I’ve been getting a lot of questions recently from people asking me “What happens when FedNow goes live?”

Even some family members reaching out.

So I thought I’d address it.

Short answer?

No one really knows for sure, because this is new unpaved ground.

We’ve never done this before.

But I think I have a pretty good idea of where it’s going so let me break it down for you.

FedNow is the new system designed to roll out the U.S. CBDC, which stands for Central Bank Digital Currency.

Central Bank = The Federal Reserve Bank = “The Fed”

And as a friendly reminder, the Federal Reserve Bank is:

Not Federal (it is entirely ran by private, Deep State families)

Not A Bank

Has No Reserves

Imagine that…even in the name, they lied to you three times!

So The Fed now wants to go digital.

Why?

Control.

Right now, when you have cash or even your bank accounts at local banks or credit unions, The Fed doesn’t have great control over what you do with that money.

But….if the money were digital and if the connection was made directly between YOU and The Fed, then suddenly they can exert a ton of control over you.

You know how you get locked out of Facebook if you say the wrong thing?

Now imagine that happening to your bank account.

Posted the wrong thing online?

Used the wrong pronoun?

Had a wrong thought?

Sorry, you just got zapped by FedNow!

Your money is now inaccessible for 24 hours.

Sure hope you don’t have another violation, next freeze out will be 7 days.

Third violation?

One month strike!

Think that can’t happen?

It can, and it’s coming.

But that’s not all.

No, this will be “programmable money” which means it’s very different than cash.

With cash, you can choose to spend it however you want.

Buy groceries, take a trip, gamble it away….you choose!

Some decisions are smarter than others, but YOU have always been in control of that decision for YOUR money.

Not anymore.

Federal CBDC programmable money means The Fed can put restrictions on what you can do with it….and it all goes right into the computer code!

So sure, maybe you have $5,000 in your account, but shoot….the overlords at The Fed have noticed you’ve been traveling too much recently.

Taking too many plane trips…

You’ve been flagged as a polluter!

Your money is now locked out for 6 months from being allowed to be used for anything related to travel.

Hope you like staying home!

Think that can’t happen?

It can, and it’s coming.

Now, watch how they try to spin this…

They’ll say, no, no, that’s not true!

What Noah is telling you is a lie….

They’ll do “Fact Checks”.

They’ll roll out all their buddies at all the big Fact-Checking websites and they’ll deem what I just told you 100% FAKE — NOT TRUE, they will say!

Why?

Because they’ll say FedNow is not a direct link from The Fed to your bank account.

You don’t have a direct account with The Fed.

You still have your account at your local bank.

So see?

See….we can’t control your money because there’s still a bank in between us and you!

So nothing to worry about.

So devious.

That’s how they always do this stuff.

They boil the frog SLOWLY.

Same game plan they’ve been running for years.

They’re going to get you used to this system exactly that way, by saying there’s really nothing new here, you still have your account at your local bank or credit union, and The Fed has no direct control over you.

And they’ll be right….for now.

But for those of you paying attention and reading along with me, you’ve already connected the dots in your head on what comes next, right?

What is the final step they need to remove that last barrier?

Remove the local banks, of course!

And gee, what did we see back in April and May of this year?

A banking crisis where in the span of 3 days we lost four huge banks!

Just gone — poof, overnight!

Went to zero!

Absorbed into JP Morgan Chase.

The big get bigger and the small(er) banks disappear.

Was that….a test run?

I think so.

They tested out how quickly they could take down a bank and it was lightning fast.

Then they stopped.

See, banking crisis over!

Except, it’s not.

It was just put on the shelf because they needed time to pass.

They needed people to forget about that crisis.

They also needed time to roll out FedNow and their CBDCs.

Then they pull the banking crisis back off the shelf, run that same playbook except this time it’s bigger….much bigger.

Wipe out all the small banks, all the credit unions, or at least wipe out enough that they rest will slowly die off over time.

You roll those small banks into JP Morgan Chase, Citi, BOA and Wells Fargo.

Then you have essentially only four banks remaining.

Then what do you do?

Then you wait some more.

Then you get those 4 down to 1.

Then when you only have 1 national bank left, you slowly merge that bank with The Fed until you have completed the plan.

These people think in 100 year blocks of time, not months.

They’ve been working this since 1913, and they’re ready to finish up the final act.

So there you go.

It’s not pretty, but what I’m telling you IS their plan.

