Russia and Iran have officially ditched the U.S. dollar for trade.

Russia and Iran have finalized a deal requiring each country to trade with each other using their local currencies instead of the U.S dollar.

In an official statement Iran shared “Banks and economic actors can now use infrastructures including non-SWIFT interbank systems to deal in local currencies.”

Iran and Russia are currently facing sanctions from the United States.

💥 End of Petrodollar

20% of global oil this year was sold in currencies other than USD.

Wait till Saudi Arabia joins Russia and Iran in selling oil for yuan.

The fat lady has started singing…

The Dominant Dollar Faces a Backlash in the Oil Market. pic.twitter.com/5GIuSHfxFQ

— S.L. Kanthan (@Kanthan2030) December 28, 2023

Here’s what Oil Price reported:

Russia and Iran have finalized an agreement to trade in their local currencies instead of the U.S dollar, Iran’s state media has reported.

Both countries are subject to U.S. sanctions.

“Banks and economic actors can now use infrastructures including non-SWIFT interbank systems to deal in local currencies,” Iran’s state media has declared.

Moscow has lately been cozying up to Tehran, with Iran revealing in November it will provide Russia with Su-35 fighter jets, Mi-28 attack helicopters and Yak-130 pilot training aircraft.

The global de-dollarization drive has been going on for years with BRIC countries and the so-called pariah states trying to ditch the American dollar in favor of other currencies.

Back in 2019, Putin declared that time was ripe to review the dollar’s role in trade. At that time, Russia and China considered switching to the euro, the world’s second most dominant currency, as an acceptable stalemate, with the ultimate goal being to use their own currencies.

Earlier in the current year, Russia paid dividends from the Sakhalin 1 and 2 oil projects in Chinese yuan instead of the dollar. Last year, Russia was cut off from the US dollar-dominated global payments systems following sweeping sanctions off the Ukraine war.

Russia has declared it will no longer accept the American currency as payment for its energy commodities but will instead switch to Chinese and Emirati currencies.

However, global de-dollarization efforts have borne little fruit with the vast majority of cross-border transactions involving BRICS members continuing to be invoiced in dollars. Indeed, exchanging BRICS members’ local currencies with each other and with other emerging market currencies frequently requires using the dollar as an intermediary.

BREAKING:

Iran and Russia have agreed to trade in local currencies instead of the US Dollar. pic.twitter.com/uTpks6Efe4

— Globe Eye News (@GlobeEyeNews) December 27, 2023

Per Insider Paper:

Iran and Russia have struck a deal to trade using their local currencies rather than relying on the US dollar, as reported by Iran’s state news agency, IRNA, on Wednesday.

“The establishment of new financial and banking platforms has opened a ‘new chapter’ in banking relations between Iran and Russia, with the two countries agreeing to ditch the US dollar and instead trade in local currencies,” said IRNA, citing information from the Central Bank of Iran.

The agreement was reached during a meeting in Russia between the central bank chiefs of both countries.

The report mentioned that Iranian and Russian banks and businesses are now leveraging alternative messaging systems, excluding SWIFT, and establishing direct financial ties using their national currencies.

Back in July 2022, both nations had revealed intentions to bypass the US dollar in their bilateral trade, opting for their respective currencies.

At a Tehran gathering that same month, Iran’s supreme leader, Ayatollah Ali Khamenei, emphasized the necessity of moving away from the dollar in global commerce.

Iran, Russia ditch US dollar to trade in local currencies https://t.co/VQ2eCv6un5

— Insider Paper (@TheInsiderPaper) December 28, 2023

We’ve been warning you this was coming!

Remember this report?

ECONOMIC WARFARE: UAE Ditches The “Petro-Dollar” For Oil Trades, Crisis Incoming?

Folks, this is very serious….

The “Petrodollar” is what has led to such incredible prosperity here in America for the past 50 years.

Unprecedented prosperity!

A way of life and a quality of life that is rarely seen elsewhere in the world and definitely rarely seen elsewhere in history.

