Heads up folks, we have another big financial warning!

As I like to do, I go to Kevin Paffrath for his take on the markets and this is what he just posted:

Major Bank *JUST NOW* FREAKING OUT | Collapse Warning

Allow me to explain….

Basically it’s not just one back but TWO major banks.

In fact, the top two major banks!

Goldman Sachs and JPMorgan have raised their recession odds to 25% and 35%, respectively. JPMorgan’s Jamie Dimon indicated that the economy is slowing down, and inflation will likely not reach 2% soon.

That’s bad.

Really bad.

Look, here’s the deal….eventually the dam is going to break and it’s going to get really ugly, really fast.

I think we still have a small bit to go until that happens, but the cracks are increasing and getting larger.

This is just the latest but it won’t be the last.

And then one day you’ll log on to your computer to check the news and the crash will have hit. And at that point it will be too late to do anything.

So watch this right now and then scroll down for what you can do right now to take action and protect yourself:

Full transcript:

Kevin:

Oh man, it’s getting worse. Banks are now worried about a collapse; recession odds are going up. Japan failed us today. Mind you, Jim Cramer tanked Tesla, Taylor Swift almost got ISIS, and a recession is getting closer by the day. I’m going to catch you up with everything that’s going on here.

The first thing that we should really touch on, though, because, well, it’s a classic, it just doesn’t miss, it’s Jimbo, Jim Cramer. The clip I’m about to show you took place in our free every morning market open livestream, took place at about 6:41 a.m., and from the exact moment of this clip, Tesla stock fell about 4.3%. You could follow me at RealMeKevin to see me tweet this stuff during the day, but I want you to see it here. Ready for it? Here we go.

Jim Cramer:

“I’d rather buy Tesla thinking that demand isn’t that—”

Kevin:

Oh no, I know.

It was then that we knew Tesla was screwed for the day. In fact, if you look at the individual chart for Tesla, I don’t know how he does it, but he literally matched the peak when he said, “I’d rather buy Tesla.” It was the highest candle. This is a 5-minute candle here of the day. So naturally, when that happened, I couldn’t help myself. I bought a put. I bought a $100 put for $65, and it was up almost 50% by the end of the trading day. Actually, it’s up even more now because Tesla’s down 1.34% in after-hours. So, dang it, Jim, JY strikes again.

Anyway, of course, I sent that alert to everybody in my stocks group. If you want in on the alerts that I send in my stocks group, which really, the purpose of them is for you to get perspective on where I’m seeing trends or trades, we still have that flash sale going on through the day today. That flash sale ends tonight. You get access to all the course member livestreams, the archive of course member livestreams, the trade alerts. Can’t guarantee you’ll make money, but we’ll always do our best.

This was my P&L today. I kept my Tesla contract, so I haven’t closed it out yet, so that after-hours is still printing on it. Anyway, if you want to see those, learn more at MeetKevin.com. Again, can’t make any guarantees; it’s just for educational purposes.

So, that’s Jim Cramer and Tesla, but what the heck happened with Japan yesterday?

Japan had their central bank bailout markets, and we’re not even close to the banking part yet. This is a whole crisis. We’re going to talk banks in just a moment, but yesterday the central bank of Japan bailed out markets. I made a video yesterday and I said, “This is bad. This is not good.” In fact, this is a sign that the stock market—and I even tweeted it here and made a video on it—I said, “The stock market is so illiquid, the BOJ had to capitulate within 48 hours. Not good.”

Now, of course, the market started rising after this in after-hours, even in America, you know, futures or whatever, and I’m like, “This is bad. It’s not going to play out good tomorrow.” And sure enough, even though we had indices open up nicely and positively this morning by over a percent, take a look on screen here, the Qs were at 4.49. We closed yesterday way lower than that; it was like 439 that we closed yesterday. So, we ran up a good 2% and this just tanked throughout the entire day. And guess what? The Qs ended up down 1.08%, and they’re down another percent in the after-hours. And that’s why I tweeted the following here:

“Wait, so you mean the Bank of Japan isn’t bailing out US stocks? Oh no, if only someone had warned us.”

Anyway, that’s why you subscribe here. We talked about exactly this happening yesterday.