Now, let me back it up and give you a lot more.

Start here and tell me if this sounds EXACTLY like what I just told you:

When you know…

YOU KNOW#FEDNOW https://t.co/qpQLzYDCTA

— Chad Steingraber (@ChadSteingraber) June 26, 2023

Testing complete….

And gee, what are the names listed here?

Are those the same names I just told you?

NEW: JPMorgan Chase, Bank of New York Mellon, US Bancorp and Wells Fargo, have completed formal testing for FedNow 😮

They will be ready to provide instant payments after the new service is live in late July 👀 pic.twitter.com/QqCWk98HL5

— Bitcoin News (@BitcoinNewsCom) July 1, 2023

Want a prime source?

Does Reuters work for you?

Fed says 57 firms set to use 'FedNow' instant payments after late July launch https://t.co/Absz0WxMwK

— DJ Peter Vas (33k) (@PeterVas6) July 1, 2023

From Reuters:

The U.S. Federal Reserve announced on Thursday that 57 firms have been certified to utilize its “FedNow” instant payments system after it launches in late July.

The Fed did not provide a specific date for the launch, but 41 banks and 15 service providers, including large firms like JPMorgan Chase (JPM.N), Bank of New York Mellon (BK.N), US Bancorp (USB.N) and Wells Fargo (WFC.N), have completed formal testing and will be ready to provide instant payments after the new service is live.

Jim Rickards has been one of the loudest voices sounding the alarm:

#Rickards stated that a #CBDC would facilitate "the creation of a social credit system that allows governments to punish those who engage in unapproved activity." https://t.co/UddLzcukV1

— Bitcoin.com News (@BTCTN) June 26, 2023

From Bitcoin.com:

Jim Rickards, an economist with more than 40 years of experience in investment banking, has warned about a hypothetical social credit system in the U.S. powered by a central bank digital currency (CBDC). In his latest article, Rickards explains that issuing a CBDC would allow the government to get the data needed to construct such a system.

Rickards stated that the information collected by monitoring transactions on a CBDC would facilitate “the creation of a social credit system that allows governments to punish those who engage in unapproved activity such as buying guns, donating money to the wrong political party, buying unapproved literature, etc.”

While recognizing this might sound paranoid to some, Rickards compares these measures to the ones taken by the federal government to stop the Covid pandemic, declaring:

Before the pandemic, you probably wouldn’t have thought that any of this was possible. But it all happened. When you think of it in that light, you begin to understand that some type of social credit system in the U.S. really isn’t that far-fetched.

A System Built for Control

In Rickards’ hypothetical system, implementing a CBDC would allow the government to control or block people’s movement to other cities or countries, limit their liberties by nullifying their opinions on social media, and even target them via intelligence agencies. Using the CBDC would be the only way of paying, and a social credit score would be the tool for limiting these actions.

According to his forecast, this might be done deceptively, establishing measures to pursue extremists and criminals first. On this, he declared:

It’ll all be made to sound very benign, even necessary, to support ‘our democracy’ against MAGA types, white supremacists, climate deniers and domestic terrorists.

More from Rickards:

https://www.youtube.com/watch?app=desktop&v=vu_-1CEAljk

One more:

https://www.youtube.com/watch?v=CeRJFUa75B0

In fact, Rickards has been telling us about “Ice9” for years:

MORE:

URGENT: FedNow Launching In July — Goodbye Freedom!

Have you heard of “FedNow”?

We’ve been talking about it but it’s not getting much attention in the MSM.

Of course not….

Want to know why?

Because it’s going to be very bad for you (and me).

This is a plan that goes back decades, even over a century….back to the launch of the Federal Reserve in 1913.

Watch this video I just found which shows EXACTLY what’s coming next and how you can be prepared for it.

Not much time left:

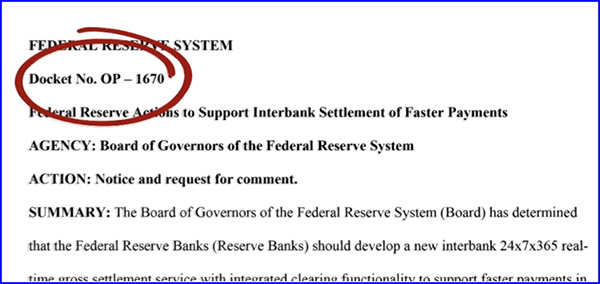

Now let’s go deep into the details and examine U.S. Docket No. OP-1670…

U.S. Govt. Docket No. OP–1670 Gives The FED Power to Seize Control of U.S. Bank Accounts! Do THIS Now…

WARNING: the U.S. banking crisis is NOT over.

