Heads up folks….

I like to bring you GOOD news whenever I can, but more important than that is to bring you TRUE news.

Look, no one has a crystal ball and I can’t predict the future or give anyone personalized financial advice, but I can post a warning when I see flashing red signs that the market is about to go down big time, so that’s what I’m going to do.

There’s a lot of great information I could show you, but I’m going to hand pick a few.

Starting with Michael Gayed, who I think does great work….

He is saying what I have been warning about: they are going to pull the rug on President Trump and crash the economy on him as a last ditch effort to keep him so distracted that he can’t do anything else:

Trump will preside over a recession.

Few understand this.

Like and repost if you agree.

— Michael A. Gayed, CFA (@leadlagreport) November 15, 2024

Not good news, but I’d rather warn and report truthfully than tickle ears.

It’s also why I keep telling you about Gold and Silver:

Unpopular opinion: Gold is about to surge again.

— Michael A. Gayed, CFA (@leadlagreport) November 15, 2024

Crash incoming!

And it likely starts in Japan:

Japan will blow up the world.

Like and repost if you understand this.

— Michael A. Gayed, CFA (@leadlagreport) November 14, 2024

But next I want to go to Kevin “MeetKevin” Paffrath who just published the MOAL — Mother of all Lists of flashing red bearish indicators.

As usual, I think Kevin presents an incredible analysis. You don’t have to like it or agree with it, but this is solid financial reporting.

Wow, take a look at this:

⚠️Why I'm a dirty bear.⚠️

😇 Serious Risks, by Meet Kevin 😇

➡️ Hawkish Fed: DOWNSIDE RISK looking at lagging data. Very stupid. Leading indicators are BAD. Overtightening substantially.

➡️ Hawkish yields: DOWNSIDE RISK. Tightening conditions.

➡️ Topping / Greedy Market on…— Meet Kevin😇 (@realMeetKevin) November 15, 2024

⚠️Why I’m a dirty bear.⚠️

😇 Serious Risks, by Meet Kevin 😇

➡️ Hawkish Fed: DOWNSIDE RISK looking at lagging data. Very stupid. Leading indicators are BAD. Overtightening substantially.

➡️ Hawkish yields: DOWNSIDE RISK. Tightening conditions.

➡️ Topping / Greedy Market on Euphoria, Hope, Momentum, and Call options: DOWNSIDE RISK.

➡️ 40% of small caps in Russell 2000 are either zombies or struggling to repay debts/not profitable.

➡️ Wages are already indicating softness and a higher risk of DEFLATING.

➡️ A massive lack of pricing power at big companies: DOWNSIDE risk.

➡️ 1 USD to JPY: RISK FACTOR AGAIN OF A TOPPING MARKET. Our market peaked July 10, as the JPY peaked. Now JPY is peaking again.

➡️ Euro crisis / recession > contributes to potentially lower trade and lower US GDP.

➡️ When the stock market crashes, we tend to lose JOBS.

➡️ When the stock market rallies, we tend NOT to gain JOBS.

➡️ 27 weeks unemployed level rising in recessionary level.

➡️ AI bubble / AMD layoffs, Applied Materials miss, ARM/AMD miss slightly, and stocks sell-off. This is just the beginning, but remember: once LLMs are a commodity, then infrastructure build-out becomes redundant, especially as AI progress plateaus.

➡️ Yield-curve warning.

➡️ Sahm rule trigger/untrigger (happened in 06 as well).

➡️ Private payrolls negative.

(All of these could U-turn and everything could then be fine). But I’m not optimistic as the trend is rough.IMO not personalized advice: the great PP over the next 12-18 months

➡️ I may come early often… but I think I come strong w/ my ideas and plans:

➡️ (20-year treasuries MOONSHOT over the next 12-18 AND mortgage companies).Upshot:

➡️ Trump leads to hiring

➡️ Trump leads to lower taxes

➡️ Trump leads to a boom in the economy. Bill Ackman

➡️ The question is: WHEN. I believe 2026, NOT 2025.Search:

➡️ Meet Kevin Germany Crisis

➡️ Meet Kevin 10 investments in a recessionIf Christmas Coal (Sell off).

