Although it’s infuriating but unsurprising, U.S. defense stocks and Congress members have financially benefited from the Israel-Hamas conflict.

Tragically, war is a profitable business for the bloodthirsty banking cartels and weapons manufacturers.

It always comes at the cost of innocent civilians.

Our friends at 100 Percent Fed Up noted:

“War Is a Racket!”

The famous short book by Major General Smedley D. Butler, printed in 1935, described war as nothing more than profiteering for bankers and corporate interests.

It’s message rings true today.

Banking cartels profit at the expense of innocent lives on all fronts.

ADVERTISEMENTAs the Israel-Hamas conflict continues, U.S. defense stocks soared in response.

“Shares of Lockheed Martin, Northrop Grumman, RTX and General Dynamics all rose as investors speculate how the U.S. made aid its ally which could include ordering more weapons,” Fox Business reports.

Most of congress has stock and takes PAC money from these. pic.twitter.com/JijQ1X5dH2

— Ted (@ted_macie) October 11, 2023

Via Fox Business:

The Israeli leader has previously said that the war against Hamas will be “long and difficult.”

Hamas terrorists struck Israel over the weekend in the deadliest attacks the country has experienced in decades. Israel’s government has launched airstrikes on the Hamas-controlled Gaza Strip and is mobilizing military reservists in preparation for a response, while Hezbollah – an Iran-backed terror proxy based in Lebanon – has expressed support for Hamas and remains a threat on Israel’s northern border.

Shares of General Dynamics, which makes submarines and combat vehicles, rose the most since March 2020 when it gained over 9%, according to Dow Jones Market Data Group.

Lockheed Martin makes F-35 fighter jets as well as Sikorsky and Black Hawk helicopters.

The fiscal 2024 National Defense Authorization Act is asking for a 3.3% rise in U.S. defense spending to $886.3 billion, while analysts at Bank of America predict the U.S. Department of Defense’s discretionary spending will shoot past the $1 trillion level by fiscal 2026.

X account ‘unusual whales’ dug into war-related stocks of Congress members.

BREAKING: Here is every US politician in Congress who currently holds stock positions that directly benefit from war in the Middle East:

Alan Lowenthal

Andrew Garbarino

Bill Hagerty

Blake Moore

Bob Gibbs

Carol Miller

Christopher Jacobs

Daniel Goldman

David McKinley

Dean Phillips…— unusual_whales (@unusual_whales) October 10, 2023

BREAKING: Here is every US politician in Congress who currently holds stock positions that directly benefit from war in the Middle East:

Alan Lowenthal

Andrew Garbarino

Bill Hagerty

Blake Moore

Bob Gibbs

Carol Miller

ADVERTISEMENTChristopher Jacobs

Daniel Goldman

David McKinley

Dean Phillips

Debbie Schultz

Deborah Ross

Diana Harshbarger

Donald McEachin

Dwight Evans

Earl Blumenauer

Fred Upton

Garret Graves

ADVERTISEMENTJerry Moran

Jerry Moran

John Curtis

John Yarmuth

Josh Gottheimer

Katherine Clark

Kathy Manning

Kevin Hern

Kurt Schrader

Lois Frankel

Maria Salazar

Marjorie Greene

Mark Green

Michael Guest

Michael McCaul

Mike Kelly

Mike Simpson

Mo Brooks

Patrick Fallon

Rick Allen

Ro Khanna

Robert Wittman

Roger Marshall

Scott Franklin

Shelley Capito

Steve Cohen

Susie Lee

Thomas Carper

Thomas Suozzi

Tommy Tuberville

Trey Hollingsworth

Virginia Foxx

William Keating

Zoe Lofgren

My report is coming soon. Be ready.