Far from it.

Do NOT take your eye off the ball.

Here’s the truth…

If you use a checking account connected to the U.S. banking system, you could soon be at risk for surveillance of all your transactions, or worse …Direct control of your money by unelected officials in the U.S. government.

An economic forecaster and banking expert, who has been accurately predicting market disasters for more than four decades, is about to expose these disturbing details.

He correctly predicted the bank failures of the 1980s … the dot-com bust of the early 2000s … and the Great Financial Crisis of 2008.

In fact, his firm predicted bank failures months before the 2008 meltdown with a stunning 99.8% accuracy.

Those who listened to his warnings could have kept their money safe and even made substantial profits during each crisis …

While nearly all those who didn’t listen to him and failed to get out in time, suffered stomach-wrenching losses.

The Wall Street Journal reported that investors who followed his independent stock ratings could have made more money than if they had followed the ratings issued by …

Deutsche Bank …

Merrill Lynch …

JPMorgan Chase …

Goldman Sachs …

Standard & Poor’s, and …

Every single other firm reviewed in The Wall Street Journal.

In 41 seconds, he’s coming forward with a new warning, but it isn’t about the stock market.

It’s about your checking account — and how your financial transactions are going to be recorded and possibly even controlled by a small group of insiders in the U.S. government …

Starting as soon as June 2023.

The facts you’re about to hear could upset you. We urge you not to panic because, according to this legendary economic forecaster, there are four actions you can take to preserve and even grow your wealth.

You will hear about them in his presentation.

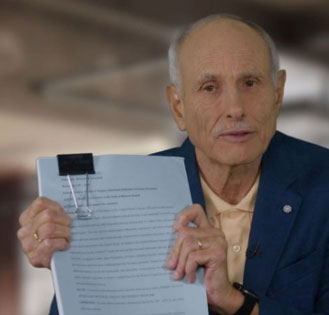

This man’s name is Dr. Martin Weiss.

After avoiding the spotlight for several years, he’s going public to reveal this new financial threat.

He will show you the actual document produced by the government, detailing their plan.

He will even reveal a top-secret presentation that the government used to train their agents to spy on us.

And he will show you how to protect yourself.

Now, here’s Dr. Martin Weiss …

Imagine a government agent gets assigned to snoop through your bank account — to see if your transactions are considered a “threat” to the government’s agenda.

If that idea sickens you … or if you think it won’t be a real possibility starting just a few months from today …

Then pay attention to what I reveal now.

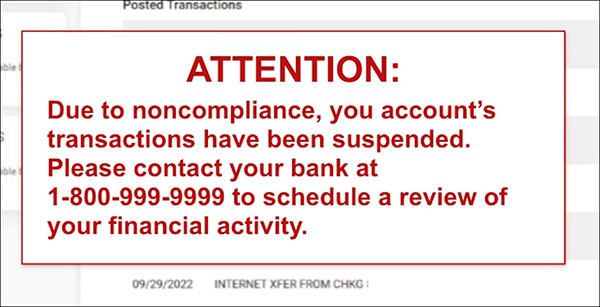

Because, according to this official government document I’m holding in my hand, starting as soon as June 2023, you could wake up one morning, log into your bank account and …

Stare at a red flashing alert that your account’s transactions have been frozen.

Your ability to send money and receive money — frozen.

Your crime? You didn’t commit one.

It’s all because of the U.S. government’s horrifying new program that gives unelected officials the power to closely monitor or even freeze your account based on your behavior, and potentially even based on your political views.

It starts with this 93-page government document.

Its name: Docket No. OP — 1670.

This innocent-sounding document, which was never meant for the general public, gives them the power to suspend your ability to pay others or get paid, even punish you with fees andfines, andultimately …

Seize control over your money.

Some of the largest U.S. banks are already joining our central bank, the Federal Reserve, to roll this out as rapidly as possible.

There’s a good chance your bank is already participating. I’ll give you the names of these banks in just a moment because …

There’s no stopping this from happening.

You don’t get a vote. You don’t get to “opt out.” And your money is in danger, unless you take …

Four Simple Steps to Protect Your Savings

The catch is …

You don’t have much time left.

