Now this is what I like to hear!

The Texas Board of Education is telling BlackRock to go kick sand!

The reason is because they’ve connected the dots and realized that BlackRock is the all-powerful force behind all the DEI anti-White ESG propaganda that’s being pushed in our face daily.

They said that “BlackRock’s dominant and persistent leadership in the ESG movement immeasurably damages our state’s oil & gas economy…”

Not to mention all the other anti-American, anti-family actions that BlackRock is involved in.

Let’s hope this spread to other states!

Texas yanks $8.5B from Larry Fink’s BlackRock in ‘massive blow against the scam of ESG’ https://t.co/UwNS8buuOe pic.twitter.com/9rK5ivJ7KM

— New York Post (@nypost) March 19, 2024

National Review reports:

The Texas Board of Education is divesting $8.5 billion from BlackRock because of the asset manager’s Environmental, Social, and Governance investment philosophy.

The Texas Permanent School Fund (TPSF) will be terminating its financial relationship with BlackRock and searching for a new firm to manage its $8.5 billion of state assets, the TPSF notified BlackRock on Tuesday.

“Today, PSF leadership delivered an official notice to global asset manager BlackRock terminating its financial management of approximately $8.5 billion in Texas’ assets. Terminating BlackRock’s contract ensures PSF’s full compliance with Texas law,” Texas Board of Education Chairman Aaron Kinsey said in a statement shared with National Review.

“BlackRock’s dominant and persistent leadership in the ESG movement immeasurably damages our state’s oil & gas economy and the very companies that generate revenues for our PSF. Texas and the PSF have worked hard to grow this fund to build Texas’ schools.”

Texas state law prohibits state investment in financial services companies that boycott the oil and gas industry, a major aspect of the state economy. The environmental aspect of BlackRock’s ESG strategy promotes an economic transition away from fossil fuels and towards green energy investments.

“Today’s unilateral and arbitrary decision by Board of Education Chair Aaron Kinsey jeopardizes Texas schools and the families who have benefited from BlackRock’s consistent long-term outperformance for the Texas Permanent School Fund. The decision ignores our $120 billion investment in Texas public energy companies and defies expert advice. As a fiduciary, politics should never outweigh performance, especially for taxpayers,” BlackRock told National Review in a statement.

The TPSF outperformed BlackRock’s targeted benchmarks over the past five years net of fees, BlackRock said in an annual report last year. The fund achieved 6.14 percent returns last year, above the 4.38 percent benchmark, and a 6.19 percent return over five years, higher than the 5.52 percent.

Advocates against ESG believe the TPSF’s move to end its financial relationship with BlackRock is a significant step in the pushback against ESG.

“Under Larry Fink’s leadership, BlackRock has been misusing client funds to push a political agenda for years. Nowhere was that more egregious than in Texas, where BlackRock was simultaneously trying to destroy the domestic oil and gas industry while managing funds that depended on royalties derived from that very same industry. A more flagrant violation of fiduciary duty is difficult to imagine,” said Will Hild, executive director of Consumers’ Research, a leading consumer advocacy group. Hild is a prominent opponent of ESG and “woke” corporate activism.

Texas is not the only red state pushing back against BlackRock for its adoption of ESG investment goals. West Virginia Treasurer Riley Moore (R) placed BlackRock on its restricted financial institutions list in July 2022 for limiting business with the coal and natural gas sectors without a reasonable business purpose. The state recently warned six financial institutions they could be added to the list because of their environmental investing goals.

“Today’s bold step by Aaron Kinsey and the Permanent School Fund of Texas, in accordance with state law, is a massive blow against the scam of ESG,” State Financial Officers Foundation CEO Derek Kreifels told NR.

And make no mistake, Larry Fink will NEVER back away from ESG/DEI unless made to do so by force.

Why? Because it aligns with his belief system.

Don’t let the headline mislead you.

Black Rock CEO isn’t ashamed of ESG.

He’s ashamed that he was too slow to recognize the public’s growing awareness of the discriminatory practice that he promotes – ESG.

Larry Fink will continue to champion it, but with a rephrased name. pic.twitter.com/mFlZFmvBlE

— ZNO 🇺🇸 (@therealZNO) June 26, 2023

Also, Larry Fink is sort of like the secret Bill Gates.

Not as many people know about him but that’s changing.

And while his net worth isn’t as much as Gates, what he controls is far greater as BlackRock manages assets totaling over 9 TRILLION dollars.

And like Gates, he’s behind the scenes buying up everything, from single family residence homes to farmland, even in Ukraine.

Because he has a few spare billions lying around so he figured, what the heck, why not buy some farmland.

I’m guessing there’s an agenda at play here.

Larry Fink the Chairman of Blackrock is preparing to spend billions of dollars to buy vast tracks of Ukrainian farmland.

Paying attention?

— Douglas Macgregor (@DougAMacgregor) March 18, 2024

🚩 Robert F. Kennedy Jr Warns of BlackRock's Plan to 'Gain Ownership of All the Single-Family Residences in This Country'

"Most of us know people who were about to buy a home. They were ready to do it and at the last moment, somebody comes in with a cash offer and scoops it out… pic.twitter.com/U2eWSgji73

— Chief Nerd (@TheChiefNerd) August 25, 2023

BONUS:

Have you heard of Rupes Nigra?

It means Black Rock and it’s supposedly a massive mountain at the North Pole.

Is that where BlackRock got their name?

Hidden in plain sight.

