A new wave of “bank” failures has just hit….

And almost no one is talking about it.

I put “bank” in air-quotes because what makes this even worse than all the others is that these are not traditional “banks” and that means there is NO FDIC insurance!

Just money lost, poof! Gone!

In some cases, entire life savings.

This is so sad, but unfortunately it is 100% real and only getting worse by the day.

And…almost no one is talking about it:

I feel like more people should be talking about the Synapse Bank Collapse. How is this going under the radar?

— JohneFinance | John Eringman (@johnefinance) November 26, 2024

So we will cover it.

It all starts with a company called Synapse Bank which serviced a bunch of fin-tech “banks”.

These were places like Yotta Bank and Evolve Bank.

When Synapse collapsed and filed for Bankruptcy, it left thousands of people completely cut off from their money and slim hopes of ever seeing it again.

CNBC posted this report where thousands of Americans are now saying “I have no money” — through no fault of their own:

'I have no money': Thousands of Americans see their savings vanish in Synapse fintech crisis https://t.co/vIMEdzEbqC

— CNBC (@CNBC) November 22, 2024

This is an absolutely TRAGIC story….

CNBC explains more about how this happened:

For 15 years, former Texas schoolteacher Kayla Morris put every dollar she could save into a home for her growing family.

When she and her husband sold the house last year, they stowed away the proceeds, $282,153.87, in what they thought of as a safe place — an account at the savings startup Yotta held at a real bank.

Morris, like thousands of other customers, was snared in the collapse of a behind-the-scenes fintech firm called Synapse and has been locked out of her account for six months as of November. She held out hope that her money was still secure. Then she learned how much Evolve Bank & Trust, the lender where her funds were supposed to be held, was prepared to return to her.

“We were informed last Monday that Evolve was only going to pay us $500 out of that $280,000,” Morris said during a court hearing last week, her voice wavering. “It’s just devastating.”

The crisis started in May when a dispute between Synapse and Evolve Bank over customer balances boiled over and the fintech middleman turned off access to a key system used to process transactions. Synapse helped fintech startups like Yotta and Juno, which are not banks, offer checking accounts and debit cards by hooking them up with small lenders like Evolve.

In the immediate aftermath of Synapse’s bankruptcy, which happened after an exodus of its fintech clients, a court-appointed trustee found that up to $96 million of customer funds was missing.

The mystery of where those funds are hasn’t been solved, despite six months of court-mediated efforts between the four banks involved. That’s mostly because the estate of Andreessen Horowitz-backed Synapse doesn’t have the money to hire an outside firm to perform a full reconciliation of its ledgers, according to Jelena McWilliams, the bankruptcy trustee.

But what is now clear is that regular Americans like Morris are bearing the brunt of that shortfall and will receive little or nothing from savings accounts that they believed were backed by the full faith and credit of the U.S. government.

The losses demonstrate the risks of a system where customers didn’t have direct relationships with banks, instead relying on startups to keep track of their funds, who offloaded that responsibility onto middlemen like Synapse.

There are thousands of others like Morris. While there’s not yet a full tally of those left shortchanged, at Yotta alone, 13,725 customers say they are being offered a combined $11.8 million despite putting in $64.9 million in deposits, according to figures shared by Yotta co-founder and CEO Adam Moelis.

CNBC spoke to a dozen customers caught in this predicament, people who are owed sums ranging from $7,000 to well over $200,000.

From FedEx drivers to small business owners, teachers to dentists, they described the loss of years of savings after turning to fintechs like Yotta for the higher interest rates on offer, for innovative features or because they were turned away from traditional banks.

One Yotta customer, Zach Jacobs, logged onto Evolve’s website on Nov. 4 to find he was getting back just $128.68 of the $94,468.92 he had deposited — and he decided to act.

