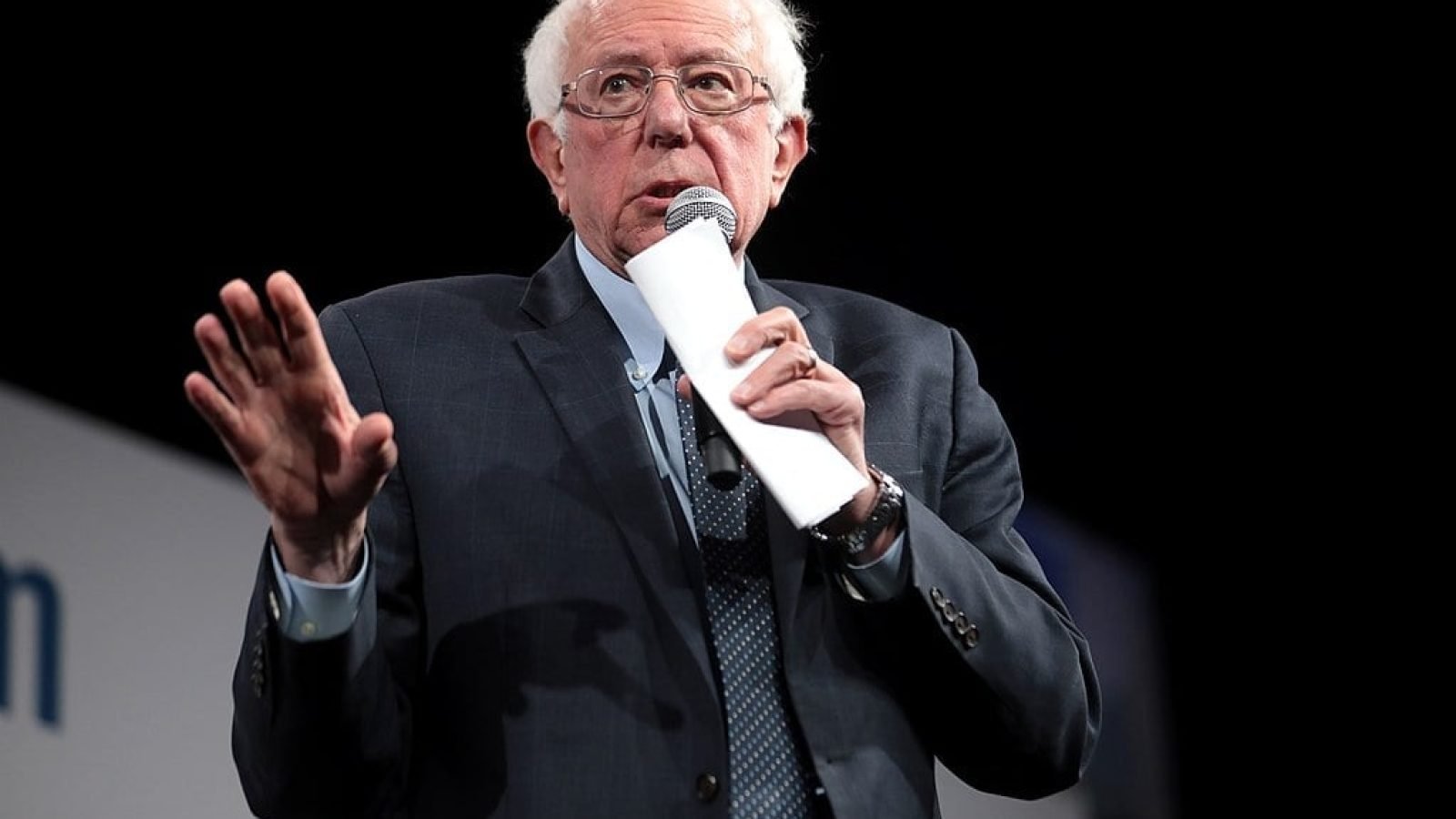

Sen. Bernie Sanders (I-VT) said he would introduce legislation to cap credit card interest rates to 10% based on President Trump’s campaign proposal.

“During the recent campaign Donald Trump proposed a 10% cap on credit card interest rates. Great idea. Let’s see if he supports the legislation that I will introduce to do just that,” Sanders said.

During the recent campaign Donald Trump proposed a 10% cap on credit card interest rates. Great idea. Let’s see if he supports the legislation that I will introduce to do just that.

— Bernie Sanders (@SenSanders) December 30, 2024

Fox News reports:

While campaigning in New York before winning the election against Vice President Kamala Harris, Trump threw his support behind a “temporary cap on credit card interest rates.”

“We’re going to cap it at around 10%. We can’t let them make 25 and 30%.”

Trump framed the temporary policy as something to help Americans as they “catch up.”

The amount of credit card debt held by Americans rose to $1.17 trillion in the third quarter of 2024, per MarketWatch.

ADVERTISEMENTAccording to data from Lending Tree, the average credit card interest rate in December was 24.43%, MarketWatch also reported.

Regarding whether the president-elect still intends to implement this policy after he debuted it in September, transition spokesperson Karoline Leavitt told Fox News Digital in a statement, “The American people re-elected President Trump by a resounding margin giving him a mandate to implement the promises he made on the campaign trail. He will deliver.”

Trump vows to impose usury laws on issuers, capping credit card interest at 10%.

“We can’t let them make it 25% and 30%.”

Follow: @AFpost pic.twitter.com/NonBrI3Ait

— AF Post (@AFpost) September 19, 2024

WATCH:

PRESIDENT TRUMP’S AGENDA:

1. SEAL THE BORDER – STOP THE INVASION

2. LARGEST DEPORTATION

3. END INFLATION – LOWER PRICES

4. TEMPORARY CAP ON CREDIT CARD INTEREST RATES

5. ENERGY DOMINANCE

6. DRILL, BABY, DRILL!

7. BECOME MANUFACTURING SUPER POWER. pic.twitter.com/3ntdtIahoK— Real America’s Voice (RAV) (@RealAmVoice) September 29, 2024

Per CNBC:

The average credit card balance was $6,329 in the second quarter of 2024, compared with $4,828 during the same period in 2021, according to TransUnion. The current delinquency rate of more than 3% is the highest since 2011, Federal Reserve data shows.

Trump’s proposed rate cap, if enacted, would have a huge impact on both consumers and on the financial industry.

The average interest rate on credit cards is currently over 20%, with some cards charging as much as 36% APR, said Ted Rossman, a senior industry analyst at Bankrate.

“A 10% cap would completely upend the credit card market,” Rossman told CNBC.

ADVERTISEMENTWhile the Trump campaign has yet to provide details of how the proposed cap would work, campaign spokesperson Karoline Leavitt said the intent was to “provide temporary and immediate relief for hardworking Americans,” including those “who are struggling to make ends meet and cannot afford hefty interest payments on top of the skyrocketing costs of mortgages, rent, groceries and gas.”

This is a Guest Post from our friends over at 100 Percent Fed Up.

View the original article here.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!