Canada’s financial system is in dire straits.

It has been for some time, according to many Canadians.

But many Canadian supporters of liberal Prime Minister Justin Trudeau have been proudly touting Canada’s “most diversified economy in years” recently.

“Trudeau Diversified Canada’s Economy Like No One Before”

✔️Unprecedented population growth

✔️Record-low unemployment

✔️Most diversified economy in its 156-year history

✔️A world-beating stock market since 2021…read more⬇️https://t.co/jX2ngSIGDr

— Anita Anand (@AnitaAnandMP) March 25, 2024

Woohoo! Looks great Canada!

And then one day later…

Time to break the glass !

Freeland is bankrupting Canada!

“You know those signs that say 'In an emergency, break the glass?' Well, it's time to break the glass,” Bank of Canada senior deputy governor Carolyn Rogers said in a speech Tuesday.https://t.co/gP6a75hwYc

— Rob Logan (@Northerngold01) March 26, 2024

Yesterday Liberal MP Anita Anand in desperation for something positive shared a bs opinion piece from last year.

Today the Bank of Canada called Canada's weak productivity and shrinking standard of living an Emergency.This is as alarm ringing as it gets from a central bank.… pic.twitter.com/0010fgigDt

— Kirk Lubimov (@KirkLubimov) March 26, 2024

Bank of Canada’s senior deputy governor, Carolyn Rogers, strongly called for “increasing productivity.”

Most know this is another way of saying “create more currency,” therefore devaluing it.

Typical Trudeau cabinet minister.

Stock market is not same as economy. You can keep the stock market pumped up by printing money— Pankaj (@pankajsameold) March 26, 2024

The BoC seems set on increasing the Canadian money supply as Trudeau plans to increase taxes on Canadians with a new carbon tax in April.

Make this go viral 🤣 https://t.co/YLTNr7ZpGY

— ba (@bagriffiths) March 26, 2024

It might be time Canadians start asking, “Got gold?”

The Financial Post has more on Canada’s economic woes:

Canada must tackle weak productivity to inoculate the economy against factors that will drive future inflation, such as the pullback from globalization, said Carolyn Rogers, senior deputy governor of the Bank of Canada.

“An economy with low productivity can grow only so quickly before inflation sets in. But an economy with strong productivity can have faster growth, more jobs and higher wages with less risk of inflation,” she said in a March 26 speech in Halifax, adding that other drivers of inflation will include changing demographics, the economic impact of climate change and global tensions.

Canada’s productivity has fallen from a “not great” record of producing 88 per cent of the value generated by the United States economy per hour in 1984 to just 71 per cent in 2022, she said. And while weak investment has been a problem in Canada for the past 50 years, the gap between the level of capital spending per worker by Canadian firms and the level spent by their U.S. counterparts has become worse over the past decade or so.

ADVERTISEMENT“While U.S. spending continues to increase, Canadian investment levels are lower than they were a decade ago,” Rogers told her audience, adding that Canada has also fallen behind most of its G7 peers, with only Italy seeing a larger decline in productivity relative to the United States.

“You’ve seen those signs that say: In emergency, break glass — Well, it’s time to break the glass,” she said.

Bank Liquidity Crisis! Reports Of Customers Unable to Withdraw Funds From Banks!

I do not want this article to come off as “Alarmist”….

I simply want to be a Watchmen on the Wall, reporting what I’m seeing and hearing and making sure I pass it on to all of you as quickly as I can.

Earlier today I brought you this report:

Grant Cardone on the Charlie Kirk Show: “300 Banks WILL FAIL in Next 24 Months”

I'll copy that full report below in case you missed it.

But shortly after covering that story I saw this report breaking from my friend Chris Greene over at AMTV.

You really need to watch this video, he explains it so well, but I'll try to summarize the two main points I picked up on:

- There is a banking liquidity crisis, which essentially means the banks don't have the money they claim to have. That's always been true thanks to Fractional Reserve Banking, but Greene reports it's become much worse now that trillions are flowing into Bitcoin and Crypto. It's a flight out of the USD and out of Banks and into Crypto and it's leaving banks holding the bag. Which flows into point #2....

