Evergrande, one of China’s largest property developers, has collapsed.

The property giant’s collapse comes after a Hong Kong court ruled for Evergrande to be liquidated after the company was unable to “restructure the $300 billion it owed investors.”

Evergrande’s fall is another sign China’s economy is facing a time of slow growth and stagnation.

In 2018, Evergrande was deemed as the world’s most valuable real estate company.

A Hong Kong court has ordered the liquidation of china Evergrande group, the world's most indebted developer with over $300 billion in liabilities.@SaroyaHem examines its role on the Chinese economy pic.twitter.com/H4FDrbIpeA

— WION (@WIONews) January 29, 2024

🚨🇨🇳 China – Property Developer Evergrande ordered to liquidate

Global Financial Collapse incoming…. pic.twitter.com/gPlil4uqt9

— Concerned Citizen (@BGatesIsaPyscho) January 29, 2024

Per NPR:

A Hong Kong court has ordered the liquidation of the Evergrande Group, China’s giant and massively indebted real estate developer, after the company was unable to restructure the $300 billion it owed investors.

ADVERTISEMENTJust six years ago, Evergrande was riding high, preselling apartments to middle- and upper-income Chinese. In 2018, it was listed as the world’s most valuable real estate company. But just three years later, it was on the financial ropes. Massively overleveraged and unable to complete some existing projects, Evergrande has become symbolic of a Chinese economy that faces some major near-term obstacles: slowing growth, increasing debt and a shrinking workforce.

Evergrande had been seeking a $23 billion debt restructuring plan, but that fell apart last year when the company’s billionaire CEO, Hui Ka Yan, also known as Xu Jiayin — once one of Asia’s richest people — came under investigation for unspecified criminal behavior.

China invests roughly 20% to 30% of gross domestic product annually in the economy’s property and infrastructure sectors.

Although Evergrande’s demise is unlikely to have an immediate impact on U.S. consumers, it is yet another indicator that China’s economy — which makes up about 20% of the world’s GDP — is undergoing a painful period of slowdown, and that could result in slower global growth down the road.

GCH Nonresident Senior Fellow @dtiffroberts spoke to @NPR about the collapse of China's Evergrande property developer.

Read More:https://t.co/S2wB2CLKo0

— ACGlobalChina (@ACGlobalChina) February 1, 2024

Here’s what The Guardian reported:

As China’s most embattled – and indebted – property developer is ordered to liquidate, the effects that Evergrande’s collapse will have on investors, debt holders and the hundreds of thousands of homebuyers who have paid deposits for homes remains uncertain.

Evergrande, the Chinese property developer, was worth just $275m on Monday, down 99% from its peak in 2017. It owes more than $300bn to various creditors, according to its most recent financial report.

In a scathing judgment delivered in Hong Kong’s high court on Monday, Justice Linda Chan said “enough is enough”.

“It is indisputable that the company is grossly insolvent and is unable to pay its debts,” Chan wrote, as she ordered the company to liquidate its assets.

ADVERTISEMENT

⚠️WORLDS LARGEST REAL ESTATE DEVELOPER GOING BANKRUPT!⚠️

We're covering the Evergrande collapse today on the morning show – going live in less than 1 hour! pic.twitter.com/P5ul3wQrSL

— Discover Crypto (@DiscoverCrypto_) January 29, 2024

Folks, can you see the writing on the wall?

I can.

This comes directly on the heels of THIS happening yesterday here in the U.S.:

Bank Crash 2.0 Incoming? Another Bank On The Verge Of Collapse — Death Candle — Trading Halted!

Heads up folks…

I’ve been on my soapbox sounding the alarm about the banking system for the past several months.

We had 6 banks crash and collapse last year in 2023 and many thought the Banking Crash was over.

I kept telling you it wasn’t.

I kept telling you I feared that was just the prelude.

This is one of those times I wished I was wrong, but it’s not looking like I will be.

In fact, it’s looking like the Bank Crash 2.0 is right around the corner.

Here’s what’s happening right now as I type this:

JUST IN – New York Community Bancorp stock crashes, trading halted.

