HEADS UP FOLKS!

Breaking news and a very bad warning for the US Stock Market from my friend Kevin Paffrath (“MeetKevin”).

No, this is not Noah fear-mongering or being a “Bear”.

This is Noah reporting on the news that just came out from UBS.

I’ve got the full video for you down below, plus the full transcript if that’s easier for you to read, but basically they’re saying they are extremely bearish for the next two months and they expect we could see a 10-15% downturn in the market pretty easily.

They are also comparing this to times we haven’t seen in some respects dating back to the “Great Financial Crisis” of 2008/2009.

Watch here:

Full transcript:

[Speaker]: This is the most bearish piece yet, and it just came out from UBS. I’m not looking for bear pieces—I’ve covered plenty of bull pieces here—but I’ll tell you, this is scary. Look at this very closely.

[Speaker]: Market internal weekly UBS: I am turning tactically bearish for the next two months, expecting at least a 10% decline. Looking for hedges in various different areas. We’re going to be covering which hedges they like, and boy oh boy, this is a really big piece. They talk about how some things have gotten so bad in the market that we haven’t been positioned like this since six years ago—since COVID, since ’08 in some cases. This is crazy. So, let’s go through this and try to add some balance to this.

A few things to know:

Number one: tonight at 6 p.m., folks—6:00 p.m. tonight—what are you going to get? You’re going to get the debate between Harris and Trump. This is obviously going to be a big deal, mostly because if Donald Trump is deemed to potentially win this debate, people think markets and crypto might go up, and vice versa for Harris potentially winning the debate. I’ll be covering it live.

Next, tomorrow at 5:30 a.m. California time—all these times are California time—we get the CPI report, and then 5:30 a.m. on Thursday, we’re going to get the PPI report. These are really going to be important for the direction of Treasury yields, investments related to those, mortgages—you name it. A lot happens within the next 48 hours here, and that’s why it’s really important you mark your calendar for 6:00 p.m. tonight. And then you could also mark your calendar for 6:00 p.m. on Thursday, because folks, you’ve been asking for it—we’re adding a flash sale to cover this wild period of time. It’s going to be just until 6:00 p.m. on Thursday.

Now, until 6:00 p.m. on Thursday, flash sale for the courses on building your wealth over at meetkevin.com. Those will include the Stocks and Psychology of Money group, where I’m planning to increase one trade that I’ve got going on right now—that’s a $1.5 million trade—to over two, maybe even $3 million in size. It is a huge trade, and we’re going to do a full course member livestream on why we’re making that trade tomorrow morning.

All right, so here we go. Over the last two weeks, market internals have deteriorated to be the worst year-to-date. The current condition is also the most vulnerable in six years, which means any external shock or slight disappointment in the data could trigger a large unwind. Notice how they’re saying “slight disappointment, large unwind.” Folks, this is the opposite of when people think, “Oh, a lot of people have money to buy the dip.” You’re going to see right here—people are selling the dip, not buying the dip. You’re going to see everything about retail flows and a lot of warnings here. It’s wild.

It’s actually one of the reasons why I think the trade that I have, that’s $1.5 million in value now—it’s already up, this trade; it’s been up; I’ve just added to it again—but I might go as far as maybe doubling the trade that I’m doing. The reason I might do that is because I think this trade works whether we have a recession, no recession, or some form of shock collapse. And boy oh boy, this piece right here will make you want to consider that trade. Now, evaluate it for your own portfolio. This video is not financial advice. You could come to the course member livestream tomorrow; we’ll talk all about it. That’s all tomorrow’s course member livestream is going to be dedicated to—why I would potentially put $1.5 to $3 million on one trade. It’s going to be wild.

Okay, take a look at this: I’m tactically bearish for the next two months before the election on the back of the two-month intraday recovery score collapse to a six-year low. The intraday recovery scores, just so you know, are just a fancy way of saying, “Hey, we have an algorithm where we can weigh how much we think after a market sell-off the market is likely to recover based on volatility, sentiment flows, and a whole host of other factors.” They’re saying they have not seen recovery scores as low as this in six years, which takes you back to the, you know, bond crisis of 2018—even worse than what you saw during COVID.

