A seismic shock to the global financial system is coming according to BlackRock. …

The world’s biggest hedge fund, with roughly $10 trillion in assets, recently filed a report detailing its macroeconomic outlook.

According to that report, BlackRock is reallocating a percentage of its U.S.-based assets to foreign emerging markets.

The report cites seismic shifts in the geopolitical order, high debt, record-high interest rates, and volatility as reasons for the portfolio reallocation.

RJ Talks of SnapForce dissected the report in a recent video:

Here’s Axel Christensen of BlackRock explaining it himself on the official BlackRock X social media page:

“A renewed focus on U.S. fiscal challenges and surprise policy tightening in Japan have stirred up volatility in developed markets. Axel Christensen of the BlackRock Investment Institute shares why we prefer emerging market assets.”

A renewed focus on U.S. fiscal challenges and surprise policy tightening in Japan have stirred up volatility in developed markets. Axel Christensen of the BlackRock Investment Institute shares why we prefer emerging market assets. #MarketTake 👉 https://t.co/KrhyxnEzwQ pic.twitter.com/H8mSpwxKMQ

— BlackRock (@BlackRock) August 9, 2023

BlackRock continued with its current macro economic perspective: “We believe geopolitical fragmentation, like the strategic competition between the U.S. and China, is set to rewire global supply chains. Learn more about global fragmentation as a #MegaForce in the BlackRock Investment Institute’s 2023 Midyear 0utlook.”

We believe geopolitical fragmentation, like the strategic competition between the U.S. and China, is set to rewire global supply chains. Learn more about global fragmentation as a #MegaForce in the BlackRock Investment Institute’s 2023 Midyear 0utlook: https://t.co/NQjMrq6zxn pic.twitter.com/7nQru3x1Ps

— BlackRock (@BlackRock) August 3, 2023

An earlier report from Bloomberg explained BlackRock’s position:

Local-currency debt is getting a boost as policymakers from the developed world wrap up their monetary tightening cycles, supporting emerging-market currencies, according to BlackRock Investment Institute strategists including Wei Li.

Moreover, The Select Committee on the CCP has increased government scrutiny of BlackRock for its foreign business dealings.

The Select Committee explained: “BlackRock and MSCI financial products funnel U.S. $ to Chinese companies implicated in the CCP’s human rights abuses and techno-totalitarianism.”

.@BGI_Genomics collaborated with the Chinese military to collect genetic data on foreign persons without their consent and @CommerceGov found that they support forced labor. @BlackRock and @MSCI_Inc financial products funnel U.S. $ to @BGI_Genomics pic.twitter.com/iDjIib4N00

— Select Committee on the Chinese Communist Party (@committeeonccp) August 3, 2023

Steve Milloy, at Washington Examiner, writes:

Wall Street giant BlackRock just added the CEO of Saudi Arabia ’s national oil company, Saudi Aramco, to its board of directors. The New York Times headline announcing the move read, “ BlackRock Forges New Ties With Big Oil ,” giving the impression that BlackRock was reversing course on environmental, social, and governance investing and coming to its senses on fossil fuels.

The exact opposite is the case.

This is just the latest chapter in the tragic and ongoing tale of America being sold out by the elites for the economic and geopolitical benefit of foreign competitors.

Speaking of BlackRock, have you seen this?

THIS Is How We Defeat BlackRock, Vanguard and the ESG-DEI Nightmare — Can I Count On You?

This may be one of the most important articles I’ve published in a while…

Let me explain why.

I’ll start at the beginning and I think you’ll really get it by the time I hit the end.

Ok, so why do we even care about BlackRock, Vanguard and State Street in the first place?

And who are they?

They are the three largest Asset Managers in the world.

Essentially, and this is no exaggeration, they are the people pulling the strings in the background.

These are the “Masters of the Universe”.

Larry Fink runs BlackRock and he is almost certainly more powerful than the President of the United States.

That’s not an exaggeration, and I’ll explain to you why in just a minute.

First, let’s start here with something called the “Illusion of Choice”.