— Disclose.tv (@disclosetv) January 31, 2024

This is what the chart looks like:

https://twitter.com/WhaleWire/status/1752731983078097093

This is the same bank that bought Signature Bank last year….gee, I guess the contagion spread?

Who would have thought?

While everyone is focused on Mag7s, NYCB – New York Community Bancorp (yes, the bank that bought troubled Signature Bank last year) announced a $260M loss in Q4, and the stock opened down 40%.

What was in that loan portfolio? pic.twitter.com/lzNlj9ED1t

— James Lavish (@jameslavish) January 31, 2024

Many are calling this the “death candle”:

🚨 BREAKING: New York Community Bancorp #NYCB shows a concerning Death Candle. $NYCB pic.twitter.com/cTVi3xzwtX

— Financial Summit (@FinSummit) January 31, 2024

I asked Grok if New York Community Bank is collapsing and here’s what it said:

Quote: “It is facing significant challenges….[but]…..it would be premature to conclude the bank is failing.

Anyone else get echoes of Jim Cramer in 2009 when you hear that?

“BEAR STERNS IS FINE!”

Remember this?

On this day in 2008 Bear Stearns was bailed out by JP Morgan $JPM and The Federal Reserve at $2 per share

Six days prior Jim Cramer told Mad Money viewers that “Bear Stearns is fine” and to “not pull money out” pic.twitter.com/9H68ztTZsU

— Ticker History 🗞 (@TickerHistory) March 16, 2023

Here’s what I just wrote:

"BEAR STERNS IS FINE!" — Jim Cramer

On March 16 in 2008 Bear Stearns was bailed out by JP Morgan $JPM and The Federal Reserve at $2 per share.

Six days prior Jim Cramer told Mad Money viewers that "Bear Stearns is fine" and to "not pull money out".

History is about to repeat… pic.twitter.com/yaeKeXoqQ6

— Noah Christopher (@DailyNoahNews) January 31, 2024

Look, I’m not a financial advisor….

I’m not an accountant….

I’m not a TV guru like Jim Cramer (thank God!).

I’m just a reporter and a dot-connector and I’m telling you I think a major crash is right around the corner.

I think it’s likely this bank fully goes under or gets bought out….

I think you see a much bigger name go down next, and if I had to pick one I’d say it’s Citibank….

And I’ll leave you with this….

The time to get prepared is NOT after the crash starts.

The time to get prepared is now.

And while I’m not a financial advisor, I will tell you Gold and Silver have always been God’s money and they historically are safe-havens in times of massive financial crashes.

That is, if you can find any.

KEEP READING AND I’LL GIVE YOU THE BEST CONNECTION I HAVE FOR KEEPING YOUR FAMILY SAFE AND GETTING PREPARED

Andy Shectman: “No one wants to sell their Gold or Silver at these make believe prices”

I’ve been telling you for a long time now that Gold and Silver are vastly undervalued.

I’m not a financial advisor and I can’t tell you what to do, but I can look at historical data and I can easily see that the current price of Gold and Silver makes no sense unless….it’s being manipulated.

Now who would want to do that?

And the more important question: will it go on forever, or do the manipulators eventually release the stretched rubber band and ride an explosion up?

I’ve you’ve been paying attention in life, you know the answer.

You know these crooks on Wall Street manipulate things down, ⭐️ then they load their boats, then they manipulate them up into a bubble.

Where are we in that process right now for commodities like Gold and Silver?

Right exactly where I placed that star up above.

⭐️ = You Are Here

The Big Boys are loading their boats.

But that’s not just my opinion.

I’m a nobody.

Listen to Andy Schectman who is an expert on these things and he lays it out PERFECTLY in two minutes.

Here’s my rough paraphrase:

“A concerted effort by the very powerful to use the suppression of commodities (gold, silver, but also a long list of all other commodities)…these countries are not complaining about suppressed low prices yet because they’re accumulating! But once it becomes obvious that the availability of these commodities is very scarce and no one wants to sell at these “make believe prices” then the public says “OMG, what have we been missing?” And maybe that all happens in concert with a breakdown of the banking system, then the public says “give it to me now” and that’s when you’ll see the circuit breakers be put into affect. But at that point it’s too late.”

