The Texas Legislature has introduced bills in the House and Senate that would create a state-issued, gold-backed digital currency.

The legislation aims to directly combat the Federal Reserve’s attempt to create a central bank digital currency and provide an alternative for Texans.

Texas Bill Would Create State-Issued Gold-Backed Digital Currency @schiffgold https://t.co/RZTNmj448D

— Peter Schiff (@PeterSchiff) April 6, 2023

NEW: Texas bill proposes state-issued gold-backed digital currencyhttps://t.co/iw5fktJXI4

— Insider Paper (@TheInsiderPaper) April 7, 2023

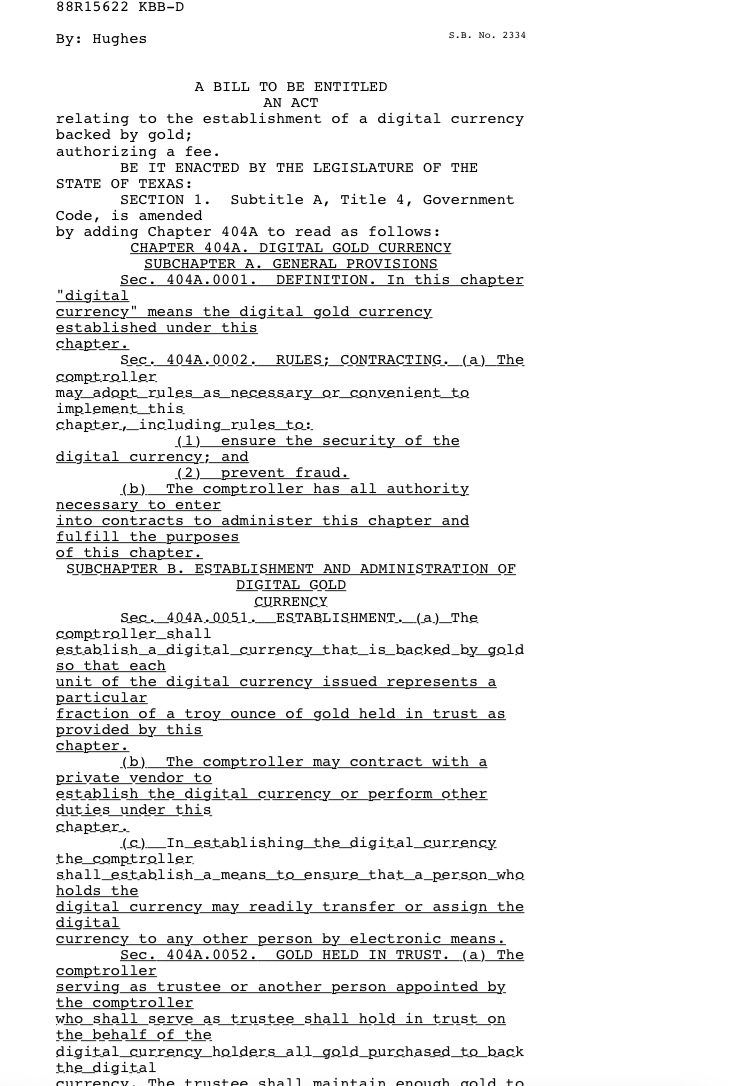

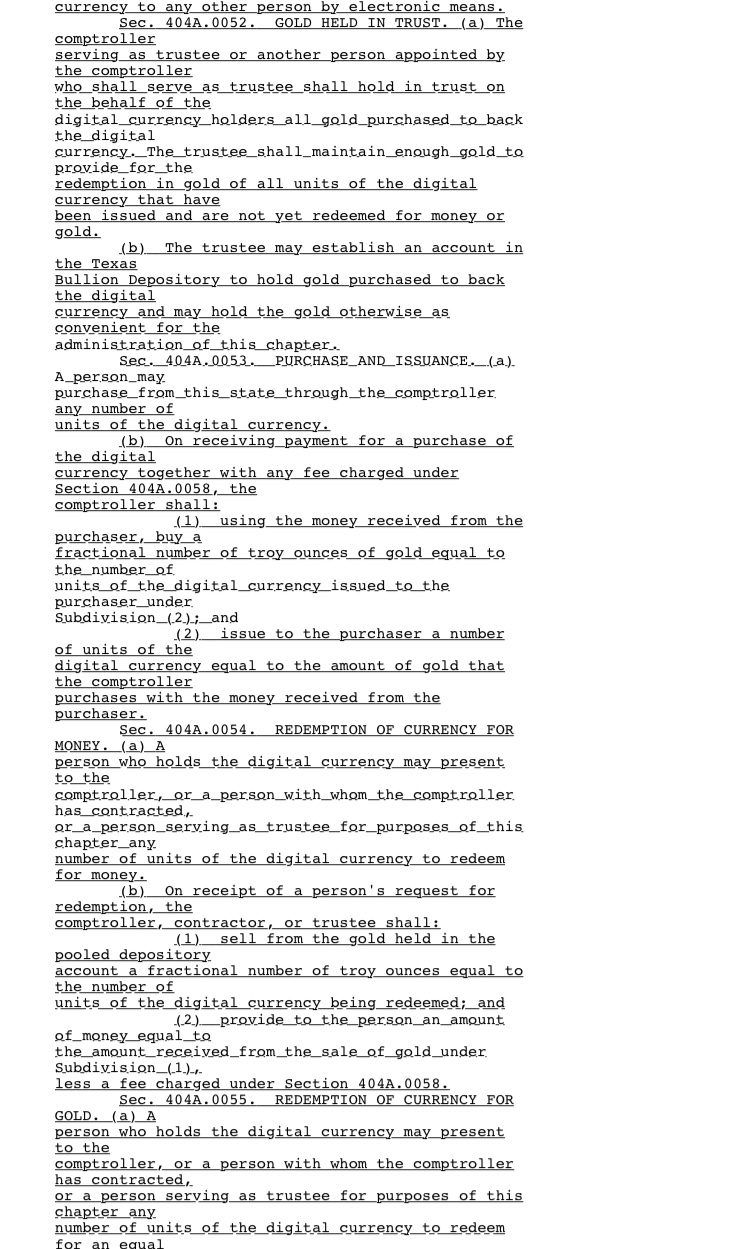

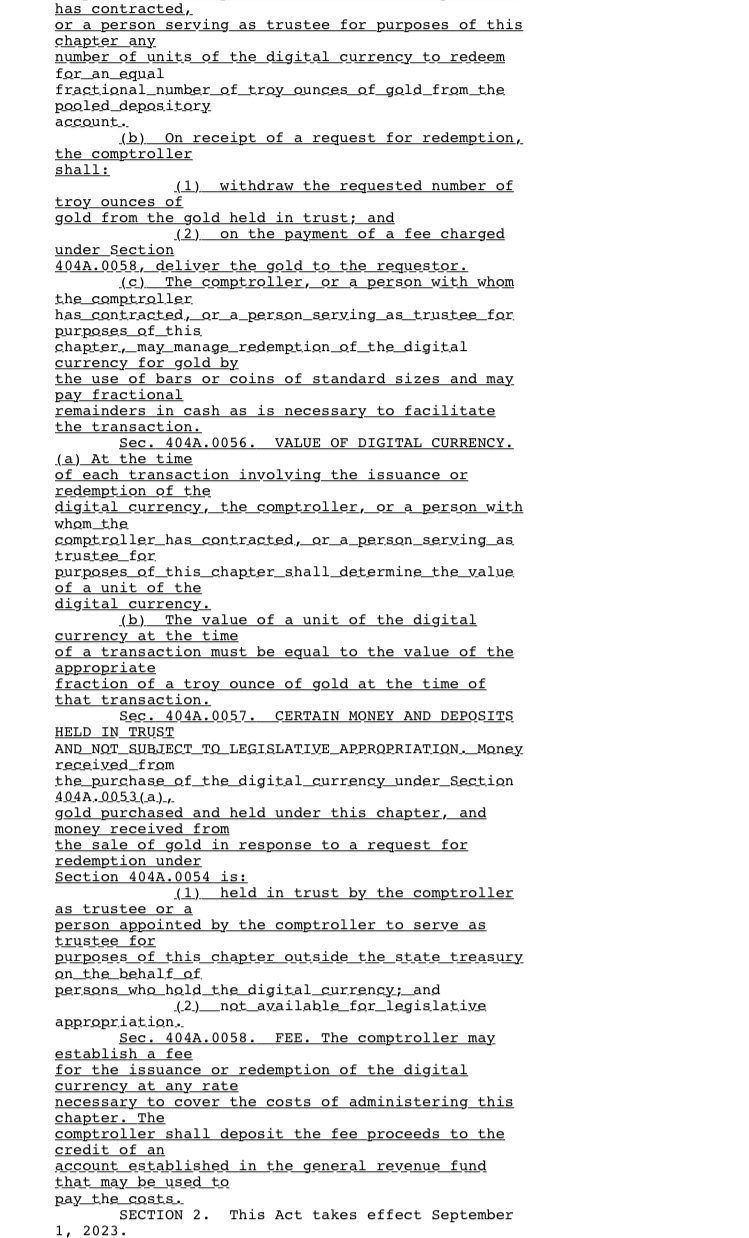

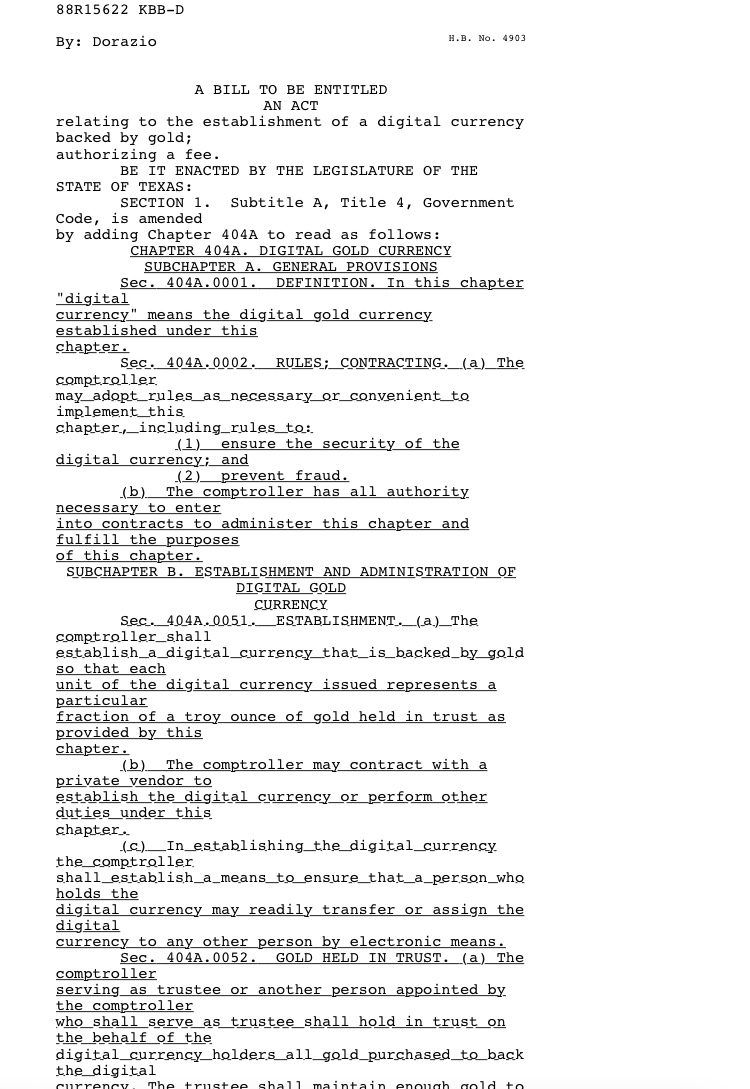

Senate Bill 2334 and House Bill 4903 would “require the state comptroller to establish a digital currency that is fully backed by gold and fully redeemable in cash or gold as well,” Schiff Gold reports.

“The comptroller would also be required to create a mechanism to use this gold-backed digital currency in everyday transactions,” the outlet added.

Cont. from Schiff Gold:

In practice, individuals would be able to purchase digital currency from the state. The state would then use the money to purchase gold that would be held in the Texas Bullion Depository or another secure vault. Individuals would be able to redeem their digital currency for dollars or gold.

CENTRAL BANK DIGITAL CURRENCIES (CBDC)

A gold-backed digital currency would create an alternative and allow individuals and businesses to avoid a CBDC.

