Elizabeth Warren is slinging insults and accusations towards those closest to President Trump at an increasingly fast pace lately.

Pete Hegseth has drawn much of her most recent fire as she seems to be doubling down on the false narrative that his tattoos pose a national security risk.

Nevertheless, Elon Musk has often proven a favorite target for her online tirades, and even her hatred of Hegseth’s faith-based tattoos doesn’t seem to match the joy she apparently gets from attacking Musk.

With nothing more substantive than the same old tired accusations to level at her political enemies, Warren has apparently contented herself with those attacks — specifically the fact that Elon Musk has a lot of money.

That characterization may sound oversimplified or immature, but that speaks more to the nature of Warren’s attacks than anything else; both shallow and lacking maturity.

But what really caught my attention was her accidental blunder during her latest attack on Elon Musk.

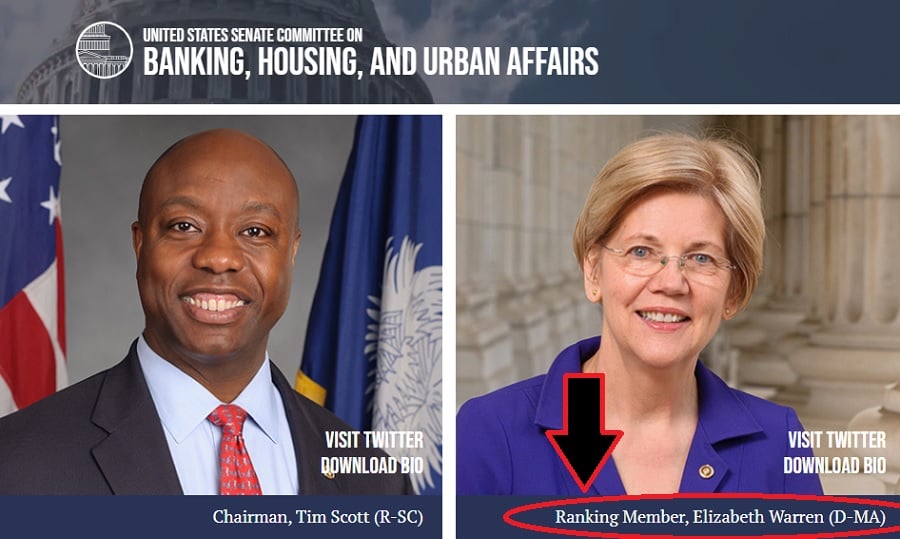

You would think that the ranking democrat on the Senate Committee on Banking would have a grasp on how the Social Security program operates — but according to her most recent attack on Elon Musk, that is a flawed assumption.

Check out Elizabeth Warren’s recent jab at Elon Musk:

When Elon Musk, the richest man on earth, is set to pay the same amount in taxes for Social Security as your neighborhood dentist, we’ve got a problem.

I'm fighting to get the wealthy to pay their fair share into Social Security so we can increase benefits.

— Elizabeth Warren (@ewarren) January 10, 2025

The problem with Warren’s argument is that she seems to think that the amount of taxes a person must pay towards Social Security is directly proportional to their income.

But while there is a graduated bracketing system related to a person’s total income that dictates how much a person must pay towards Social Security, it comes with caps — on both what you pay in, and what is paid out to you once you qualify for monthly Social Security payments.

Social Security has a cap on both the amount you pay in and the amount you get paid out, you lying cunt.

If Musk paid what you call his "fair share," his monthly payments 7 years from now when he's 62 would be $500M a month. pic.twitter.com/JtMKNybYno

— Photo of John Wayne (@ThatOldCoyote) January 11, 2025

As stated, Elizabeth Warren isn’t just a Senator with nearly 12 years under her belt in Congress.

She is also the RANKING DEMOCRAT on the Senate Committee on Banking, Housing, and Urban Affairs.

You would think SHE, of all people, would at least understand the basic concept of how Social Security works.