➡️ Recession odds INCREASE substantially.Advice:

➡️ Don’t copy me, but be aware.

➡️ Pay off debt.

➡️ Save money.

➡️ Insulate your job.

➡️ Work harder NOW, not then.

Wow, that’s quite a list!

Look, I know no one likes a Bear, so don’t shoot the messenger….but wouldn’t you rather have someone tell you the truth instead of spoonfeeding you sugar candy that’s bad for you?

If you learn better watching a video, watch this instead:

FULL TRANSCRIPT:

Stock market indices are giving us a major warning sign, and we’ve got to pay attention to what could potentially be going on here.

First and foremost, the NASDAQ 100 is, today, on track to hit its first time this year of being negative for five days in a row. This is very bad because if we get to a sixth day in a row, we haven’t seen six red days in a row in the NASDAQ since before 2019. It’s been over five years.

This is a red flag that potentially markets are saying, “Hey, look, we have gotten very euphoric. We’ve made a lot of money in Bitcoin, we’ve made a lot of money in stocks, we’ve made a lot of money betting on Trump before the election, and we’ve made a lot of money on Trump after the election.” That’s great, but if it turns into profit-taking, it’s going to occur at a very precarious time for the U.S. economy.

I want you to, for a moment, consider the combination of a few different factors here. And we’re going to write these down so you can see these broadly, simply, and together. Very, very simple.

The first thing that we have to know is that the Federal Reserve is now only at a coin toss for whether or not they’re actually going to reduce interest rates by 25 basis points in the December meeting. This is not ideal.

Think about this: this means we have a hawkish Fed as a downside. This is a downside risk because the Fed is looking at data from the past, and they are hawking too much—keeping rates too high for too long to crush our economy.

This is very bad, especially at a time when we’re equal with the job openings-to-unemployed rate. What happens when, all of a sudden, you actually start getting layoffs in the first quarter? Now you’re going to have more unemployed people than you have jobs for them, which is very bad for the economy.

Add to that the level of 27 weeks unemployed skyrocketing—which is very recessionary—temporary job hires plummeting, and some of the job openings we think are open might not actually be open. Mostly because companies don’t have to hire as much now—we’ve got AI to help us.

AI doesn’t replace everyone, but it’s certainly, at the margin, probably going to affect at least 10% to 15% of jobs out there, and that’s scary. So, hawkish Fed is what we have right now.

Then we also have hawkish yields, which creates a downside risk. This creates pain for the economy because you’re increasing the cost to borrow for machinery, for houses, for equipment, for autos.

Now, the auto companies are buying down interest rates, leading to a beat on retail sales for October, thanks to autos, but that all goes into EPS. Somebody is paying for that.

So, you’ve got hawkish Fed, hawkish yields, but on top of that, you have a topping, greedy market, which also presents downside risk.

Don’t get me wrong, I love seeing people make money off of Paler. I’ve had a line on Paler and indicated that Paler is likely—if it keeps running—to run all the way up to $67.23. And, quite frankly, we’re at about $65 right now. It’s up 8% today on the idea that, since it moved from the New York Stock Exchange to NASDAQ, it might be eligible for NASDAQ inclusion.

You might not know this, but there are actually multiple stock exchanges. There’s the New York Stock Exchange, where I rang the bell—I had the honor of doing that, I love it. It’s a beautiful building. It’s on Wall Street.

NASDAQ is actually more of your technology hub, whereas your Dow-style companies are usually over at the NYSE—they call it the NY. But if you go to NASDAQ, that’s actually in Times Square. That’s where, rather than ringing the bell with a hammer, technically, you push a button. There’s more of an electronic panel that you push a button on over at NAS.

Anyway, there’s hope that NASDAQ will be included in the QQQ—basically, the NASDAQ 100. Which, by the way, you shouldn’t buy QQQ if you’re going to hold it long term; you should buy QQQM because the fees are lower.

It’s the same thing—they just market QQQ more to make money off you because most people don’t know about QQQM. But that’s really a topic for a different video.

