Allow me to tell you a story about 2008/2009…

The stock market crash in ’08/09 has now been dubbed the “Great Recession”. How charming.

Most people don’t know this, but in the months leading up to the Great Recession, all of the economic data released by the Government looked good.

Things are great, they shouted on CNBC!

Never been better!

And then, of course, the crash.

Very, very nasty, so much so that they named it after the 1929 crash (the Great Depression).

But here’s the part most people don’t know….

While they lied to you in the months leading up to the crash by giving you data that looked really good, they later “revised” that data after the crash to admit just how bad things actually were.

It’s true and here are the details of how it went down:

Economic data is often subject to revisions as more accurate information becomes available, a process that is normal and expected in the realm of economic analysis. Following the 2008/09 financial crisis, several key economic indicators were indeed revised to reflect more accurate or updated assessments of economic conditions. These revisions can result from a variety of factors, including late reporting by respondents, errors in data collection, or changes in methodology. Here are a few notable examples:

- Gross Domestic Product (GDP): GDP estimates are frequently revised as more complete data becomes available. After the 2008 financial crisis, initial estimates of GDP growth were revised to show a deeper recession than initially reported. For instance, the U.S. Bureau of Economic Analysis (BEA) often revises GDP data as part of its regular process, reflecting more complete and accurate information that was not available at the time of the initial estimate.

- Employment figures: The U.S. Bureau of Labor Statistics (BLS) regularly revises employment figures as more comprehensive data from employers becomes available. After the 2008 crisis, employment losses in certain months were found to be more severe than initially reported, reflecting the depth of the job market’s struggles.

- Housing market data: Data on home sales, prices, and construction starts are also subject to revisions. The severity of the housing market collapse leading up to and following the 2008 crisis was, in some cases, understated in initial reports. Later revisions showed a steeper decline in home prices and a higher number of foreclosures.

- Banking and financial sector metrics: Data on bank losses, write-downs, and the overall health of the financial sector were revised as the full extent of the crisis became clear. Initially, the magnitude of toxic assets held by banks and their impact on financial stability was not fully recognized.

- Consumer confidence and spending: Estimates of consumer confidence and retail spending are also revised. The revisions can reflect a more accurate picture of consumer sentiment and spending behavior during the crisis.

So my question to you is this: does any of that sound familiar?

What is the Government telling us now?

There’s no inflation!

In fact, inflation is coming down!

Things look good!

And yet, everywhere I look things DON’T look good.

Every time I go to the grocery store, my bill is higher than the last time.

I see inflation everywhere!

I see companies laying off tons of people!

So I have to ask….is it possible, just POSSIBLE, that history is repeating itself? And our Government is lying to us again right before another big crash?

I’ll let you answer that for yourself, but here’s the latest.

Citigroup is laying off more people….you know, the Banking sector that is supposed to be so robust and healthy?

Then why do they keep firing people?

➡️ Citigroup to Lay Off 286 Employees in New York

The planned cull was revealed in State Dept of Labor filings, at a time the bank is carrying out its biggest overhaul in decades.

Citigroup announced in January plans to cut 20k jobs over the next two years, while acknowledging… pic.twitter.com/WzJNQHTKru

— Noah Christopher (@DailyNoahNews) February 29, 2024

Laying off 286 employees in New York.

And that’s just a drop in the bucket amidst the already-announced 20,000 layoffs that are still coming!

Citigroup CEO Jane Fraser got a 6% pay bump for her performance in 2023, a year the bank's profits dropped 38% and Fraser began a dramatic restructuring that will result in an estimated 20,000 job cuts. https://t.co/lqvFw4qsMg

— Yahoo Finance (@YahooFinance) February 24, 2024

Oh but don’t worry about the CEO, she will be just fine.

In fact, they’re giving her a 6% pay bump!

From Yahoo Finance:

Citigroup CEO Jane Fraser got a 6% pay bump for her performance in 2023, a year the bank’s profits dropped 38% and Fraser began a dramatic restructuring that will result in an estimated 20,000 job cuts.

The board awarded her total compensation of $26 million, Citigroup (C) said in a Tuesday regulatory filing. The amount includes a base salary of $1.5 million and $24.5 million in cash as well as deferred stock and performance-based compensation units vesting in the coming years.

The award, which was up from $24.5 million in 2022, reflected the board’s “belief that Ms. Fraser’s strategic and other priorities are sound and that she is executing on them promptly and thoughtfully, with an eye towards driving long-term sustainable growth, improved returns and enhanced safety and soundness,” according to the filing.

The $26 million for Fraser was the lowest among CEO rivals at JPMorgan Chase, Bank of America, Wells Fargo, Goldman Sachs, and Morgan Stanley, who received between $29 million and $37 million. Bank of America’s Brian Moynihan was the only CEO among this group to experience a compensation decline.

