China and India have reached an agreement to de-escalate tensions at their disputed border region and end a four-year military standoff.

According to BBC, the disputed Himalayan border has witnessed violent clashes in recent years.

However, the two Asian nations seek to normalize relations as the BRICS Summit in Russia approaches this week.

India and China agree to de-escalate border tensions https://t.co/D3UWE6EPTu

— BBC News (World) (@BBCWorld) October 21, 2024

Per BBC:

Vikram Misri said on Monday the two sides have agreed on “disengagement and resolution of issues in these [border] areas that had arisen in 2020”.

He was referring to the Galwan Valley clashes – the first fatal confrontation between the two sides since 1975, in which both sides suffered casualties.

Relations between the neighbours have been strained since then.

ADVERTISEMENT“An agreement has been arrived at on patrolling arrangements along the Line of Actual Control (LAC) in the India-China border areas, leading to disengagement and a resolution of the issues that had arisen in these areas in 2020,” Mr Misri said.

Mr Misri, however, did not give any details about the disengagement process and whether it would cover all points of conflict along the disputed border.

The Indian foreign secretary’s statement comes just a day before Indian Prime Minister Narendra Modi travels to Russia for a meeting of Brics nations which includes Brazil, Russia, India, China and South Africa.

Mr Misri didn’t confirm if a bilateral meeting between Mr Modi and Chinese President Xi Jinping was on the agenda.

The BRICS Summit will take place in Kazan, Russia, from October 22 to 24.

The event will include the five namesake countries (Brazil, Russia, India, China, and South Africa) and the first meeting for new members: Egypt, Ethiopia, Iran, and the United Arab Emirates.

Breaking! China and India have reached an agreement to de-escalate along the border just ahead of BRICS summit.

Border patrols will pull back and disengage to avoid clashes pic.twitter.com/Fb1O63lKi6

— Carl Zha (@CarlZha) October 21, 2024

From The New York Times:

BRICS now includes countries representing almost half the world’s population and more than 35 percent of global economic output, adjusted by purchasing power.

The conference is intended to present a hefty showcase of economic might but also entice new countries into a coalition Russia hopes to build that would form a new world order not dominated by the West.

ADVERTISEMENT“This summit is about Putin punching back,” said Alexander Gabuev, director of the Carnegie Russia Eurasia Center in Berlin. Mr. Putin presents his country’s war in Ukraine as “the spearhead of destroying the old world order and helping to build a new one,” Mr. Gabuev said.

“And BRICs is the most potent and representative structure of this new world order,” he added.

That was a message Mr. Putin emphasized at a meeting of officials and businessmen last week in Moscow ahead of the summit.

WATCH:

What to expect from the #BRICS2024 Summit in Kazan, Russia

The 16th BRICS summit will take place in Kazan, Russia on October 22-24, marking a significant expansion for the bloc.

Key Highlights:

Expansion: The summit will be the first with the newly admitted… pic.twitter.com/ERLmSjTktm

— John Metzner (@JohnRMetzner) October 21, 2024

BREAKING

India and China officially ended the 4-year conflict on the Himalayan border

Peace was achieved on the eve of the BRICS Summit, clearing the path for Modi and Xi Jinping to hold the first bilateral meeting since 2020 pic.twitter.com/HLijFlltRA

— What the media hides. (@narrative_hole) October 21, 2024

Reuters reports:

Relations between the world’s two most populous nations – both nuclear powers – have been strained since clashes between their troops on the largely undemarcated frontier in the western Himalayas left 20 Indian and four Chinese soldiers dead in 2020.

ADVERTISEMENTThe two sides had since stopped patrolling several points along the border in the Ladakh region to avoid new confrontations, while moving tens of thousands of new troops and military equipment closer to the freezing highlands.

“We reached an agreement on patrolling, and with that we have gone back to where the situation was in 2020 and we can say … the disengagement process with China has been completed,” Indian Foreign Minister Subrahmanyam Jaishankar said at a NDTV media conclave.

The “understanding was reached only today,” he said, adding: “We always said that if you disturb the peace and tranquillity how can the rest of the relationship go forward?”

To avoid clashes, the two militaries will patrol contested points along the border according to an agreed schedule, a senior Indian military officer aware of the details told Reuters.

RELATED REPORT:

Here’s Why The Central Banks Are Suddenly Buying Up All The Gold…

Here’s Why The Central Banks Are Suddenly Buying Up All The Gold…

Over the past year or so, I’ve been reporting on the fact that after years of SELLING Gold, Central Banks from all over the world, all of the top countries, are suddenly buying Gold hand over fist…

As much as they can get their hands on!

Only two questions remain: (1) why are they doing it, and (2) what will YOU do about it?

Let’s answer the first one first, and then down below I’ll tell you what I’m doing in light of this news.

Spoiler alert: never listen to what they tell you to do, watch and copy what they’re doing!