The point is, I don’t even know if you’re going to want to be a part of the Q’s, because right now the Q’s are tanking. That’s because Apple, Microsoft, Google, and Meta have all topped out since the summer. They’re either trading sideways or down. So, your mega caps are rotating down, and the risk here is to the downside.

You’re seeing very few companies actually keep this market propped up. You can see this very clearly by heading over to the CNN Greed and Fear Index, where we’ve just moved from greed to neutral intraday because markets are starting to sell down. But look at market momentum—just two days ago, we were at the “extreme greed” characterization on market momentum. But the underlying is breaking apart.

The number of new 52-week highs is actually in “extreme fear.” Stock price strength, which is the number of stocks contributing to upside—number of winners versus losers—is at “extreme fear.” Yet, at the same time, valuations index momentum is in the greed category, and options are in greed. Two days ago, they were in extreme greed, which means people are speculating at the top while, underneath, things are starting to turn rotten.

RELATED REPORTS:

Here’s Why The Central Banks Are Suddenly Buying Up All The Gold…

Here’s What I Told a Family Member Who Asked If He Should Buy More Gold Right Now

Here's What I Told a Family Member Who Asked If He Should Buy More Gold Right Now

Want to get find out how you can get Gold and Silver with NO MONEY out of pocket? I'll tell you in this article, keep reading!

Recently, a family member called me up to ask what I thought about buying more Gold and Silver right now.

Since I've been preaching about Gold and Silver for a while now, and since that preaching has been proven to be right as Gold and Silver at creating new all-time highs on a nearly daily basis, I guess I've gained a bit of a reputation for being "the Gold guy".

But I was happy to have the conversation and honored to have been asked my opinion.

I've actually received the same question from many of you by email, so I thought I'd go ahead and share what I told my family member with all of you!

Sound good?

Ok, so the first thing I told him was what I would tell all of you: I'm not a financial advisor and I can't give anyone personalized financial advice. Not even a family member and definitely not any of you reading this. I'm just a reporter who reports on the political and financial news and someone who notices trends and reports on where I see things going.

So that's the first thing.

But I can tell you what makes sense to me and what I'm doing, so beyond that, I told him that what I would tell anyone in general is you never want to buy any investment with money you need to maintain your daily lifestyle. That's first and foremost.

Investments are generally a good thing, especially protective investments that will do well when everything else is going down, but you never want to put yourself in a situation where you don't have enough cash or cash flow on hand to cover your basic living expenses and maintain your current lifestyle.

So that's where we start, let's get over that hurdle first.

Second, Gold and Silver are not "cash flowing" assets, meaning they do not kick off any monthly or quarterly cash flow the way something like real estate or dividend stocks or even municipal bonds might do.

So you're not buying Gold and Silver because you need a monthly "cash flow" check to arrive in the mailbox each month, let's just be clear on that too.

Third, let's say you've checked all the boxes so far...why would you want to buy Gold and Silver right now?

I love the way this guy put it....this is legendary investor Rick Rule who has one of the best quotes on Gold and Silver I have ever heard in the beginning of this video below.

He says: "I don't own Gold because I think it's going to go from $2,400 to $2,700....I own Gold because I'm AFRAID it will go to $9,000 or $10,000!"

Let that sink in a little bit....

Gold and Silver are not assets you're necessary buying because you think they're going to go up 10% over 5 years.

No, they are SAFE HAVEN assets that could one day jump up to $10,000/ounce in the midst of a crashing US Dollar and crashing US stock market and economy.

So if you're afraid that the US stock market is at all time highs and may soon be in for a nasty correction, or that the US dollar might soon crash as Bo Polny keeps telling us, then Gold and Silver would be serious protections to you and your family.

That's exactly why according to the new Basel III banking standards, Gold was recently reclassified as the ONLY other "Tier 1 Risk Free Asset" other than cash and treasury bonds....

Wow!

More on that here:

As for me personally, my goal at all times is to hold as FEW US Dollars as possible because you are literally LOSING money if you just hold dollars.

Did you know that?