But what about the banks? Well, the banks are freaking out. And I mean the big ones. Goldman Sachs just lifted their recession risk to 25%, which is kind of low for the year though, could go into recession in 2025. What did JP Morgan do today? For this year in 2024, the calendar year only has five months left here. JP Morgan just increased their risk of recession from 25% to 35%. Jamie Dimon does say, “I don’t think we’re in a recession yet today, but things are obviously slowing down. There’s no question of that.” He also doesn’t see us actually getting back to 2% inflation anytime soon, which is actually really bad. He says there are multiple inflationary forces still ahead of us. This is bad because it means higher for longer, a slower Fed, and the slower the Fed is, the more they’re actually tightening. See, as inflation slowly falls and the Fed stays here, you’re getting tighter because those interest rates have more of a bite as inflation falls. It’s not quite at 2%. Even if you get a 25 or 50 basis point cut or even 75 bips of cuts this year, if inflation is significantly lower than that, you’re actually net net tightening more than you’re loosening policy.

I told you the banks are freaking out. Take a look at this, MUFG. It’s both an investment bank and a lender. So, I know an investment bank technically isn’t a bank, but they also have banking services. Okay, whatever, who cares? MUFG, this is a big one, okay? What do they say? “As the dust settles, we remain vigilant and unconvinced that the coast is clear. We’ve said no to the no landing narrative. We didn’t go soft on soft landing, and our thesis remains that a bumpy landing can turn into a hard landing if the Fed drags out the easing cycle.” That’s basically what I just described about how we’re actually tightening as time goes on. They say, “This time is not different. The longer they wait, the more they will need to cut. If the Fed delivers major cuts, it’s possible they could foam the runway, lessen the impact of consumer spending, small business financing, and avoid causing damage to jobs.” And they go over here and mention that they actually see a 50/50 risk on recession versus expansion. “Although hard landing views have largely receded, the curve reminds us that perhaps the risk still lingers.” They actually suggest that a recession is much more likely in the new year. So, basically like Q1, Q2, which sort of aligns with JP Morgan and Goldman Sachs saying no recession right now. And even though the odds are going up this year, you start asking about next year, the numbers start going up a little bit. It’s no bueno. It’s no bueno at all.

Okay, on top of that, they also see the rate cuts that we’ve already been expecting, like the September 50 basis point cut, that’s mostly priced in. It’s priced in with like a 70% chance, 100% chance of a 25 BPS. But anyway, they argue, “You know, it’s actually a problem because the stock market is falling and we’ve already priced in these cuts. So, when the cuts come, it’s like, yeah, we were already expecting that. Like, what are you going to rally off of that?” They’re not very happy here at all. And I mean, frankly, to some extent, you shouldn’t be happy either. There are some serious concerns. Consider some of these other elements of concerns right here. I’ll throw this on screen. This is Discover and Capital One showing their net charge-off ratio. Something to know about these companies is they cater to a lower-income consumer, and they’re struggling. They’re struggling more than Taylor Swift. Now, you might think, “Oh, Taylor Swift isn’t struggling.” Did you hear that she just had to cancel three shows because she almost got ISIS? Yeah, literally. Apparently, two ISIS followers—we don’t know if they actually were ISIS terrorists, one of them was just 19 years old—but anyway, two alleged adherents to ISIS were planning a potential chemical weapons attack on the Ern Haal Stadium during the AOS tour. Now, this was foiled in Austria, but like, my goodness, it’s scary. Goodness gracious.

Anyway, it’s not just these charge-off ratios going up for poor individuals, but you’re starting to price in—uh-oh—the consumer really is starting to hit a wall. That’s what we’re seeing in earnings. Mind you, Q3 earnings aren’t great. They’re not going to be great. We get those in October, and the guidance we get for Q4 I’m almost certain is going to be recessionary. But in the meantime, take a look at the consumer credit data that we just got today. Again, it isn’t good. Here it is, revolving credit monthly change. I want you to see these little red bars right here. So, if we zoom or just look at the right over there, see those two little red nicks? Okay, we’ve had those two little red nicks now two times in the last three months. How many times did we have that before COVID? Well, in the six years on this chart before COVID, we had it one, two, three, four, five times. That’s it. I mean, maybe there’s like a tiny little nick there on the left. I can’t tell if that’s green or red. But the point is, we just had two in three months, and we had five to six in six years. So, we generally only average a red maybe once a year, if that. Now we’ve had two reds on consumer credit in literally two months.