Digital currencies exist as virtual banknotes or coins held in a digital wallet on your computer or smartphone. The difference between a central bank (government) digital currency and peer-to-peer electronic cash such as bitcoin is that the value of the CBDC is backed and controlled by the government, just like traditional fiat currency.

At the root of the move toward a CBDC is “the war on cash.” The elimination of cash creates the potential for the government to track and even control consumer spending.

Kitco added further details:

There will be no limit on the amount of gold-backed digital currency that Texans can purchase. As soon as a purchase is made, the comptroller will be required to “buy a fractional number of troy ounces of gold equal to the number of units of the digital currency issued to the purchaser, and issue to the purchaser a number of units of the digital currency equal to the amount of gold that the comptroller purchases with the money received from the purchaser.”

When someone holding the digital currency wants to redeem it for cash, all they would need to do is present it to the comptroller or a designated agent, who will then sell gold held in the depository account equal to the redemption amount and transfer the funds to the redeemer, minus any fees.

Holders can also elect to redeem the digital currency for gold. The comptroller or one of its designated agents “may manage redemption of the digital currency for gold by the use of bars or coins of standard sizes and may pay fractional remainders in cash as necessary to facilitate the transaction,” the bill states.

The value of each unit of the digital currency will be determined at the time of a transaction and “must be equal to the value of the appropriate fraction of a troy ounce of gold at the time of that transaction.”

And as a way to reassure investors in the fund who are worried about issues like bail-ins, the bill explicitly states that “Money received from the purchase of the digital currency, gold purchased and held under this chapter, and money received from the sale of gold in response to a request for redemption is not available for legislative appropriation.”

The Federal Reserve announced that its FedNow instant payment system, which would lay the foundation for a CBDC, will start in July.

The U.S. Federal Reserve is launching its very own “CashApp” called “FedNow” in July. The new app will allow businesses and individual customers of participating banks to send and receive payments 24/7 💰 pic.twitter.com/AyfIEE0TaU

— Daily Loud (@DailyLoud) April 6, 2023

The Fed just announced it will introduce its “FedNow” Central Bank Digital Currency (CBDC) in July. CBDCs grease the slippery slope to financial slavery and political tyranny.

While cash transactions are anonymous, a #CBDC will allow the government to surveil all our private…

— Robert F. Kennedy Jr (@RobertKennedyJr) April 5, 2023

Read the full text for SB 2334 and HB 4903 below:

.

.

.

.

.

.

In related news, three Congressmen, Alex Mooney, Andy Biggs, and Paul Gosar, introduced the Gold Standard Bill to have the USD backed by its weight in gold.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!