More on that in a minute if you don’t fully understand what I’m talking about….I’ll explain it in a really easy to understand way in just a bit, but here’s a quick breakdown:

Impact of “Petro-Dollar” on Quality of Life in the USA:

- Economic Stability: The strength of the dollar helps ensure economic stability in the U.S., contributing to a stable and predictable economic environment.

- Lower Borrowing Costs: The demand for U.S. dollars and government securities often results in lower borrowing costs for the U.S. government and, by extension, for American businesses and consumers.

- Purchasing Power: A strong dollar enhances the purchasing power of U.S. consumers, making imports and foreign travel more affordable.

- Inflation Control: The petrodollar helps in controlling inflation to a certain extent. A strong dollar usually means lower import prices, which can help keep inflation in check.

- Investment in U.S. Assets: Foreign demand for U.S. dollars often translates into investment in U.S. assets, including treasury bonds, stocks, and real estate, supporting these markets.

- Global Economic Ties: The U.S.’s central role in global finance fosters deeper economic ties with other nations, which can lead to more stable and prosperous international relations.

But first, here’s the very alarming breaking news:

UAE OFFICIALLY STOPS USING DOLLAR FOR OIL TRADES!!!

•The United Arab Emirates (UAE) has shifted from using the US dollar to local currencies in its oil trades. •This move aligns with the broader de-dollarization efforts of the BRICS economic alliance, which the UAE recently… pic.twitter.com/9IVyiIhtYa

— Eric Yeung 👍🚀🌕 (@KingKong9888) November 28, 2023

And:

🚨 Breaking: UAE ditches US dollar for local currencies in oil trades, aligning with BRICS's de-dollarization drive. This strategic pivot, part of the UAE's recent BRICS membership, challenges dollar dominance in global oil markets. The move, signaling UAE's strengthened position… pic.twitter.com/pUqG071U5U

— WallStreetBulls (@w_thejazz) November 28, 2023

Here’s what WatcherGuru reported:

BRICS is looking to topple the U.S. dollar global reserve status by controlling a major portion of the oil sector. In the first instance, Russia’s third-largest oil exporting firm ‘Gazprom Neft‘ announced that the company is ending its reliance on the U.S. dollar. The oil exporter will not be accepting the U.S. dollar for trade and is open to accepting local currencies. The Russian firm is the first oil company to publicly announce cutting ties with the U.S. dollar for cross-border transactions.

The move comes after BRICS members India and the UAE settled oil trade in the rupee and not the dollar. Additionally, Saudi Arabia has also expressed that the Kingdom is open to accepting local currencies for oil exports. The development puts pressure on the U.S. dollar, as the greenback will find it challenging to fund its deficit.

And from Cyptopolitan:

The global financial landscape is witnessing a seismic shift as the United Arab Emirates (UAE) boldly moves away from the US dollar in its oil trade dealings.

This strategic pivot aligns with the broader ambitions of the BRICS economic alliance, of which the UAE is a recent addition.

The changeover, involving the transition to local currencies for oil transactions, marks a significant departure from the long-established dollar dominance in the global oil market.

The BRICS Influence and UAE’s Strategic Shift

The BRICS bloc, comprising Brazil, Russia, India, China, and South Africa, recently expanded its membership to include the UAE, along with Saudi Arabia, Egypt, Ethiopia, Iran, and Argentina.

This expansion signifies a growing inclination towards de-dollarization among these nations, a move that challenges the traditional hegemony of the US dollar in international trade.

The UAE’s decision to prioritize local currency over the US dollar in new oil deals is a clear reflection of this sentiment. This move isn’t just a mere policy shift; it’s a strategic maneuver in the complex chess game of global economics.

By aligning with the BRICS nations, the UAE is not only diversifying its economic partnerships but also reinforcing its position as a global oil powerhouse.

This change could potentially reshuffle the cards in the international oil trade, impacting the dollar’s stronghold and introducing a new era of currency dynamics in oil transactions.

🚨BREAKING: China & India Ditch US Dollar For Oil, Save $17 Billion! 👀🔥 #BRICS pic.twitter.com/GMhFr5IP15

— JackTheRippler ©️ (@RippleXrpie) October 16, 2023

Ok, now the big question: why does it matter to YOU?