- There may soon be a run on the banks, and even as we speak there are reports that some customers are having trouble withdrawing THEIR funds from THEIR banks.

As to Point #2, I wanted to Fact-Check that myself, so I asked Grok and this is what it told me:

Oh my!

So Grok confirms it is true.

Here is one such report:

Why exactly can’t customer withdrawals be met even if it’s in 24-48 hours if their deposits are actually there

Not looking good

— Ebovi Wali 🗺️ (@ebovi_wali) March 14, 2024

Ok, please watch this video in full (and then scroll down for some ideas of what you can do right now to protect yourself. I never leave you hanging with only bad news!)

Watch here:

https://www.youtube.com/watch?v=c3lEzBCeb6c&t=1321

Backup video here if YouTube deletes that:

BREAKING !!!! BANKING LIQUIDITY CRISIS! AMERICANS HAVE NO IDEA WHAT’S COMING (Get ReadY!)

MIRROR: https://t.co/mmO6L2mPmJ

👉 @DailyNoahNews pic.twitter.com/Rr8SK4Ho2y

— DailyNoah.com (@DailyNoahNews) March 14, 2024

Folks, the red flashing lights are blaring right now, can you see them?

Grant Cardone on the Charlie Kirk Show: "300 Banks WILL FAIL in Next 24 Months"

I've been warning you about our banks and banking system for the past several months now...

But if you think I'm seeing trouble, I don't hold a candle to what some other experts are saying!

Here's the latest from real estate expert Grant Cardone.

Cardone was on The Charlie Kirk Show last week and he made some startling predictions (one including the incoming replacement for Joe Biden).

But the biggest one that caught my attention was his claim that 300 Banks will FAIL in the United States over the next 24 months (and likely sooner than that).

Think that's crazy?

Oddly enough, it's right in line with this report I brought you last week:

Real Estate CEO and Federal Reserve Board Member: “500 or more banks in the USA will fail”

If you don't know who that is, that Scott Rechler and he sits on the Board of Directors for the Federal Reserve.

Basically, you don't get much higher up than that.

And he has an even higher number than Cardone -- 500 Bank Failures!

So is it 300 or 500?

Or does it really even matter at that point?

Folks, things could get very bad, very quickly.

The FDIC can insure losses when it's just a couple baks failing every year, but what happens when the number jumps into the hundreds?

Do you think the FDIC can insure all of that?

And even if they do, it will just be by massive money printing and your money will be devalued like Zimbabwe 2.0!

It's why I keep preaching about the value of Gold so much. More on that down below, including how you can get Gold for no money out of pocket. Yes, that is 100% true -- no catches. I'll explain down below.

But first I have to show you this interview with Charlie Kirk and Grant Cardone:

Backup here if needed:

Grant Cardone on the Charlie Kirk Show: "300 Banks WILL FAIL in Next 24 Months"

FULL VIDEO SOURCE:https://t.co/s52DEogXyn pic.twitter.com/PjCtTACKDn

— DailyNoah.com (@DailyNoahNews) March 14, 2024

Now read this next (and then keep scrolling for how I can help you with gold):

Real Estate CEO and Federal Reserve Board Member: "500 or more banks in the USA will fail"

I have been sounding the alarm about our economy for a while now...and specifically about our banking system.

I've been very vocal about it, and at times even sounding extreme.

But perhaps I haven't been extreme enough.

Because while I've been warning you there are going to be MORE bank failures this year (and some of you even doubt that), I haven't said there are going to be 500-1,000 bank failures in the US!

No, that would be Scott Rechler and here's a short bio in case you don't know who he is:

Scott Rechler is a prominent figure in the real estate industry, known for his leadership as the CEO and Chairman of RXR Realty LLC. With a career spanning several decades, Rechler has been instrumental in the growth and success of the company, which manages a portfolio of commercial properties and investments valued at approximately $15.7 billion.