Rumor has it that this mountain is comprised of lodestone, which is composed of a mineral called magnetite.

Ergo, this mountain is magnetized.

Is that why the needle on all compasses points north?

Because there’s a huge mountain there that contains magnetite?

Could God be that clever?

The elites wouldn’t try to hide this would they? That’s not like them.

Let’s go visit the North Pole and try to find it.

Oh, wait. The military is camped out up there to block anyone trying to trek that far north.

I wonder why?

Here’s a 400 year old map that’s from Atlas (Mercator, G. and Hondius, J. 1606)

What’s that in the middle?

‘Rupes nigra…’

Why that’s odd.

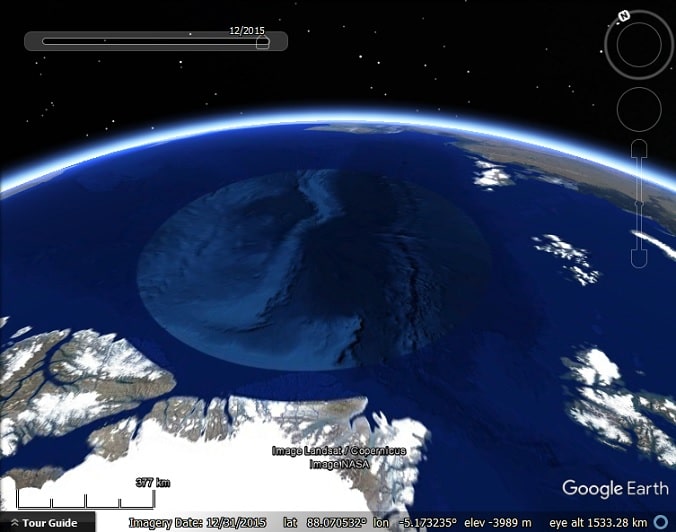

Google has blocked out that area on Google Earth.

Are they trying to hide something?

This is an old video clip taken above the North Pole.

Is this what they’re blocking out?

We’ve been told more lies than we think.

Stay curious, my friends.

MORE:

UPDATE: BlackRock Now Advising Its Clients Invest In Gold! We Told You First!

We are proud of our reporting here and we’re always proud to be on a story first.

While the Big Banks and the Financial MSM Talking Heads “talk their book” (which means telling you to sell when they’re actually buying), we’ve been shooting you straight here.

Now it looks like even BlackRock is boarding the long-gold trade.

Just remember we told you first — months ago!

BlackRock, the world’s largest asset management firm and the biggest promoters of Environment, Social, and Governance (ESG) investments, has released a report recommending investors allocate money into physical precious metals.

“Gold is having a moment; one we believe is likely to continue. The precious metal has risen over 8% so far in 2023, thanks to a combination of positive factors,” the analysts said in the report. “Gold fell from its May 3 high around $2050 per ounce amid expectations the U.S. would avoid missing the deadline to raise the debt ceiling. That said, the decline occurred after gold rallied nearly 30% from its 52-week low. If gold proves able to sustain a rally above its 10-year high of $2067, that may suggest another leg in the rally is likely.”

“This move is not surprising considering they’re in the business of not only making money, but making sure their investors don’t lose too much,” said Jonathan Rose, co-founder of Genesis Gold Group.

“They are pushing ESG funds which have proven to lose money, so promoting gold at this time makes sense as they try to achieve balance.”

While BlackRock and the World Economic Forum claim ESG funds are beneficial, their actions do not jibe with their words.

Even the Biden-Harris regime has tried to force the issue by incentivizing financial advisors to push ESG investments even as they continuously lose money.

This is why tens of thousands of Americans are moving their retirement accounts to self-directed IRAs backed by physical precious metals.

Unlike a traditional IRA, a self-directed IRA allows individuals to invest in a broader range of assets (including gold) while benefiting from similar tax advantages as a traditional IRA.

Step 1: Opening Your Self-Directed IRA

– To open a self-directed IRA, many people typically work with a precious metals provider such as Genesis Gold Group who can walk you through each step of the process.

Step 2: Funding Your Self-Directed IRA

– You can fund your self-directed IRA by rolling over or transferring assets from your existing retirement accounts, such as a 401(k), 403(b), TSP, savings, or other IRA accounts. Those rollovers and transfers usually take place without tax consequences. Once your self-directed IRA is funded, you can buy gold as part of your retirement account.

Click here to get in touch with Genesis Gold Group today.

Unlike other precious metals companies, Genesis Gold Group does not take advantage of investors’ angst to push them into the wrong metals.

Their focus is on customer service and putting the right mix of metals into their clients’ portfolios through rollovers or transfers of retirement accounts. This is why they don’t engage in the devious ploy of “free” silver marketing.

BlackRock is not alone with their sudden adoration of precious metals. China continues to ramp up purchases of gold, hitting all-time highs each of the last seven months.

Central Banks have been buying as much gold as they can for two years, slowing only recently when investors started noticing and calling them out.

If you’re concerned about the future, contact Genesis Gold Group…

You’ll receive a free Definitive Gold Guide and you’ll work with faith-driven, patriotic experts who can set up your retirement accounts with any desired mix of physical precious metals.

Click here to talk to Genesis Gold Group today.

p.s. Did you know Superman likes them too?

That’s right, Dean Cain is a big fan just like I am…watch here:

(Note: The information provided by WLTReport or any related communications is for informational purposes only and should not be considered as financial advice. We do not provide personalized investment, financial, or legal advice.)

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!