Even if inflation is only at 2% (the stated goal of the FED, but it's actually much higher) you are LOSING 2% of your money every single year just holding dollars. Their purchasing power goes down 2% each year, and if you know anything about compounding interest, that starts to add up fast.

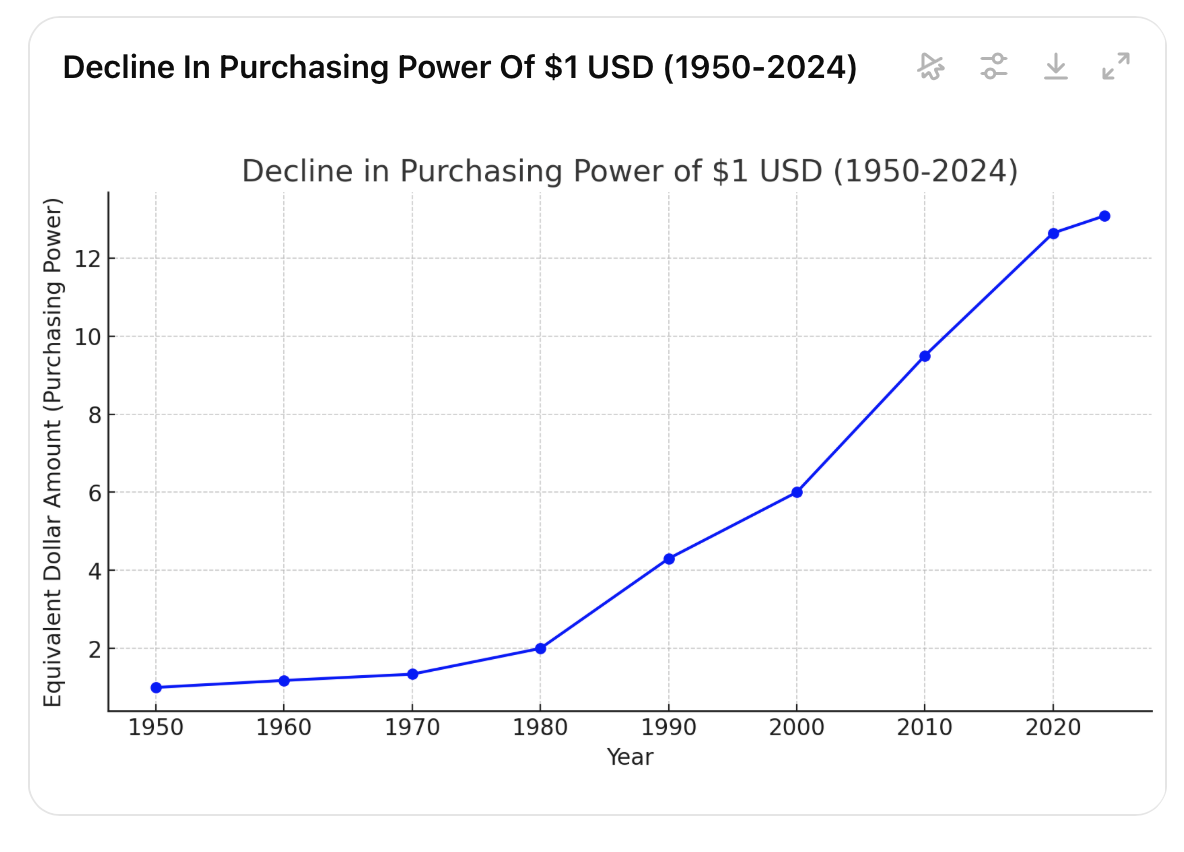

For all the visual learners out there, this might blow your mind...

Let's say you had $1 in 1950....you could purchase $1 worth of goods. Simple, right?

Now let's say you kept your money in US Dollars all these years because we were all told to "save your money! Put it in a savings bank!" right? Were you told that?

Let's say you did, how many Dollars would you need in 2024 to buy the same thing based on historical inflation rates?

You would need $13 to buy the same thing!