Now, you might be saying to yourself, “Oh, but Kevin, I mean consumer credit, it still rose today.” Yes, it did. In fact, the St. Louis Federal Reserve, they talked specifically about this. You could actually see it. I love following them. I don’t know how many people actually engage with this crap because it’s really boring. I mean, they got four likes on their—I still call it Twitter—their X page. But anyway, “In June, seasonally adjusted revolving consumer credit, credit cards decreased 1.7 billion while seasonally adjusted non-revolving consumer debt like autos and student loans rose 10.6 billion.” In other words, because you’re still waiting for Biden’s student loan forgiveness, you’re seeing an explosion—this was mostly student loan forgiveness, mind you—seeing an or student loan debt, seeing an explosion in student loan debt. You’re actually decreasing credit card spending, which is bad for GDP. It’s recessionary. Now, it’s good for people individually because hopefully they’re trying to balance their finances, but the reality is most people aren’t using their credit less because they have balanced finances. They’re using their credit less because they’re out. They’re tapped out. They fully maxed out their credit.

I actually think one of the first companies to go bankrupt in the next recession is going to be Affirm. I got puts on that sucker. Just to be transparent, I have a full thesis on that that I talked with course members about, but I’ll just give it to you straight here. They hold over $5 billion of their crappy debt, their buy-now-pay-later debt on their books, and then they finance more, like getting more cash to do more of these garbage loans against those assets. They have like $6 billion of debt secured against those crappy loans. So, you are literally borrowing assuming that asset is good, but the asset is like a rotten basket of trash. It’s the first thing that people are going to stop paying, their stupid buy-now-pay-later loan. It’s not like they’re going to repossess your flight that you buy now pay later or your Peloton or your groceries. Maybe they might ding your credit. Maybe. There have been a lot of issues reporting buy-now-pay-later on credit anyway. That’s like the first thing people should stop paying, and I suspect likely will stop paying. It’s crazy. Absolutely crazy.

So, anyway, these are really, really bad figures from banks and what’s going on with consumers. But then you got to look and see, okay, well, what’s going on with pay, like pay and employment? Are people at least able to get hopefully pay raises and make more money? Well, not according to the Wall Street Journal. Pay rates for new hires across industries are 7% lower than they were for new recruits for the same roles in 2022. The biggest drops have been in white-collar jobs, especially in finance. New hire pay rates down 9.2% since last year. Those are quotes from the Wall Street Journal, and I think this is going to keep happening. Most of these companies are just going to keep offering lower pay raises, lower initial salaries. They’re going to advertise fewer jobs, they’re going to cut hours, and eventually they’ll just lay off excess staff. And I think this is going to get worse before it gets better.

Now, a lot of people are like, “Oh, but Kevin, you know, the Federal Reserve doesn’t want unemployment.” Bro, do you know what the historical unemployment rate is? I really want you to think about that. Right now, we are at 4.3%. What do you think the historic average unemployment rate is? In other words, how much buffer do we think the Federal Reserve has before you’re actually like higher than normal unemployment? Well, the average is roughly 5.5%. In fact, you could look at this chart right here. I’ll hide myself for a second so you could see it a little better. I drew this line right here where I think you sort of have the best fit for it, but it sits roughly at about 5.5%. And you can see all that spread over there on the right where I’m scribbling right there. Yeah, that’s all of the room they have to potentially go up with the unemployment rate and still be at the historic average. That’s crazy. Understand that if we go up, that’s like 1.5 million people out of jobs at any given time. That’s not good.

