Will we see a bank crash on Monday?

I don’t know.

It’s very possible we don’t.

But does Monday kick off a chain reaction that will soon lead to one?

Now THAT I think is very possible.

I’m not a financial advisor, I’m just a reporter but this is a big deal….

Remember the Banking Crisis of 2023?

Back in March/April of last year, when 4 banks failed all within a few weeks of each other?

Well, it turns out the way they stopped that bank run crisis and the contagion from spreading was something known as the Bank Term Funding Program. And that has been running ever since. But it ends on Monday. What happens when you remove the safety from the system?

Let me put it like this…imagine you have a big giant skyscraper that suddenly becomes very unbalanced and is about to tip over. An emergency crew rushes in and builds tons of reinforcements, stabilizing the building. It stays stable for over a year. Then the reinforcements are removed. What happens next?

Don’t worry, you don’t need to be a banker or expert economist to understand this, I’ll make it simple for you.

In fact, I’ll let Grok explain it for you:

And in case that’s hard to read:

The Bank Term Funding Program (BTFP) is an emergency lending program created by the Federal Reserve in March 2023 to provide emergency liquidity to U.S. depository institutions. It was established in response to the sudden bank failures of Signature Bank and Silicon Valley Bank, which were the largest such collapses since the 2008 financial crisis. The program offers loans of up to one year in length to eligible borrowers pledging collateral eligible for purchase by Federal Reserve Banks in open market operations.

The program started on March 12, 2023, and is scheduled to end on March 11, 2024. The Federal Reserve has announced that the program will cease making new loans as scheduled.

The ending of the BTFP might create chaos and even a banking crisis or bank crash because it has provided an additional source of liquidity for financial institutions with an asset-liability duration mismatch relating to high-quality collateral. The program’s goal was to provide banks an alternative to quickly selling off high-quality collateral at current discounted market values to fund liquidity needs.

If the program ends, banks that have been relying on the BTFP for liquidity may find themselves in a difficult position, potentially leading to a banking crisis or bank crash. However, the Federal Reserve has stated that the program’s ending is a planned measure and part of its effort to demonstrate support for the banking system.

ADVERTISEMENT

In other words, I like the way this guy said it — the Fed just pulled the Bank’s safety net:

The Fed just rug pulled the bank’s safety net on their emergency Bank Term Funding Program that was implemented to slow down deposit flight after SVB’s rapid failure. Stop the arb now and ending program in March. https://t.co/qkskXFo6Tl pic.twitter.com/dEQZdnOjKh

— Edward Dowd (@DowdEdward) January 25, 2024

UH OH!!!

Here it is from the Fed’s own Twitter account:

@federalreserve announces that the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11: https://t.co/W4dc2cj6TB

— Federal Reserve (@federalreserve) January 25, 2024

And the official Press Release from the Federal Reserve:

The Federal Reserve Board on Wednesday announced that the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11. The program will continue to make loans until that time and is available as an additional source of liquidity for eligible institutions.

During a period of stress last spring, the Bank Term Funding Program helped assure the stability of the banking system and provide support for the economy. After March 11, banks and other depository institutions will continue to have ready access to the discount window to meet liquidity needs.

ADVERTISEMENTAs the program ends, the interest rate applicable to new BTFP loans has been adjusted such that the rate on new loans extended from now through program expiration will be no lower than the interest rate on reserve balances in effect on the day the loan is made. This rate adjustment ensures that the BTFP continues to support the goals of the program in the current interest rate environment. This change is effective immediately. All other terms of the program are unchanged.

The BTFP was established under Section 13(3) of the Federal Reserve Act, with approval of the Treasury Secretary.

Nothing has improved from last year, it’s only been covered up by this program.

And interest rates are now higher creating more pressure on the system.

In other words…not good!

So…what happens when the safety net gets pulled?

It should be interesting to see what happens when the BTFP ends in March.

This is the emergency loan program that the Fed established during the regional bank crisis.

Small banks are still feeling the pain.

Follow us @KobeissiLetter for real time analysis as this develops.

— The Kobeissi Letter (@KobeissiLetter) January 31, 2024

Brandon Aceto did a good job of breaking it all down here:

Heads up folks…this could get VERY ugly, VERY fast.

And I think we’re already seeing the early cracks start to form.

Below is the first bank that many believe is starting to fail.

If that has already started on January 31st, what happens when we get closer to March 11? Or after March 11?

There’s a reason I keep telling you it might be a good idea to get your money into GOLD.

READ BELOW TO SEE EXACTLY HOW TO DO IT — FOR MANY OF YOU, WITH NO MONEY OUT OF POCKET! YES REALLY!

