I love it when people WAY smarter than me confirm something I have been telling you about for a long time.

In this particular case, that would be the fine folks at the Mises Institute.

Never heard of them?

That’s ok, here’s a short bio of who they are:

The Austrian Mises Institute, a non-profit organization, was founded to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, following the tradition of Ludwig von Mises and Murray N. Rothbard. As a think tank headquartered in Auburn, Alabama, the institute is recognized as a center for Austrian economics, radical right-wing libertarian thought, and the paleolibertarian and anarcho-capitalist movements in the United States. It was established under the leadership of Lew Rockwell, Burton Blumert, and Murray Rothbard, who was a student of Ludwig von Mises and a leading figure in the development of anarcho-capitalism.

The institute has been instrumental in the revival and popularization of Austrian economics and libertarian thought, hosting numerous events, publishing books, and engaging in research. It has attracted scholars, activists, and students from around the world, fostering intellectual exchange and collaboration. The institute’s efforts have been particularly influential in the United States, with its ideas and principles impacting political and economic discussions and policies.

The Mises Institute publishes The Quarterly Journal of Austrian Economics, a leading academic journal in the field, and The Austrian, a flagship physical print publication featuring provocative articles by cutting-edge laissez-faire and Austrian thinkers. It also maintains a comprehensive online presence, offering a vast array of resources, including books, articles, lectures, and courses, to promote the understanding and application of Austrian economics and libertarian principles.

The institute has received various accolades and recognition for its contributions to economic thought and policy. It has been a strong voice against economic interventionism, central banking, and the welfare state, advocating for free markets, individual liberty, and private property rights. It has also played a significant role in the development and dissemination of the Austrian Business Cycle Theory, which has provided a powerful critique of central banking and inflationary monetary policies.

In addition to its academic and intellectual contributions, the Mises Institute has been involved in public outreach and educational initiatives. It has organized numerous events, conferences, and seminars to engage with the broader public and to encourage the study and application of Austrian economics. The institute’s efforts have helped to create a vibrant community of scholars, students, and activists committed to advancing the principles of liberty, free markets, and peace.

And here’s what they just told the world:

As The Dollar Falters, Gold Becomes Insurance, Not Speculation https://t.co/CloSuFYMxR

— zerohedge (@zerohedge) May 10, 2024

Allow me to translate….

It’s exactly what I’ve been telling you for months now.

Gold becomes a safe-haven.

It’s why I recently told you about this:

https://wltreport.com/2023/10/15/gold-now-classified-as-tier-1-risk-free/

Yes folks, that is the Banks classifying gold as a quote “TIER 1 RISK FREE ASSET”.

It doesn’t mean it can’t go down in price, but that’s a very important term used by banks to convey a very specific and important designation.

More on that down below in a just a bit, but first I want to show you more of the report from the Mises Institute because it’s important you see this:

Economics trumps sentimentality, and gold’s elevated price has some people raiding the family jewelry box to pay bills. “Young people are not wearing grandma’s jewels. Most of the young people, they want an Apple watch. They don’t want a pocket watch,” Tobina Kahn, president of House of Kahn Estate Jewelers told Bloomberg. “Sentimental is now out the door.”

When times are tough, treasures change hands, the late Burt Blumert, once a gold dealer and Mises Institute Board Chairman, used to say. “Prices are high, and I need cash,” Branden Sabino, a thirty-year-old information technology worker said, adding that with the cost of rent, groceries, and car insurance rising, he doesn’t have any savings. He sold a gold necklace and a gold ring to King Gold and Pawn on Avenue 5 in Brooklyn. “People are using gold as an ATM they never had,” said store owner Gene Furman.

At King Gold, fifty-five-year-old Mirsa Vijil pawned a bracelet to pay her gas bill. “Gold is high,” she said, adding she’d never pawned her jewelry before but will do it again if she needs to.

Adrian Ash, director of research at online gold investment service BullionVault says there is twice as much selling as a year ago on BullionVault’s platform. “People are very happy to take this price.”

“It’s very busy and we are getting more calls than ever before about clients wanting to bring in their jewels,” Kahn said. “I’m telling the clients to bring them in now, as we are at unprecedented levels.”

So while there is plenty of liquidating to pay the bills, demand at the United States Mint is tepid, with sales in March the worst since 2019 for its American Eagle gold coin.