Now, I mean, there is a little bit of relief. Like McDonald’s, which had its first sales decline since 2020, well, you know, they introduced a $5 value meal. So, if you want to basically die off of food—I shouldn’t say that—don’t sue me, McDonald’s. Okay, $5 value meal. Unless you’re in France, then you’ll only get a Happy Meal for €4, which is about $5. I haven’t checked the exchange rate recently, so fact-check me on that. But anyway, you can also go to Jack in the Box, who’s now doing munchies under $4. Hershey’s, Kraft, Procter & Gamble, Amazon, all of them say sales are weakening. AI euphoria is collapsing. I mean, did you see what happened to Super Micro trash today? Oh my gosh, complete insanity. And we talked about this yesterday, but I want to show you something. I mean, look at this absolute trash stock right here, okay? Down 20% on the day yesterday, and after-hours it was up at like $720, $730. So, it literally had like a 40% swing over the last 24 hours, which is crazy. It’s at $480 right now. But take a look at this. I want you to see this. Three weeks. Three weeks. You can see that right here because this is a screenshot. These are two screenshots here of my February 14th course member livestream archive. That’s what people really like the courses for, by the way. That’s what you’re paying for, the lectures, the course member livestreams. You know, we throw in the occasional trade alerts when I trade on a daily basis, sort of for free. But these course member livestreams, this is really, I think, where my real value and perspective comes from. The trading is fun too, but look at what we said. Three weeks after course members asked me to analyze Super Micro Computer, mind you again, February 14th. Okay, three weeks after Super Micro Computer stock peaked and then collapsed 56% within five months.

Why did I not invest based on what I saw February 14th? Because I did not. I said comps in 2025 will be insane. In other words, the comparable sales comparing to 2024, and management will blame high comps for faltering growth. So, basically, I drew this out. I thought that their growth rate was going to collapse, and then I wrote, “Does this justify higher prices when the industry gets to that level of normalized growth? Does enthusiasm wane?” And then I wrote, “Tough comps next year will be very real, and margins are going to compress,” which is really interesting because if you look at what they just said, I wrote, “Margin compression will come,” and management literally just complained about margin compression yesterday. I wrote this back on February 14th. You know, I’m not trying to pretend I’ve got a crystal ball here. I’m just saying we do fundamental analysis. This is some of the stuff that you get if you join today using the flash sale. You get our archive going all the way back to like, I don’t know, 2017 livestreams, depending on which of the courses you got. But anyway, all my analysis is there. It’s included. Does peak and growth justify valuations? No, of course not. And when growth normalizes, will enthusiasm wane and valuation collapse? Well, I mean, you tell me. It’s down 56-plus percent now. It’s probably down 60% now. The writing was on the wall for a very, very long time. So, the AI euphoria is really rolling over.

But then you have to understand that the Federal Reserve really has problems here. The Federal Reserve is in this position where if they cut quickly, maybe they avoid a recession. But then if they reignite inflation, they’re going to lose all credibility. We talked about this yesterday. If they do cut, by the way, they’re actually going to likely push down the value of the dollar. Oh my gosh, why would you be worried about the value of the dollar going down? Well, if the value of the dollar goes down and the Japanese yen stays stable, then the spread widens. Oh no, the carry trade becomes a problem again. Oopsies. Remember yesterday we talked about how Reuters reported that there’s still 50% unwinding to do on the carry trade? And then you also have to look at just the massive imbalance that there is in selling pressure. I mean, on the stock market right now, you know, some tweeted—I’m just so used to that—somebody tweeted here, “Reminder, there is a record $6.1 trillion of cash sitting on the sidelines. They’re buying the dip.” And I wrote, “No, they’re not buying the dip with that pool. Investable cash is at record low levels we have not seen since 2001 era. Most right before the crash. Most of this money on the sidelines is probably cash, cash equivalents at mega caps, banks, and corporations. It’s not investable. Oopsies.”

We talked about that because that was research from—I think it’s BR research is what it’s called or is RCA. I can’t remember what they’re called. But anyway, this is a problem. You know, add to this what we saw with MUFG and what you’re seeing with the Fed, you really have a problem here because you’ve got an amplified carry trade that’s possible, people who can’t buy the dip because they’re already allocated. This is why I’ve been screaming for weeks, “Increase your cash allocation. Do what Warren Buffett’s doing.” And the longer the Fed waits, the more tightening you’re getting at the same time as banks are freaking out. This is all good. This is all like, it’s all worsening. I don’t know why I said good. It’s all worsening. All not good is what I meant to say. But you have to remember there is something worse than a recession. A recession is going to destroy stocks. Like, a recession is a stock killer because, you know, growth collapses. At stocks, which is what you’re paying for at a lot of stocks is growth. Even value stocks, you want them to grow something because otherwise they’re just burning your capital if they’re not growing. So, they just grow less. But anyway, there’s something worse than a recession for the Fed. That’s inflation. It destroys central banks, countries’ currencies. So, the dual mandate is actually skewed towards recession because we can afford for unemployment to go up another 1.2%, and it would still be within historic norms. So, it’s easy for the Fed to justify that. We still have pricing pressures. Disney just raised prices. Insurances are still sky-high. ISM service numbers on Monday indicated pricing pressure still rising. Jamie Dimon says we still have pricing pressures ahead of us in terms of rising prices.