Andy Shectman: “No one wants to sell their Gold or Silver at these make believe prices”

I’ve been telling you for a long time now that Gold and Silver are vastly undervalued.

I’m not a financial advisor and I can’t tell you what to do, but I can look at historical data and I can easily see that the current price of Gold and Silver makes no sense unless….it’s being manipulated.

Now who would want to do that?

And the more important question: will it go on forever, or do the manipulators eventually release the stretched rubber band and ride an explosion up?

I’ve you’ve been paying attention in life, you know the answer.

You know these crooks on Wall Street manipulate things down, ⭐️ then they load their boats, then they manipulate them up into a bubble.

Where are we in that process right now for commodities like Gold and Silver?

Right exactly where I placed that star up above.

⭐️ = You Are Here

The Big Boys are loading their boats.

But that’s not just my opinion.

I’m a nobody.

Listen to Andy Schectman who is an expert on these things and he lays it out PERFECTLY in two minutes.

Here’s my rough paraphrase:

“A concerted effort by the very powerful to use the suppression of commodities (gold, silver, but also a long list of all other commodities)…these countries are not complaining about suppressed low prices yet because they’re accumulating! But once it becomes obvious that the availability of these commodities is very scarce and no one wants to sell at these “make believe prices” then the public says “OMG, what have we been missing?” And maybe that all happens in concert with a breakdown of the banking system, then the public says “give it to me now” and that’s when you’ll see the circuit breakers be put into affect. But at that point it’s too late.”

Oh my!

It’s so much better to listen to him explain it in his own words.

It’s just 2 minutes long.

Watch here (as presented by my friend the Digital Asset Investor):

Comex 589 pic.twitter.com/uPzrOGXhZ5

— Digital Asset Investor (@digitalassetbuy) September 11, 2023

Or if that doesn’t work, try this:

Andy Shectman:

“A concerted effort by the very powerful to use the suppression of commodities (gold, silver, but also a long list of all other commodities)…these countries are not complaining about suppressed low prices yet because they’re accumulating! But once it becomes… pic.twitter.com/PyDSyEnCFX— DailyNoah.com (@DailyNoahNews) December 14, 2023

So, what can YOU do to protect yourself?

To protect your family?

To stay safe?

Simple: you need to get some #Gold or #Silver in your own possession.

It’s called “physical” gold and silver.

Not paper traded garbage on the stock exchanges that isn’t backed by anything.

Don’t touch that stuff.

I have two special hook-ups for you.

Both involve PHYSICAL gold and silver.

Because if you do NOTHING else, make sure you own “physical” gold and silver, not paper contracts.

The paper contracts (like stock ticker SLV and GLD) could very well go POOF one day and disappear or go to zero, because they’re not actually backed by the gold and silver they claim to represent.

It’s a massive game of musical chairs out there and when the music stops (and I think it will stop soon…) people who only own paper might find themselves owning something not worth the paper it’s literally written on.

And I know you’ll never forget it if I give you this GIF so….Let’s Get Physical:

Now…WHERE do you get physical gold and silver and how do you know it’s real and safe?

And that you’re getting the best price?

Oh, and how about personal one-on-one real customer service?

You know, like you were some Big Wig millionaire at Goldman Sachs who could just call their personal banker and get help?

That’s what I’m about to tell you.

I have two killer connections for you…

The first is for purchasing gold and silver bullion.

That means bulk bars.

That’s the cheapest and most economical way to do it, to stretch your dollar into as much gold and silver as possible.

The website is called [DELETED] and when you see my logo in the top left-hand corner, you’ll know you’re in the right place.