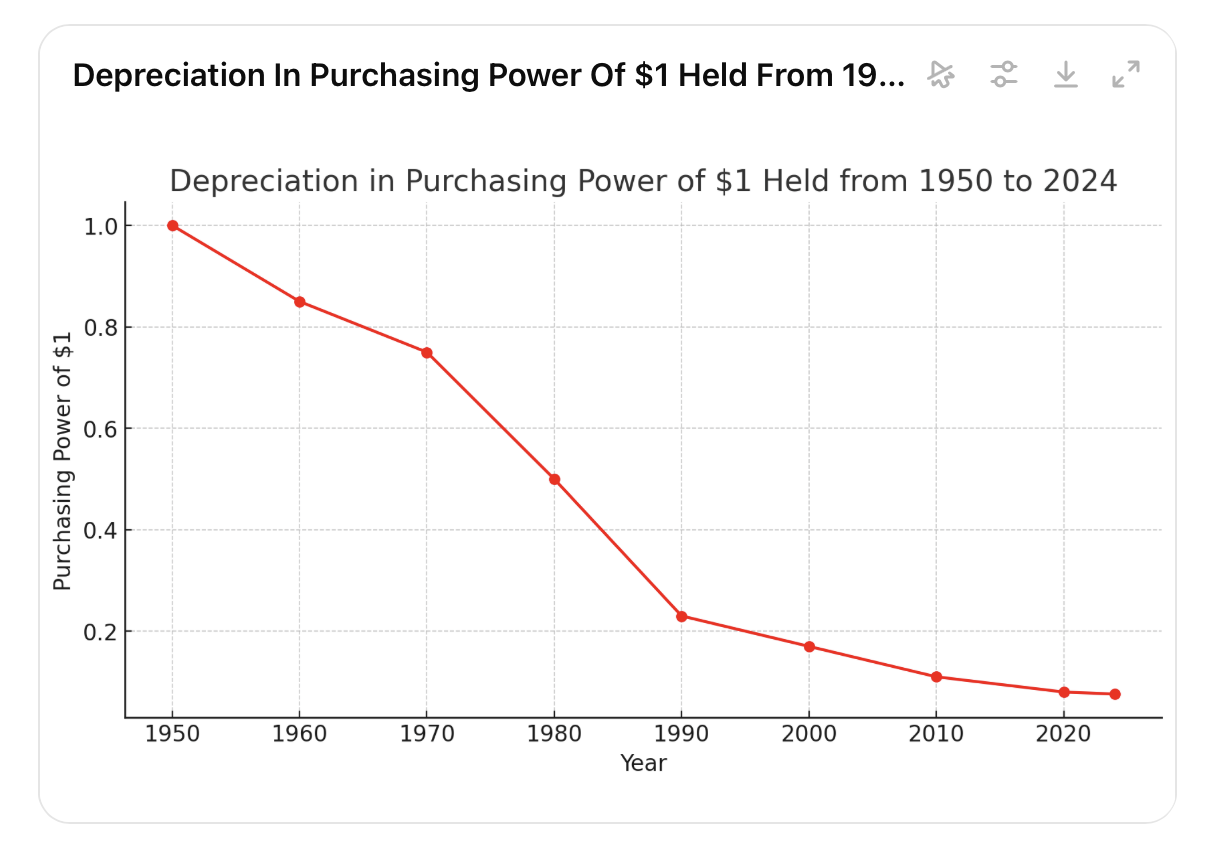

I actually think the more powerful way to look at it is the reverse, so I like this chart better...

Let's say you had that same $1 from 1950 and you were a good boy or good girl and saved it in your savings account at the bank just like they told you to do....

How much could you buy with that $1 in 2024?

Only 7.6 cents worth!

$1 in 1950 turns into only $0.076 in 2024 thanks to inflation! Wow!!

That's why I personally try to get as much of my money OUT of US Dollars and into other assets that will tend to hold their value over a long enough time.

For me, that means Gold, Silver and Crypto.

Another great option is Real Estate, it's just a lot harder to get into.

I like how I can buy smaller batches of Gold, Silver and Crypto whenever I want to.

So that's what I told my family member:

- I can't give you personalized financial advice.

