It’s no secret that the U.S. dollar is in trouble.

Decades as the global reserve currency put the United States and the Federal Reserve Bank, in particular, in the unfortunate position of printing insane sums of money to meet the demand globally.

This has meant two things for the United States: first, our exports have become increasingly unattractive to foreign countries because of the strength, and, therefore, expense of the dollar in global markets.

Secondly, and more importantly, there are likely quadrillions of dollars floating around internationally—dollars that will, in all likelihood, come back home as the world tapers off strict reliance on the USD.

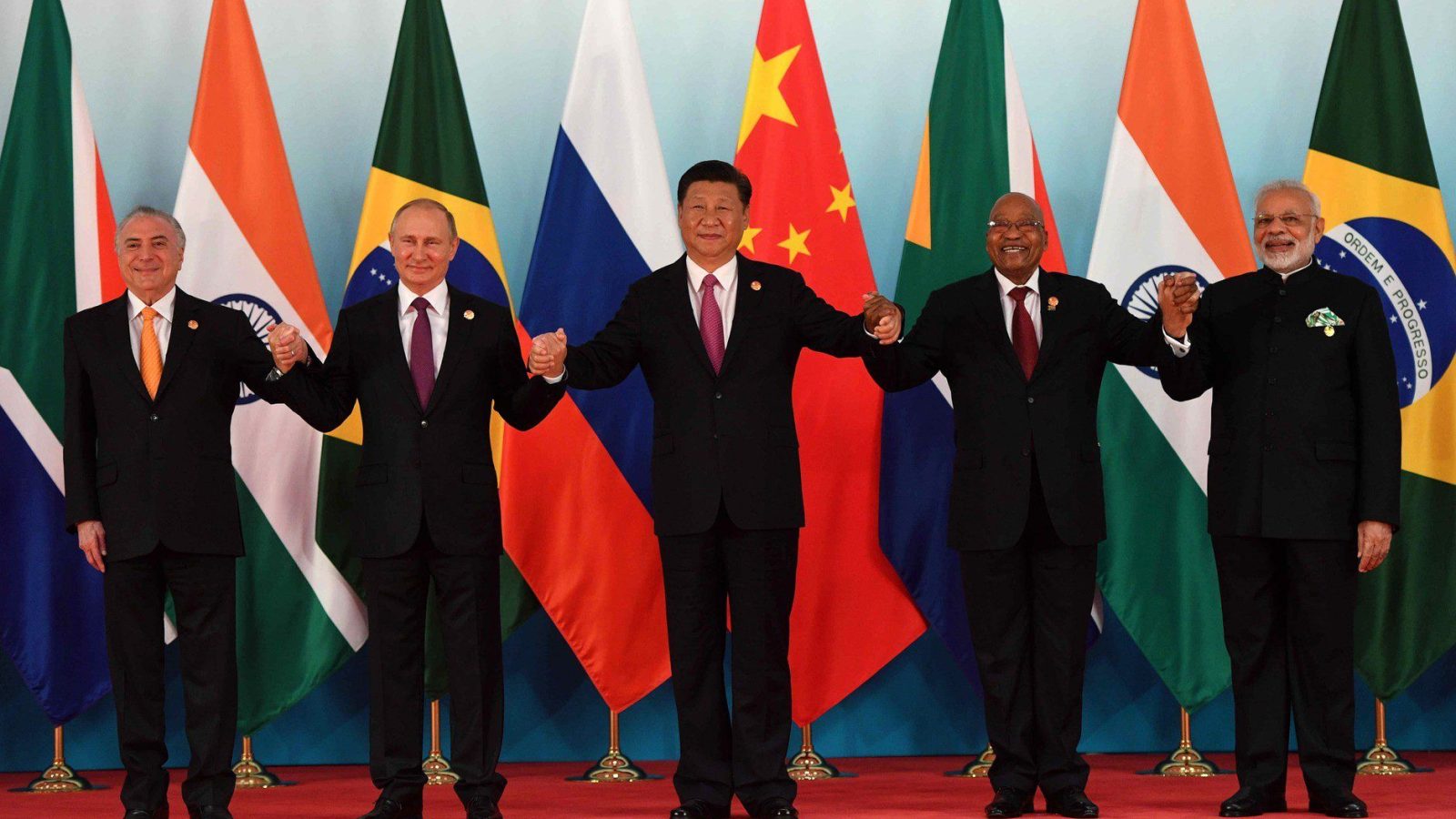

Over the last several months the BRICS countries have been coordinating an effort to upend U.S. global hegemony in energy trade and geopolitical affairs.

Even France, a Western European country, and a close ally, recently completed its first energy trade in Chinese yuan.

The BRICS countries alone represent roughly 40% of the total global population and are commodity-rich, producing countries.

This alone signals that demand for the U.S. dollar will likely drop internationally by the corresponding amount.

To make matters worse, over 150 countries are currently signed on to China’s Belt and Road Initiative—an effort to build infrastructure that will better connect Asia, Africa & Europe.

Those 150+ countries will also likely be using the Chinese currency to transact internationally, purchase energy, and pay for the Chinese infrastructure development happening in their countries.

Now we are getting reports that at least 19 nations have applied to be a part of the BRICS strategic partnership. …

Taken together, this economic bloc will represent a majority of global GDP and a majority of the world that no longer sees the dollar as a safe haven currency or even a desirable investment.

What is the average American to do?

While this is not financial advice and you must always do your own research before making any investment, assets with a fixed supply and no counter-party risk, such as precious metals and Bitcoin, might be your best bet to hedge against a rapidly inflating fiat currency. For more information on that click here.

Analyst Dan Popescu shared GDP figures comparing BRICS and the G7: “BRICS is getting even bigger. 13 new applicants including Saudi Arabia, UAE, Iran, Algeria, Egypt, Argentina, Mexico. 6 of them are OPEC members.”

And BRICS is getting even bigger. 13 new applicants including Saudi Arabia, UAE, Iran, Algeria, Egypt, Argentina, Mexico. 6 of them are OPEC members. https://t.co/73F8oUfICk

— 🇪🇺 🇲🇨🇨🇭Dan Popescu 🇫🇷🇮🇹🇷🇴 (@PopescuCo) April 19, 2023

Watcher Guru explained:

Earlier this year, the BRICS collective made it known that they were open to new members. Additionally, as the bloc of countries has surpassed the G7 nations in GDP (PPP), it seems expansion could continue to implement a shift in the global power balance.

ADVERTISEMENTSpecifically, amidst their continued efforts to replace the US dollar in international trade.

As the BRICS economic bloc continues to gain steam, China is simultaneously cutting U.S. Treasury holdings, according to Wall Street Silver.

The popular financial outlet reports: “China cuts US Treasury holdings to lowest level since global financial crisis. And the sales are accelerating. At the same time China is increasing its gold reserves.”

China cuts US Treasury holdings to lowest level since global financial crisis. And the sales are accelerating.

At the same time China is increasing its gold reserves. #gold pic.twitter.com/5JwJSkfRJg

— Wall Street Mav (@WallStreetMav) March 25, 2023

Bloomberg provided more details on the growing BRICS alliance:

China initiated the conversation about expansion when it was BRICS chair last year, as the world’s second-biggest economy tries to build diplomatic clout to counter the dominance of developed countries in the United Nations.

The proposed enlargement triggered concern among other members that their influence will be diluted, especially if Beijing’s close allies are admitted.

China’s gross domestic product is more than twice the size of all four other BRICS members combined.

ADVERTISEMENT

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!