Before his time at RXR Realty, Rechler served as CEO and Chairman of Reckson Associates Realty Corp, where he oversaw the company's dynamic growth from its $300-million IPO in 1995 to its $6.0-billion sale in 2007. This sale marked one of the largest public real estate management buyouts in REIT history, generating a return of over 700% to Reckson shareholders.

In addition to his business accomplishments, Rechler has also made significant contributions to the community. He served on the Board of Commissioners of the Port Authority of New York and New Jersey, as well as on the Board of The National September 11 Memorial & Museum at the World Trade Center Foundation, Inc.

Rechler is also known for his involvement in various cultural institutions, including the Tribeca Film Institute, the Long Island Children's Museum, and The National September 11 Memorial & Museum at the World Trade Center Foundation, Inc.

Regarding his role on the Board of the Federal Reserve, Scott Rechler is indeed a member of the Board of Directors of the Federal Reserve Bank of New York. In this capacity, he contributes to the oversight and governance of the Federal Reserve's operations and policies.

Throughout his career, Scott Rechler has demonstrated a commitment to enhancing the communities in which he operates, making him a respected figure in both the business and philanthropic worlds.

I bolded the most important part.

You think this guy knows what he's talking about? Has access to information you and I don't?

He's on the Board of Directors at the Federal Reserve Bank of New York! You don't get much higher up than that!

And here's what he's saying:

“500 to 1,000 smaller banks could disappear because of insolvency or consolidation”

-Scott Rechler, CEO of RXRRegional and community banks hold about $2.3 trillion in commercial real estate debt

banks trying to cut their real estate exposure will have to offload their loans… pic.twitter.com/mueuhiDvdv

— Covered Land Play (@UntrendedYOC) June 29, 2023

“Some 500 to 1,000 smaller banks could disappear because of insolvency or consolidation, says Scott Rechler, chief executive officer of real estate giant RXR and a Federal Reserve Bank of New York board member.” @business via @AppleNews https://t.co/ZjKfoW20XU

— Dave Wald (@waldadvisors) July 2, 2023

Here's more, from Yahoo News:

Ever since four regional banks holding a combined $532 billion in assets—headlined by Silicon Valley Bank—failed in March 2023, regional banks have been under scrutiny from regulators. And given the commercial real estate (CRE) industry’s issues, a key focus has been on banks with the most exposure to the volatile sector.

In an upcoming white paper seen exclusively by Fortune, RXR CEO Scott Rechler described how regional banks will face a “slow-moving train wreck” as waves of commercial real estate loans mature over the next few years. Rechler has faith that many commercial real estate owners, operators, and lenders will figure out a way to overcome the challenges facing them, but he’s more skeptical about regional banks. “I think there's going to be…500 or more fewer banks in the U.S. over the next two years,” he said. “I'm not saying they're all going to fail, but they're going to be forced into consolidation if they don't fail.”

“They don't have a business model that's going to enable them to stand alone, and be competitive, and retain deposits and service customers the way that they have,” he added.

Regulators’ fears about regional banks with exposure to CRE aren’t unfounded, New York Community Bancorp (NYCB) being the prime example. Shares of NYCB have plummeted roughly 78% from their July 2023 peak due to concerns over the bank’s CRE exposure. The pain accelerated after NYCB reported a surprise fourth-quarter loss and slashed its dividend on Jan. 31, 2024, because it had to put away more money to cover its CRE holdings.

For Rechler, regional banks’ CRE exposure could even end up being a “systemic issue.”

“I think when you hear the Treasury or the regulators talk about, ‘Well, with real estate, this isn't a systemic issue,’ I think they're really focused on the large systemically important, too-big-to-fail banks,” he said. “But when you look at the regional banks around the country, they have a significant allocation of their loans to commercial real estate. A lot of it to multifamily developers that are going to have loans that are upside-down.”

