According to a Nasdaq report, BlackRock increased its position in Fox Corporation (FOXA) earlier this year.

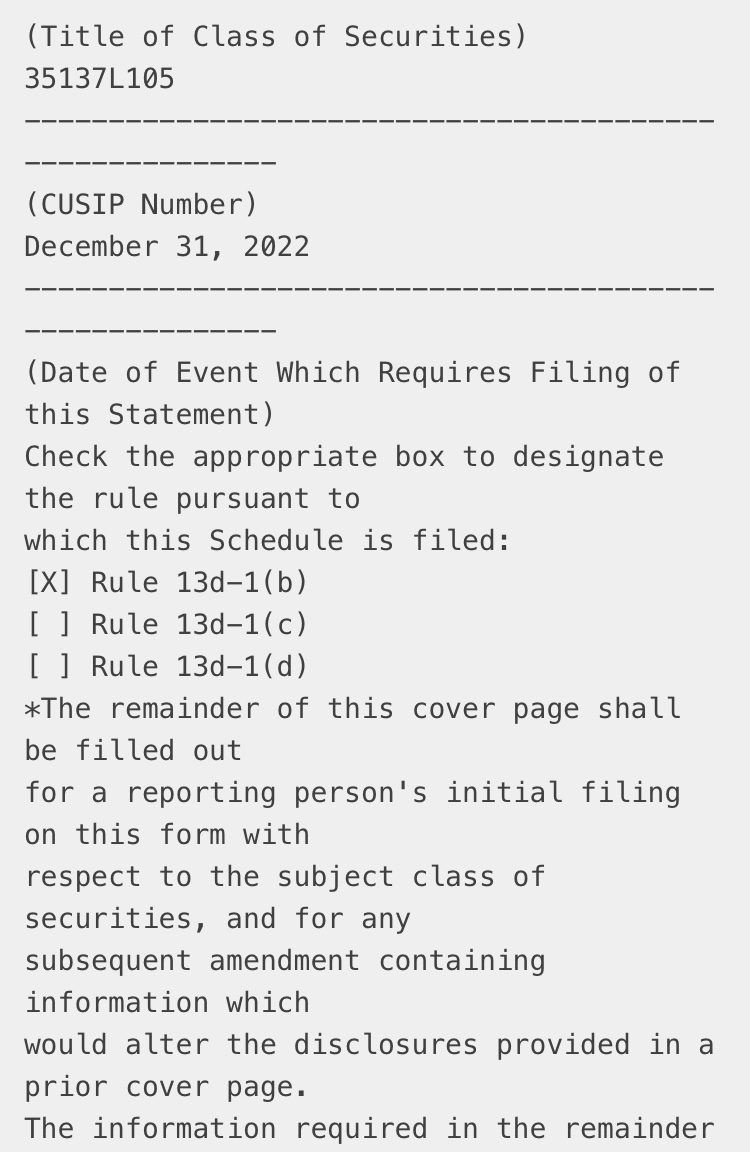

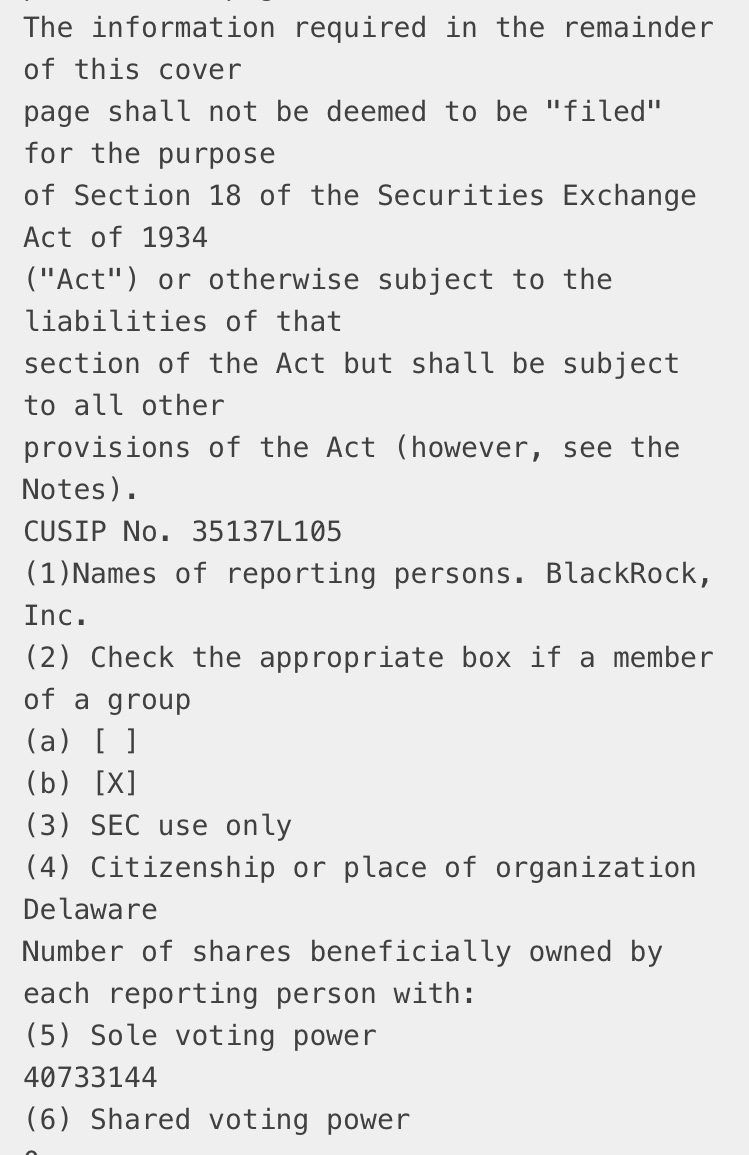

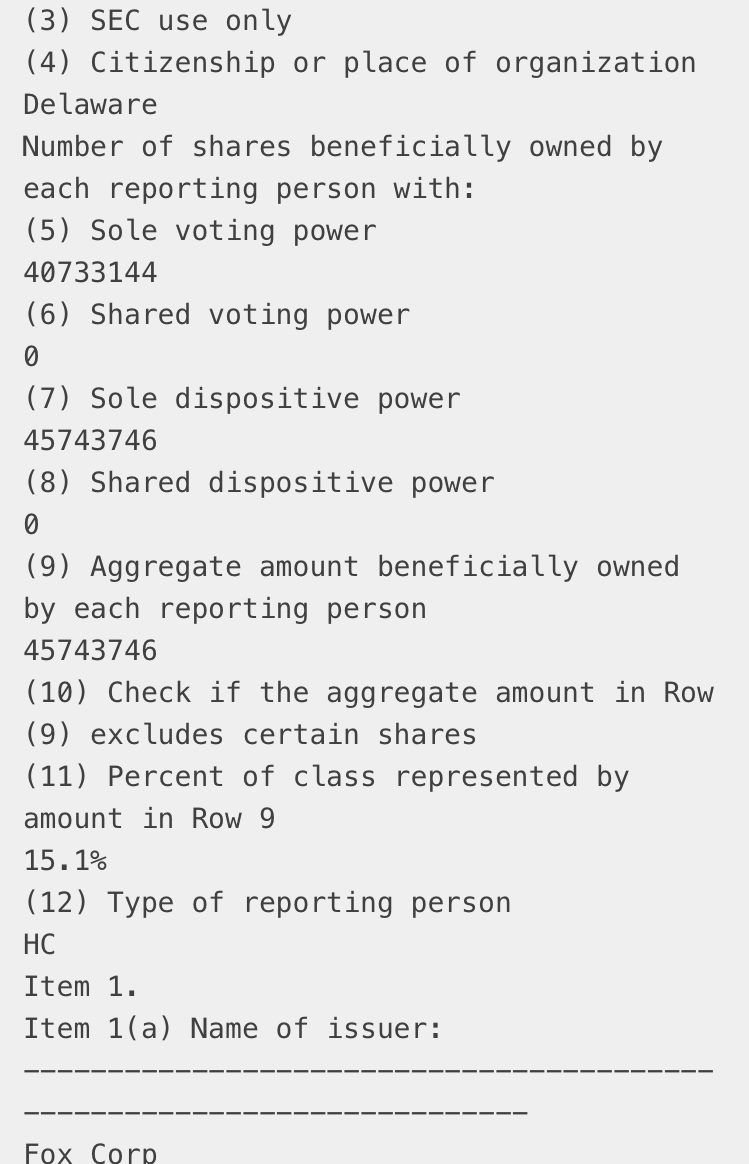

“Fintel reports that BlackRock has filed a 13G/A form with the SEC disclosing ownership of 45.74MM shares of Fox Corporation, Class A (FOXA). This represents 15.1% of the company,” Nasdaq writes.

“In their previous filing dated January 27, 2022 they reported 39.87MM shares and 12.40% of the company, an increase in shares of 14.75% and an increase in total ownership of 2.70% (calculated as current – previous percent ownership),” the report adds.

With BlackRock’s increased ownership in Fox News, did Tucker Carlson get the boot to silence his message to its viewing audience?

After learning about BlackRock’s moves behind the scenes, social media users speculate Carlson’s ousting from the network isn’t a coincidence.

BlackRock Increased its Position in Fox Corporation (FOXA) ahead of @TuckerCarlson’s departure. This is NOT a coincidence. BlackRock is simply too powerful – pushing ESG down our throats. https://t.co/5RUhwDGrK5 pic.twitter.com/eQEpvpXzto

— @amuse (@amuse) April 24, 2023

Whoa – BlackRock increased its stock ownership of Fox Corporation to over *15%* in February