Most people have no idea this is even happening right now because almost no one is covering it…

And there’s a reason I put “Bank Runs” in the title image above….because if/when this truly goes viral, I think Michael Horn is right — I would not be surprised to see “bank” runs on a lot of fintechs:

This is a sad and dangerous story. There should be serious legal consequences and immediate systemic reforms. If more ordinary people were aware of this, it would not be surprising to see existential “bank” runs on a lot of fintechs. https://t.co/nbcCyCG4Ig

— Michael Horn (@mikehorn) November 22, 2024

It’s one tragic story after another:

“We were informed last Monday that Evolve was only going to pay us $500 out of that $280,000,” Morris said during a court hearing last week, her voice wavering. “It’s just devastating.”

The crisis started when a dispute between Synapse and Evolve Bank over customer balances. pic.twitter.com/ebYkLytjnQ— MacroSpeed Economics (@MacroSpeedEcon) November 25, 2024

Another:

'I have no money': Thousands of Americans see their savings vanish in Synapse fintech crisis https://t.co/YSWPGDptMk pic.twitter.com/0FxiRBlgNe

— Shawn 🇻🇮 (@LivesInThought) November 24, 2024

I actually warned everyone about this back in June:

RELATED REPORT:

And get your money out of the banks if you're worried about this type of stuff!

JUST IN: Billionaire Real Estate Investor Barry Sternlicht Expects One Bank Failure PER WEEK!

JUST IN: Billionaire Real Estate Investor Barry Sternlicht Expects One Bank Failure PER WEEK!

Last year we had 6 fairly large banks FAIL in the United States.

Unprecedented at least in my recollection in recent years.

But I kept telling you it was NOT over.

Then a few weeks ago this happened:

BREAKING NEW BANK FAILURE: Republic First Bank Collapses, Seized By Regulators

And through it all I continue to warn you....something much bigger and much worse is coming.

I sure hope I'm wrong, but I don't think I am.

In fact, I continue to see things getting worse at an accelerated pace.

But who cares what I think....I'm just a reporter. Your humble correspondent!

What you should care about, however, is what Barry Sternlicht thinks.

Do you know who that is?

Sternlicht is an American billionare and real estate expert:

Barry Sternlicht, born on November 27, 1960, in New York City, is a renowned American billionaire and the co-founder (with Bob Faith), chairman, and CEO of Starwood Capital Group, a prominent investment fund managing over $100 billion in assets. He also holds the position of chairman of Starwood Property Trust. Sternlicht's professional journey began in 1991 when he co-founded Starwood Capital Group with Bob Faith, and he later founded the W hotel chain and Starwood Property Trust, one of the largest commercial mortgage REITs. In 1995, he became the chairman and CEO of Starwood Hotels and Resorts Worldwide until 2005.

Throughout his career, Barry Sternlicht has been recognized for his significant contributions to the hospitality industry, real estate markets, and the global business community. He was named the Cornell Icon of the Industry in 2015, a prestigious honor acknowledging his leadership and innovation within the hospitality sector. Additionally, in 2010, Sternlicht was awarded both the "Executive of the Year" and "Investor of the Year" titles by Commercial Property Executive, highlighting his remarkable achievements in real estate investment and management.

Sternlicht has been involved in various philanthropic endeavors, including serving on the board of directors for the Robin Hood Foundation and the Dreamland Community Theatre. His commitment to giving back extends to his alma mater, Brown University, where he has been a trustee.

In terms of market predictions and business acumen, Sternlicht has demonstrated a keen understanding of economic trends and investment opportunities. He has successfully navigated multiple economic downturns and has been instrumental in the growth and development of his companies. His ability to identify and capitalize on market opportunities has earned him a reputation as a savvy investor and a leader in the real estate and hospitality industries.

And here's what he's saying RIGHT NOW:

Billionaire real estate investor Barry Sternlicht says he expects at least one bank failure per week. pic.twitter.com/yVZtsFBCZF

— Watcher.Guru (@WatcherGuru) May 10, 2024

Ok so what can you do to stay safe?

And how can you get gold with NO MONEY OUT OF POCKET?

Read below...

The ONLY Two Gold Companies I Am Proud To Partner With

We mostly cover politics here, but politics affects the economy and the economy affects...YOU and ME! And our pocketbooks.