Take a look at this: This call is more bearish than my email on Tuesday. On Tuesday, I suggested a “just-in-case” hedge of macro events given a neutral recovery score. This was last Tuesday; they just released this note. I got it out last night here, and I expect a choppy market today. I suggested a tail hedge due to the two-month recovery score collapse, as I expect the S&P 500 could be minus 10% from peak to peak or minus 8% from here within one month, and minus 5%—so double that—within two months.

You know, after I read this note last night, I think I spent probably around two hours trying to evaluate what the best hedges would be for this, and I actually don’t like their hedges. Their hedges are IWM, XLF, and HYG. I actually think I have a better hedge that can last longer than these and work whether this person is right or wrong, and that’s why I’m going so bullish on it. Obviously, that’s my—the thing about me is I just put my money where my mouth is, and if you want to see what my perspective is and why it is, use the flash sale at meetkevin.com. You know how to do it: you pay once, you get lifetime access forever to all the course member livestreams ever.

This is not a long-term view unless the four-month recovery score makes a decisive shift. So in other words, the four-month recovery score after the election is basically saying, “Hey, maybe we could still be okay.” So they’re essentially saying, “Hey, four months out—neutral; two months out—really bearish,” which aligns with my desire to hedge between now and then and then buy the dip before the election if we get an unwinding in recessionary data. There’s a lot of recessionary data out there, and it’s just getting worse—it’s not getting better.

Okay, so what else do we have here? Even a slight disappointment in any upcoming economic releases could trigger a large unwind. On no news events, moderate volume selling could continue in the market. My current preferred hedges are IWM, XLF, and HYG downside. So, in other words, short XLF and HYG. Option premiums are screened as cheap. Basically, they’re saying here, like, not a lot of people are shorting them right now—maybe because IWM had a short squeeze; it had a little run-up there, which people like Tom Lee thought was fundamental, and it was really just a short squeeze. And those actually make for a good hedge right now.

Financials, by the way, just tanked today after the Basel III release, but financials were actually above their 50-day moving average, which suggests near-term upside could be limited. How funny, because they literally just tanked like 5 to 7%—like, JP Morgan even tanked. But anyway, the financial sector is also the least hedged across all 11 sectors. Yikes.

Take a look at this: intraday recovery scores. The recent rally was associated with a constant sell-the-rally profit-taking and a lack of buy-the-dip flow—an indication that investors are losing conviction in the market. Very bad going into a volatile September and October in election season. The intraday recovery score fell by 14% in one month, on August 29th, to -7% in four months—again, being neutral today. The two-month score fell further to 22%. So, in other words, the recovery score is terrible here at a six-year low. They say that the risk asymmetry has now increased to where you only need six sell-the-rally days to turn the entire market bearish, and you need 12 days of buy-the-dip to turn the market bullish. So, in other words, much more negative skew here—might not take a lot to push this market over the edge.

To make this condition even more rare, the recent sharp confidence collapse was so rare in history that it’s only happened 15 times since 2000, and only nine times in the 25 years when the recovery score collapse was coupled with an S&P 500 rally. So, in other words, out of those 15 times, only nine of them occurred when you had a recovery in the S&P 500 and the recovery was low. In other words, this is probably not a built-to-last recovery we’re seeing in the NASDAQ or the S&P 500. This is very bearish.

In all seven out of seven times since June of 2001, the S&P 500 fell an average of 5.2% within one month and 8.1% within three months. And they give the ranges here—pretty much all down on the ranges. So far, the S&P 500 is only down 1.6% since August 29th, when this indication was triggered. Investors are on the edge and are vulnerable to any bad news. Given the S&P 500 up 18% all the way to August 30th, many investors had a good year and are ready to cut some risk in the two months before the election. This is why sentiment hasn’t turned bearish, but trading behavior has been cautious. Any disappointment in the upcoming economic releases could accelerate the modest profit-taking behavior and the massive unwind.

Retail market-making flow has turned bad in the last two weeks. This implies that in the case of any market selloff, I do not expect retail investors to buy the dip. They may actually instead sell the dip. Selling was all in single stocks, with the most extreme being in consumer staples over the last 12 days of August. Current retail sell flow is almost identical to the three-week sell flow that we saw in July and early August. And retail market-making data suggests that sell-the-dip in the last five of ten days was associated with the S&P 500 down 1.33% on average in the future.