I’ll tell you the best way to do that down below, but first we have to answer the first question….because it will connect all the dots for you.

I have two things I need to show you to answer that.

The first is this excellent clip from ITM Trading:

What do Central Banks Want to Do With All that Gold? Dr. Doom Weighs in on their Masterplan.

Watch Now

https://t.co/B5q1ZKiXdK#gold #centralbanks #money #investment #finance pic.twitter.com/E2dMLbKteK

— ITM Trading (@ITMTrading) October 20, 2024

Backup video here if needed:

Here’s why the Central Banks are buying up all the Gold!!

CREDIT and FOLLOW

https://t.co/iLQGi14MZD pic.twitter.com/jqQstgk7XD

— DailyNoah.com (@DailyNoahNews) October 20, 2024

As great as that clip is, I think it only tells HALF the story….

I think the other half, the BIG half, is what happens next.

Check this out:

REPORT: Central Banks Preparing To “Revalue Gold” Price

Evidence is mounting that Central Banks are preparing to revalue the price of Gold.

Sound crazy?

It’s not, and it just shows you don’t know your history, because it’s happened before and evidence is building that it’s about to happen again.

I’ll give you a very detailed analysis of how and why that might happen in just a minute, but first I simply want you to listen to this:

WOW!

The BIS and central banks worldwide continue to accumulate gold reserves, setting the stage for a gold revaluation in 2024!

The merger of physical gold and blockchain will redefine wealth in ways we could never have imagined! #XRP pic.twitter.com/p7gdkN53CP

— 𝓐𝓶𝓮𝓵𝓲𝓮 (@_Crypto_Barbie) January 22, 2024

Full screen video player here:

WOW!

The BIS and central banks worldwide continue to accumulate gold reserves, setting the stage for a gold revaluation in 2024!

The merger of physical gold and blockchain will redefine wealth in ways we could never have imagined! #XRP pic.twitter.com/p7gdkN53CP

— 𝓐𝓶𝓮𝓵𝓲𝓮 (@_Crypto_Barbie) January 22, 2024

Note that this video was originally posted in January of 2024, so we have the benefit of looking back with a little bit of hindsight and guess what? Everything he’s said has played out EXACTLY like he predicted in 2024.

The only piece that hasn’t get happened is the revaluation of gold, but I believe that’s coming soon.