It turns out more than a few of those well-publicized Costco gold bar buyers are having trouble selling them. The bars, not being American Eagles or other similar gold coins, are not as liquid, given that the seller, Costco, will not buy them back. The Wall Street Journal reports, thirty-three-year old Adam Xi called five different gold dealers to get a price he would accept for the gold bar he bought at Costco in October.

He was offered $200 less by one dealer than the $2,000 he had paid. But he found a Philadelphia coin dealer near his home willing to pay $1,960, or twenty dollars under market price.

Mr. Xi has learned, or should have learned, that buying gold to turn a quick profit is a fantasy. His plan was to rack up credit-card points buying the gold and then quickly resell it for a profit.

Buyers can expect their gold to immediately lose around 5 percent of its value, according to Tom Graff, chief investment officer at the wealth advising company Facet. One pays a premium to buy and pays fees to sell. “You need a holding period that’s long enough to overwhelm that cost,” said Graff.

What Has Government Done to Our Money?

Luke Greib told the Wall Street Journal that he sold a one-ounce Credit Suisse bar on a Reddit page dedicated to trading precious metals to avoid taxes and fees. Buying physical gold is purchasing insurance against monetary mischief by the Federal Reserve, not to earn a profit via a quick flip.Perhaps it’s hard to imagine currency destruction so devastating that your gold would serve as not only a store of value but a medium of exchange. Peter C. Earle explains in a piece for the American Institute for Economic Research, “During the peak of its 2008 hyperinflation, [Zimbabwe] experienced a catastrophic economic downturn, characterized by the issuance of billion—and trillion-dollar banknotes that were, despite their nominal enormity, virtually worthless.”

Now with that in mind I want you to read this very carefully:

Gold Now Classified As A “TIER 1 RISK FREE” Asset — Here’s Why That’s A Big Deal!

I’ve been telling you about gold for a while now…

Here’s more proof you can trust my reporting.

Actually, this is a double whammy!

You have to check out this video below and then I’ll give you more sources below, but here’s the short summary….

1️⃣ Thanks to Basel III, gold is now classified as a Tier 1 asset.

What’s that mean?

It’s essentially classified as a “risk free” asset, right along side cash and treasury bonds!

2️⃣ Because of this, and because of the historic price manipulation, many believe gold could easily reach $10,000/ounce in the not too distant future!

I’m not a financial advisor, I’m just a reporter, let me make that clear….

But I know a good thing when I hear it.

“Risk free” and the potential to go up significantly?

That’s not me saying it, watch this short video and they’ll explain it all in about 2 minutes:

An ounce of GOLD gold⚜️ could reach $10,000 DOLLARS. 💵

There’s an intersection between commodities and Blockchain.

The price of gold is 100% manipulated.

Some precious insights by @VersanAljarrah pic.twitter.com/lPcM7hCTvH

— EDO FARINA 🅧 XRP (@edward_farina) October 14, 2023

Incredible, right?

This is a good summary from Chards:

It’s basic supply and demand…

As more banks and institutions can now hold gold as a TIER ONE asset, that should lead to an increase in its demand.

From Investing.com, you have to read this — and then tell me if this isn’t exactly what I’ve been telling you recently?

The Bank of International Settlements created new regulations following the collapse of Lehman Brothers to stop banks from reckless lending and a repeat of the ensuing financial collapse. Having carried out regulations previously through Basel I and Basel II, Basel III rules are pages and pages of jargon and waffle; however, the salient points that we need to consider are the Net Stable Funding Ratio and how this relates to banks and their balance sheets.

The Net Stable Funding Ratio is the available amount of stable funding divided by the required amount. This must be equal to or greater than 100%. Put, you cannot lend more than you own.

Banks have two sides to their balance sheets – assets and liabilities. On the assets side, amongst other things, are tier 1 assets. As the name suggests, these are zero-risk tangible assets valued at 100% of their value.

These are cash, treasuries, and now physical gold. Paper gold or any unallocated gold is not classified as a tier 1 and hence would need to be “topped up” with cash reserves to make it 100%. This is critical to understand. A leaflet in your vault claiming gold ownership cannot be rated at 100% cash value, and therefore is not classed as tier 1, whereas physical gold now is.

On June 28, Europe (Excluding the UK), the USA, and the Comex became Basel III NSFR compliant. The UK and the LBMA, who have fought this for nearly a decade, were given a further six-month extension until Jan. 1, 2022, to be NSFR compliant.

What Does This Mean For Gold?

It, of course, raises several serious questions.