We’re very close to the day when the government will roll out this new system.

They’ve already been caught red-handed snooping in the private emails and personal family videos of millions of innocent Americans.

Now comes the next layer of control.

And this time it’s for your money.

The Federal Reserve has set a date for when banks will begin handing over this control. It could start as soon as June 2023.

Fast forward to a future date and picture this:

You see a post on Facebook criticizing politicians for out-of-control inflation. You hit the “Like” button.

An hour later, you read a post by a blogger you follow, asking for donations.

You decide to give him $30 using PayPal.

When you click the button to send, a strange error message pops up. You figure the charity just didn’t set up their page properly. So, you move on and you don’t think anything of it.

But the next morning, when you log in to your bank account, you see this:

What the heck …!

You take fast, shallow breaths and your heart starts thumping quicker as you realize what’s going to happen.

Your electric bill is still due in a few days.

Your mortgage payment is set to draft from your account in a week.

And you had planned to use your credit or debit card to buy holiday gifts for your grandkids.

But now with your account frozen …

You’re helpless.

As your forehead breaks out in sweat, you call the number flashing on your bank account screen. Nobody picks up.

Instead, you get an automated menu that asks for your Social Security number and other sensitive information.

You never get to speak to a live person. A robotic voice makes you choose a date for a hearing to get your banking reinstated. The soonest appointment is over a month away.

After you hang up, the screen of your frozen bank account still stares at you.

How could this have happened?

You think back to what you’ve posted on social media. You remember the charities you’ve given to. The causes you’ve supported. You remember that the news has reported more and more men and women are getting “cancelled” by their financial institutions.

Why?

Did they buy too much gas? Did they donate money to the “wrong” candidate?

No one seems to know for sure.

But somehow, whenever you thought about protecting your savings from their control, you just shrugged your shoulders and figured you’d “get around to it.”

Now that your account’s frozen and it’s not coming back for weeks, you start to wonder:

What’s going to happen next?

Will the electric company send out a warning notice?

Or maybe they’ll just shut your power off.

And what about your mortgage?

How long before you start getting warnings about THAT?

How are you going to explain to your spouse that you need to stop all spending from your checking account?

You can’t write checks. You can’t pay off credit cards.

This might sound like a nightmare straight out of a dystopian novel, but …

As you’ll see in just a couple of minutes, millions of innocent American citizens have been spied upon by the government. Quite a few have also had their accounts suspended.

In fact, government confiscation of personal assets has happened a lot more frequently than most people realize. Right here in America.

So, government surveillance and manipulation of financial transactions would be entirely new.

It would simply be the NEXT step in a very disturbing pattern.

And the Federal Reserve’s Docket No. OP — 1670 shows how that would work.

The document maps out how a small group of unelected government officials will soon gain access to all your financial transactions.

And we know, from years of experience, that government ACCESS to all your data is just one step away from the government’s power to CONTROL everything that data tells them about who you are and what you do.

They’d have the power to watch how you invest your money, and …

Restrict the amount you invest in companies that are not “compliant” with environmental, social and governance standards.

They’d have the power to limit your purchases of fossil fuels, including gas at the pump.

They’d have the power to restrict your contributions to certain causes or political parties.

They’d have the power to pressure folks of all ages to get government-mandated vaccinations.

Or worse.

If you find this hard to believe, just consider what our government has already done.

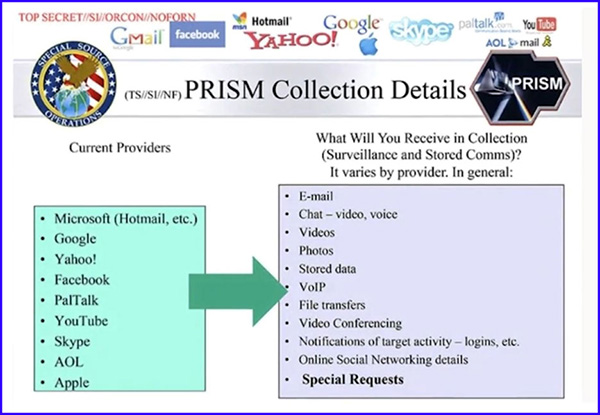

In 2013, the National Security Agency (the NSA) illegally collected the phone records of millions of American citizens.

Not just once, but for over five years.

The government spied on millions of people who were never suspected of any wrongdoing whatsoever.

