Multiple outlets report that President Trump has selected investor and hedge fund manager Scott Bessent to serve as Treasury secretary.

One source told the New York Post that Bessent “got the thumbs up” after a meeting with Trump at Mar-a-Lago on Thursday night.

Breaking: Donald Trump named hedge-fund manager Scott Bessent to lead the Treasury Department https://t.co/GGiiIAalVK

— The Wall Street Journal (@WSJ) November 22, 2024

From the New York Post:

Bessent, the 62-year-old founder of Key Square Group, has repeatedly backed the president-elect’s pro-tariff stance in a series of op-eds and media appearances over the past year.

A source close to the Trump transition team told the Post earlier on Friday that the hedge fund executive was “being vetted” for the role ahead of a formal announcement.

“If you want to bring a genius into that job who is loyal to the president, Scott is the right guy,” one source close to the situation said.

One faction of Trump World had been pushing for Bessent for weeks, trying to outmaneuver Howard Lutnick — the CEO of Cantor Fitzgerald and co-chair of Trump’s transition team — in what had reportedly escalated into a bitter “knife fight” for the coveted role.

ADVERTISEMENT

Trump chose Lutnick for the role of Commerce secretary.

“We may not have to get to tariffs, but the threat of tariffs will change the quality and fairness of a lot of historically poor trade deals,” Bessent said.