- Make sure you don't buy any investment with money you need to live on.

- Don't buy Gold or Silver if you need something that provides "cash flow".

- But if you can check off all those boxes, and you don't want to see your $1 turn into $0.076, it might be a very smart idea to park your money in Gold and Silver!

Every person's situation is different and I always encourage you consult with your own personal financial advisor if you have one.

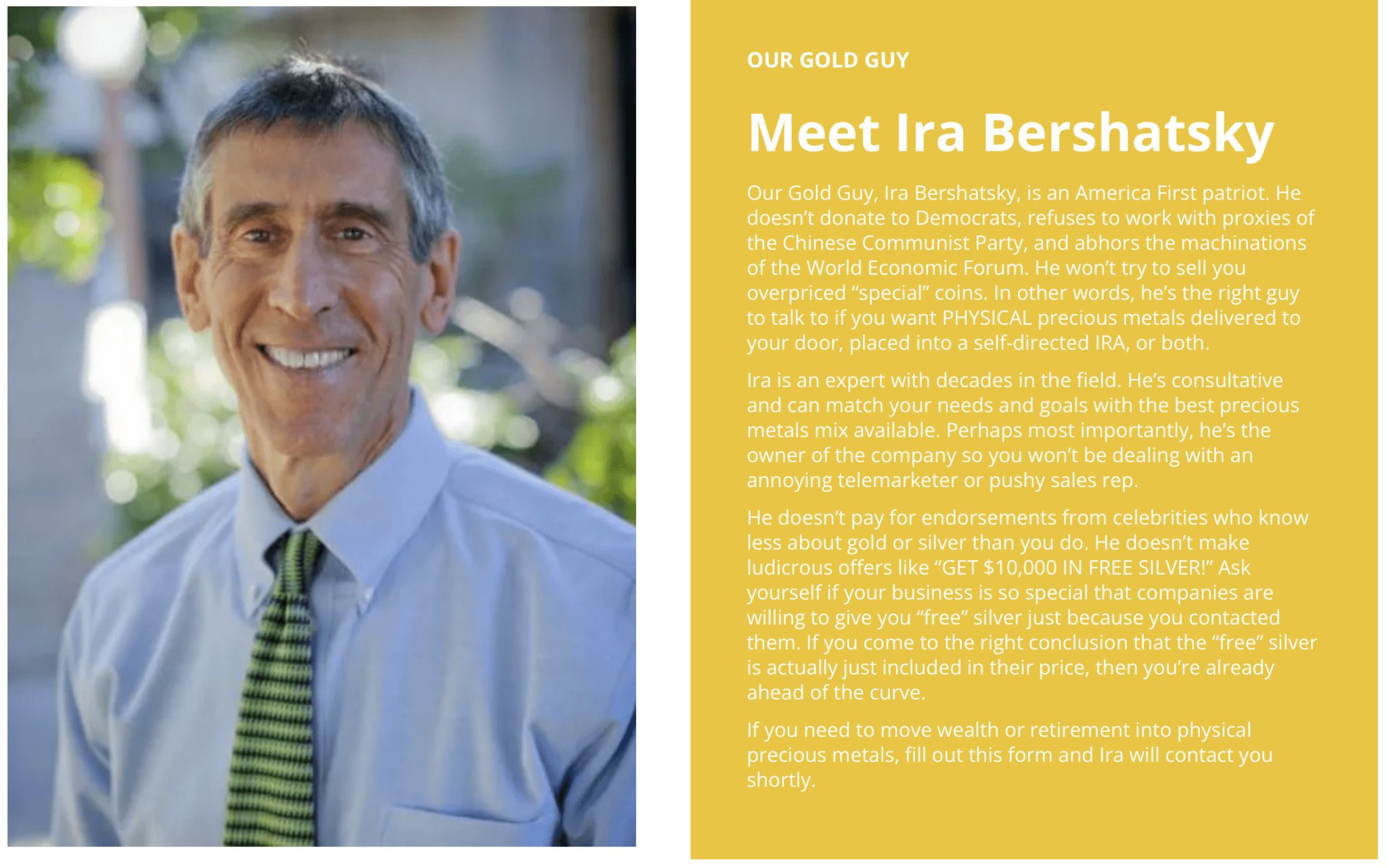

But if you NEED an advisor or need some help getting started, I'd like to introduce you to my friend Ira Bershatsky...and I'd like to tell you about a little secret -- how you can get Gold and Silver with NO MONEY OUT OF POCKET! Yes, really. Keep reading...

