After years of inquiry and speculation the Federal Reserve’s ‘Doomsday Book’ has finally been revealed.

The Doomsday Book is a lengthy document used as a resource manual in the event of serious financial or economic emergencies and can obviously be used to justify anything the Federal Reserve does.

People with knowledge of the book have long viewed the Federal Reserve’s Doomsday Book as a tool of malfeasance because the Federal Reserve is a tool of malfeasance.

Why do we allow a banking cartel to control the supply of currency in this country? Emergencies or not, the Federal Reserve Banking system has been an absolute disaster for this country.

You can read the full document by clicking on this link. Legendary former Congressman Ron Paul writes:

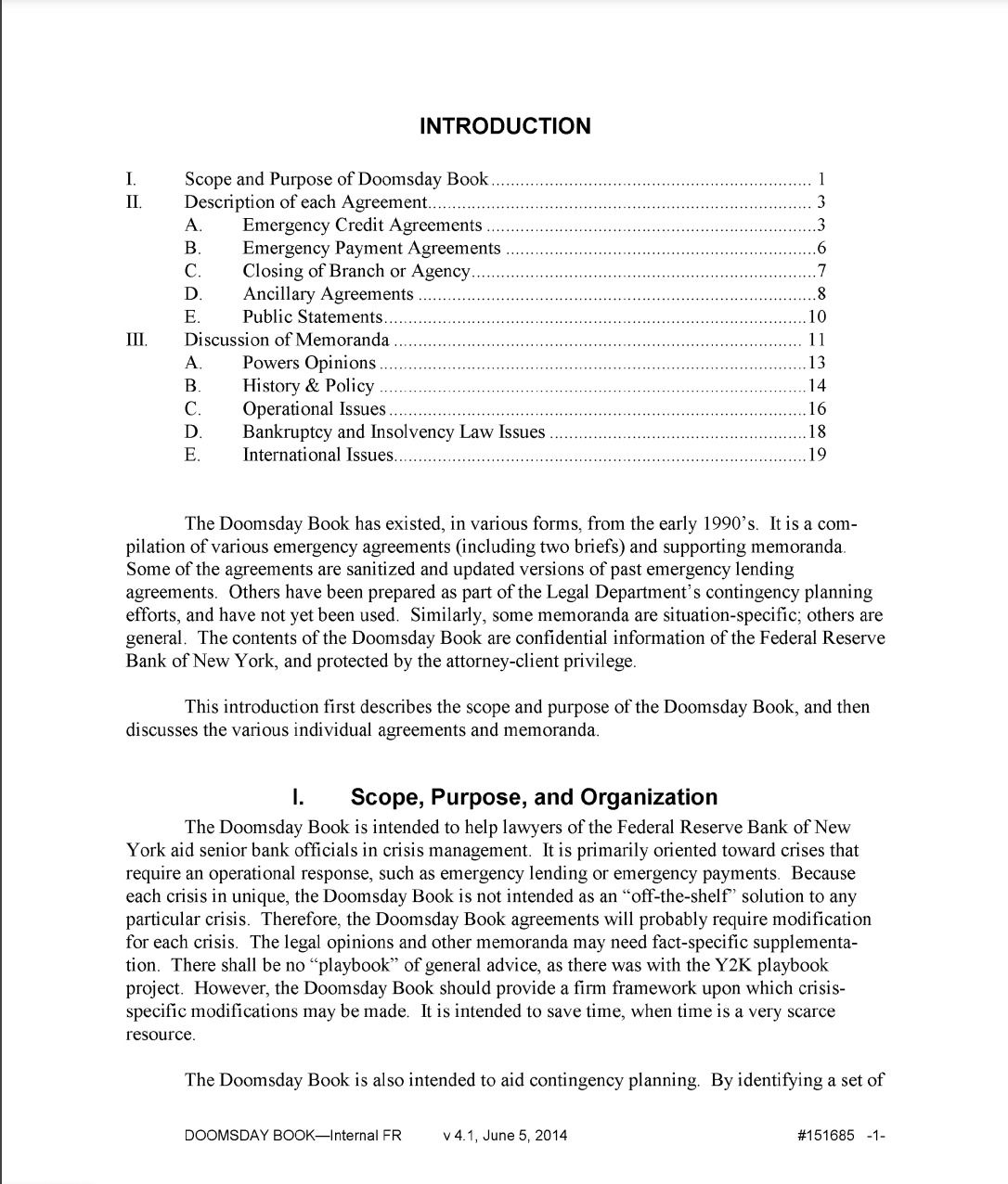

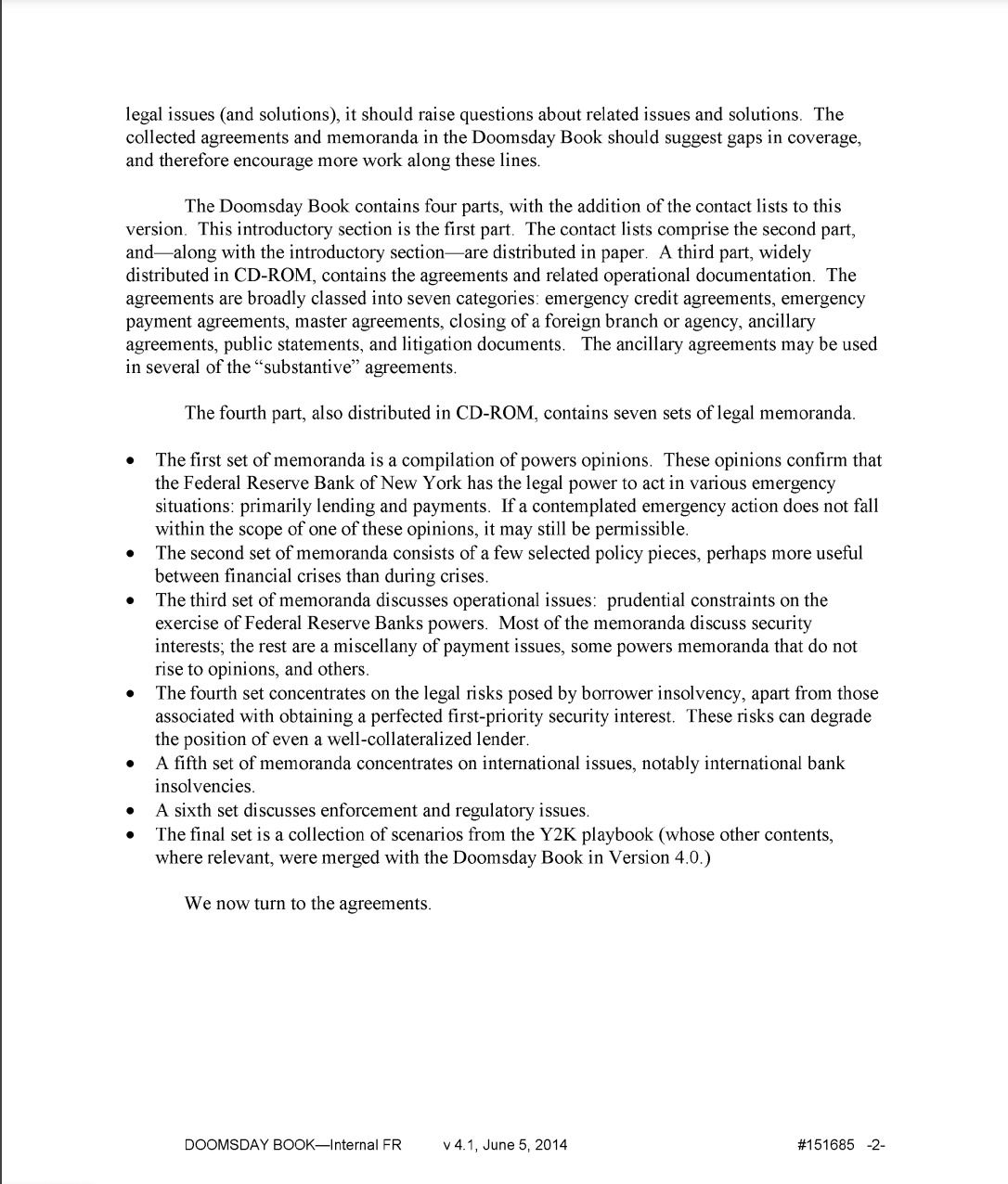