In addition to that, we hit peak seasonality for corporate buybacks now, and by the third week of September, you hit a blackout again where you’re going to stop getting corporate buybacks at all until October earnings for Q3. This means the market is expected to lose a major buyer of last resort in the third week of September. So in other words, you’ve kind of got a little heads-up warning here that probably between September 21st to maybe October 30th, you’ve got some major potential oopsy-dupsies ahead of you that you might want to prepare for.

Again, I’m preparing with multi-million-dollar bets that I think will do well whether we just slowly trend down or we trade sideways, the Fed moves slowly, or we have a dirty recession. I think I found a way to play this. We’ll have the full explanation in the course member livestream tomorrow. That’ll be right around 7:15 to 7:30 California time in the morning after we get the CPI data. We’ll cover this in detail—exactly what I think the upside and downside risks are and how to minimize some of those downside risks while maximizing the upside. And remember, once you join, you get access for life. So even if you just want to look and go, “What’s he seeing out there?” and you look at it and go, “Nah, I’m going to do the opposite,” that’s fine—you get access for life.

I, you know, I can’t make any guarantees, obviously—you know that. I also expect risk appetite collapse to dominate market internals. So in other words, you know, if you get a selloff, you’re going to see the selloff potentially everywhere, is what they’re suggesting. They see commodity and trading association individuals planning to sell within the next few weeks. I don’t really trust that data—I feel like they always sort of flip-flop anyway, so I didn’t add any highlights here. We got a lot of charts and data that go on in the next, frankly, 30 pages of this, but that’s the overall big warning. And again, they’re telling you, worst data signs that we have seen for the market since 2018, and the market had a little oopsy-doopsy in 2018.

Now, that doesn’t mean you’re going to have red every single day, and it doesn’t mean it’s time to panic. Look, the reality is, in the long run, investing in a diversified portfolio like VOO, with some bonds and some real estate, is probably a fantastic way to build wealth. You could even get some crypto in there if you really want. If somebody needs to analyze your personal situation, then do consider going to get actual licensed financial advice from my team of financial advisers. They get my advice in terms of how to work with you, and so we’ll be reviewing your scenario together. So I’ll actually be looking at every one of our client scenarios to make sure that my fingers and my touch have been on it, and we want to try to say, “Hey, how can we position you to make sure, whether you’re in VOO and bonds, how can we expose you to some real estate? Maybe you’re all real estate—how can we get you exposed to some buy-the-dip opportunities in stocks? You’re all bonds—how can we get you into real estate and stocks? You want to throw some crypto in there, need a new car, need a new house, need to renovate a property, need help with this, or separately need business consulting—go to stockstack.com, check it out, sign up.” That’s obviously separate from the courses and the trading that I do that you can find over at meetkevin.com. Stockstack.com is a great option.

This terrible bear piece—sorry to say, there’s no sugarcoating this one. Thanks so much for watching. We’ll see you in the next one. Goodbye, and good luck. Cannot advertise these things that you told us here—I feel like nobody else knows about this. We’ll try a little advertising and see how it goes. Congratulations, man—you have done so much. People love you; people look up to you.

[Speaker]: Kevin Paffrath, financial analyst and YouTuber “Meet Kevin”—always great to get your take. Even though I’m a licensed financial adviser, licensed real estate broker, and becoming a stockbroker, this video is not personalized advice for you. It is not tax, legal, or otherwise personalized advice tailored to you. This video provides generalized perspective, information, and commentary. Any third-party content I show shall not be deemed endorsed by me. This video is not, and shall never be, deemed reasonably sufficient information for the purposes of evaluating a security or investment decision. Any links are promoted products—either paid affiliations or products or services we may benefit from. I also personally operate and actively manage an ETF. I may personally hold or otherwise hold long or short positions in various securities, potentially including those mentioned in this video. However, I have no relationship to any issuer other than House Hack, nor am I presently acting as a market maker. Make sure if you’re considering investing in House Hack to always read the PPM at househack.com.

Do you think this is why Warren Buffett just sold ONE BILLION worth of this Bank of America stock?

Folks, the warning signs are flashing bright red all around you!

Do not get wiped out.

I'm not a financial advisor and I can't give you personalized financial advice, but this might be an excellent time to get very DEFENSIVE and SAFE with your retirement and investments.

INSIDER'S SELLING (Part 6): Warren Buffett DUMPS Almost $1 BILLION of Stock, Stock Market Crash Incoming?