That’s not all. The NSA and the FBI colluded with America’s biggest tech companies to spy on nearly everything you could do online.

It’s all revealed in this slide from a top-secret PowerPoint presentation that the NSA and the FBI used to train their agents:

Look at the left column. These are the so-called “providers,” the companies that provided your private data to the government:

Microsoft, Google, Yahoo!, Facebook, YouTube, Skype, AOL, Apple, and others.

And see this list in the right column? Those are your private activities that the government agents could search and spy on at any time, whether live or recorded.

Your chats.

Videos.

Photos.

Stored data.

Any file you’ve ever sent.

All the websites you visited.

And details about your friends too.

This was under the Obama administration.

But it could happen under any government, left, right, or in between.

All they need is an excuse to declare a “national emergency”: A terrorist attack. A surge in the drug trade. Inflation out of control. Even melting glaciers in Greenland.

Scary, right? Well, what’s even scarier is that, starting in June, they’re going down that path again — with two big differences.

This time, it won’t be run by the NSA.

It will be run by the Federal Reserve.

And this time they’ll have the power to do it far more efficiently — by tracking all your money, down to the last penny of our bank accounts and financial transactions.

It all starts with the new Fed power to control your money, and time is running out to protect yourself.

Fortunately, there are four simple steps you can take to legally sidestep the worst of this program. I’ll explain exactly what they are in this presentation.

My name is Dr. Martin Weiss.

My financial education began in 1959, when my father founded the Sound Dollar Committee to help President Dwight D.Eisenhower balance the federal budget.

Then, in 1971, I founded my own investment research company to issue independent ratings on every bank, every stock, and every mutual fund in America.

Unlike Moody’s, Standard & Poor’s, or Fitch, who are paid by the companies for their ratings, we’ve never accepted — and will never accept — a dime from the companies we rate.

Since we began publicly releasing our ratings and investment recommendations, our track record has caught the attention of Barron’s, Forbes, Fortune, Newsmax — even The New York Times and the Wall Street Journal.

They have all praised the accuracy of our ratings — not to mention our uncanny knack for predicting financial disasters …

Like when I rang the alarm bells months before the Great Financial Crisis of 2008.

Consider the big Bear Stearns failure, for example. On December 3, 2007, I published an alert warning that …

“Bear Stearns has sunk its balance sheet even deeper into the hole, with $20.2 billion in dead assets, or 155 percent of its equity, and is threatened with insolvency.”

Bear Steans collapsed 33 days later.

I also published an article warning that …

“Lehman Brothers is in similar shape because of an even larger $34.7 billion pile-up of dead assets, or 160 percent of its equity.”

Lehman collapsed 182 days later.

And that single collapse is what ignited the greatest financial crisis since the Great Depression.

I also warned well ahead of time about Washington Mutual, Bank of America, Citigroup, and all the major banks that failed or required a bailout.

I pounded the table for investors, telling them …

“Do not touch these companies with a ten-foot pole!”

While all along, officials on Wall Street and in Washington swore on a stack of bibles that no such failures could EVER be possible.

Those who listened to me would have kept every penny of their savings and investments far, FAR away from those banks.

They would have avoided catastrophic losses and the personal pain that comes with it, while …

Those who owned the shares in those same big banks saw them plunge 96%, 98%, even 100% from their peak value.

Look. The closer you get to retirement — and especially if you are ALREADY in retirement — the more crucial it is to protect every penny you’ve earned.

Unfortunately, today it’s not as simple as consulting with a financial advisor or relying on your 401K or IRA.

No.

Because the U.S. government itself could soon be targeting your money.

Not just your investment portfolio, but also your savings and checking accounts.

Yes, your ordinary bank accounts.

Something that’s supposed to be reliable, FDIC-insured, and safe. Unfortunately, it’s no longer safe.

Understand that, after decades of successful investing, I was actually semi-retired. But in the last few years …

I’ve come out of retirement to sound this alarm with a very different and far starker warning than my previous, and accurate, disaster predictions.

This goes beyond any individual company, any sector of the economy or any market cycle. It goes beyond your investment portfolio.

Today, I’m warning you about your right to spend and receive money how you wish … and how this right could be quietly erased by an eerie Federal Reserve program.

The name of this program is Fed Now, although I prefer to call it Fed Control …

Because that’s exactly what I think it could turn into:

The power to control your ability to spend and receive money.