Big league.

So in the midst of covering politics, we also cover money from time to time...and while I'm not a financial advisor, I share what I'm learning in the hopes that it can help you and keep you and your family safe.

And that often leads me to covering Gold and Silver.

You know, what they have always called "God's Money".

He made it, they aren't making any more of it, and it has always been highly valued as money from the beginning of time until now.

So I'm a big fan and I think it has the potential to do big things if, say, the U.S. Dollar were to suddenly collapse.

So that's why I talk about it and why I want to make sure everyone protects themselves and your families.

So to answer the question of "what can I do?" it's really quite simple: you need to get some #Gold or #Silver in your own possession.

It's called "physical" gold and silver.

Not paper traded garbage on the stock exchanges that isn't backed by anything.

Don't touch that stuff.

And because I get asked so much how to buy it and what the best places are, I thought I would publish this and just get it out there for all to have....

I have two special hook-ups for you and these are the ONLY two companies I am proud to partner up with on Gold and Silver.

Both involve PHYSICAL gold and silver.

Because if you do NOTHING else, make sure you own "physical" gold and silver, not paper contracts.

The paper contracts (like stock ticker SLV and GLD) could very well go POOF one day and disappear or go to zero, because they're not actually backed by the gold and silver they claim to represent.

It's a massive game of musical chairs out there and when the music stops (and I think it will stop soon...) people who only own paper might find themselves owning something not worth the paper it's literally written on.

And I know you'll never forget it if I give you this GIF so....Let's Get Physical:

Now...WHERE do you get physical gold and silver and how do you know it's real and safe?

And that you're getting the best price?

Oh, and how about personal one-on-one real customer service?

You know, like you were some Big Wig millionaire at Goldman Sachs who could just call their personal banker and get help?

That's what I'm about to tell you.

I have two killer connections for you...

The first is for purchasing gold and silver bullion.

That means bulk bars.

That's the cheapest and most economical way to do it, to stretch your dollar into as much gold and silver as possible.

The website is called WLT Precious Metals and when you see my logo in the top left-hand corner, you'll know you're in the right place.