Heads up....the "Oracle of Omaha" just sold almost $1 billion of Bank of America stock.

Now I'm not a financial expert or anything, but Warren Buffett is and do you generally BUY or SELL when you think the market is at a top and might soon crash?

Right.

As I always say, don't listen to what they tell you, watch what they DO!

That's why I've been bringing you my "Insider's Selling" series, which is now up to Part 6.

Here was Part 5 from last week:

Today it's Warren Buffett casually cashing out of nearly a BILLION worth of Bank of America stock.

Take a look:

JUST IN: 🇺🇸 Warren Buffett sold another $981 MILLION shares of Bank of America.

‼️Buffett now holds $278 Billion in CASH and selling stocks like never before, including Apple.

He's getting ready for a crash... pic.twitter.com/XUkxj3whAd

— Radar🚨 (@RadarHits) August 28, 2024

That brings his "cash hoard" up to $278 billion in liquid cash:

🇺🇸 Warren Buffett just sold $981M shares of Bank of America and now holds $278 Billion in CASH.

He should convert it into #Bitcoin 👀 pic.twitter.com/GsZ83fGd1U

— Vivek⚡️ (@Vivek4real_) August 28, 2024

The last time he had such a large cash reserve was heading in to the 2008/09 stock market crash, where Buffett famously bailed out the US Government and Goldman Sachs.

Remember that?

ZeroHedge had more details:

Warren Buffett's ongoing liquidation of his Bank of America stake comes right before the Federal Reserve's expected start of the interest rate-cutting cycle in mid-September. Additionally, Buffett has halved his Apple holdings and amassed a record amount of cash. At 93, it seems the billionaire investor is bracing for a rough patch in the US economy.

Buffett's Berkshire Hathaway has been on a six-week selling spree of Bank of America shares, trimming its entire position by nearly 13% and generating upwards of $5.4 billion in proceeds, according to Bloomberg. Berkshire's latest filing shows that since last Monday, another $982 million worth of shares were sold.

Bloomberg data shows Berkshire has dumped more than 129 million BofA shares in the last six weeks.

Berkshire remains the bank's largest stockholder, with 903.8 million shares, worth about $36 billion, as of Tuesday's closing price. However, the position's size has fallen to early 2019 levels.

Berkshire's selling was abrupt and without reason. The wave of selling began in mid-July around and above the $40 handle.

In addition to the BofA selling, Berkshire dumped half its Apple shares and other securities, sending its cash pile soaring by a record $88 billion to an all-time high of $277 billion at the end of the second quarter.

RELATED REPORT -- we've seen this movie before:

The Warren Buffett Indicator? Cash Hoard PERFECTLY PREDICTS Stock Market Crash?

This is really interesting....

We all know the "Oracle of Omaha" is a rare unicorn in the investing world.

Perhaps originally a man who outsmarted Wall Street, he is also famous (or infamous) for getting sweetheart deals during the 2008 Stock Market Crash.

Remember that?

He coughed up a few billion to bail out some "too big to fail banks" and in return basically received a guarantee of his "investment" from the Federal Government.

If you or I had done that, they might just call it insider trading, but for Uncle Warren it was deemed "patriotic".

But that's not the main focus of this article.

The main focus is something I'm now calling the "Warren Buffett Indicator".

This short video below explains it in video format, but basically as Warren Buffett's cash hoard grows, it almost always seems to top out right before a huge stock market crash hits....

And guess who's there to scoop up all the great assets for pennies on the dollar?

Uncle Warren.

Look, I'm not suggesting he's doing anything wrong, not at all.

Perhaps he's just really, really smart and really, really patient and disciplined.

More power to him.

But the indicator appears to be dead on.

Take a look:

WARREN BUFFET’S CASH POSITION OVER TIME

ONE THING THAT STANDS OUT IS RIGHT BEFORE A STOCK MARKET CRASH HIS CASH POSITION BALLOONS LOOK AT 1999 , 2007 AND 2019pic.twitter.com/a0Zk0ZEJrZ

— GURGAVIN (@gurgavin) November 9, 2023

The scariest part is right at the end....

Look at this:

When people keep telling you the next crash is going to be much worse than the 2008 crash (which for most of us was by far the biggest of our lifetimes), this is what they mean...