And now, over 121 financial institutions have joined the first phase of Fed Control, including:

- Capital One Financial

- Fidelity Securities

- First Bank

- Goldman Sachs

- JPMorgan Chase

- U.S. Bank

- Wells Fargo

- And many more.

If you have a checking account with any of the banks you see on your screen, stick with me for the solution I’m recommending.

But these 121 banks are merely part of the first phase. Soon thereafter, this program will roll out to virtually all U.S. banks, credit unions, and savings & loans.

Fed Control is launching as soon as June 2023. And if this program is designed as reports indicate …

You cannot “opt out.”

You cannot simply switch banks.

You don’t get to vote against this.

Lawmakers are already cooperating with the unelected financial insiders at the Federal Reserve.

And meanwhile, Biden is pushing for the IRS to more closely monitor people’s accounts, so they know exactly how much in taxes to extract from you.

You don’t have a lot of time.

The rollout will begin just months from now.

And almost no one outside the Federal Reserve understands what’s really possible.

I fear this will be much worse than the simple government surveillance we saw under the Obama administration.

Because now government officials will have the power to choke off your money.

At will.

And if they decide you’re not in “compliance” with whatever their policy agenda dictates at the time, for all intents and purposes, they will have the power to freeze your account.

It doesn’t matter if you’re trying to buy a gift online for your grandson.

It doesn’t matter if you’re standing in line at the grocery store, trying to buy next week’s food for your family.

It doesn’t matter if you’re trying to pay off your Visa or Mastercard bill … or your phone bill … or your mortgage.

It doesn’t matter if you’ve done nothing wrong.

With the Federal Reserve gaining the power to control nearly all money transactions, it’s not about innocence or guilt as defined by the law.

When they control your money, they control your life.

Listen: As part of my economic research, I’ve spent nearly 20 years living in Latin America and Asia.

And I can tell you corrupt governments have a specific blueprint for controlling their citizens.

I never thought this kind of control mechanism would come to America. But it has.

In the next 17 seconds, I’ll show you exactly how their plan works. Then, I’ll tell you about the four exact steps you can take to protect yourself and your family’s savings.

I’m sure you’ve purchased many items and paid for many services by writing a check or swiping your card. Or perhaps you’ve used something like Apple Pay.

You’ve also made deposits in your checking account or even had paychecks set up for direct deposit automatically.

How, exactly, does the money move from your bank account to someone else’s?

It’s something we hardly think about, and yet over $2 trillion worth of these transactions happen every day.

That includes the money transactions you make, that your family makes, that your friends make, and every company you pay or that pays you.

It also includes Social Security payments from the government.

Yes, over two trillion dollars every single day.

Most of these transactions are handled by a company called The Clearing House, which is owned by major banks. The Clearing House has been handling interbank transactions for over 169 years.

And while the system is far from perfect, it’s worked for over a century and a half.

However, the Federal Reserve saw the chance to make it more “efficient.” And in 2019, with little fanfare or press coverage, they released their Docket No. OP-1670.

The docket reveals their plan to take over these transactions.

But that’s not all. It also reveals their plan to centralize all transactions handled by private payment systems, such as PayPal, Zelle, Venmo, Apple Pay, Google Pay and more.

In other words …

The Federal Reserve will be the central engine in charge of all payment systems, with the power to control how you spend and receive money.

They’ll have their hands on the entire process.

You’re probably aware that banks already require you to fill out special IRS forms if you attempt to withdraw about $10,000 or more in cash.

Well, with Fed Control, merely transferring money from one place to another — in practically any amount — could raise red flags.

Some people seem to think the government would never do crazy things or change their policies drastically.

But the truth is, our government already has done crazy things and changed their policies drastically.

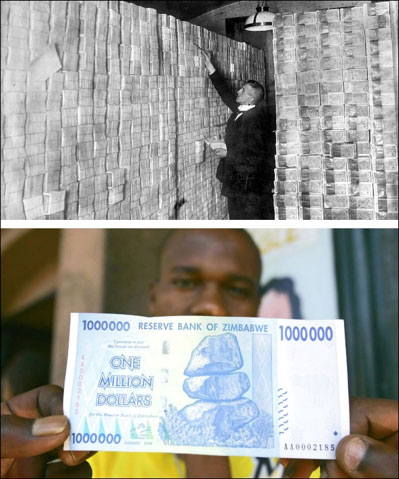

The U.S. Congress has abandoned any sense of fiscal sanity and given us more than $31 trillion in government debt.