- Why would the LBMA, which deals almost exclusively in unallocated gold, be so heavily against the implementation of the NSFR?

- Have central banks been front running this and been buying physical gold for the last few years at a greater rate than we have seen for decades?

- If physical gold can be rated as a tier 1 and given point two, wouldn’t it be in banks’ interest for the price of gold to go up?

Folks, I’ve been telling you!

Here’s one more prime source for you….

Direct from MarketWatch.com:

In its essence, Basel III is a multiyear regime change that aims to prevent another global banking crisis, by requiring banks to hold more stable assets and fewer ones deemed risky.

Under the new regime, physical, or allocated, gold, like bars and coins, will be reclassified from a tier 3 asset, the riskiest asset class, to a tier 1 zero-risk weight —putting it “right alongside with cash and currencies as an asset class,” said Adam Koos, president of Libertas Wealth Management Group.

Since physical gold will have a risk-free status, this could cause banks around the world to continue to buy more, Koos said, adding that central banks already have stepped up purchases of physical gold to be held in the institutions’ vaults, and not held in unallocated, or paper form.

Allocated gold is owned directly by an investor, in physical form, such as coins or bars. Unallocated gold, or paper contracts, often are owned by banks, but investors are entitled to that gold, and avoid storage and delivery fees.

Under the new rules, paper gold would be classified as more risky than physical gold, and no longer counted as an asset equal to gold bars or coins.

That’s why I always recommend PHYSICAL GOLD.

Always have, always will.

In fact, keep reading and I can get you connected with the best option to grab some…even tax free and maybe with no money out of pocket!

How’s that sound?

So, what can YOU do to protect yourself?

To protect your family?

To stay safe?

Simple: you need to get some #Gold or #Silver in your own possession.

It’s called “physical” gold and silver.

Not paper traded garbage on the stock exchanges that isn’t backed by anything.

Don’t touch that stuff.

I have two special hook-ups for you.

Both involve PHYSICAL gold and silver.

Because if you do NOTHING else, make sure you own “physical” gold and silver, not paper contracts.

The paper contracts (like stock ticker SLV and GLD) could very well go POOF one day and disappear or go to zero, because they’re not actually backed by the gold and silver they claim to represent.

It’s a massive game of musical chairs out there and when the music stops (and I think it will stop soon…) people who only own paper might find themselves owning something not worth the paper it’s literally written on.

And I know you’ll never forget it if I give you this GIF so….Let’s Get Physical:

Now…WHERE do you get physical gold and silver and how do you know it’s real and safe?

And that you’re getting the best price?

Oh, and how about personal one-on-one real customer service?

You know, like you were some Big Wig millionaire at Goldman Sachs who could just call their personal banker and get help?

That’s what I’m about to tell you.

I have two killer connections for you…

The first is for purchasing gold and silver bullion.

That means bulk bars.

That’s the cheapest and most economical way to do it, to stretch your dollar into as much gold and silver as possible.

The website is called WLT Precious Metals and when you see my logo in the top left-hand corner, you’ll know you’re in the right place.