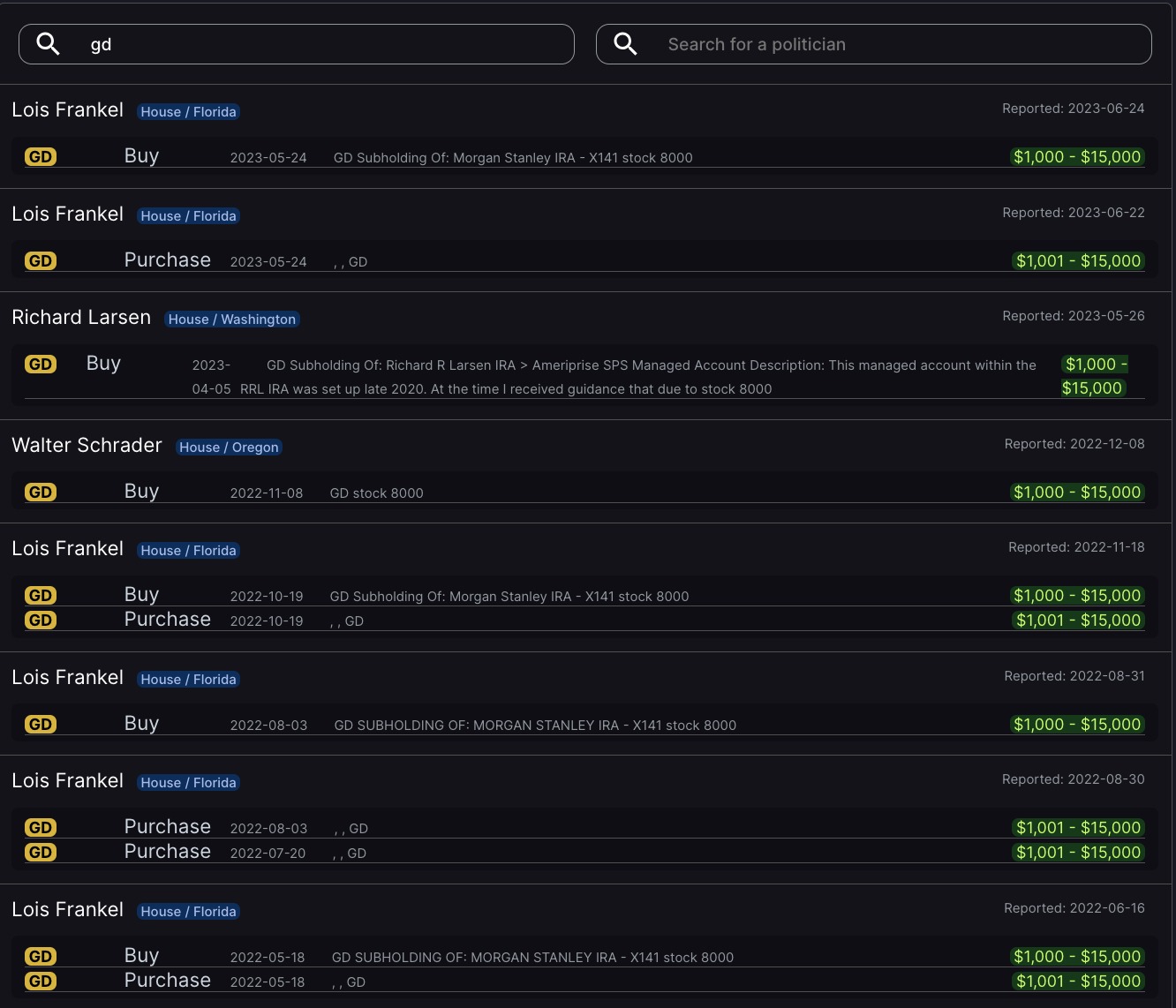

“Congress has been buying war stocks. Many bought defense company $GD, General Dynamics,” unusual whales previously noted.