Don’t get me wrong. I personally think the inflation problem is gone. I think the Fed should cut. I think inflation will die. We’re going to get back to the great moderation of disinflation over the last 40 years. But the one way you can guarantee that is with a recession. So, the Fed’s going to bias towards that. So, anyway, my strategy remains very clear. If there’s no recession by the election, then based on whatever data we have, then I’ll probably buy the dip right before the election because that’s when you’ll be at peak uncertainty and probably high volatility. If there is a recession by the election, then I’ll probably wait until the Federal Reserve capitulates. And by that, I mean like we’re going back to zero rates, we’re going back to quantitative easing.

Anyway, now the big takeaway here is the consumer is so weak and the Fed is still tightening by doing nothing right now that you are literally getting banks warning of a bumpy path ahead, and if not a recession this year, then next. It’s not a great place to be right now. So, I’m nervous. I still think the risk/reward for being in stocks is very, very low. Anyway, if you do want to take advantage of the flash sale, it’s still going on tonight. We’ll probably swap that price out closer to midnight, give you a chance to get in there. If you have any questions, you can always email us at [email protected]if you have any issues. But otherwise, it’s all at MeetKevin.com. Again, none of this is personalized financial advice. I just try my best to provide perspective. What you do with that information is totally up to you.

Anyway, thank you so very much for being here. We’ll see you in the next one, and folks, seriously, good luck out there. Do not advertise these things that you told us here. I feel like nobody else knows about this. We’ll try a little advertising and see how it goes. Congratulations, man. You have done so much. People love you. People look up to you.

Kevin P:

Financial analyst and YouTuber, Meet Kevin. Always great to get your take. Even though I’m a licensed financial adviser, licensed real estate broker, and becoming a stock broker, this video is not personalized advice for you. It is not tax, legal, or otherwise personalized advice tailored to you. This video provides generalized perspective, information, and commentary. Any third-party content I show shall not be deemed endorsed by me. This video is not and shall never be deemed reasonably sufficient information for the purposes of evaluating a security or investment decision. Any links or promoted products are either paid affiliations or products or services we may benefit from. I also personally operate an actively managed ETF. I may personally hold or otherwise hold long or short positions in various securities, potentially including those mentioned in this video. However, I have no relationship to any issuer other than House Act, nor am I presently acting as a market maker. Make sure if you’re considering investing in House to always read the PPM at House.com.

So what can you do RIGHT NOW?

And how soon will the crash hit?

Read this for my thoughts:

No, It’s Not Too Late To Get Gold (With No Money Out of Pocket)….But It Soon Will Be!

Today we saw one of the nastiest days on Wall Street in years….

Perhaps dating back to the last crash.

It was so ugly people have been texting me all day about it.

I guess that’s what happens when you’re the guy who’s been preaching about gold for the last year and some people didn’t listen.

Is this it?

Is this finally it?

Did I wait too long?

Did I miss out?

Those are the essence of the messages I received today.

But I wanted to share what I wrote back to a good friend (Mark) who texted me today and asked “Is the market finally crumbling?”

I wrote back the following:

I stand by that 100%.

There is almost ZERO history of a stock market crash ever happening in the summer.

Just doesn’t happen, don’t ask me why.

But they DO happen in the fall and winter.

Almost every time.

And I do believe one of the final cards they can play against President Trump if he wins (other than assassination, which failed) is crashing the economy on him.

Make it so bad and keep him so distracted by a crash BIGGER than the Great Depression that he can’t do anything else!

That makes a lot of sense, doesn’t it?

I think it’s exactly what they’re gonna do.

So was today the start of the crash?

No, I don’t think so.

I think it was just a little blip….a test balloon…..a warning signal.

Just a baby little blip on the radar!

The big one will come later, and it will make today look like child’s play.

That’s my take.

So are you too late to take action?

Too late to prepare?

Too late to apply some defense?

No, I don’t think so…but I think time is quickly running out.

It’s why I have been preaching so much about Gold and Silver and why I’ll continue to do so.