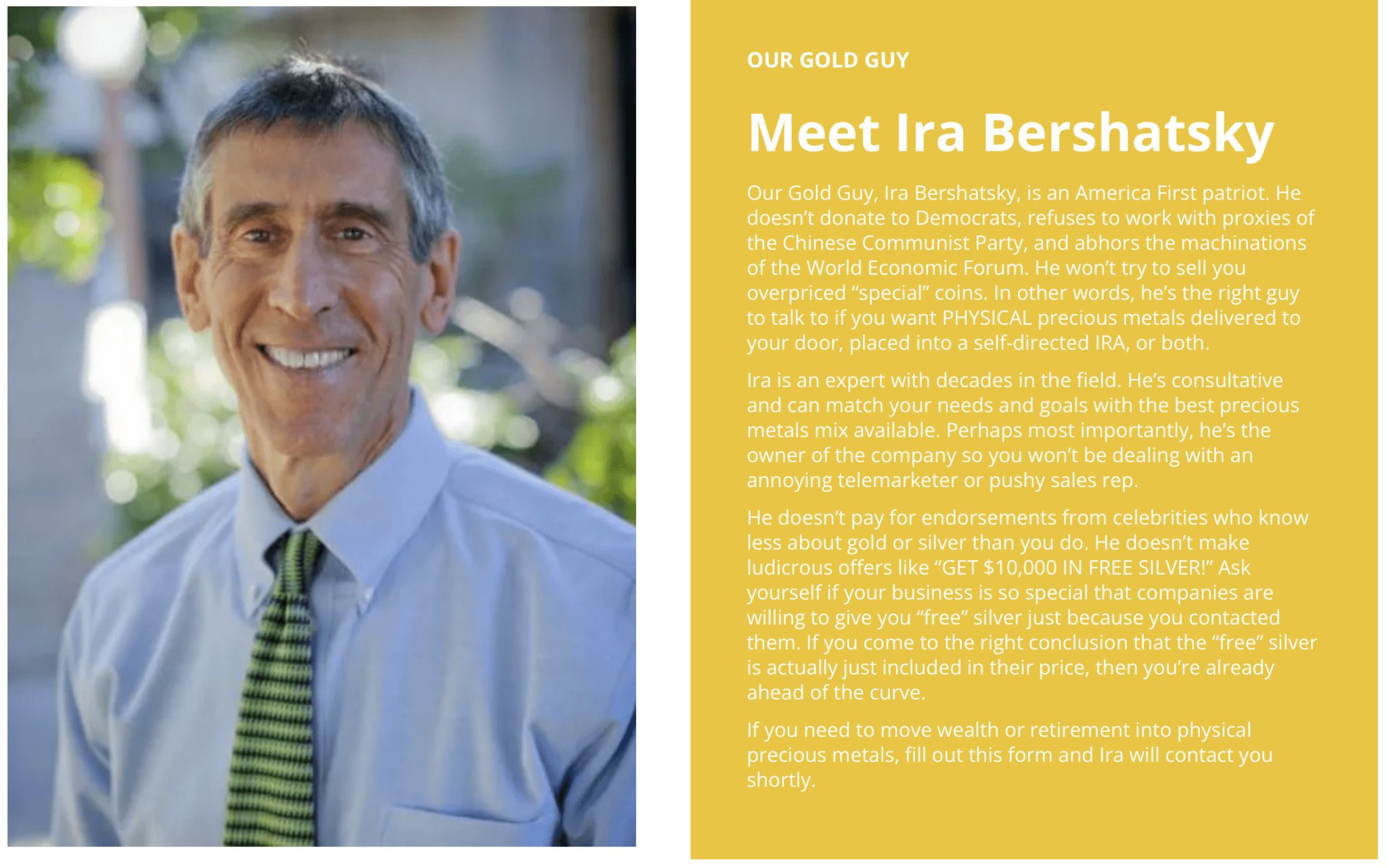

You’ll get a personal phone call with Ira Bershatsky (or someone on his team) and they will work with you free of charge for as long as needed to answer any questions you have and get you taken care of.

How about that!

You don’t see that much anymore, but Ira and his team pride themselves on good old-fashioned real customers service:

No sales pitch, just real, actual help.

And the best prices you will find.

Here’s the only disclaimer I will give you: because they do pride themselves on dedicated service, it might take a few days before you get a phone call back. Just be patient.

Good things come to those who wait!

You can contact Ira and WLT Precious Metals here.

Ok, that was #1.

Now I want to tell you about option #2.

An equally great company, I am so happy to be working with these guys.

This next company is called Genesis Gold and this is for people who want to purchase real physical gold or silver in their IRAs (Investment Retirement Accounts).

You know what the beauty of that is?

TAX FREE baby!

I’m not a tax advisor, but that’s a general oversimplification.

Never pay more taxes than you are legally required to pay.

And that’s why I love getting gold and silver in my IRA (and why I hold a large chunk in an IRA myself!).

There’s so much to love about Genesis Gold, starting with the fact they are proudly and un-ashamedly Christina!

They call it “Faith-Driven Stewardship” and they put it right on the homepage of their website along with a quote from Ezekiel:

Here’s more on why gold and silver in your IRA are so powerful:

You can contact Genesis Gold here.

They are also very backed up with record demand, so you may have to wait a bit, but someone WILL get in touch with you for personal customer service and assistance!

Tell ’em Noah sent ya!

Oh, and did you know Genesis is recommended by SUPERMAN himself?

It’s true.

Superman himself, Clark Kent — Dean Cain — came on my show a few weeks ago and we broke it all down:

Watch here:

Stay safe!

Make sure you can weather the storm when it hits!

Because the storm always hits eventually, doesn’t it?

As for me and my house, we will be ready. 💪

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!