Firstly, there is a “maximum” — a limit — on a person’s earnings that can be taxed for Social Security purposes.

Here’s how the Social Security website lays that out:

If you are working, there is a limit on the amount of your earnings that is taxable by Social Security. This amount is known as the “maximum taxable earnings” and changes each year.

The maximum taxable earnings have changed through the years, as shown in the chart below. If you earned more than the maximum in any year, whether in one job or more than one, we only use the maximum to calculate your benefits.

When you have more than one job in a year, each employer must withhold Social Security taxes from your wages. This applies no matter what other employers have already withheld. When this happens, the total Social Security taxes withheld could exceed the maximum limit. When you file your tax return the following year, you can claim a refund from the Internal Revenue Service for Social Security taxes withheld that exceeded the maximum amount.

Here are the maximum earnings taxable for the last few years, also according to the Social Security website:

Likewise, there is a corresponding bracketed amount payable once a person qualifies for Social Security payouts.

And while that amount is indeed determined by the previously taxed income, the cap on monthly payouts is much more stringent — as anyone with real world experience with Social Security knows perfectly well.

Here’s what the Social Security website has to say about the payable benefits:

The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2025, your maximum benefit would be $4,018. However, if you retire at age 62 in 2025, your maximum benefit would be $2,831. If you retire at age 70 in 2025, your maximum benefit would be $5,108.

Meanwhile, the ranking member of the U.S. Senate Committee on Banking seems to think that Elon Musk should simply pay more since he’s so rich.

I don’t want to put words in the Senator’s mouth — but that’s almost exactly what she said.

Keep in mind, in the past she has attacked Elon Musk for simply not paying enough taxes in general.

Check out this clip from 2021, which quickly came back to haunt her once Elon’s total tax payment was revealed a few days later:

2021. Elizabeth Warren calls Elon Musk a freeloader and falsely claims that he pays no taxes. A week later it was revealed that Elon would be paying over $11 billion in taxes for the year.

Just another example of the biggest proponents of censorship being the biggest liars. pic.twitter.com/Ks9c6HPJ9v

— MAZE (@mazemoore) October 20, 2024

As Maze pointed out, that “freeloader” payed over $11 billion in taxes that year.

Elizabeth Warren calls Elon Musk a freeloader and falsely claims that he pays no taxes. A week later it was revealed that Elon would be paying over $11 billion in taxes for the year.

Just another example of the biggest proponents of censorship being the biggest liars.

The fact is, Elon Musk has paid far more money in taxes during his relatively few years as an American citizen than Elizabeth Warren has made in her life.

And for a democratic Senator… that is saying something!

Elon Musk has been an American citizen for 8,100 days.

In 2021, he paid $11 billion in federal income taxes.

That amounts to $1,358,024 per day of citizenship.