Simply put: GET YOUR MONEY OUT OF THE BANKS!

And out of the (trash) US Dollar!

Got Gold?

Got Silver?

The really cool thing is you might be able to get a TON of it for no money out of pocket.

Yes, really.

You see, if you have a retirement account, there’s a good chance you can shift a portion of that from risky stocks and bonds into Gold and Silver (Precious Metals)!

I’m not a financial advisor, so I can’t tell you what’s right for you, but if you think you can’t “afford” to get Gold right now, you might be absolutely wrong!

In fact, it’s might be “Free”.

Keep reading for details:

GET YOUR MONEY OUT OF THE BANKS!

I’m going to give you one big disclaimer upfront: I am not a financial advisor and I can’t give you personalized financial advice. We square on that? Ok good.

But I am a reporter and what I see happening with the banking system scares me a lot.

The first thing that scares me about keeping dollars in a bank account is how they lose value year over year.

You know that right?

Think you’re being smart and “saving up”?

You’re literally losing money every year to inflation.

This perfectly sums it up:

This. pic.twitter.com/rvvuoYvE8i

— Declaration of Memes (@LibertyCappy) July 29, 2024

Yes, if you simply left $1 million in cash in the bank since 1913, do you know what it would be worth?

$40,000.

Your $1 million from 1913 would have the purchasing power in 2024 of $40,000.

Ouch!

But that’s not even what scares me the most….

What scares me is another round of bank closures like we had last year.

Here’s what’s happening in China right now:

BREAKING: 40 Chinese Banks Just Crashed and Vanished — “Worse Than 1980 S&L Crisis!”

Yes, that's real.

And yes, I believe it comes here next.

But even if your bank is open, can you get the money out?

Have you ever tried?

Sure you have to leave some money in there, but you don't want big amounts of money sitting in bank accounts.

Because you might never be able to get it out!

Go ahead, test me out on this...even right now in good times (before a full-blown banking crisis hits America) go to your bank right now and try and withdraw $10,000. They will look at you with panicked looks on their face. I guarantee it. Then they'll go get their supervisor. The supervisor will come over and tell you they can't do that today. Come back in 2-3 days. And then they'll start the interrogation. "What do you need this money for?" "Where is this money going?" Only after you answer all their questions, wait 2-3 days, fill out a bunch of paperwork, only then will you MAYBE be allowed to take YOUR money out of YOUR account.

I guarantee that's how it will go for you....

Test me out!

Go try it and report back below in the comments.

So now the big question: Ok, what can YOU do about it?

How do you prepare?

How do you make sure you and your family are not at risk when the banking crisis hits America (which I believe it will, very soon).

The answer is you do exactly what I've been preaching about for over a year now....get your money OUT of the banks! (Not personalized financial advice, just common sense from where I sit). That's Step #1.

Hold firm, be determined, play their stupid games, and get your money out of the banks!

Because while YOU view it as your money in your bank account, that's not how the bank views it. The bank views it as their money. And the dirty little secret is they LENT OUT your money to other people already. Sometimes 9-10 times over! It's true, I'll do a separate report soon on that explaining "fractional reserve banking".

But Step #2 is the most critical....you don't want to just get your money out of the banks, you want to get it out of the US Dollar.

The most basic and traditional financial wisdom has always viewed Precious Metals (Gold and Silver) as the safest places to have your money when a crisis hits.

So while I can't give you personalized financial advice, I can tell you a couple things: (1) the Big Central Banks have all been buying Gold and Silver hand over fist for the last couple years. Gee, I wonder why? And (2) Gold and Silver have stood the test of time back to the Bible times as being the best store of wealth to weather out a storm in the economy. Period.

And now Step #3 is where I'm going to make sure I don't leave you hanging.

I have two killer connections for you...

Two companies that I trust for getting the best deals on Gold and Silver. PHYSICAL Gold and Silver, the real stuff. Not some phony symbol traded on some stock exchange that may or may not have actual Gold and Silver backing it up. You want the real stuff.

And because I love the free market and competition, I have two great companies to recommend to you. You can talk to both, see who you like better, and then take action!