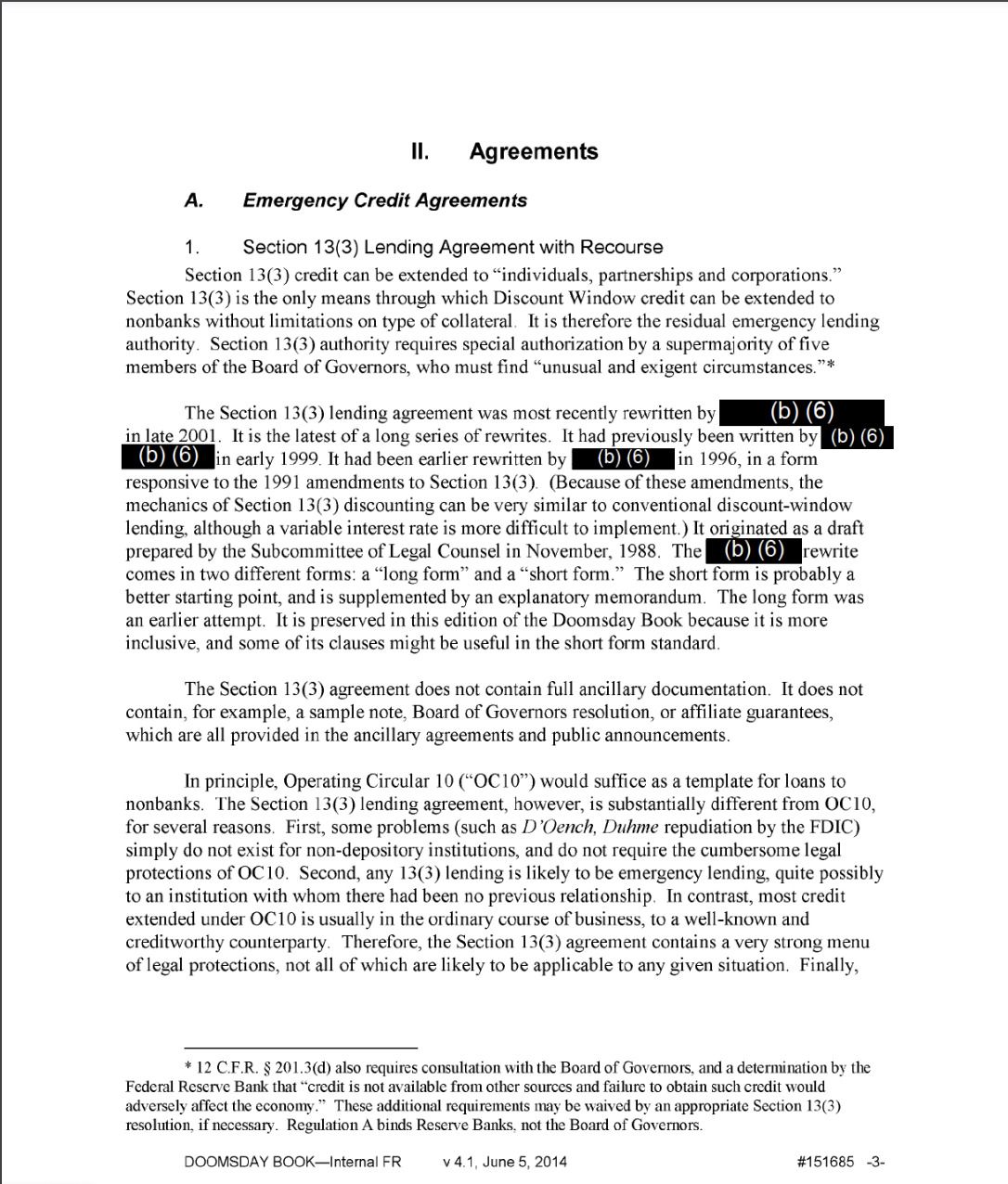

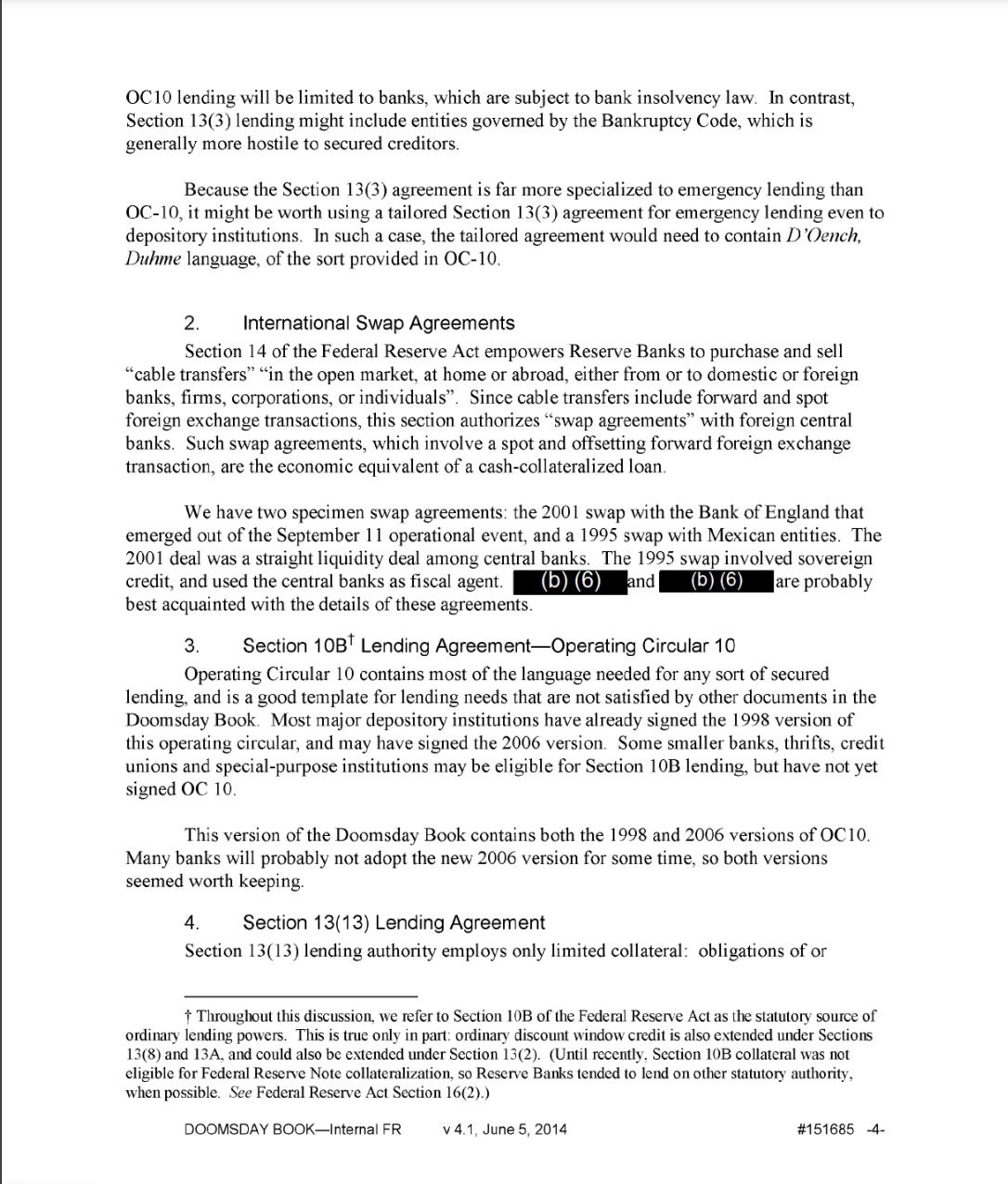

“Thanks to a FOIA request, an internal document from the Federal Reserve, known as the “Doomsday Book” has been released. The purpose of it is to guide The Fed’s actions during emergencies.

Emre Kuvvet, professor of finance at Nova Southeastern University says “The central bank—or at least the legal team at its dominant member bank—apparently believes it can rely on precedent to justify virtually any emergency action.”

Do laws lose their meaning and purpose when virtually anything can be justified? Tacitus was right: “The more corrupt the state, the more numerous the laws.”

Thanks to a FOIA request, an internal document from the Federal Reserve, known as the "Doomsday Book" has been released. The purpose of it is to guide The Fed's actions during emergencies.