Rechler went on to describe the dreaded “doom loop” that many regional banks may face. As Fortune previously reported, if depositors start to worry that regional banks with excessive CRE exposure could be in trouble, they may begin withdrawing funds. This loss of deposits, coupled with the increasing cost of compliance and insurance for CRE lenders due to regulatory pressure, could lead to more bank failures.

If more banks fail or are consolidated, they will complete the so-called doom loop by lowering the availability of CRE loans, hurting the industry. “The crisis will be exacerbated unless we take steps to unclog the financial plumbing and create some liquidity and price discovery in the market,” Rechler warned.

This is all why we keep telling you this:

Ok, so is it all DOOM and GLOOM?

What can you do about it?

Keep reading and I'll tell you!

Peter Schiff: "Gold is going to be revalued MUCH higher than it is..."

I've been telling you that you might want to get some GOLD for a while now...

I'm not a financial advisor, I'm just your humble reporter.

But someone who's much smarter than me and is a professional money manager just said something that you have to see.

That would be Peter Schiff and he just said on MeetKevin's podcast that Gold is about to be revalued MUCH higher!

Oh, and Patrick Bet-David loves gold too!

Check this out:

Peter Schiff: "Gold is going to be revalued MUCH higher than it is..."#GotGold ?@digitalassetbuy @DigPerspectives @realMeetKevin @PeterSchiff

READ THIS: https://t.co/8SfgaIbPgF pic.twitter.com/vmTuHQcAEY

— DailyNoah.com (@DailyNoahNews) February 8, 2024

Here is a dedicated video player if this is easier for you to see:

Peter Schiff: "Gold is going to be revalued MUCH higher than it is..."#GotGold ?@digitalassetbuy @DigPerspectives @realMeetKevin @PeterSchiff

READ THIS: https://t.co/8SfgaIbPgF pic.twitter.com/vmTuHQcAEY

— DailyNoah.com (@DailyNoahNews) February 8, 2024

You can watch the entire interview right here if you like:

Two VERY smart guys, Peter Schiff and Patrick Bet-David.

Here's more on Schiff if you don't know much about him:

Peter Schiff is an accomplished American economist, financial broker, author, and stock market commentator with a significant influence in finance and investment circles. Schiff is the CEO and chief global strategist of Euro Pacific Capital Inc., a brokerage firm founded in 1996, focused on international markets and securities. He has successfully expanded the firm's operations over the years, demonstrating his acumen in identifying growth opportunities and his expertise in global financial markets.

One of Schiff's major accomplishments is his prescient call on the 2008 financial crisis. He gained widespread recognition for his predictions of the housing market bubble and the ensuing financial crisis, which were made well before they occurred. His accurate forecast of these events earned him a reputation as a savvy investor and a keen observer of economic trends. Schiff's warnings about the dangers of excessive debt and speculative bubbles have been validated by market events, reinforcing his status as a forward-thinking economist.

In addition to his financial career, Peter Schiff is an accomplished author, having written several books on economics and investing. His works, including "Crash Proof: How to Profit From the Coming Economic Collapse," have been critically acclaimed for their insightful analysis and practical advice on safeguarding investments against economic downturns. Schiff's ability to break down complex economic concepts into accessible language has made his books popular among both novice and experienced investors.

Schiff has been a vocal advocate for sound money and fiscal conservatism, often appearing on financial news networks to share his views. His advocacy for gold as a hedge against inflation and currency devaluation has influenced many investors' strategies. Despite his sometimes controversial opinions, Schiff's expertise and deep understanding of economic principles have earned him respect in the investment community.

Speaking of Gold being revalued in the future, we first told you about that three months ago:

“Gold Revaluation” Incoming? Price Could Be $10,000-60,000 Per Ounce!

Ok so how can you get gold with NO MONEY OUT OF POCKET? Read below...

The ONLY Two Gold Companies I Am Proud To Partner With

We mostly cover politics here, but politics affects the economy and the economy affects...YOU and ME! And our pocketbooks.

Big league.