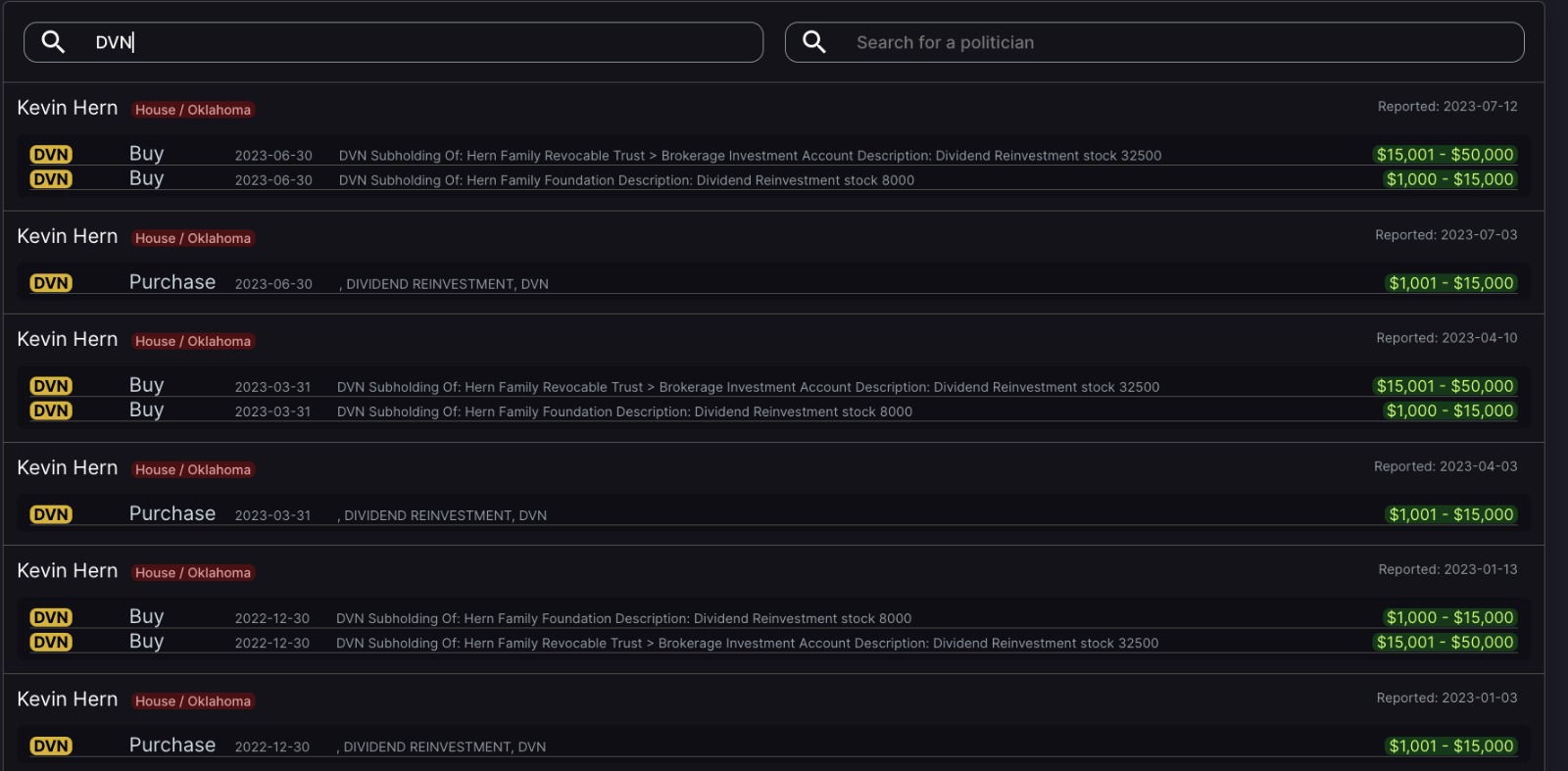

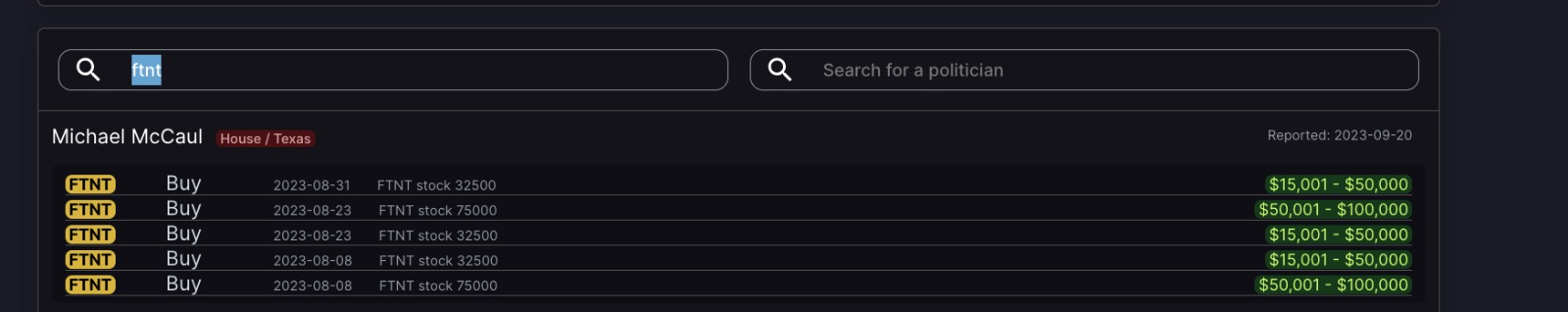

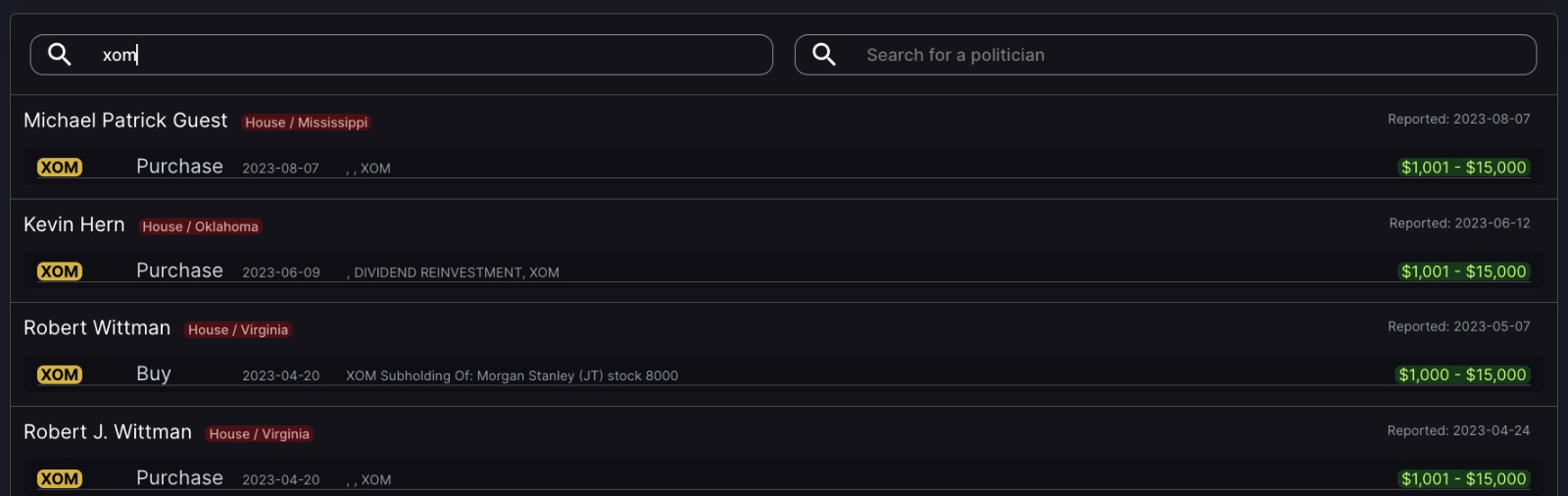

“Numerous Republicans bought heavy into oil + energy companies, with buys in $XOM, $DVN, $CVX. Democrats bought cybersecurity like $FTNT. These companies lobby Congress heavily,” unusual whales added.

BREAKING: Congress has been buying war stocks.

Many bought defense company $GD, General Dynamics.

Numerous Republicans bought heavy into oil + energy companies, with buys in $XOM, $DVN, $CVX.

Democrats bought cybersecurity like $FTNT.

These companies lobby Congress heavily. pic.twitter.com/0JUKURNmMT

— unusual_whales (@unusual_whales) October 8, 2023

*Screenshots from unusual whales X post*

So dirty and oh so predictable!: Congress buys up war stocks ahead of Hamas attack on Israel https://t.co/wAulenobAM pic.twitter.com/80sciIdjSC

— VeBee🇺🇸✝️ (@VeBo1991) October 10, 2023

Financial news outlet Finbold has more:

Now, there’s no ignoring the fact that these companies lobby Congress with gusto. Lobbying, in many ways, serves as an avenue for corporations to communicate their perspective and interests to policymakers.

Taking a closer look, some of the notable members who’ve entered the fray include Republicans Michael McCaul (Texas), Kevin Hern (Oklahoma), and Michael Guest (Mississippi), with the latter acquiring up to $15,000 of XOM in August. Among Democrats, Fankel (Florida), Richard Larsen (Washington), and Walter Schrader (Oregon) stand out.

The market is a reflection of geopolitical events, and those with the right foresight can harness its potential. As they say, it’s about ‘buying the rumor and selling the news.’ Congressional moves, while subject to scrutiny, can often offer a finger on the pulse of where the ‘smart’ money might be heading.

We’ll release the results as soon as we have at least 1,000 replies:

NATIONAL POLL: What Do YOU Think The USA Should Do In The Israel War?

Thank you!

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!