A bigger pay raise than Jamie Dimon!

Citigroup, amid layoffs, gives CEO Jane Fraser bigger pay raise than Jamie Dimon https://t.co/aIBGS6cQTn pic.twitter.com/cz2zIw5eoM

— New York Post (@nypost) February 21, 2024

And speaking of Jamie Dimon, why are all the BIG DOGS at all these huge companies rushing to sell their stock?

Have you seen this?

I just did a 5-part series on this.

Part 1:

Insider’s Selling (Part 1): Jeff Bezos Sells $8.5 BILLION of Amazon Stock

Part 2:

Insider’s Selling (Part 2): Walton Family Cashes Out of Wal-Mart!

Part 3:

Insider’s Selling (Part 3): Jamie Dimon Sells MILLIONS Of Stock — First Time Ever In Over 18 Years

Part 4:

Part 5:

Now ask yourself this….

What do they know that YOU don’t know?

Probably a lot, right?

And do they tend to time the markets much better than you?

Of course they do.

Almost as good as Nancy Pelosi!

So what can you do?

Simple: follow what they DO, not what they SAY!

I am NOT a financial advisor, but if you feel like you want to follow these guys and get OUT of stocks and into something safe like Gold, here are the only two Gold companies I trust to work with.

They will take VERY good care of you if you need assistance:

The ONLY Two Gold Companies I Am Proud To Partner With

We mostly cover politics here, but politics affects the economy and the economy affects…YOU and ME! And our pocketbooks.

Big league.

So in the midst of covering politics, we also cover money from time to time…and while I’m not a financial advisor, I share what I’m learning in the hopes that it can help you and keep you and your family safe.

And that often leads me to covering Gold and Silver.

You know, what they have always called “God’s Money”.

He made it, they aren’t making any more of it, and it has always been highly valued as money from the beginning of time until now.

So I’m a big fan and I think it has the potential to do big things if, say, the U.S. Dollar were to suddenly collapse.

So that’s why I talk about it and why I want to make sure everyone protects themselves and your families.

So to answer the question of “what can I do?” it’s really quite simple: you need to get some #Gold or #Silver in your own possession.

It’s called “physical” gold and silver.

Not paper traded garbage on the stock exchanges that isn’t backed by anything.

Don’t touch that stuff.

And because I get asked so much how to buy it and what the best places are, I thought I would publish this and just get it out there for all to have….

I have two special hook-ups for you and these are the ONLY two companies I am proud to partner up with on Gold and Silver.

Both involve PHYSICAL gold and silver.

Because if you do NOTHING else, make sure you own “physical” gold and silver, not paper contracts.

The paper contracts (like stock ticker SLV and GLD) could very well go POOF one day and disappear or go to zero, because they’re not actually backed by the gold and silver they claim to represent.

It’s a massive game of musical chairs out there and when the music stops (and I think it will stop soon…) people who only own paper might find themselves owning something not worth the paper it’s literally written on.

And I know you’ll never forget it if I give you this GIF so….Let’s Get Physical:

Now…WHERE do you get physical gold and silver and how do you know it’s real and safe?

And that you’re getting the best price?

Oh, and how about personal one-on-one real customer service?

You know, like you were some Big Wig millionaire at Goldman Sachs who could just call their personal banker and get help?

That’s what I’m about to tell you.

I have two killer connections for you…

The first is for purchasing gold and silver bullion.

That means bulk bars.

That’s the cheapest and most economical way to do it, to stretch your dollar into as much gold and silver as possible.

The website is called WLT Precious Metals and when you see my logo in the top left-hand corner, you’ll know you’re in the right place.