So in the midst of covering politics, we also cover money from time to time...and while I'm not a financial advisor, I share what I'm learning in the hopes that it can help you and keep you and your family safe.

And that often leads me to covering Gold and Silver.

You know, what they have always called "God's Money".

He made it, they aren't making any more of it, and it has always been highly valued as money from the beginning of time until now.

So I'm a big fan and I think it has the potential to do big things if, say, the U.S. Dollar were to suddenly collapse.

So that's why I talk about it and why I want to make sure everyone protects themselves and your families.

So to answer the question of "what can I do?" it's really quite simple: you need to get some #Gold or #Silver in your own possession.

It's called "physical" gold and silver.

Not paper traded garbage on the stock exchanges that isn't backed by anything.

Don't touch that stuff.

And because I get asked so much how to buy it and what the best places are, I thought I would publish this and just get it out there for all to have....

I have two special hook-ups for you and these are the ONLY two companies I am proud to partner up with on Gold and Silver.

Both involve PHYSICAL gold and silver.

Because if you do NOTHING else, make sure you own "physical" gold and silver, not paper contracts.

The paper contracts (like stock ticker SLV and GLD) could very well go POOF one day and disappear or go to zero, because they're not actually backed by the gold and silver they claim to represent.

It's a massive game of musical chairs out there and when the music stops (and I think it will stop soon...) people who only own paper might find themselves owning something not worth the paper it's literally written on.

And I know you'll never forget it if I give you this GIF so....Let's Get Physical:

Now...WHERE do you get physical gold and silver and how do you know it's real and safe?

And that you're getting the best price?

Oh, and how about personal one-on-one real customer service?

You know, like you were some Big Wig millionaire at Goldman Sachs who could just call their personal banker and get help?

That's what I'm about to tell you.

I have two killer connections for you...

The first is for purchasing gold and silver bullion.

That means bulk bars.

That's the cheapest and most economical way to do it, to stretch your dollar into as much gold and silver as possible.

The website is called WLT Precious Metals and when you see my logo in the top left-hand corner, you'll know you're in the right place.

