GOP presidential candidate Vivek Ramaswamy called BlackRock, State Street, and Vanguard “arguably the most powerful cartel in human history.”

“They’re the largest shareholders of nearly every major public company (even of each other) & they use *your* own money to foist ESG agendas onto corporate boards,” Ramaswamy added.

“As President I will cut off the real hand that guides the ESG movement – not the invisible hand of the free market, but the invisible fist of government itself,” he said.

WATCH:

BlackRock, State Street, & Vanguard represent arguably the most powerful cartel in human history: they’re the largest shareholders of nearly every major public company (even of each other) & they use *your* own money to foist ESG agendas onto corporate boards – voting for “racial… pic.twitter.com/FhCfmEsDdp

— Vivek Ramaswamy (@VivekGRamaswamy) August 20, 2023

Would Ramaswamy battle this powerful cartel if he became president?

If so, he would bite the hand that feeds him.

Why do I say that?

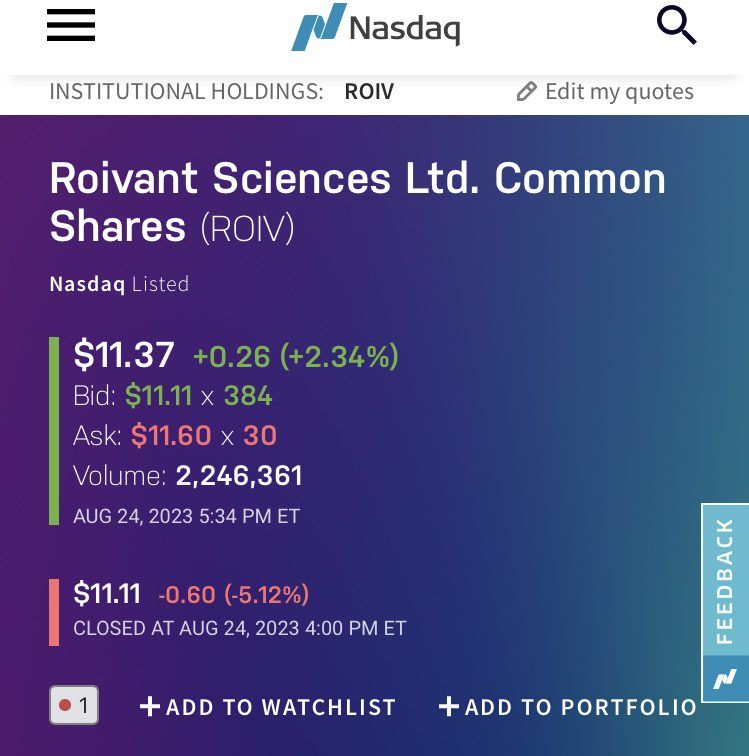

The same players that form this ruthless cartel are shareholders of Roivant Sciences Ltd., the pharmaceutical company Ramaswamy founded in 2014.

The ‘anti-woke’ crusader “derives most of his fortune from the 10% ownership stake in Roivant Sciences,” the New York Post reports.

The outlet reports Ramaswamy is worth approximately $950 million, although he was briefly a billionaire before a stock market dip.

Per the New York Post:

Ramaswamy, who was raised in the Hindu faith by his parents but went to a Catholic high school, was a hedge fund analyst at QVT before he started Roivant at the age of 29.

He conceived of Roivant as a company that would create subsidiaries that would develop drugs that were overlooked and abandoned by larger pharmaceutical makers.

One of his first major business moves was to acquire the rights to an Alzheimer’s medication that was developed by GlaxoSmithKline and make the drug the centerpiece of a Roivant subsidiary, Axovant.

Fintel states Vivek Ramaswamy is a 10% owner in Roivant Sciences Ltd., with his latest reported holdings as 54,691,501.

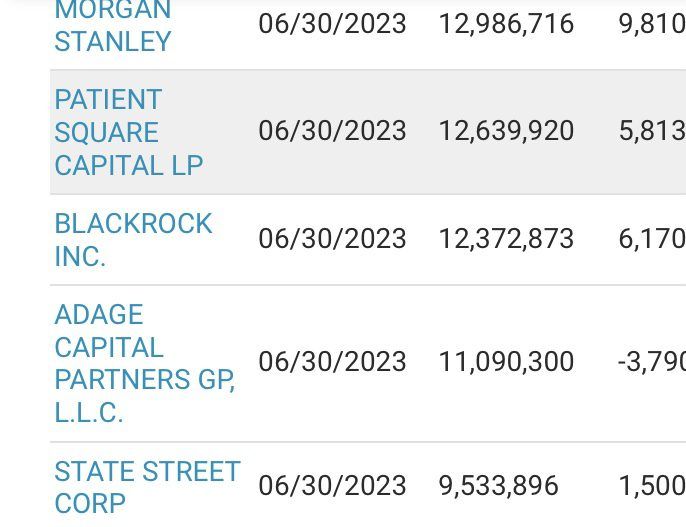

“Roivant Sciences Ltd (US:ROIV) has 231 institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC),” Fintel states.