Emre Kuvvet, professor of finance at Nova Southeastern University says "the central… pic.twitter.com/bBlZEyagAD

— Ron Paul (@RonPaul) December 15, 2023

The Wall Street Journal, which broke the story, noted:

The Doomsday Book is also revealing for the conversation around a U.S. central-bank digital currency, or CBDC.

Most notably, as Mr. Kuvvet explains, “Instead of adhering strictly to clear legislative boundaries to justify its actions during financial crises, the central bank appears to ground many of its decisions in the New York Fed’s belief in the Fed’s discretionary authority . . . without explicit congressional authorization in some instances.”

Here are the first couple of pages from the Federal Reserve’s Doomsday Book to give you a taste of what this all-encompassing resource manual is all about.

Two years ago, Politico warned:

The Fed is now in a vise. Inflation is rising faster than the Fed believed it would even a few months ago, with higher prices for gas, goods and automobiles being fueled by the Fed’s unprecedented money printing programs.

This comes after years of the Fed steadily pumping up the price of assets like stocks and bonds through its zero-percent interest rates and quantitative easing during and after Hoenig’s time on the FOMC.

To respond to rising inflation, the Fed has signaled that it will start hiking interest rates next year.

ADVERTISEMENTBut if that happens, there is every reason to expect that it will cause stock and bond markets to fall, perhaps precipitously, or even cause a recession.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!