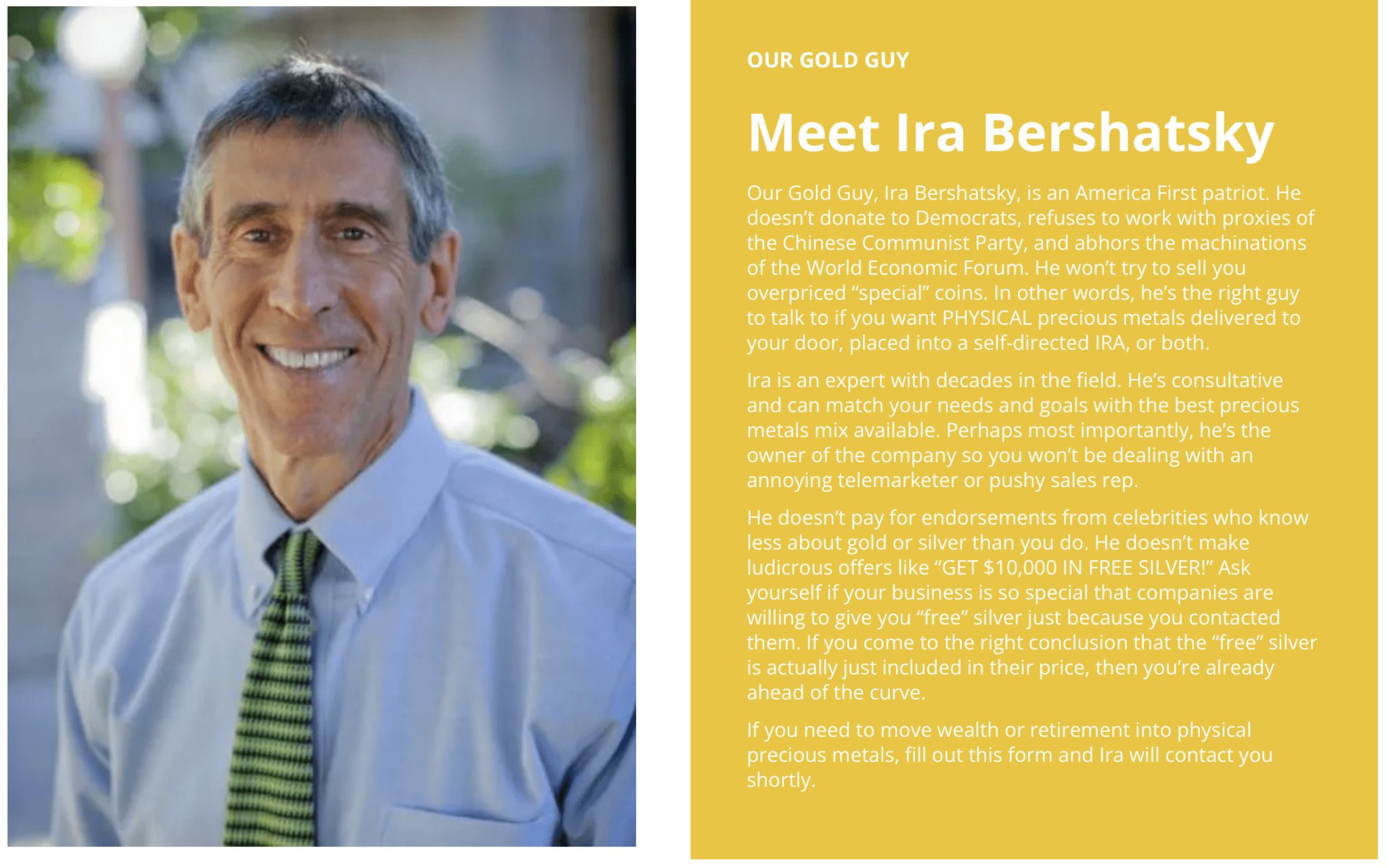

You'll get a personal phone call with Ira Bershatsky (or someone on his team) and they will work with you free of charge for as long as needed to answer any questions you have and get you taken care of.

How about that!

You don't see that much anymore, but Ira and his team pride themselves on good old-fashioned real customers service:

No sales pitch, just real, actual help.

And the best prices you will find.

Here's the only disclaimer I will give you: because they do pride themselves on dedicated service, it might take a few days before you get a phone call back. Just be patient.

Good things come to those who wait!

You can contact Ira and WLT Precious Metals here.

Ok, that was #1.

Now I want to tell you about option #2.

An equally great company, I am so happy to be working with these guys.

This next company is called Genesis Gold and this is for people who want to purchase real physical gold or silver in their IRAs (Investment Retirement Accounts).

You know what the beauty of that is?

Two huge benefits actually...

First is TAX FREE baby!

I'm not a tax advisor, but that's a general oversimplification.

Never pay more taxes than you are legally required to pay.

And that's why I love getting gold and silver in my IRA (and why I hold a large chunk in an IRA myself!).

Second is if you simply shift money out of stocks (like Peter Schiff recommends) and into Gold, it won't cost you anything! No money out of pocket!

BOOM!

There's so much to love about Genesis Gold, starting with the fact they are proudly and un-ashamedly Christina!

They call it "Faith-Driven Stewardship" and they put it right on the homepage of their website along with a quote from Ezekiel:

Here's more on why gold and silver in your IRA are so powerful:

You can contact Genesis Gold here.

They are also very backed up with record demand, so you may have to wait a bit, but someone WILL get in touch with you for personal customer service and assistance!

Tell 'em Noah sent ya!

Oh, and did you know Genesis is recommended by SUPERMAN himself?

It's true.

Superman himself, Clark Kent -- Dean Cain -- came on my show a few weeks ago and we broke it all down:

Watch here:

Stay safe!

Make sure you can weather the storm when it hits!

Because the storm always hits eventually, doesn't it?

As for me and my house, we will be ready. 💪

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!