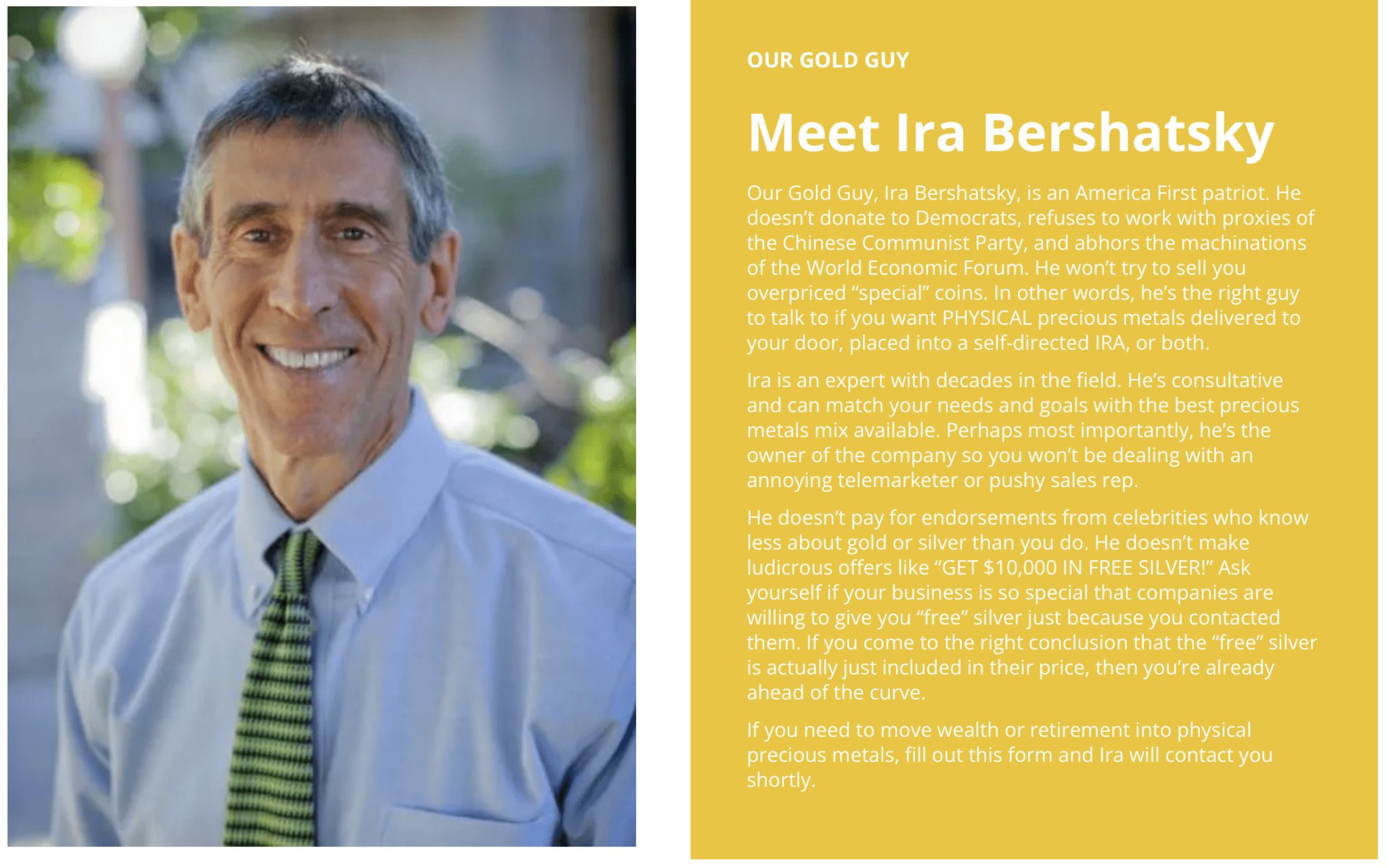

You'll get a personal phone call with Ira Bershatsky (or someone on his team) and they will work with you free of charge for as long as needed to answer any questions you have and get you taken care of.

How about that!

You don't see that much anymore, but Ira and his team pride themselves on good old-fashioned real customers service:

No sales pitch, just real, actual help.

And the best prices you will find.

Here's the only disclaimer I will give you: because they do pride themselves on dedicated service, it might take a few days before you get a phone call back. Just be patient.

Good things come to those who wait!

You can contact Ira and WLT Precious Metals here.

Ok, that was #1.

Now I want to tell you about option #2.

An equally great company, I am so happy to be working with these guys.

This next company is called Genesis Gold and this is for people who want to purchase real physical gold or silver in their IRAs (Investment Retirement Accounts).

You know what the beauty of that is?

Two huge benefits actually...

First is TAX FREE baby!

I'm not a tax advisor, but that's a general oversimplification.

Never pay more taxes than you are legally required to pay.

And that's why I love getting gold and silver in my IRA (and why I hold a large chunk in an IRA myself!).

Second is if you simply shift money out of stocks (like Peter Schiff recommends) and into Gold, it won't cost you anything! No money out of pocket!

BOOM!

There's so much to love about Genesis Gold, starting with the fact they are proudly and un-ashamedly Christina!

They call it "Faith-Driven Stewardship" and they put it right on the homepage of their website along with a quote from Ezekiel:

Here's more on why gold and silver in your IRA are so powerful:

You can contact Genesis Gold here.

They are also very backed up with record demand, so you may have to wait a bit, but someone WILL get in touch with you for personal customer service and assistance!

Tell 'em Noah sent ya!

Oh, and did you know Genesis is recommended by SUPERMAN himself?

It's true.

Superman himself, Clark Kent -- Dean Cain -- came on my show a few weeks ago and we broke it all down:

Watch here:

Stay safe!

Make sure you can weather the storm when it hits!

Because the storm always hits eventually, doesn't it?

As for me and my house, we will be ready. 💪

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!