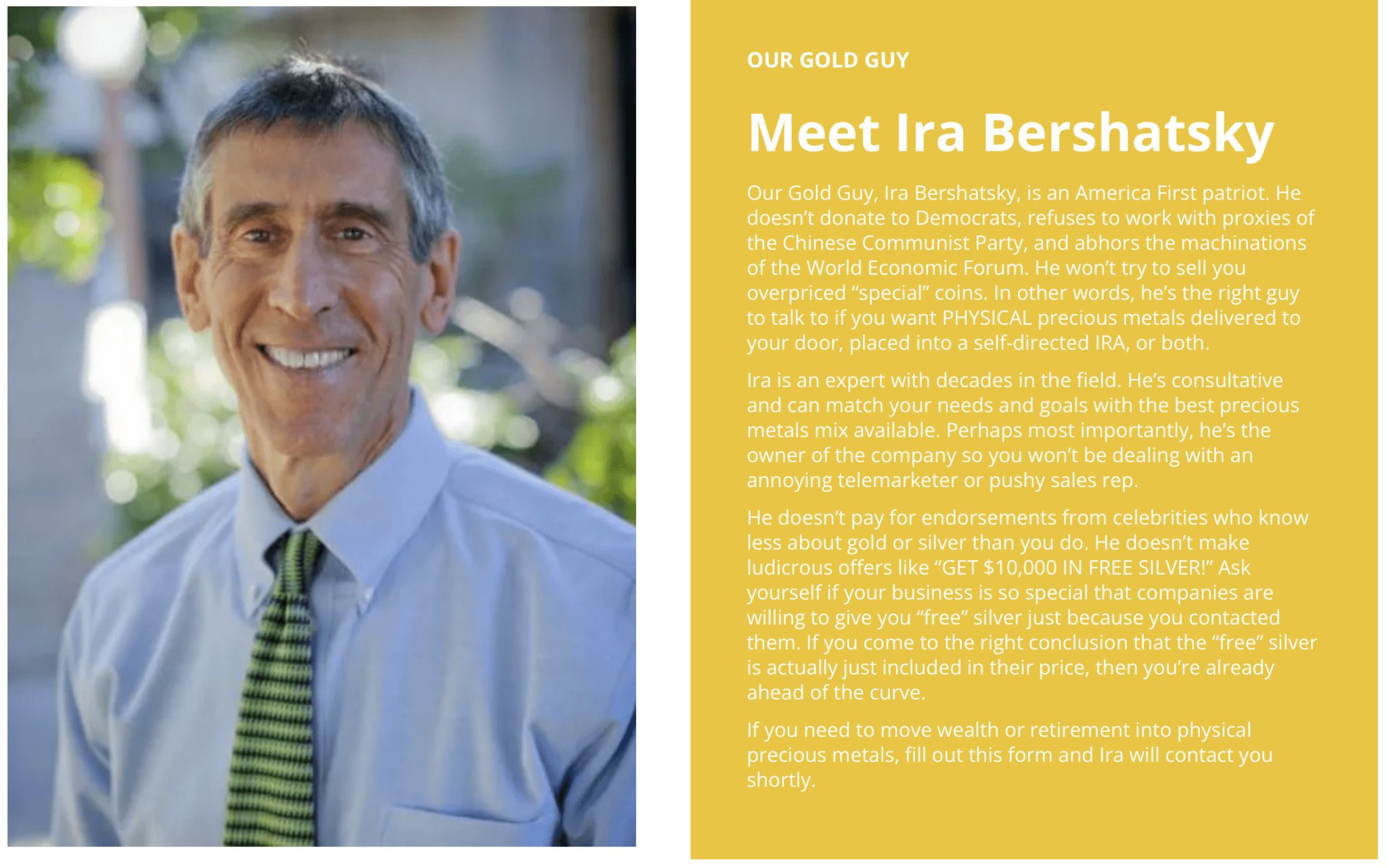

The first is [DELETED] ran by my friend Ira Bershatsky.

I have personally sent family members to Ira for 5-figure purchases of Gold and Silver and he treated them like royalty. They were very pleased.

That's how much I trust Ira.

I didn't tell him I was sending them over either (and these particular family members have a different last name) so I did it as a bit of a "secret shopper" test and Ira passed with flying colors.

Of course I knew he would.

That's why I work with him and that's why I have confidence telling you about him.

Ira can handle bulk purchases of bullion, coins, whatever you want.

All custom ordered and shipped right to your door.