And why am I so fired up about this?

Folks, it’s way bigger than you realize.

Think this is just something happening in the sand dunes an ocean away that will never impact you and kind of bores you to think about?

Nothing could be farther from the truth!

Here’s why:

Janet Yellen Confirms U.S. Dollar To Lose World Reserve Currency Status?

THIS IS CONTINUING COVERAGE OF THE GREATEST STORY THE MSM WILL NOT COVER!

About 2-3 years ago, Bo Polny first started coming on my show to warn that the U.S. Dollar could lose it’s World Reserve Currency status.

Many laughed.

Few even considered it could be possible.

And yet flash forward to present day and it’s all over the news every day.

The Saudis have ditched the U.S. Dollar (the “petrodollar”) and joined the BRICS.

As I said recently, the patient has already died, we just haven’t had the funeral yet.

But it’s coming.

Because now it’s not just Bo Polny warning us, now I give you head of the “Federal Reserve” Janet Yellen commenting on whether or not the U.S. Dollar will fall and lose its World Reserve Currency status.

Spoiler alert, she ultimately tries to defend the Dollar and say it’s fine, but it’s written all over her face — it’s doomed.

It’s also obvious from reading between the lines of her comments that she is worried.

Check this out:

U.S. Dollar kaput as per Janet Yellen?https://t.co/SDOLdoZQG7

— Benji Yamamoto (@Benji_Newz) September 24, 2023

What a legacy to have:

Yellen is Overseeing ‘the End of the Dollar Empire’…. https://t.co/k8vDzoGEi4 https://t.co/MG6pJJeuSt

— 🍊Prudence🍊 (@Dennygirl817) September 25, 2023

From Yahoo Finance:

The U.S. dollar saw an 8% decline in its share of global reserves in 2022 — causing some to question whether the dollar’s days of dominance are over.

Treasury Secretary Jannet Yellen gave her two cents on the matter during a congressional hearing in June — stating that no currency currently exists that could displace the greenback.

U.S. sanctions and foreign policy plays have inspired a backlash from China, Russia and other prominent countries who may be keen to dethrone the dollar.

Yellen remains adamant that “it will not be easy for any country to devise a way to get around the dollar.” She did, however, warn that the dollar’s share of global reserves may continue to decline as countries look to “diversify.”

Here’s why the topic of de-dollarization is front and center these days — and what you can do if you’re worried about the strength of the dollar.

Impact of U.S. sanctions

The dollar’s dominance in global trade and capital flow dates back at least 80 years — not just because the U.S. is the world’s largest economy, but also because oil and other essential commodities are priced in the greenback.

However, recent events — including the Fed’s aggressive rate hikes to stem domestic inflation, the trade war with China and the U.S. sanctions enforced after Russia’s invasion of Ukraine — have caused more countries to call for trade to be carried out in other currencies besides the U.S. dollar.

Prominent powerhouses India and the United Arab Emirates (UAE) have officially started trading with each other in their local currencies. The Indian government announced recently that the country’s leading petroleum refiner, Indian Oil Corp., used the local rupee to buy one million barrels of oil from the Abu Dhabi National Oil Company — not the greenback.

At the 14th BRICS Summit last year, Russian President Vladimir Putin announced measures to create a new “international currency standard.” Meanwhile, China has been urging oil producers and major exporters to accept yuan for payments, and major oil exporter Saudi Arabia has said it’s “open” to the idea of trading other currencies.

This headline should be terrifying:

As always, we’ve been on this story FIRST.

We were on it first 2-3 years ago, but even recently we’ve been shouting warnings from the rooftops…

Just yesterday I warned you about this:

U.S. DEBT COLLAPSE IMMINENT?

Are things about to go from Bad to Worse?

The only reason we have such a high standard of living here in the United States is because the U.S. Dollar (“petrodollar”) has been the World Reserve Currency for a long time.

Our standard of living is unique to almost all other places in the world.

And it’s NOT guaranteed.