Yet, Elizabeth Warren insists he should pay more. pic.twitter.com/XFwUSPCAcm

— Apple Lamps (@lamps_apple) December 6, 2024

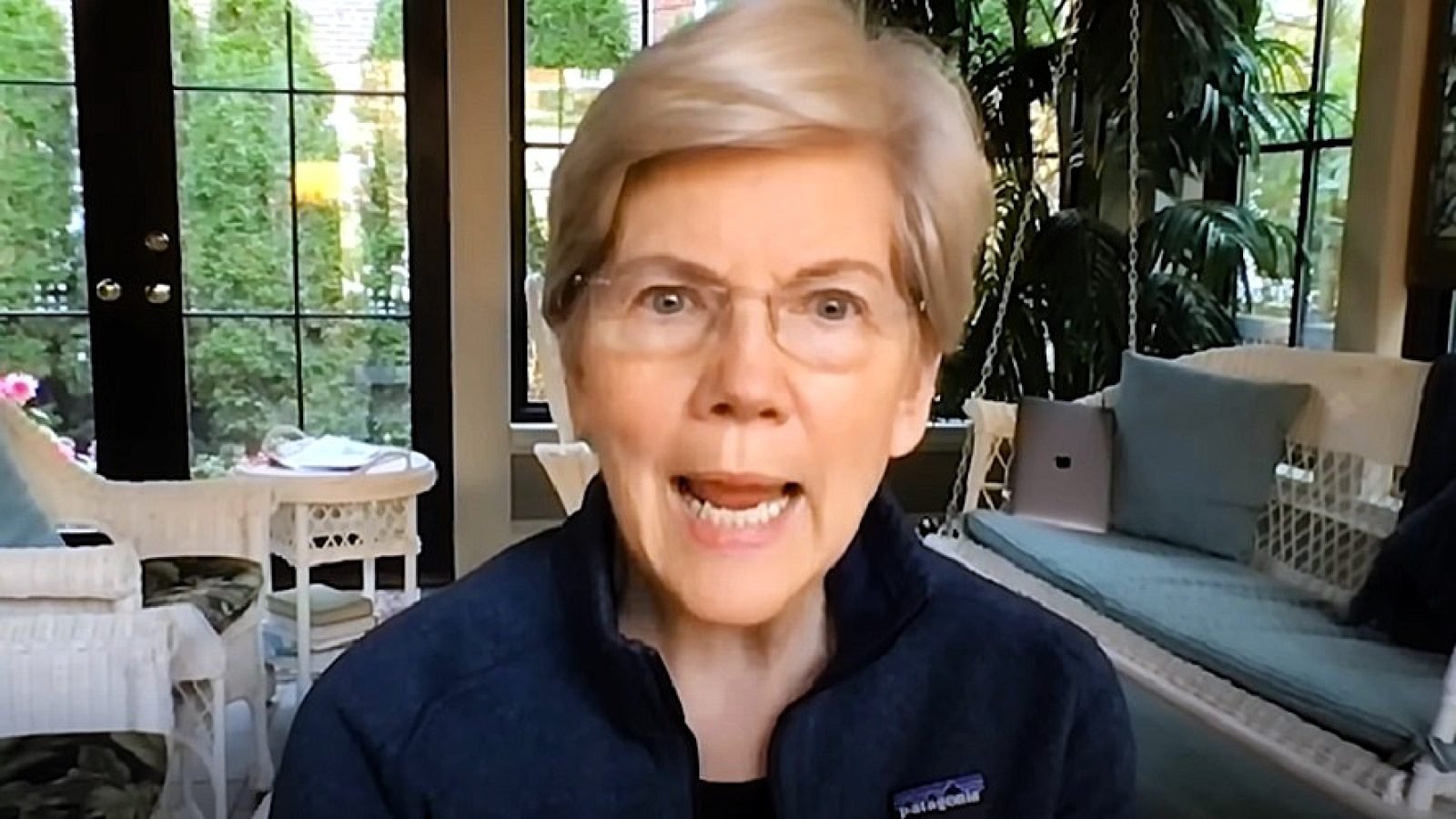

Elizabeth Warren’s baseless, illogical, and dishonest attacks will surely continue.

After all — she has nothing of substance to level against President Trump or his political allies!

As the reporter in the video shared on X earlier pointed out, that is just Warren’s line. We know it’s not true, and we know it is her intent to cause division with her false information.

The problem for Elizabeth Warren is… that same Elon Musk she loves attacking now owns the same platform on which she is badmouthing him!

And while he isn’t perfect, and X has had some rocky moments even under Elon’s rule… the fact is, he doesn’t run it like a Siberian Gulag.

He runs it like a FREE SPEECH PLATFORM.

Unfortunately for Elizabeth Warren, that means all the rest of us are much more likely to have access to information that paints her as the lying sack of divisiveness that she is.

And instead of picking up followers — or voters — for her incessant baseless attacks, all she is doing is exposing herself that much more with every stroke of the keyboard as either one of two things; a liar, or ignorant.

Or as I highly suspect… both.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!