A lot of people love Bullion because its the cheapest and most economical way to do it, to stretch your dollar into as much gold and silver as possible.

The website is called [DELETED] and when you see my logo in the top left-hand corner, you'll know you're in the right place.

You'll get a personal phone call with Ira Bershatsky (or someone on his team) and they will work with you free of charge for as long as needed to answer any questions you have and get you taken care of.

How about that!

You don't see that much anymore, but Ira and his team pride themselves on good old-fashioned real customers service:

No sales pitch, just real, actual help.

And the best prices you will find.

Here's the only disclaimer I will give you: because they do pride themselves on dedicated service, it might take a few days before you get a phone call back. Just be patient.

Good things come to those who wait!

You can contact Ira and [DELETED] here.

Ira can also help you if you want to purchase Gold and Silver in your IRA.

I mean, his name is Ira, after all, OF COURSE he can help you purchase in your IRA account.

The thing I love about purchasing in your IRA account is you can do it with no money out of pocket. You just take money already in the IRA account, perhaps in stocks or bonds or other investments, and you can shift it into Gold and Silver.

Again, I'm not your personalized financial advisor, I'm just explaining how it works.

And it's REALLY cool.

So even if you're saying times are tough right now, I don't have a lot of spare money to shift into Gold and Silver, you might have a golden opportunity (pun intended!) already sitting there in an established retirement account.

Ok, that was option #1.

Now I want to tell you about option #2.

An equally great company, I am so happy to be working with these guys.

This next company is called Genesis Gold and this is also for people who want to purchase real physical gold or silver in their IRAs (Investment Retirement Accounts).

In addition to "no money out of pocket", do you know what the beauty of that is?

TAX FREE baby!

I'm not a tax advisor, but that's a general oversimplification.

Never pay more taxes than you are legally required to pay.

And that's why I love getting gold and silver in my IRA (and why I hold a large chunk in an IRA myself!).

There's so much to love about Genesis Gold, starting with the fact they are proudly and un-ashamedly Christina!

They call it "Faith-Driven Stewardship" and they put it right on the homepage of their website along with a quote from Ezekiel:

Here's more on why gold and silver in your IRA are so powerful:

You can contact Genesis Gold here.

They are also very backed up with record demand, so you may have to wait a bit, but someone WILL get in touch with you for personal customer service and assistance!

Tell 'em Noah sent ya!

Oh, and did you know Genesis is recommended by SUPERMAN himself?

It's true.

Superman himself, Clark Kent -- Dean Cain -- came on my show and we broke it all down:

Watch here:

Stay safe!

Be ready.

Be prepared.

Before you go, I have one more thing to show you....

This actually just came out and it's super cool.

In addition to bullion, coins or even Gold and Silver in your IRA, this has a very specific purpose and it might be worth having some on hand:

Buy It -- Break It -- Trade It -- New Silver "Invention" Has Never Been Done Before!

A new physical precious metals product launched that immediately caused a stir in the gold and silver industry. "Prepper Bar" is a utility bar that is perforated to allow owners the ability to break off pieces ranging from 1.5 grams up to 7.7 grams.

They fit nicely in one's wallet so they can be carried around constantly.

"People have been asking me how we came up with the idea and I have to tell them that I can't take credit," said Jonathan Rose, CEO at Prepper Bar. "Over the years, our customers have been asking for something tradeable, portable, and spendable so we made Prepper Bar as the perfect accommodation."

These 62 gram bars are flat and come in either silver or gold. The Silver Prepper Bar is available for immediate shipment while the Gold Prepper Bar will be available by the end of June.

We asked Rose what makes these bars so different from regular bars or coins.

"Gold and silver are great for holding wealth but you'd need a pretty sturdy hacksaw to shave off incremental chunks for sale or barter," he said. "Prepper Bars are strong but they can be easily broken along the perforations so if we find ourselves in a pinch, we can break off the right amount, no problem."

Check out the new Prepper Bars today!

How cool is this?

(Note: Thank you for supporting American businesses like the one presenting a sponsored message in this article and working with them through the links in this article which benefit WLTReport. We appreciate your support and the opportunity to tell you about Genesis Gold! The information provided by WLTReport or any related communications is for generalized generalized informational purposes only and should not be considered as personal financial advice. We do not provide personalized investment, financial, or legal advice.)

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!