I’ve been sounding the alarm bells recently and it looks like we may be in the final stretch of an imminent collapse.

And when it falls?

Worse than the Great Depression — and here’s that word again: overnight.

Watch this and I think you’ll understand:

The standard of living in America will FALL OVERNIGHT if the petrodollar falls…

"Worse than the Great Depression"

🚨🚨🚨 PREPARE NOW 🚨🚨🚨

Watch: pic.twitter.com/bBbq9TI0oP

— Noah Christopher (@DailyNoahNews) June 24, 2023

Now with that understanding in mind, let’s get back to our headline report.

The U.S. Government is headed for a shutdown:

I’m done watching Texans get run over by a lawless, broken border. I will not allow the Biden Administration a pass.

Ahead of government shutdown, House Republicans vow to 'die on the hill to secure the border' https://t.co/NCtQtG04Ri via @expressnews

— Chip Roy (@chiproytx) September 27, 2023

REPORT: Matt Gaetz Tells House To Withhold His Pay During Government Shutdown..

"It is my understanding that pursuant to the Constitution, members of Congress will continue to receive their pay during a lapse in appropriations.

"Therefore, I am requesting that in the case of a… pic.twitter.com/mPQlRHIATb

— Chuck Callesto (@ChuckCallesto) September 26, 2023

Here’s how these things always tend to play out….

Once the crisis hits, it’s always too late.

Think you’ll just take your money out of the banks and buy gold and crypto once you start to see the warning signs of a crash?

In a word? — “LOL”

Remember in 2001 after 9/11 when everything closed?

You could access your bank accounts and you definitely couldn’t trade anything on the stock market.

I believe we’ll see that again here.

You’ll be frozen out in some way and by that time it will be too late.

Here’s what Reuters reports:

Republican U.S. House Speaker Kevin McCarthy on Wednesday rejected a stopgap funding bill advancing in the Senate, bringing Washington closer to its fourth partial shutdown of the U.S. government in a decade with just four days to go.

That would lead to the furlough of hundreds of thousands of federal workers and the suspension of a wide range of government services, from economic data releases to nutrition benefits, until Congress manages to pass a funding bill that President Joe Biden, a Democrat, would sign into law.

The Senate plan, which advanced on a wide bipartisan margin on Tuesday, would fund the government through Nov. 17, giving lawmakers more time to agree on funding levels for the full fiscal year beginning Oct. 1.

Top Senate Democrat Chuck Schumer said the Senate would hold the next procedural vote on its bill on Thursday, unless senators can reach an agreement that would allow them to vote sooner.

McCarthy’s House of Representatives was focusing its efforts on trying to agree on more of the 12 separate full-year funding bills, of which they have so far passed one.

“I don’t see the support in the House” for the Senate plan, McCarthy said, though the bill has the support of Senate Republicans, including Minority Leader Mitch McConnell.

The House was expected to vote late into the night on amendments to specific funding bills, though even if all four of those bills were to be signed into law by Saturday, on their own they would not be enough to prevent a partial government shutdown.

Now with ALL of that background, I want you to watch this video from Chris Greene over at AMTV Media.

I think he nails this one:

https://www.youtube.com/watch?v=s4AHn_wTmB8&t=580s

Everything is lining up (for something very bad).

I think this is a great warning from Chris Greene…

Janet Yellen of all people just confirmed the same thing (read more on that below)…

And Bo Polny just told me the same thing two days ago!

You have to see this:

Bo Polny: Sound The Trumpet, The Death of the U.S. Dollar

Bo Polny was back on my show today….

Actually it was a day or so ago, but I’m finally able to post this now.

So much in here, I think you’re really going to love this.

We actually recorded this right on Yom Kippur, so that was pretty cool….

Great timing when you’re talking to the “Analyst of Time”!

That’s why we Sound the Trumpet because that’s what you do on that Feast Day!

Did any of you sound your Trumpets?

If not, it’s not too late!

Also great timing because Bo has some really big things ahead for us.

And a lot of it revolves around the U.S. Dollar, Gold, Silver and Crypto.