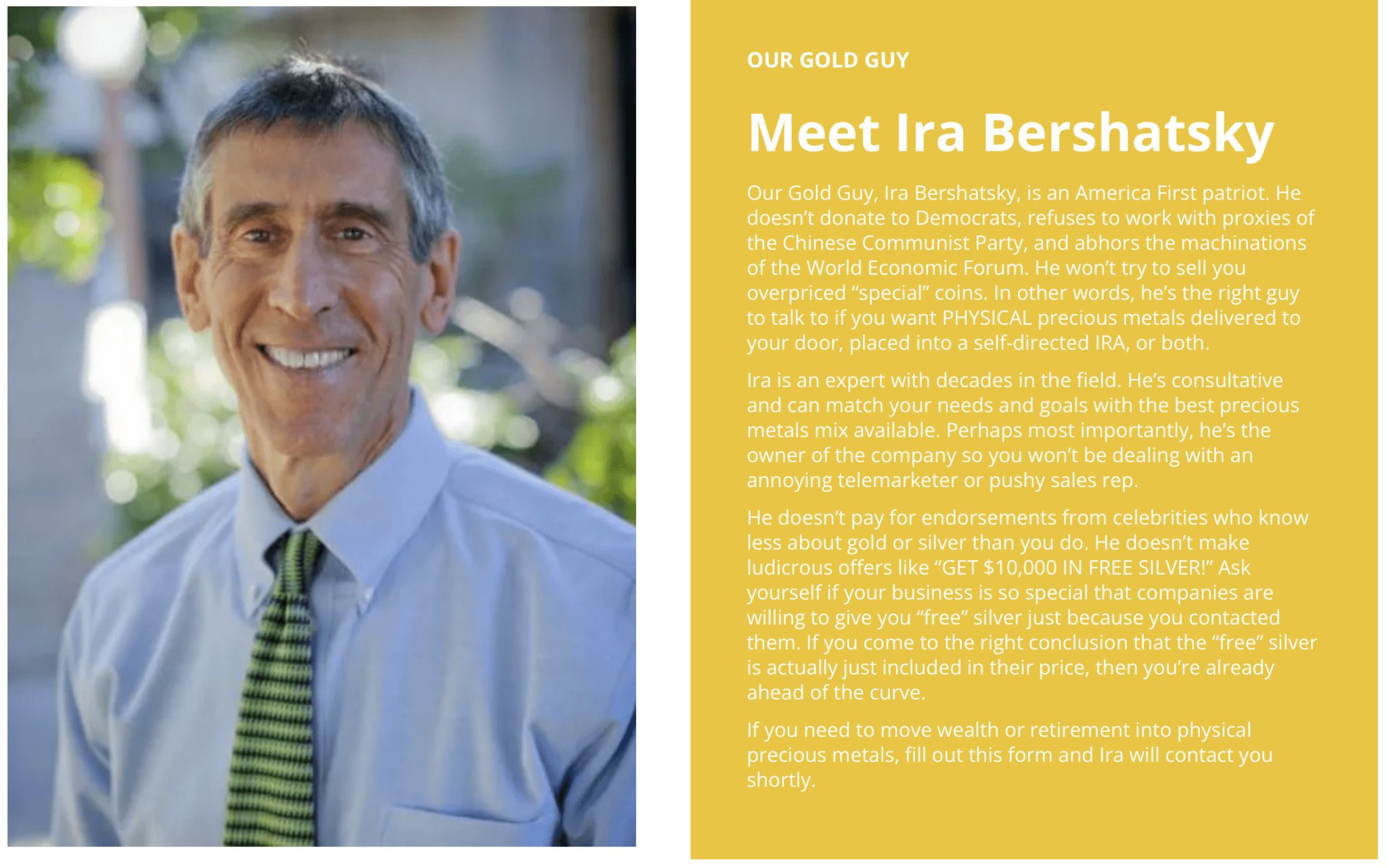

You’ll get a personal phone call with Ira Bershatsky (or someone on his team) and they will work with you free of charge for as long as needed to answer any questions you have and get you taken care of.

How about that!

You don’t see that much anymore, but Ira and his team pride themselves on good old-fashioned real customers service:

No sales pitch, just real, actual help.

And the best prices you will find.

Here’s the only disclaimer I will give you: because they do pride themselves on dedicated service, it might take a few days before you get a phone call back. Just be patient.

Good things come to those who wait!

You can contact Ira and WLT Precious Metals here.

Ok, that was #1.

Now I want to tell you about option #2.

An equally great company, I am so happy to be working with these guys.

This next company is called Genesis Gold and this is for people who want to purchase real physical gold or silver in their IRAs (Investment Retirement Accounts).

You know what the beauty of that is?

Two huge benefits actually…

First is TAX FREE baby!

I’m not a tax advisor, but that’s a general oversimplification.

Never pay more taxes than you are legally required to pay.

And that’s why I love getting gold and silver in my IRA (and why I hold a large chunk in an IRA myself!).

Second is if you simply shift money out of stocks (like Peter Schiff recommends) and into Gold, it won’t cost you anything! No money out of pocket!

BOOM!

There’s so much to love about Genesis Gold, starting with the fact they are proudly and un-ashamedly Christina!

They call it “Faith-Driven Stewardship” and they put it right on the homepage of their website along with a quote from Ezekiel:

Here’s more on why gold and silver in your IRA are so powerful:

You can contact Genesis Gold here.

They are also very backed up with record demand, so you may have to wait a bit, but someone WILL get in touch with you for personal customer service and assistance!

Tell ’em Noah sent ya!

Oh, and did you know Genesis is recommended by SUPERMAN himself?

It’s true.

Superman himself, Clark Kent — Dean Cain — came on my show a few weeks ago and we broke it all down:

Watch here:

Stay safe!

Make sure you can weather the storm when it hits!

Because the storm always hits eventually, doesn’t it?

As for me and my house, we will be ready. 💪

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!