Look how his cash hoard dwarfs 2008.

The size and scope of what is coming is going to dwarf anything you've seen before.

It has to, the amount of money printed since then is astronomical.

It's what Bo Polny told my on my show earlier this week....

Look at this chart and the chart above and tell me if they don't look extremely similar:

It's all connected to 1971 when they removed us from the Gold Standard.....

And the years that followed when they printed magic money to infinity and the money machine went BRRRRRRRRR on overdrive!

You know how growing up your parents would say money doesn't grow on trees?

To these people it does!

It grows on printers, they just turn on the printer and out spits new money.....as much as they want!

Now it's just extra zeroes in a computer program, but it used to be actual printing of greenbacks.

Same difference.

Speaking of, have you seen this?

Do you know what happens if we suddenly shocked the world and went BACK to a Gold Standard?

This:

“Gold Revaluation” Incoming? Price Could Be $10,000-60,000 Per Ounce!

Make sure you read that.

Bookmark it, print it out, save it and study it, because it could be life-changing very soon.

Or life "saving".

Got Gold?

Got Silver?

Got XRP?

Got Bitcoin?

As always, I'm not a financial advisors, but I sleep a WHOLE lot better at night holding Gold, Silver and Crypto.....

Speaking of gold, have you seen this?

https://wltreport.com/2023/10/15/gold-now-classified-as-tier-1-risk-free/

Ok, Bo's links above will get you all set for crypto!

You're in good hands there.

But what about Gold and Silver?

If you want Gold and Silver, I have you covered there too.

Keep reading for the hookup...including for a way to get GOLD without paying anything out of pocket! Yes, really!

But first, here's the most important part you have to understand -- make sure you get PHYSICAL gold and silver.

Not paper traded garbage on the stock exchanges that isn't backed by anything.

Don't touch that stuff.

I have two special hook-ups for you.

Both involve PHYSICAL gold and silver.

Because if you do NOTHING else, make sure you own "physical" gold and silver, not paper contracts.

The paper contracts (like stock ticker SLV and GLD) could very well go POOF one day and disappear or go to zero, because they're not actually backed by the gold and silver they claim to represent.

It's a massive game of musical chairs out there and when the music stops (and I think it will stop soon...) people who only own paper might find themselves owning something not worth the paper it's literally written on.

Now...WHERE do you get physical gold and silver and how do you know it's real and safe?

And that you're getting the best price?

Oh, and how about personal one-on-one real customer service?

You know, like you were some Big Wig millionaire at Goldman Sachs who could just call their personal banker and get help?

That's what I'm about to tell you.

I have two killer connections for you...

The first is for purchasing gold and silver bullion.

That means bulk bars.

That's the cheapest and most economical way to do it, to stretch your dollar into as much gold and silver as possible.