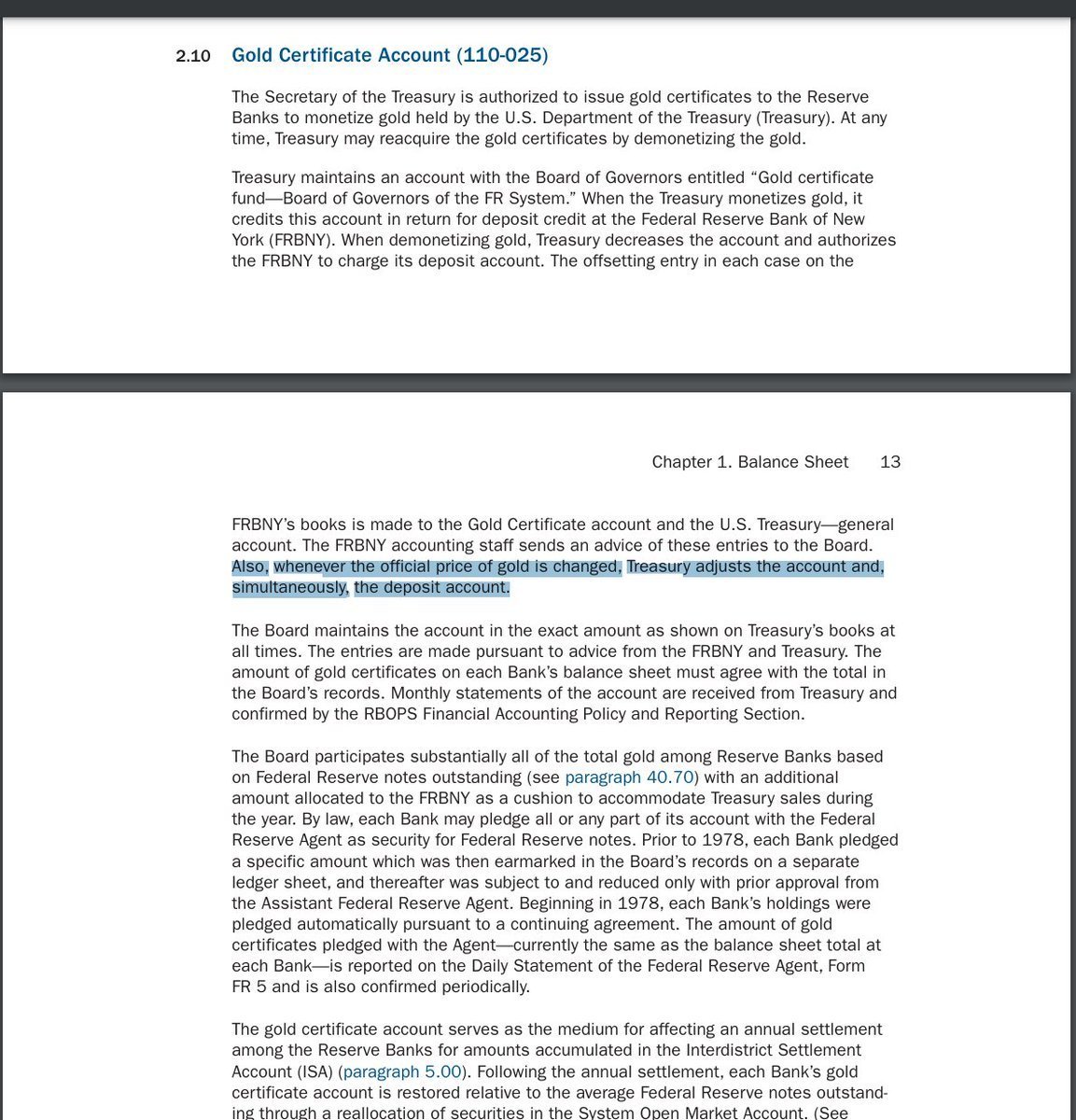

In fact, here are the exact specs for how it would happen, direct from the Federal Reserve’s own papers:

Here’s your #Gold Revaluation Proof.

Financial Accounting Manual for Federal Reserve Banks

The Treasury Secretary can instruct the Fed to revalue the Gold on the U.S. government’s Balance sheet, it will likely be revalued to over $20,000 per OZ. Boom. It’s coming.

Page 13 -… pic.twitter.com/Mh0BnoIWoK

— Vandell | Black Swan Capitalist (@vandell33) June 24, 2024

Next I thought it might be fun to ask ChatGPT if revaluing the price of gold is possible and if so how it would work? I also asked for it to rate the likelihood of a gold revaluation happening. SPOILER ALERT: likelihood = “Moderate to Highly Likely”!

Take a look for yourself:

Of course, none of this surprises me….

I’ve been telling you about Gold for a while now, and our analysis so far has been spot on!

Especially this report:

Central Banks On A Gold Buying Spree — What Do They Know That You Don’t?

What do the Central Bankers know that you don’t?

A lot.

Oh, I don’t mean they’re any smarter than you, but what’s the best way to predict the future? To plan it out and control it!

And make no mistake, these are the shadowy people pulling the strings of world affairs behind the scenes….and they rarely lose.

So I always say don’t listen to what they say (because they always “talk their book” and lie to your face) but watch what they do!

And I think I know EXACTLY what they’re thinking….

In fact, I just published this story and I think this story now explains why the Central Bankers are all stockpiling and hoarding gold:

The beautiful thing is we live in a time where it’s hard to hide real data, especially when you have people like us researching it and posting it for all to see.

And what is it that they’re doing?

Simply put — they’re on a GOLD buying spree! Yes indeed!

It’s all been right there in front of us for everyone to see…

BRICS expanding, new BRICS currency to be Gold-Backed or Priced in Gold?

I could be wrong, but I’m thinking so.

In other words: GOT GOLD?

Take a look at this:

Central banks are on a $GOLD buying spree…

This says a lot about fiat and debt

pic.twitter.com/6kSxEMvCZv

— FinFluential • Simplifying the Market (@FinFluentialx) December 6, 2023

42 tons in October alone, that is staggering!

Central banks added a net 42 tonnes to global official gold reserves in October.

Central banks continue to stockpile #gold. pic.twitter.com/BnlNtqATlG

— Gold Telegraph

(@GoldTelegraph_) December 5, 2023

For the second year in a row, these are the HIGHEST purchases by Central Banks since 2010:

Central Banks are on pace to buy more than 1,000 tons of gold for the 2nd straight year and possibly reach the highest level purchased since 2010 pic.twitter.com/UXkLPx8DY8

— Barchart (@Barchart) December 7, 2023

Here’s more from Peter Schiff:

Central banks gobbled up gold over the summer and the buying spree has continued into the fall.

Globally, central banks added another net 42 tons of gold to their reserves in October.

China continues to be the biggest gold purchaser. The People’s Bank of China added another 23 tons of gold to its hoard in October as it expanded its official reserves for the 12th straight month.

Since the beginning of the year, the People’s Bank of China increased its reserves by 204 tons, and it has added 255 tons since it resumed official purchases in November 2022. As of the end of October, China officially held 2,215 tons of gold, making up 4% of its total reserves.

Most people believe the Chinese hold even more gold than that off the books.