Oh my!

It’s so much better to listen to him explain it in his own words.

It’s just 2 minutes long.

Watch here (as presented by my friend the Digital Asset Investor):

Comex 589 pic.twitter.com/uPzrOGXhZ5

— Digital Asset Investor (@digitalassetbuy) September 11, 2023

Or if that doesn’t work, try this:

Andy Shectman:

“A concerted effort by the very powerful to use the suppression of commodities (gold, silver, but also a long list of all other commodities)…these countries are not complaining about suppressed low prices yet because they’re accumulating! But once it becomes… pic.twitter.com/PyDSyEnCFX— DailyNoah.com (@DailyNoahNews) December 14, 2023

So, what can YOU do to protect yourself?

To protect your family?

To stay safe?

Simple: you need to get some #Gold or #Silver in your own possession.

It’s called “physical” gold and silver.

Not paper traded garbage on the stock exchanges that isn’t backed by anything.

Don’t touch that stuff.

I have two special hook-ups for you.

Both involve PHYSICAL gold and silver.

Because if you do NOTHING else, make sure you own “physical” gold and silver, not paper contracts.

The paper contracts (like stock ticker SLV and GLD) could very well go POOF one day and disappear or go to zero, because they’re not actually backed by the gold and silver they claim to represent.

It’s a massive game of musical chairs out there and when the music stops (and I think it will stop soon…) people who only own paper might find themselves owning something not worth the paper it’s literally written on.

And I know you’ll never forget it if I give you this GIF so….Let’s Get Physical:

Now…WHERE do you get physical gold and silver and how do you know it’s real and safe?

And that you’re getting the best price?

Oh, and how about personal one-on-one real customer service?

You know, like you were some Big Wig millionaire at Goldman Sachs who could just call their personal banker and get help?

That’s what I’m about to tell you.

I have two killer connections for you…

The first is for purchasing gold and silver bullion.

That means bulk bars.

That’s the cheapest and most economical way to do it, to stretch your dollar into as much gold and silver as possible.

The website is called [DELETED] and when you see my logo in the top left-hand corner, you’ll know you’re in the right place.