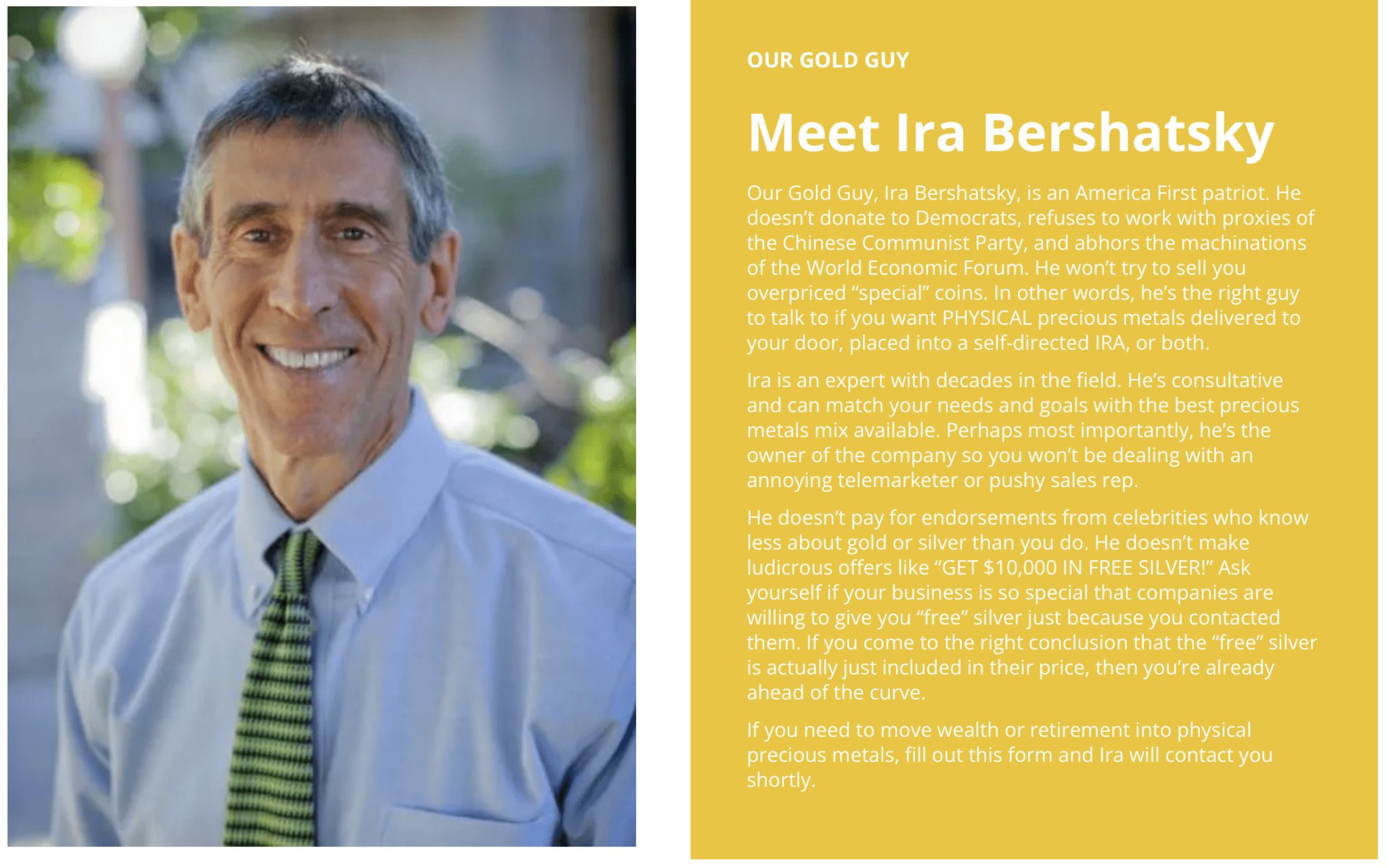

The website is called WLT Precious Metals and when you see my logo in the top left-hand corner, you'll know you're in the right place.

You'll get a personal phone call with Ira Bershatsky (or someone on his team) and they will work with you free of charge for as long as needed to answer any questions you have and get you taken care of.

How about that!

You don't see that much anymore, but Ira and his team pride themselves on good old-fashioned real customers service:

No sales pitch, just real, actual help.

And the best prices you will find.

Here's the only disclaimer I will give you: because they do pride themselves on dedicated service, it might take a few days before you get a phone call back. Just be patient.

Good things come to those who wait!

You can contact Ira and WLT Precious Metals here.

Ok, that was #1.

Now I want to tell you about option #2.

An equally great company, I am so happy to be working with these guys.

This next company is called Genesis Gold and this is for people who want to purchase real physical gold or silver in their IRAs (Investment Retirement Accounts).

You know what the beauty of that is?

TAX FREE baby!

I'm not a tax advisor, but that's a general oversimplification.

Never pay more taxes than you are legally required to pay.

And that's why I love getting gold and silver in my IRA (and why I hold a large chunk in an IRA myself!).

There's so much to love about Genesis Gold, starting with the fact they are proudly and un-ashamedly Christina!

They call it "Faith-Driven Stewardship" and they put it right on the homepage of their website along with a quote from Ezekiel:

Here's more on why gold and silver in your IRA are so powerful:

You can contact Genesis Gold here.

They are also very backed up with record demand, so you may have to wait a bit, but someone WILL get in touch with you for personal customer service and assistance!

Tell 'em Noah sent ya!

Oh, and did you know Genesis is recommended by SUPERMAN himself?

It's true.

Superman himself, Clark Kent -- Dean Cain -- came on my show a few weeks ago and we broke it all down:

Watch here:

Stay safe!

Make sure you can weather the storm when it hits!

Because the storm always hits eventually, doesn't it?

As for me and my house, we will be ready. 💪

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!