We are proud of our reporting here and we’re always proud to be on a story first.

While the Big Banks and the Financial MSM Talking Heads “talk their book” (which means telling you to sell when they’re actually buying), we’ve been shooting you straight here.

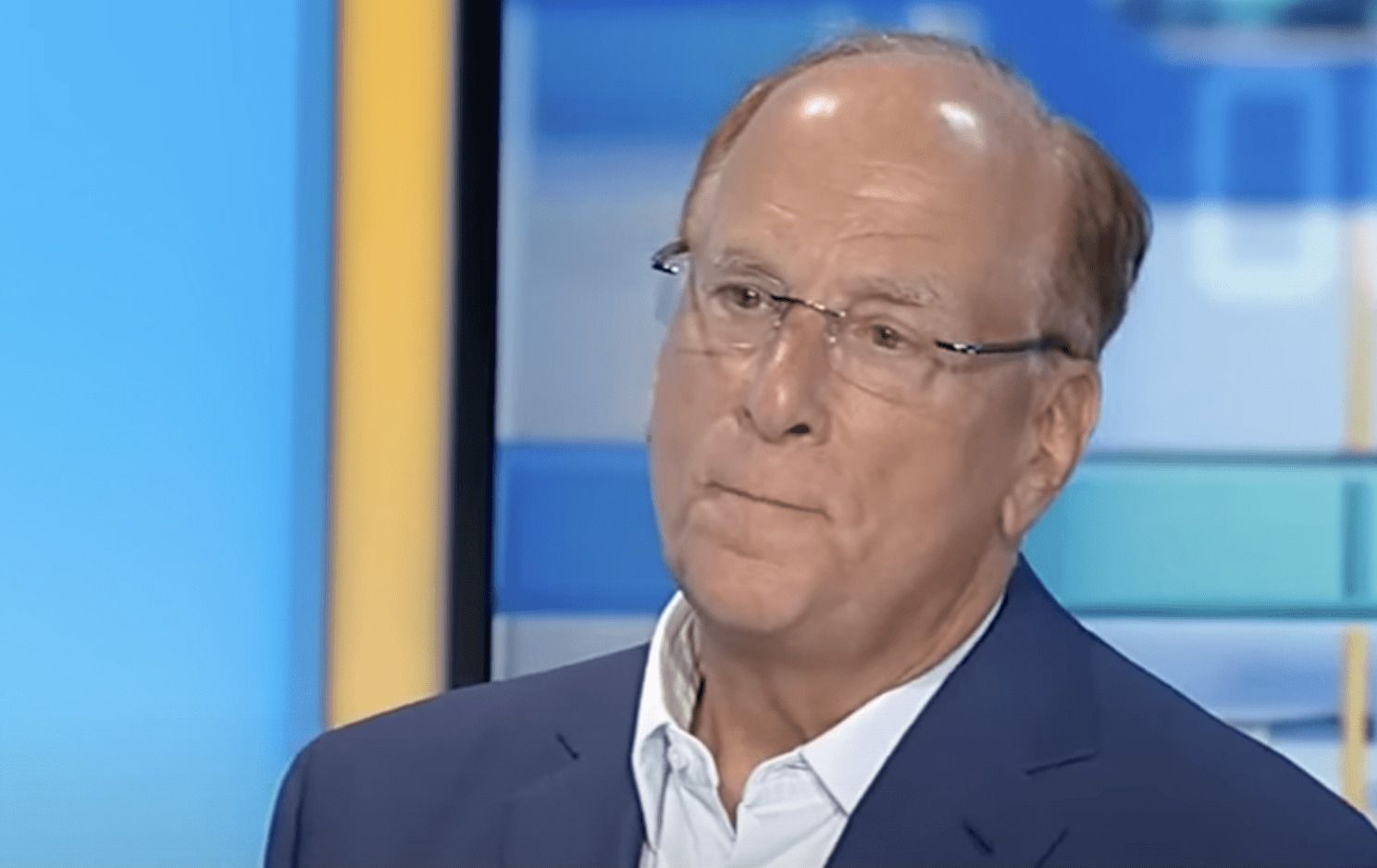

Now it looks like even BlackRock is boarding the long-gold trade.

Just remember we told you first — months ago!

BlackRock, the world’s largest asset management firm and the biggest promoters of Environment, Social, and Governance (ESG) investments, has released a report recommending investors allocate money into physical precious metals.

“Gold is having a moment; one we believe is likely to continue. The precious metal has risen over 8% so far in 2023, thanks to a combination of positive factors,” the analysts said in the report. “Gold fell from its May 3 high around $2050 per ounce amid expectations the U.S. would avoid missing the deadline to raise the debt ceiling. That said, the decline occurred after gold rallied nearly 30% from its 52-week low. If gold proves able to sustain a rally above its 10-year high of $2067, that may suggest another leg in the rally is likely.”

“This move is not surprising considering they’re in the business of not only making money, but making sure their investors don’t lose too much,” said Jonathan Rose, co-founder of Genesis Gold Group.

“They are pushing ESG funds which have proven to lose money, so promoting gold at this time makes sense as they try to achieve balance.”

While BlackRock and the World Economic Forum claim ESG funds are beneficial, their actions do not jibe with their words.

Even the Biden-Harris regime has tried to force the issue by incentivizing financial advisors to push ESG investments even as they continuously lose money.

This is why tens of thousands of Americans are moving their retirement accounts to self-directed IRAs backed by physical precious metals.

Unlike a traditional IRA, a self-directed IRA allows individuals to invest in a broader range of assets (including gold) while benefiting from similar tax advantages as a traditional IRA.

Step 1: Opening Your Self-Directed IRA

– To open a self-directed IRA, many people typically work with a precious metals provider such as Genesis Gold Group who can walk you through each step of the process.

Step 2: Funding Your Self-Directed IRA

– You can fund your self-directed IRA by rolling over or transferring assets from your existing retirement accounts, such as a 401(k), 403(b), TSP, savings, or other IRA accounts. Those rollovers and transfers usually take place without tax consequences. Once your self-directed IRA is funded, you can buy gold as part of your retirement account.

Click here to get in touch with Genesis Gold Group today.

Unlike other precious metals companies, Genesis Gold Group does not take advantage of investors’ angst to push them into the wrong metals.

Their focus is on customer service and putting the right mix of metals into their clients’ portfolios through rollovers or transfers of retirement accounts. This is why they don’t engage in the devious ploy of “free” silver marketing.

BlackRock is not alone with their sudden adoration of precious metals. China continues to ramp up purchases of gold, hitting all-time highs each of the last seven months.

Central Banks have been buying as much gold as they can for two years, slowing only recently when investors started noticing and calling them out.

If you’re concerned about the future, contact Genesis Gold Group…

You’ll receive a free Definitive Gold Guide and you’ll work with faith-driven, patriotic experts who can set up your retirement accounts with any desired mix of physical precious metals.

Click here to talk to Genesis Gold Group today.

p.s. Did you know Superman likes them too?

That’s right, Dean Cain is a big fan just like I am…watch here:

(Note: The information provided by WLTReport or any related communications is for informational purposes only and should not be considered as financial advice. We do not provide personalized investment, financial, or legal advice.)

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!