The U.S. Federal Reserve has abandoned any sense of monetary sanity and printed $8 trillion in paper money.

No wonder so many people are terrified the U.S. dollar will become worthless as prices scream from inflation to hyperinflation!

As we saw in Germany after World War I or Zimbabwe the 21st Century …

Whenever a currency starts plummeting in value, the people holding that currency scramble to get rid of it.

They rush to stores and buy any tangible item until the shelves are empty. They hoard food. They try to exchange the worthless currency for anything that has value. But …

If a small group of unelected officials controls your ability to spend money, do you really think they’ll allow you to dump your U.S. dollars in a hyperinflation?

No.

They will declare a national emergency.

They will slam shut nearly every avenue of escape.

And you’ll be stuck watching helplessly, as your savings rot away to nothing.

As someone who has studied the U.S. economy for over 50 years …

And who has accurately predicted the worst of the government’s crusades on American savers, including the 2008 financial meltdown, I can assure you the chances are increasing that …

The Federal Reserve WILL use this power to control your spending.

Think this won’t happen in the United States? Well …

It’s already happened in North America.

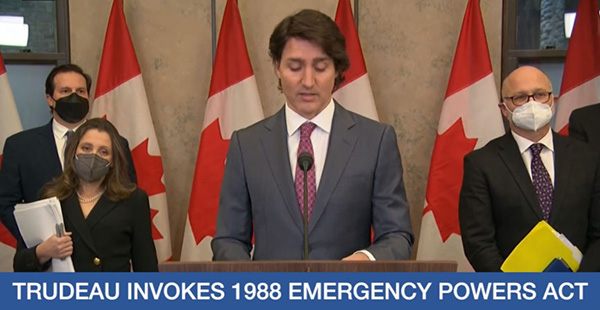

Two hundred and six bank accounts were frozen in early 2022.

The bank accounts of thousands of protesters were frozen, and they were locked out of their money!

Where?

It all happened in Canada, when the government ordered the mass freeze to break the backs of protesting Canadian truckers, trying to do their job and provide for their families.

Canada used the 1988 Emergencies Act — for the first time ever — to freeze the finances of these men and women.

Even people who merely donated to their cause, reported their accounts were frozen, too. This wasn’t just Canada, either.

United States citizens who donated to the cause were subject to the same order.

The Assistant Deputy Minister of Finance warned these punishments could continue.

Newsweek reported that, “The Emergencies Act has also allowed the Canadian government to expand the country’s money-laundering and terrorist financing laws …”

Possible scenes of the not-to-distant future? Absolutely!

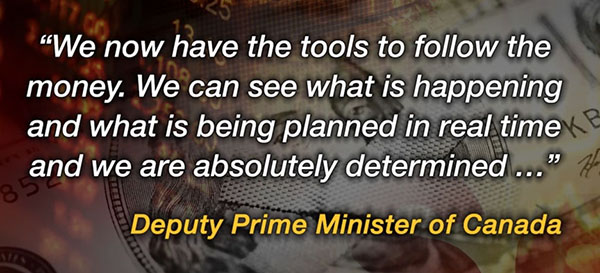

Here’s one more quote from the Deputy Prime Minister that should send chills down your spine:

“We now have the tools to follow the money. We can see what is happening and what is being planned in real time and we are absolutely determined …”

So, they can follow your money.

They can see what you’re planning.

They are determined.

And Fed Control will be like handing them a ballistic missile. Pointed straight at you.

As they record your spending and track your donations, imagine being issued a warning for donating to the “wrong” cause or candidate.

Think your spending — with your name attached — won’t get leaked?

Well, we have abundant proof that nearly every major agency of the U.S. government has already suffered major leaks and hacks:

The U.S. Department of Defense.

The U.S. Department Homeland Security.

The U.S. Department of Justice.

Even the CIA, FBI, and the White House!

Buried in their Docket No. OP — 1670 is evidence of what could be possible.

Don’t think your bank is going to stop this invasion of privacy. Chances are, your bank is begging to join the program.

More than 100 banks have already enlisted to help with the roll out. If you’re an American citizen with a checking account, you simply can’t sit back and wait anymore.

You must act now.

That’s why I’m going to show you, right here on this screen, the ONLY solution I trust to protect your ability to spend and receive money.