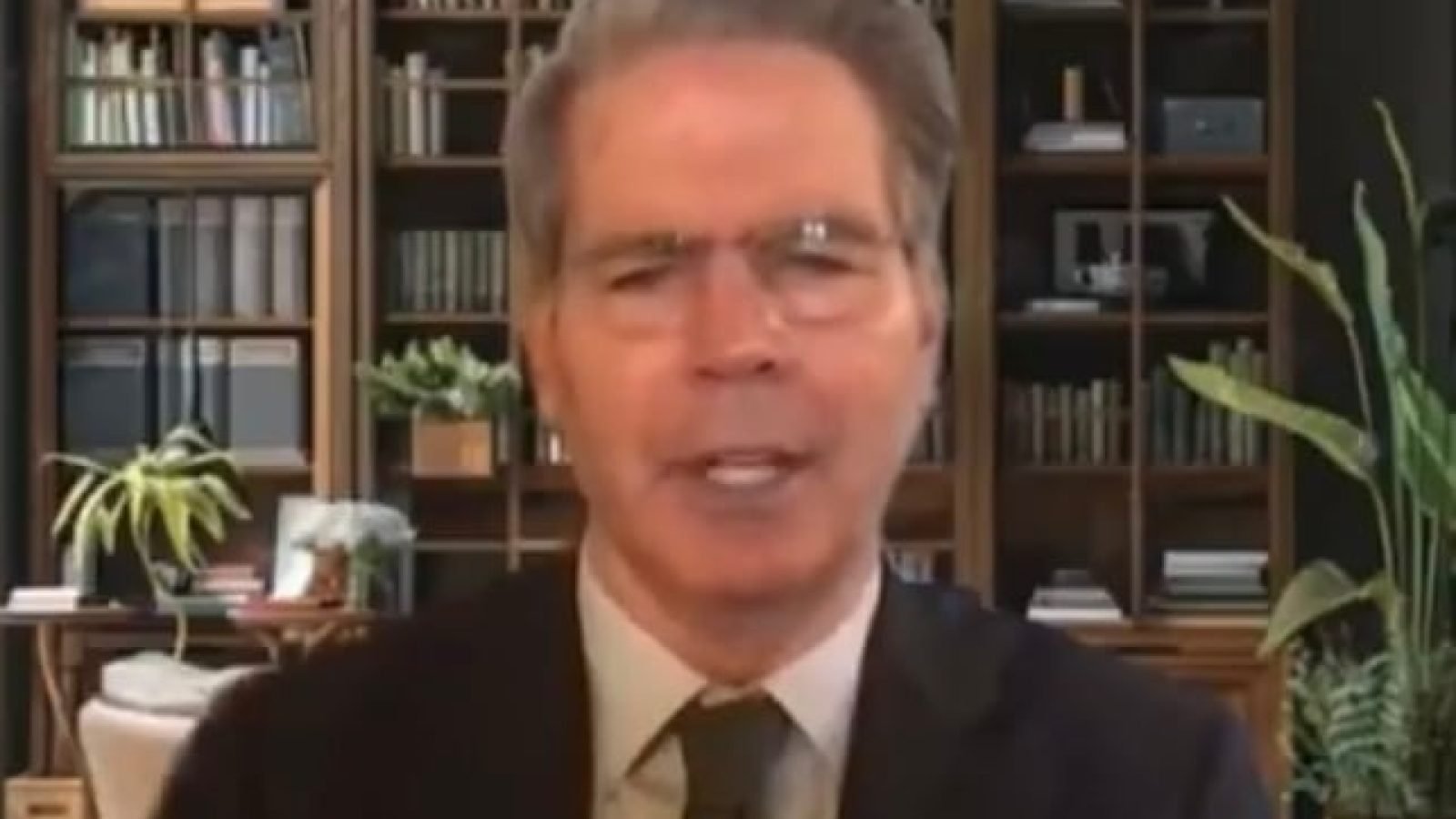

WATCH:

Scott Bessent on tariffs: “We may not have to get to tariffs, but the threat of tariffs will change the quality and fairness of a lot of historically poor trade deals.” pic.twitter.com/XEzDySboPH

— Guido Austin (@nob0dy162877102) November 16, 2024

“President Trump has selected CEO and Founder of Key Square Capital Management, Scott Bessent, to lead the Treasury Department. A phenomenal pick. Expect the markets to react favorably,” Charlie Kirk commented.

WATCH:

BREAKING: President Trump has selected CEO and Founder of Key Square Capital Management, Scott Bessent, to lead the Treasury Department.

A phenomenal pick. Expect the markets to react favorably. pic.twitter.com/dHBv5vASZX

— Charlie Kirk (@charliekirk11) November 22, 2024

In an op-ed for The Wall Street Journal, Bessent wrote that Trump will “repair the Biden damage, and his pro-growth agenda will drive private investment.”

“Donald Trump is the most transformative political figure of this century,” Bessent told Steve Bannon.

“As a financial analyst, I could see that the way the Biden administration was racking up the debt during their four years that there is a tipping point where you cannot grow your way out of it,” he said.

“I’ve been on here several times saying we have to re-privatize the economy. Biden-Harris plan was an old-style central planning bordering on Soviet-style plan,” he added.

WATCH:

Scott Bessent talks about how this is our last chance to re-privatize the economy. He discusses how the biggest burden of the Biden administration has been regulations. pic.twitter.com/yzseGawkxf

— Insurrection Barbie (@DefiyantlyFree) November 16, 2024

Per Reuters:

Bessent has advocated for tax reform and deregulation, particularly to spur more bank lending and energy production, as noted in a recent opinion piece he wrote for The Wall Street Journal.

The market’s surge after Trump’s election victory, he wrote, signaled investor “expectations of higher growth, lower volatility and inflation, and a revitalized economy for all Americans.”

Bessent follows other financial luminaries who have taken the job, including former Goldman Sachs executives Robert Rubin, Hank Paulson and Steven Mnuchin, Trump’s first Treasury chief. Janet Yellen, the current secretary and first woman in the job, previously chaired the Federal Reserve and White House Council of Economic Advisers.

As the 79th Treasury secretary, Bessent would essentially be the highest-ranking U.S. economic official, responsible for maintaining the plumbing of the world’s largest economy, from collecting taxes and paying the nation’s bills to managing the $28.6-trillion Treasury debt market and overseeing financial regulation, including handling and preventing market crises.

ADVERTISEMENTThe Treasury boss also runs U.S. financial sanctions policy, oversees the U.S.-led International Monetary Fund, World Bank and other international financial institutions, and manages national security screenings of foreign investments in the U.S.

This is a Guest Post from our friends over at 100 Percent Fed Up.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!