quantities of U.S. dollars in an attempt to slow the yuan’s depreciation.

By Aug. 18, Hong Kong’s Hang Seng (HSI) Index was down 20 percent from its peak in January.

Local governments are facing liquidity issues as debt through local government financing vehicles (LGFVs) stands at about $7.8 trillion.

The debts are usually paid off through the sale of real estate, but that sector is floundering.

If the central government does not intervene, several local governments may default.

ADVERTISEMENT

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!