It allows you to escape from under the boot heel of the Federal Reserve.

I call it …

The Make Your Money

Safe Again Solution

It’s simple and easy to use. And when you put it into action, you legally and ethically protect and grow your savings, while dodging the Federal Reserve’s control.

Even better, with the way the global economy is deteriorating, our Make Your Money Safe Again solution is also your best bet to increase your wealth.

As I said, there are just four steps you must take.

Fortunately, they’re easy for any American citizen. Once you’ve checked them off your list, you can relax.

What does that look like?

I want you to imagine another scenario:

Imagine that you get a phone call from a friend out of the blue.

“Remember when you warned me about my bank account?” he asks. “Well, I should have listened to you. Because right now, I’m staring at MY screen and it says my transactions have been cancelled, just like you warned. What should I do now?”

Thankfully, that’s your friend talking — not you.

And as bad as you feel for your friend, you also feel a quiet relief, because you did take the needed steps to protect yourself and your family …

BEFORE it was too late.

Much better than the alternative, right?

Much better than having your payments denied, your income denied, or getting a message that a special tax will be levied against your Social Security effective immediately, due to “noncompliance” with new rules.

If you think this is overblown or fearmongering, ask the truckers who were protesting and trying to put food on the table.

I’ve experienced this, too. When I was in Brazil, the government seized the savings accounts of countless citizens. Then, they replaced the money in people’s accounts with a new currency that was worth a lot less.

Years earlier, it was even worse. When inflation hit triple digits, they blamed it on their political opponents. They engineered a coup d’état. They destroyed all traces of democracy or freedom.

I never thought anything like this could come to America. But now, I’ve changed my mind. Now it’s close, too close for comfort.

I bet the citizens of Brazil would have given anything — just for a warning ahead of time.

Today, we’re lucky. We’ve gotten that warning — from the 93 pages of Federal Reserve’s Docket No. OP — 1670. And they’re about to flip the switch.

It doesn’t matter which party is in control at the White House or Congress. You can’t stop Fed Control.

But you CAN protect yourself.

I’m not a financial advisor, but I always say one thing…

Don’t listen to what they TELL you to do.

(That’s the misdirection)

Just like a magician trying to keep you distracted while he hides the ball in his other hand, the Federal Reserve and all the so-called “experts” will almost always TELL you the opposite of what is sound advice.

But you should always watch what they themselves are actually doing….

So what are they doing?

Simple:

Here’s Why Central Banks Are Buying All the Gold They Can — And What YOU Can Do!

For the last year, central banks across the globe have been buying up as much gold (and often silver) as they can acquire without raising alarm bells. Now, we see why.

The recent bank runs and ongoing collapse of the U.S. banking system was anticipated by the “elites” and the central bankers who run things behind the scenes. They saw it coming and knew the best way to protect their assets was through physical precious metals.

If you’ve been waiting for me to bring you a solution about what YOU can do to protect yourself and you’re family, I’m happy to introduce you to something I absolutely love!

Precious metals.

I just talked about precious metals this week with Bo Polny and now I’m bringing you a solution that you can utilize right away if you’re so inclined…

A faith-driven, conservative precious metals company is currently helping Americans tap into the rising precious metals market through self-directed IRAs backed by physical precious metals. And while this service is not unique to Genesis, their adherence to Biblical stewardship of money makes them singularly qualified to receive a sponsored recommendation from this site.

Unlike most companies offering similar services, Genesis deals only with physical precious metals. They do not offer “virtual” or “paper” gold or silver.

With Genesis and their depositories, customers can see and touch the precious metals that back their retirement accounts. When it comes time to take distributions, Genesis customers can cash in some or all of their precious metals or have them delivered to their door.

Central bankers aren’t slowing down. In fact, nations like China and even U.S. states like Tennessee are quickly but quietly buying up gold to back their own treasuries. When the writing on the wall is this clear, it’s understandable why these governments are moving quickly to get ahead of any potential economic catastrophes in store.

Working with Genesis is the best way our readers can explore the physical precious metals market through self-directed IRAs. It benefits us as well when our readers work with this America-First company.

Visit genesiswlt.com or call 866-292-0443 today.

Don’t wait too long, we might have more bank failures right around the corner.

You know what has NEVER “failed”?

Gold. Precious metals. Indestructible.

There’s a reason they call it “God’s money”.

Watch this for more:

Don’t wait until it’s too late!

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!