Meet my friend Ira, with Advisor Metals, custom link for all WLT Report readers right here: WLT Precious Metals.

Speaking of family members, I have personally sent family members to Ira for 5-figure purchases of Gold and Silver and he treated them like royalty. They were very pleased.

That's how much I trust Ira.

I didn't tell him I was sending them over either (and these particular family members have a different last name) so I did it as a bit of a "secret shopper" test and Ira passed with flying colors.

Of course I knew he would.

That's why I work with him and that's why I have confidence telling you about him.

Ira can handle bulk purchases of bullion, coins, whatever you want....as well as purchasing in an Ira (more on that in a minute).

All custom ordered and shipped right to your door.

A lot of people love Bullion because it's the cheapest and most economical way to do it, to stretch your dollar into as much gold and silver as possible.

Ira's company is Advisor Metals and they have DECADES of experience helping people buy Gold and Silver. Ira has set up a custom website is called WLT Precious Metals to make sure he takes EXTRA good care of our readers.

You'll get a personal phone call with Ira Bershatsky (or someone on his team) and they will work with you free of charge for as long as needed to answer any questions you have and get you taken care of.

How about that!

You don't see that much anymore, but Ira and his team pride themselves on good old-fashioned real customers service:

No sales pitch, just real, actual help.

And the best prices you will find.

There's a reason I like partnering up with Ira, and it's because of his unique experience and pedigree in this business:

Ira Bershatsky is the Managing Member and owner of Advisor Metals.

Ira has an MBA in Finance and 44 years of business experience including three decades as an institutional equity trader, compliance officer, technical chart analyst, and eight years in physical precious metals.

He is the only person in the physical precious metals industry who has the Commodities Futures Trading Commission (CFTC) Federal registration, which he has had since 1991.

What this means for you, the customer, is that everything Ira or a member of his team says to you has to be factual, there is no sales pitch or bait and switch, there are ethical considerations they have to meet, and there has to be full transparency.

Here's the only disclaimer I will give you: because they do pride themselves on dedicated service, it might take a few days before you get a phone call back. And we are experiencing a record number of new calls right now. Just be patient please.

Good things come to those who wait!

You can contact Ira and WLT Precious Metals here.

Now I promised you I would tell you about how Ira can help you get Gold and Silver with NO MONEY OUT OF POCKET, and I'm going to do that right now.

This isn't for everyone, but it is for the majority of you reading this (and you might not even realize it).

Many of you have retirement accounts that you've built up over the years at your jobs and they're loaded up with stocks and bonds.

If you'd prefer to move some or all of the money you currently have in stocks or bonds in a retirement account into a "Tier 1 Risk Free Asset" like Gold and Silver, Ira can also help you with that! It's 100% legal to purchase Gold and Silver in your IRA and you can often do so with no money out of pocket! The money is already in your IRA, we just move it into Gold and Silver. But you do need a trusted advisor to make it happen, and of course there are certain guidelines to follow, so that's where Ira comes in.

I mean, his name is Ira, after all, OF COURSE he can help you purchase precious metals in your IRA account!

Again, I'm not your personalized financial advisor, I'm just explaining how it works.

And I think it's REALLY cool.

So even if you're saying times are tough right now, I don't have a lot of spare money to shift into Gold and Silver, you might have a golden opportunity (pun intended!) already sitting there in an established retirement account.

If you'd like to see if you qualify or if you just have some questions, contact Ira here and you can get started for free, no obligation of any kind:

I've proudly sent family members to Ira and I am proud to send anyone reading this as well.

He'll take good care of you!

Cheers!

Noah

👉 https://wltpreciousmetals.com/

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!