Now do you see why Fox parted ways with Tucker only 2 months later?

Always follow the money https://t.co/xBMgpcaLnY

— DC_Draino (@DC_Draino) April 24, 2023

BlackRock has recently purchased 45.74MM shares of Fox Corporation. This represents 15.1% of the company. Enough Corporate Holding to have Tucker Carlson Deplatformed. pic.twitter.com/d3ukXtC2uw

— Pelham (@Resist_05) April 25, 2023

Cont. from Nasdaq:

Analyst Price Forecast Suggests 10.67% Upside

As of January 31, 2023, the average one-year price target for Fox Corporation is $37.56. The forecasts range from a low of $27.27 to a high of $48.30. The average price target represents an increase of 10.67% from its latest reported closing price of $33.94.

The projected annual revenue for Fox Corporation is $15,270MM, an increase of 8.14%. The projected annual EPS is $3.61, an increase of 82.37%.

Fund Sentiment

There are 1183 funds or institutions reporting positions in Fox Corporation. This is a decrease of 12 owner(s) or 1.00%.

Average portfolio weight of all funds dedicated to US:FOXA is 0.1952%, a decrease of 2.0863%. Total shares owned by institutions decreased in the last three months by 1.82% to 370,429K shares.

From the SC 13 G/A form:

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!