While the MSM is telling us the Dollar just had a “Golden Cross” (which means it would typically go higher and get stronger) Bo says his cycles show the exact opposite.

He actually sees a major crash in the U.S. Dollar.

Ok, so what does that mean?

It would mean (typically) that Gold, Silver and Crypto are about to skyrocket….

We’re going vertical Mav!

Gotta love Top Gun.

But this is serious.

Bo says there’s not much time left before the U.S. Dollar absolutely crashes.

He first told us to watch the Dollar 2-3 years ago and that it would lose its World Reserve Currency status.

Everyone laughed at the time, but they’re not laughing now.

In fact, with the Saudi’s officially joining BRICS, the U.S. “petrodollar” is officially done.

The patient has died on the operating table, we just haven’t had the funeral yet.

But Bo says the funeral is coming VERY soon, and it’s going to be an UGLY one.

Even Janet Yellen just admitted it…

This was pretty stunning to see:

U.S. Dollar kaput as per Janet Yellen?https://t.co/SDOLdoZQG7

— Benji Yamamoto (@Benji_Newz) September 24, 2023

Ok, so without any further delay, let me get you right into this one…

Watch safely here on Rumble:

And on YouTube as well:

As always, here are all the links you need:

👉 Download Bo’s slides for free: https://qrco.de/beM0jP

👉 If you want Bo’s trading Newsletter, go to https://www.gold2020forecast.com/cryptocurrency-index ➡️ use code WLT49 (LIMITED TIME DISCOUNT)

💥 For access to the Easy Crypto School, go to https://www.easycryptoschool.com ➡️ use code WLT49 (LIMITED TIME DISCOUNT)

That will get you all set for crypto.

If you want Gold and Silver, I have you covered there too.

Keep reading for the hookup…

Here’s the most important part — make sure you get PHYSICAL gold and silver.

Not paper traded garbage on the stock exchanges that isn’t backed by anything.

Don’t touch that stuff.

I have two special hook-ups for you.

Both involve PHYSICAL gold and silver.

Because if you do NOTHING else, make sure you own “physical” gold and silver, not paper contracts.

The paper contracts (like stock ticker SLV and GLD) could very well go POOF one day and disappear or go to zero, because they’re not actually backed by the gold and silver they claim to represent.

It’s a massive game of musical chairs out there and when the music stops (and I think it will stop soon…) people who only own paper might find themselves owning something not worth the paper it’s literally written on.

Now…WHERE do you get physical gold and silver and how do you know it’s real and safe?

And that you’re getting the best price?

Oh, and how about personal one-on-one real customer service?

You know, like you were some Big Wig millionaire at Goldman Sachs who could just call their personal banker and get help?

That’s what I’m about to tell you.

I have two killer connections for you…

The first is for purchasing gold and silver bullion.

That means bulk bars.

That’s the cheapest and most economical way to do it, to stretch your dollar into as much gold and silver as possible.

The website is called WLT Precious Metals and when you see my logo in the top left-hand corner, you’ll know you’re in the right place.

