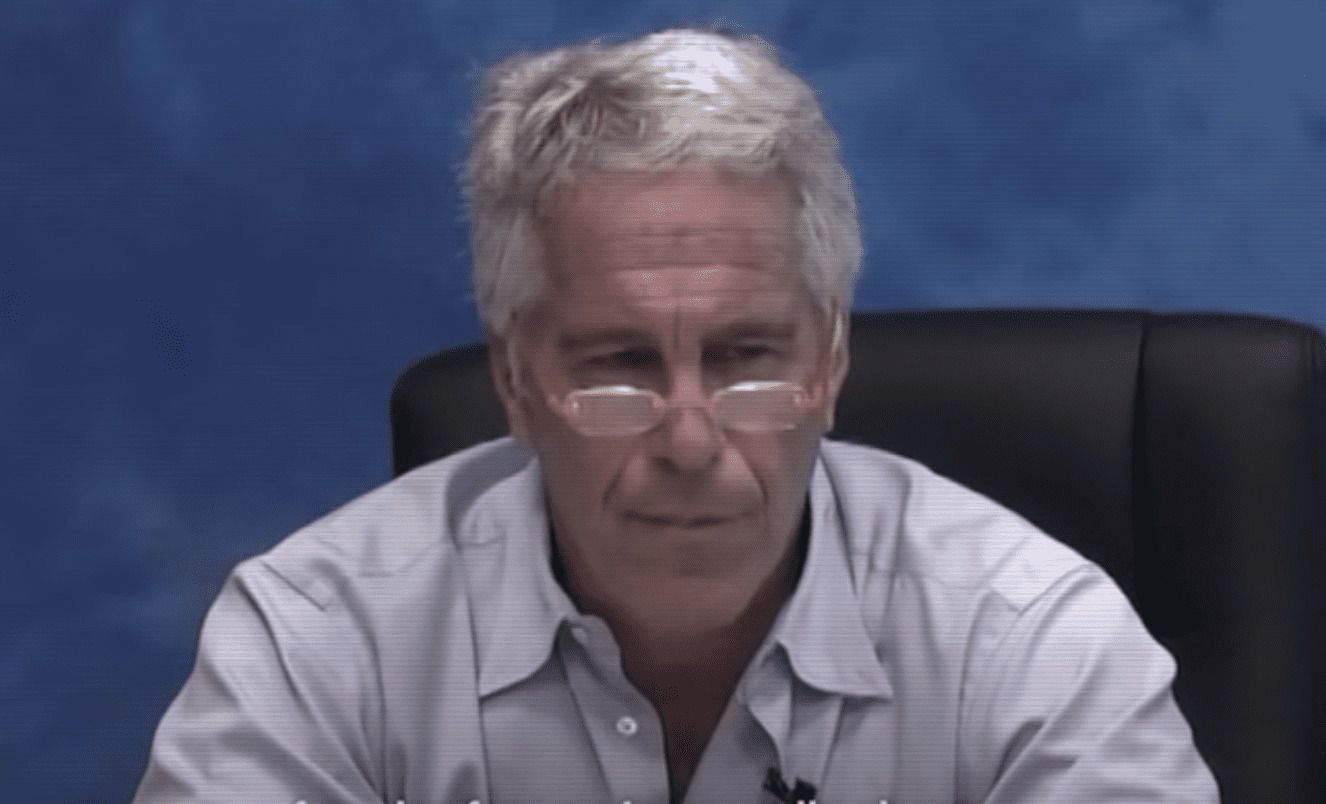

JP Morgan is in the hot seat once again for its connection to Jeffrey Epstein. …

The banking giant was reportedly notified by its risk managers in 2006 that Epstein’s cash withdrawals, amounting to roughly $750,000 a year, were highly suspicious and flagged the transactions.

Higher-ups at the bank knew about Epstein’s activities and even joked about his trafficking and grooming of young girls—despite this, JP Morgan continued to bank Epstein until 2013 when they claim they dropped him as a client.

However, other sources claim that he voluntarily closed his accounts with the bank.

My question is: why did the higher-ups decline to listen to their risk management team?

Banks are banks, but they have a bottom line—the bank does not want you to withdraw your money—this is why the ‘risk management’ team flagged Epstein’s transactions in the first place.

It wasn’t out of compassion or safety concerns—it was purely because a large client withdrawing their money en masse is negative for the health of the bank, again, this is why these risk management teams are flagging transactions in the first place. …

I can safely say, that as much money as Epstein had, he was increasingly seen as a negative development for the health of the bank, how can one be an asset when they continue to withdraw their money from an institution that makes money lending on those reserves?

Their entire goal is to keep as much of that money as possible sequestered inside the bank, for as long as humanly possible, in order to maximize their fractional reserve ratio. …

The top brass at JP Morgan declined to do this when notified…I wonder why. …

Here’s what everyone is saying:

Speaking of #TBTF @jpmorgan, the Epstein lawsuit is ongoing: JPMorgan executives joked about Epstein’s proclivities. One received an email asking her whether Epstein was at an event “with Miley Cyrus”, who was no older than 16 at the time. https://t.co/dUsVhsor5z @csapn @cspanwj

— Caliphate Pontificus @ bsky (see bio) (@cspanSnark) April 14, 2023

JPMorgan Chase knew about #JeffreyEpstein’s sex trafficking accusations for years before dropping him, according to new legal filings.

“In 2010, JPMorgan compliance officials decided that Epstein ‘should go.’”—but bank executives did not act for 3 years. https://t.co/y9yLk056Pb

— The Epoch Times (@EpochTimes) April 14, 2023

The Wall Street Journal explains:

Banks are required to file suspicious-activity reports on sizable cash withdrawals and transactions that could indicate crimes such as money laundering. JPMorgan, the U.S. Virgin Islands says, had information that could have flagged Epstein’s alleged crimes to law enforcement sooner.

Lawyers have questioned several JPMorgan employees so far in this case, including Mary Erdoes, its head of asset and wealth management. Her deposition hasn’t been released publicly, but Wednesday’s court filing sheds light on its contents.

Ms. Erdoes said in a deposition that JPMorgan executives knew as far back as 2006 that Epstein was accused of paying cash to have underage girls and young women brought to his home, according to the filing.

ADVERTISEMENT

A newly released version of the Virgin Islands’ lawsuit reveals compliance officials urged JP Morgan to ditch Jeffrey Epstein as a clienthttps://t.co/qp3dDqJOV4 pic.twitter.com/2optHycven

— RT (@RT_com) April 14, 2023

https://twitter.com/Ljune4647/status/1646899277233528832

CNBC adds:

The transactions continued in the years after Epstein’s guilty plea, though JPMorgan accepted his explanation that the money was for fuel and landing fees for his planes, even during years when Epstein was under house arrest, the USVI suit alleged.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!