Fintel listed some of those institutional owners:

These institutions hold a total of 512,948,078 shares. Largest shareholders include QVT Financial LP, Sb Investment Advisers (uk) Ltd, Viking Global Investors Lp, Fmr Llc, Wellington Management Group Llp, Morgan Stanley, Patient Square Capital LP, BlackRock Inc., Adage Capital Partners Gp, L.l.c., and VGHCX – Vanguard Health Care Fund Investor Shares .

“Ramaswamy Vivek has filed an SC 13G/A form with the Securities and Exchange Commission (SEC) disclosing ownership of 81,783,241 shares of Roivant Sciences Ltd (US:ROIV). This represents 10.9 percent ownership of the company. In their previous filing dated 2022-02-14 , Ramaswamy Vivek had reported owning 74,401,969 shares, indicating an increase of 9.92 percent,” Fintel noted.

After reviewing Roivant Sciences’ Nasdaq Institutional Holdings page, we find activity with BlackRock, Vanguard, and State Street.

An SEC filing dated July 31, 2023 states Vivek Ramaswamy is a 10% owner of Roivant Sciences, with 54,691,501 shares held following the reported transactions.

BlackRock, Vanguard, and State Street all hold shares in Ramaswamy’s company, which he’s the former CEO, former Chairman of the Board, and still a 10% owner.

Ramaswamy stepped down from the company’s board of directors when he decided to run for president.

The 38-year-old Paul & Daisy Soros scholarship recipient previously said he has no connection to the World Economic Forum.

WATCH:

We’re surging. The knives are out. “WEF.” “Soros.” “Masks.” Here’s the TRUTH. Stay skeptical. Keep the questions coming & I’ll keep answering. 🇺🇸 pic.twitter.com/eOjKTRndZu

— Vivek Ramaswamy (@VivekGRamaswamy) July 19, 2023

Viking Global Investors LP reported 75,238,700 shares held in Roivant Sciences.

Viking Global Investors CEO Ole Andreas Halvorsen, a Norwegian billionaire hedge fund manager, has ties to the World Economic Forum.

Viking Global Investors is also a WEF partner.

“Viking Global Investors is a global asset management firm that conducts fundamental, research-intensive stock selection in all industries. It was founded in 1999 and manages capital in excess of $30 billion,” the WEF writes.

“Billionaire Andreas Halvorsen’s Viking Global Investors disclosed on Wednesday that it has made an investment in Roivant Sciences, the private holding company that claims to be in the business of rescuing the pharmaceutical industry’s forgotten drugs,” Forbes wrote in 2016.

“The addition of Viking Global, one of the nation’s biggest hedge funds, to the Roivant story suggests Ramaswamy remains well-funded as he continues to spin out companies from his holding company,” the outlet added.

QVT Financial LP, a hedge fund Ramaswamy worked at from 2007 to 2014, reported 122,541,536 shares held in Roivant Sciences.

While working at QVT Financial, Ramaswamy was a partner and co-managed the firm’s biotech portfolio.

QVT Financial CEO Daniel A. Gold previously “served as star Trader at Deutsche Bank AG,” according to Crunchbase.

Deutsche Bank is also a WEF partner.

The WEF writes:

Deutsche Bank provides retail and private banking, corporate and transaction banking, lending, asset and wealth management products and services, and focused investment banking to private individuals, small and medium-sized companies, corporations, governments and institutional investors. Deutsche Bank is a leading bank in Germany, with strong European roots and a global network. Its purpose is to enable economic growth and societal progress through its positive impact to help create better, more successful companies. It believes this is a way for people to take care of the future, for themselves, for their families and for society.

Another interesting discovery is that Vivek Ramaswamy spoke at the 2019 Milken Institute Global Conference.

Ramaswamy participated in a panel discussion about “New Models Shaking Up the Health-Care Value Chain.”

WATCH:

The Milken Institute is “a non-profit, non-partisan think tank, the Milken Institute believes in the power of capital markets to solve urgent social and economic challenges. Its mission is to improve lives around the world by advancing innovative economic and policy solutions that create jobs, widen access to capital and enhance health,” according to the World Economic Forum.

After these findings about Ramaswamy, I’ll leave the conclusions for readers.

Do you trust Vivek Ramaswamy?

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!