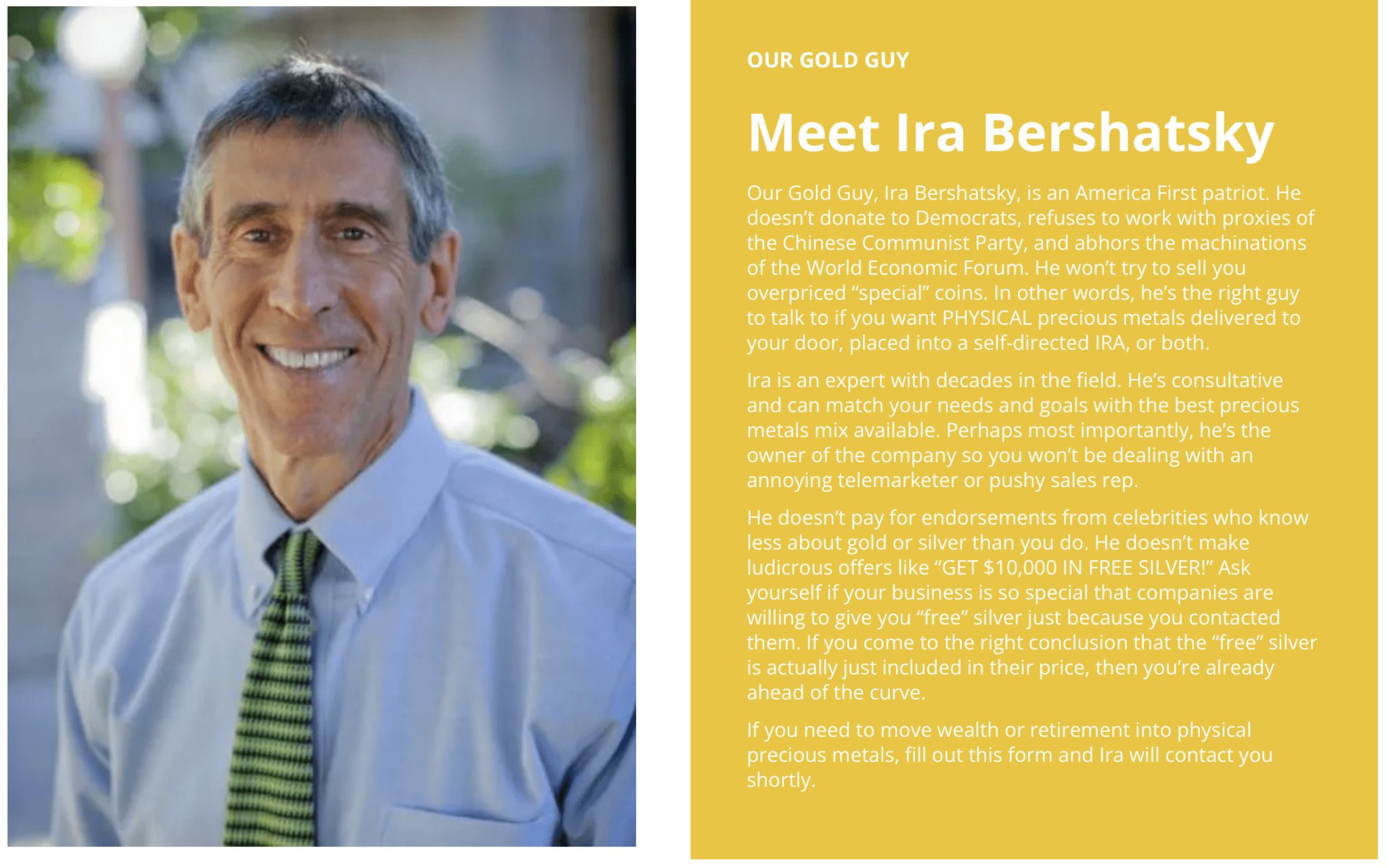

You’ll get a personal phone call with Ira Bershatsky (or someone on his team) and they will work with you free of charge for as long as needed to answer any questions you have and get you taken care of.

How about that!

You don’t see that much anymore, but Ira and his team pride themselves on good old-fashioned real customers service:

No sales pitch, just real, actual help.

And the best prices you will find.

Here’s the only disclaimer I will give you: because they do pride themselves on dedicated service, it might take a few days before you get a phone call back. Just be patient.

Good things come to those who wait!

You can contact Ira and [DELETED] here.

Ok, that was #1.

Now I want to tell you about option #2.

An equally great company, I am so happy to be working with these guys.

This next company is called Genesis Gold and this is for people who want to purchase real physical gold or silver in their IRAs (Investment Retirement Accounts).

You know what the beauty of that is?

TAX FREE baby!

I’m not a tax advisor, but that’s a general oversimplification.

Never pay more taxes than you are legally required to pay.

And that’s why I love getting gold and silver in my IRA (and why I hold a large chunk in an IRA myself!).

There’s so much to love about Genesis Gold, starting with the fact they are proudly and un-ashamedly Christina!

They call it “Faith-Driven Stewardship” and they put it right on the homepage of their website along with a quote from Ezekiel:

Here’s more on why gold and silver in your IRA are so powerful:

You can contact Genesis Gold here.

They are also very backed up with record demand, so you may have to wait a bit, but someone WILL get in touch with you for personal customer service and assistance!

Tell ’em Noah sent ya!

Oh, and did you know Genesis is recommended by SUPERMAN himself?

It’s true.

Superman himself, Clark Kent — Dean Cain — came on my show a few weeks ago and we broke it all down:

Watch here:

Stay safe!

Make sure you can weather the storm when it hits!

Because the storm always hits eventually, doesn’t it?

As for me and my house, we will be ready. 💪

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!