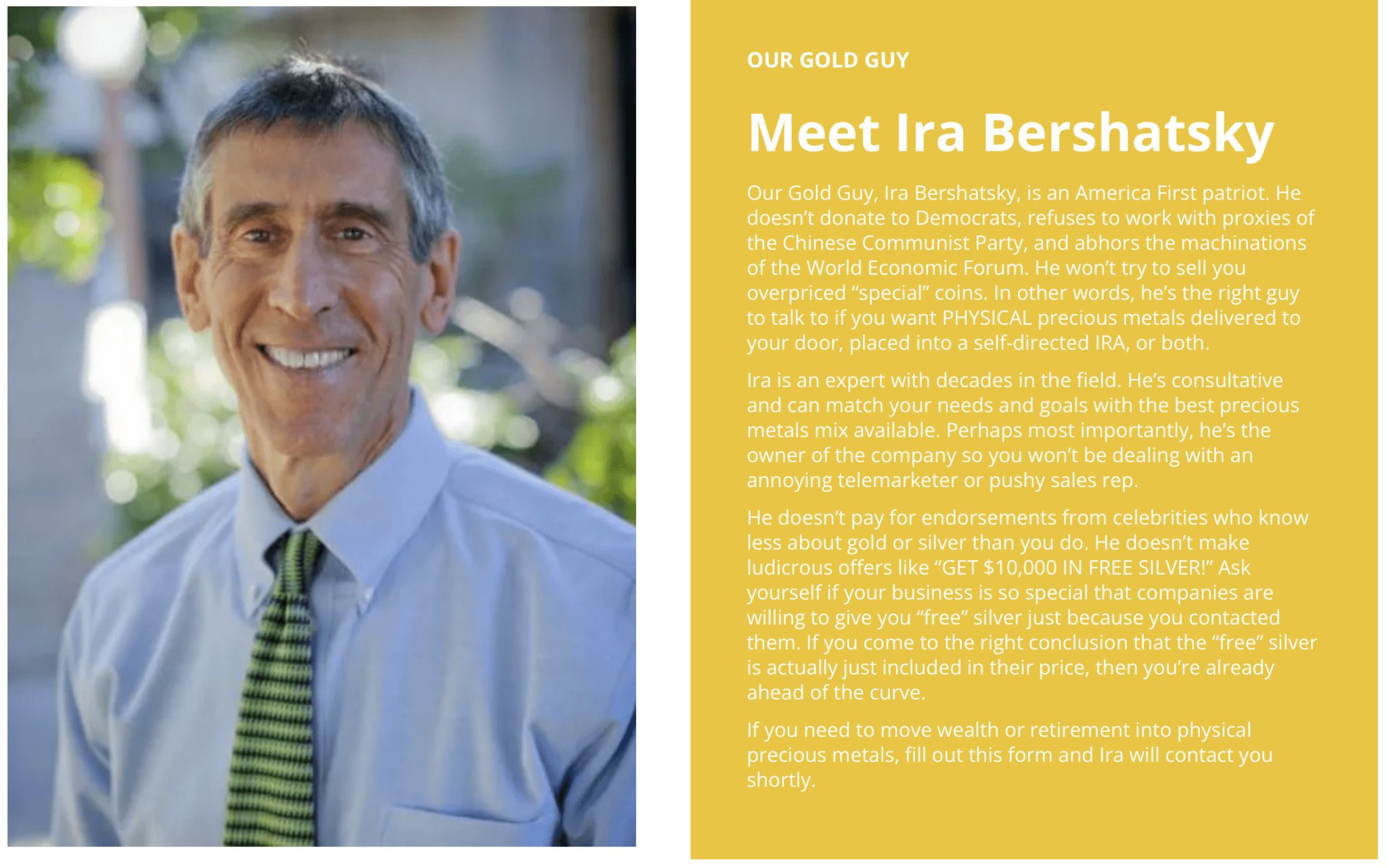

You’ll get a personal phone call with Ira Bershatsky (or someone on his team) and they will work with you free of charge for as long as needed to answer any questions you have and get you taken care of.

How about that!

You don’t see that much anymore, but Ira and his team pride themselves on good old-fashioned real customers service:

No sales pitch, just real, actual help.

And the best prices you will find.

Here’s the only disclaimer I will give you: because they do pride themselves on dedicated service, it might take a few days before you get a phone call back. Just be patient.

Good things come to those who wait!

You can contact Ira and WLT Precious Metals here.

Ok, that was #1.

Now I want to tell you about option #2.

An equally great company, I am so happy to be working with these guys.

This next company is called Genesis Gold and this is for people who want to purchase real physical gold or silver in their IRAs (Investment Retirement Accounts).

You know what the beauty of that is?

TAX FREE baby!

I’m not a tax advisor, but that’s a general oversimplification.

Never pay more taxes than you are legally required to pay.

And that’s why I love getting gold and silver in my IRA (and why I hold a large chunk in an IRA myself!).

There’s so much to love about Genesis Gold, starting with the fact they are proudly and un-ashamedly Christina!

They call it “Faith-Driven Stewardship” and they put it right on the homepage of their website along with a quote from Ezekiel:

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!