There has always been speculation that China holds far more gold than it officially reveals. As Jim Rickards pointed out on Mises Daily back in 2015, many people speculate that China keeps several thousand tons of gold “off the books” in a separate entity called the State Administration for Foreign Exchange (SAFE).

Last year, there were large unreported increases in central bank gold holdings. Central banks that often fail to report purchases include China and Russia. Many analysts believe China is the mystery buyer stockpiling gold to minimize exposure to the dollar.

The Central Bank of Turkey also made another big gold buy in October, expanding its holdings by 19 tons. Even with big purchases over the last several months, Turkey is still a net seller on the year.

The Turkish central bank sold 160 tons of gold last spring but returned to buying in the third quarter. According to the World Gold Council, the big gold sale earlier this year was a specific response to local market dynamics and didn’t likely reflect a change in the Turkish central bank’s long-term gold strategy. It sold gold into the local market to satisfy demand after the government imposed import quotas in an attempt to improve its current account balance. The country is running a significant trade deficit.

Although the Turkish government reinstated gold import quotas in early August, so far we haven’t seen a repeat of sales into the local market to meet elevated demand.

The National Bank of Poland also continued its recent gold-buying spree, expanding its reserves by another 6 tons. Its gold holdings have now risen by over 100 tons this year.

In 2021, Bank of Poland President Adam Glapiński announced a plan to expand the country’s gold reserves by 100 tons. Now that it’s reached that gold, Glapiński indicated it will continue to add gold to its holdings.

This makes Poland a more credible country, we have a better standing in all ratings, we are a very serious partner and we will continue to buy gold. The dream is to reach 20 percent.”

When he announced the plan to expand its gold reserves, Glapiński said holding gold was a matter of financial security and stability.

Gold will retain its value even when someone cuts off the power to the global financial system, destroying traditional assets based on electronic accounting records. Of course, we do not assume that this will happen. But as the saying goes – forewarned is always insured. And the central bank is required to be prepared for even the most unfavorable circumstances. That is why we see a special place for gold in our foreign exchange management process.”

Other significant gold buyers in October included:

- India — 3 tons

- The Czech Republic — 2 tons

- The Kyrgyz Republic — 1 ton

- Qatar — 1 ton

So….what can YOU do about it?

I’ve been telling you for a while now, and perhaps this is the “sign” you need to finally take action!

First, you need to watch what the big boys are doing and understand it’s smart to ride their coattails.

I think we accomplished that above.

Second, here’s my preferred solution for owning gold.

Why preferred?

A couple reasons….

I’m not a CPA or tax advisor or even an investment advisor of any kind, but the folks I’m about to tell you about are experts at this.

They’re patriots…

They’ll give you personalized, one-on-one attention by phone….

And they’ll show you how you can do this with NO MONEY OUT OF POCKET — all in a retirement account and usually tax free!

How’s that for a win-win-win?

So what can you do?

THIS!

Here’s Why Central Banks Are Buying All the Gold They Can — And What YOU Can Do!

For the last two years, central banks across the globe have been buying up as much gold (and often silver) as they can acquire without raising alarm bells. Now, we see why.

The recent bank runs and ongoing collapse of the U.S. banking system was anticipated by the “elites” and the central bankers who run things behind the scenes. They saw it coming and knew the best way to protect their assets was through physical precious metals.

If you’ve been waiting for me to bring you a solution about what YOU can do to protect yourself and you’re family, I’m happy to introduce you to something I absolutely love!

Precious metals.

I just talked about precious metals this week with Bo Polny and now I’m bringing you a solution that you can utilize right away if you’re so inclined…

A faith-driven, conservative precious metals company is currently helping Americans tap into the rising precious metals market through self-directed IRAs backed by physical precious metals. And while this service is not unique to Genesis, their adherence to Biblical stewardship of money makes them singularly qualified to receive a sponsored recommendation from this site.

Unlike most companies offering similar services, Genesis deals only with physical precious metals. They do not offer “virtual” or “paper” gold or silver.

With Genesis and their depositories, customers can see and touch the precious metals that back their retirement accounts. When it comes time to take distributions, Genesis customers can cash in some or all of their precious metals or have them delivered to their door.

Central bankers aren’t slowing down. In fact, nations like China and even U.S. states like Tennessee are quickly but quietly buying up gold to back their own treasuries. When the writing on the wall is this clear, it’s understandable why these governments are moving quickly to get ahead of any potential economic catastrophes in store.

Working with Genesis is the best way our readers can explore the physical precious metals market through self-directed IRAs. It benefits us as well when our readers work with this America-First company.

Visit genesiswlt.com or call 866-292-0443 today.

Don’t wait too long, we might have more bank failures right around the corner.

You know what has NEVER “failed”?

Gold. Precious metals. Indestructible.

There’s a reason they call it “God’s money”.

Watch this for more:

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!