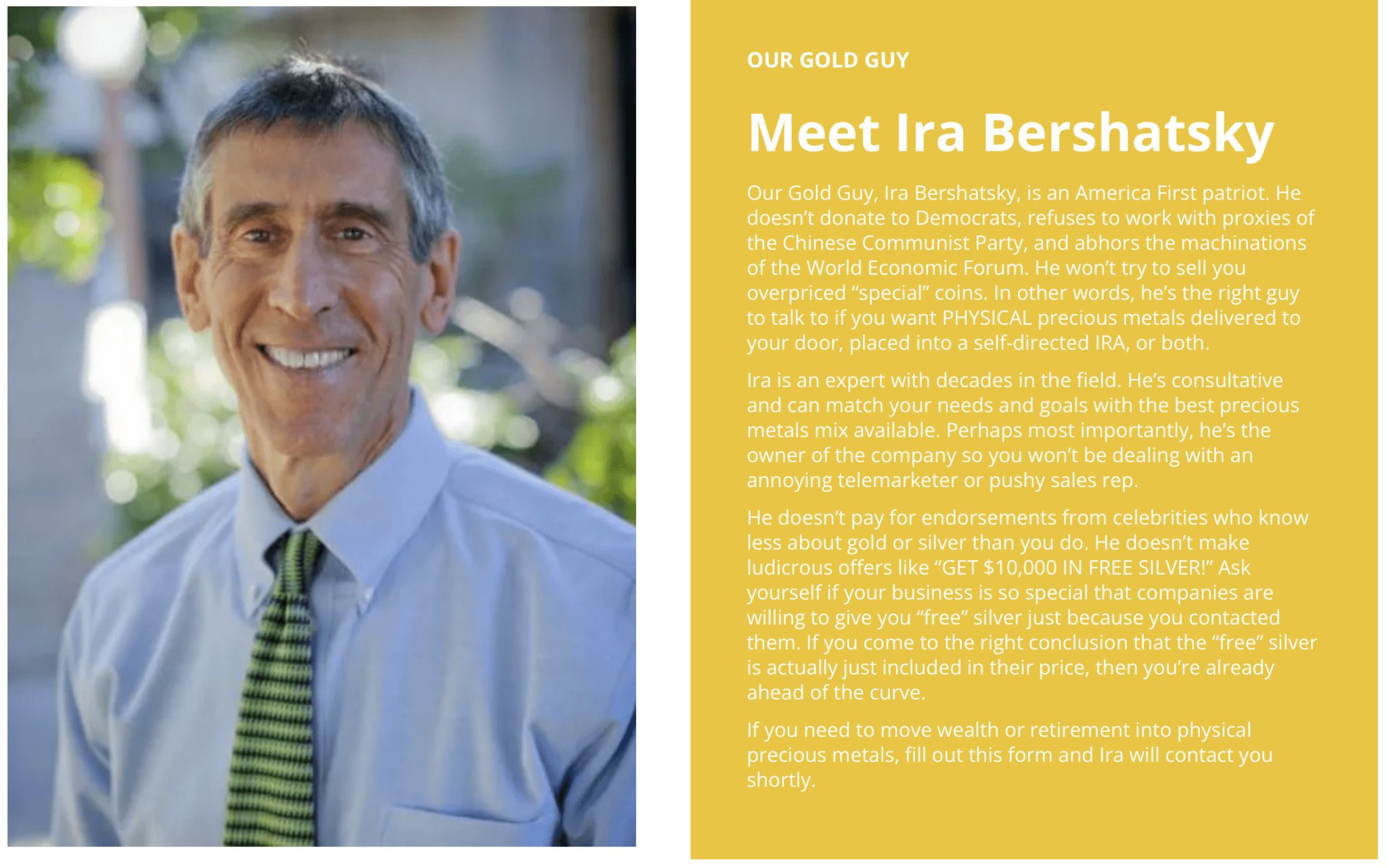

You’ll get a personal phone call with Ira Bershatsky (or someone on his team) and they will work with you free of charge for as long as needed to answer any questions you have and get you taken care of.

How about that!

You don’t see that much anymore, but Ira and his team pride themselves on good old-fashioned real customers service:

No sales pitch, just real, actual help.

And the best prices you will find.

Here’s the only disclaimer I will give you: because they do pride themselves on dedicated service, it might take a few days before you get a phone call back. Just be patient.

Good things come to those who wait!

You can contact Ira and [DELETED] here.

Ok, that was #1.

Now I want to tell you about option #2.

An equally great company, I am so happy to be working with these guys.

This next company is called Genesis Gold and this is for people who want to purchase real physical gold or silver in their IRAs (Investment Retirement Accounts).

You know what the beauty of that is?

TAX FREE baby!

I’m not a tax advisor, but that’s a general oversimplification.

Never pay more taxes than you are legally required to pay.

And that’s why I love getting gold and silver in my IRA (and why I hold a large chunk in an IRA myself!).

There’s so much to love about Genesis Gold, starting with the fact they are proudly and un-ashamedly Christina!

They call it “Faith-Driven Stewardship” and they put it right on the homepage of their website along with a quote from Ezekiel:

Here’s more on why gold and silver in your IRA are so powerful:

You can contact Genesis Gold here.

They are also very backed up with record demand, so you may have to wait a bit, but someone WILL get in touch with you for personal customer service and assistance!

Tell ’em Noah sent ya!

Oh, and did you know Genesis is recommended by SUPERMAN himself?

It’s true.

Superman himself, Clark Kent — Dean Cain — came on my show a few weeks ago and we broke it all down:

Watch here:

Stay safe!

Make sure you can weather the storm when it hits!

Because the storm always hits eventually, doesn’t it?

As for me and my house, we will be ready.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!