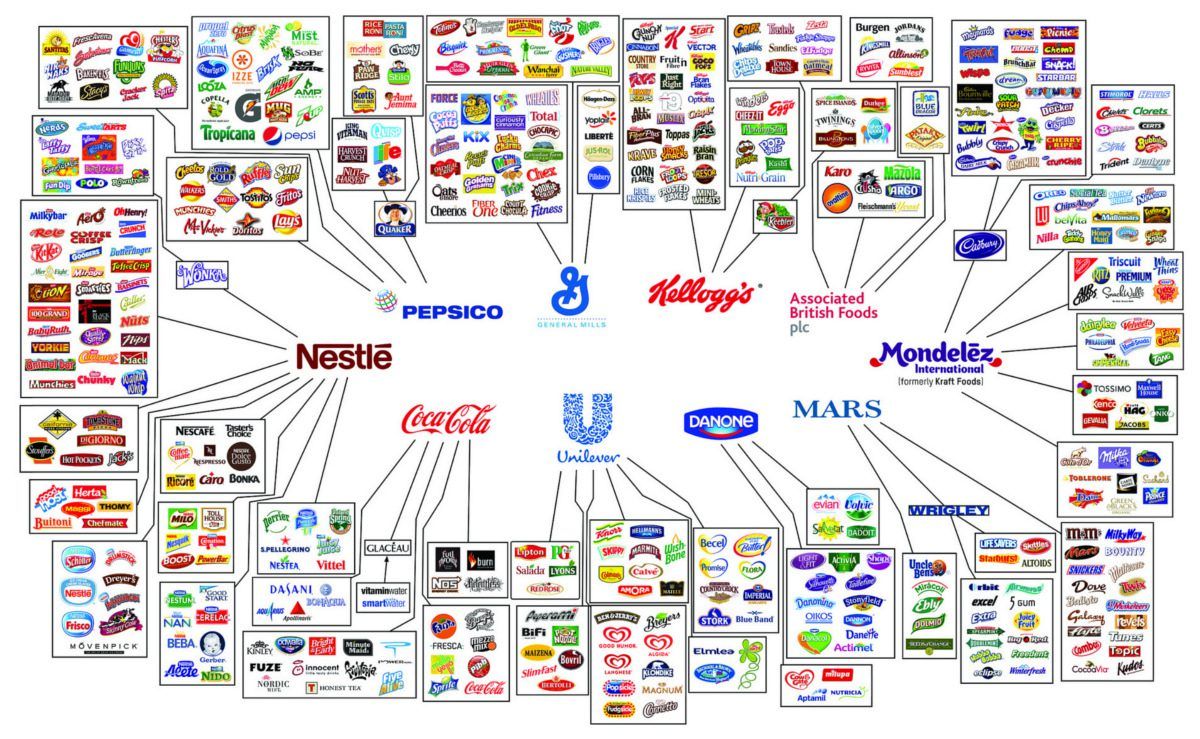

Take a look at the image below….

You THINK there are all of these different brands to choose from out there, but they are really owned by TEN big corporations.

That’s true in food:

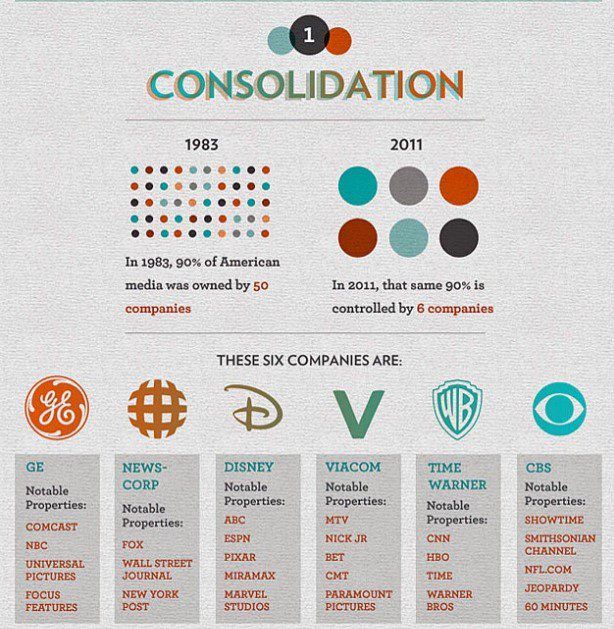

And it’s also true in Media.

Same exact thing….

You think there are a bunch of Newspapers, TV channels, radio stations, websites — but in 2011, SIX corporations controlled 90% of it all.

Ok, but that’s just the tip of the iceberg.

Because as bad as that is, here’s the part most people don’t tell you.

It’s actually way worse than that because there’s another whole layer on the pyramid at the very top that they never tell you about.

In fact, I bet most people reading this have never heard of BlackRock, Vanguard or State Street — or if you’ve heard about them you probably don’t know exactly what they do.

Or if you DO know exactly what they do, I bet you may never have realized why it’s a giant problem.

So let me explain it to you in real simple terms, and I think it will make a lot of sense.

Most people are paid every two weeks, usually on a Friday.

And most people have been coached to put 6% of their salary into their 401k and/or some other amount up to the employer match.

Great, right?

Well, here’s what’s actually happening.

Most of those funds go into ETFs and other investment vehicles managed by, you guessed it, BlackRock, Vanguard and State Street.

So they’ve built a system where millions upon millions of dollars are flowing in to them via YOUR 401k’s every two weeks.

You bust your butt at work and get a paycheck and you’ve been coached to give 6% of that check to these “Big 3”.

The Big 3 then get bigger and bigger and bigger every Friday!

What a great system, right?

For them it is.

And what are you told about it?

Almost nothing.

In fact, what do they tell you?

When you start your job, they tell you to set up your 401k auto-donation and then “forget about it”.

Isn’t that what they say?

Don’t even think about it!

The money will be there for you when you turn 65, but don’t think about it until then.

And DEFINITELY don’t ask who’s managing it or what they’re doing with it.

My friend Patrick Bet-David has been all over this, breaking the story wide open.

He was on Joe Rogan last week and he dropped this bombshell….

You think those charts above are bad?

That’s not even the worst of it.

Of the TEN food corporations and SIX media corporations, the control and ownership is actually way more centralized than that.

Remember all that money coming in every Friday from YOUR paychecks?

That goes to the Big 3, and they use it to own all of those companies.

So it’s not even the Big 10 Food Companies or the Big 6 Media companies….it’s just the Big 3.

And of the Big 3 it’s really mostly the Big 2.

Many believe the Big 2 may eventually take over State Street.

For those who like stats, here’s the stat for you: 88% of the companies in the S&P 500 has one of the Big 3 as that company’s biggest shareholder.

PBD breaks it all down here:

So…why do I tell you all of that?

Because when you centralize ownership and control, bad things start to happen.

What starts to happen is the Big 3 and their “affiliates” create things like ESG and DEI scores.

ESG stands for Environmental, Social and Governance and it’s a score they give to companies to “keep them in line.”

So is DEI, which stands for Diversity, Equity and Inclusion.

Don’t follow enough Far-Left “social” trends — not promoting enough Trans agenda or LGBTQ agenda or Climate Change agenda (i.e. Bud Light, Target, etc.)?

Then your score takes a huge hit!

That really explains a lot, doesn’t it?

Because I can’t tell you how many conversations I’ve been in with people who say: this stuff doesn’t make any sense! Why are these companies doing this? Why would Bud Light TANK their company? They know it’s not going to play well to the people who buy their beer?

THAT. DOESN’T. MAKE. SENSE!

And you’d be right to say that, but only if you assume Bud Light is trying to please the people who buy its products.

What if Bud Light had a higher master?

What if Bud Light was more concerned with its ESG score?

What if all the Executives at Bud Light knew that if their ESG score dropped too low, then their #1 Shareholder (the Big 3) would fire them and replace them with someone who would be “ESG Friendly”?

What if you’re pulling in a total comp package as a top exec in the $20 million range and your choice is to push the Far Left agenda and push LGBTQ or know that you’ll be fired and replaced in a year by the Big 3?

What do you do?

NOW what decision would you make?

Now is it suddenly making a lot more sense?

And there you have it.

Now I think you get it.

Now suddenly every single corporation turning their logo to the Rainbow Flag in June suddenly makes a lot of sense.

Once again, here is my friend PBD explaining ESG in much more detail:

Now let’s recap…

Do you see how insidious this is?

A big chunk of YOUR paycheck goes to prop up the Big 3 every single Friday, they get bigger and stronger, they use that money to buy all the major corporations in the world, and then they force them to do things you would NEVER support.

Sick, right?

Now let me bring this in for a landing…

And here’s why I’m telling you about this.

Because we don’t just report the news here and then say “good luck”!

No, we give you solutions!

And I DO have a solution here.

It’s a big one.

There IS a way we can fight back.

It’s one of the last battlegrounds we have left and I happen to think it’s very important we hold this one.

I’m doing a huge Zoom this coming Tuesday night, August 15th, at 8pm Eastern / 7pm Central to tell everyone all about it.

I am expecting we should have over 1,000 people on this Zoom.

But I need your help with two things….

One, I need YOU to be there.

Two, I need you to invite your friends and family and share this article.

If we don’t fight back hard and fast, we’re going to lose the last bastion we have left.

So please join me on the Zoom.

It will run about 30 minutes and it’s completely FREE to attend but you do have to register because it WILL fill up.

TAP HERE TO REGISTER FOR THE ZOOM.

I will be there and I’ll hang around afterwards to answer any questions you may have.

This ties in perfectly with the new Mission I launched back in February and I feel like it was really a God-thing that we got that going when we did.

But I can’t do it alone.

I will need a lot of help if we’re going to take back some ground from the Big 3.

Can I count on you to be there?

And can I count on you to invite your friends and family?

We will likely hit capacity for the room, so please register early to guarantee your seat.

I’ll see you there!

Noah

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!